Hedged vs Unhedged ETF – What Should You Choose?

The investing world is difficult enough as is. Complex terminology clouds our judgment and makes it difficult to make decisions. And, one of these situations is when we’re looking at a hedged vs unhedged ETF.

For some, they’ll have a basic understanding of what exactly currency hedging is. But for others, the concept is confusing to them.

So of course here at Stocktrades, our primary objective is to take the confusion out of investing. That’s exactly what we’re going to do in this Canadian ETFs article when it comes to currency-hedged ETFs versus unhedged ETFs.

First, let’s start with the basics.

What is currency hedging?

Many fund managers, individual investors, and investment professionals hedge their portfolios from currency risk. In a nutshell, currency hedging protects you from fluctuating currency prices.

Let’s go over a quick scenario.

You own an S&P 500 index fund that is not hedged. Over the next year, that index fund gains 10%, but the US dollar also weakens against the Canadian dollar by 10%.

Your total returns are 10%, right? Not so fast. In fact, you’ve really gained nothing.

Yes, the underlying ETF tracking the S&P 500 has gained 10%, but fluctuations in the value of the underlying currency wipe out your returns.

If you were to have bought a currency-hedged version of that index fund, currency fluctuations would be a non-factor. Yes, your currency has still lost 10% of its value, but due to some purchases inside of the fund by management, the 10% returns from the index itself are protected.

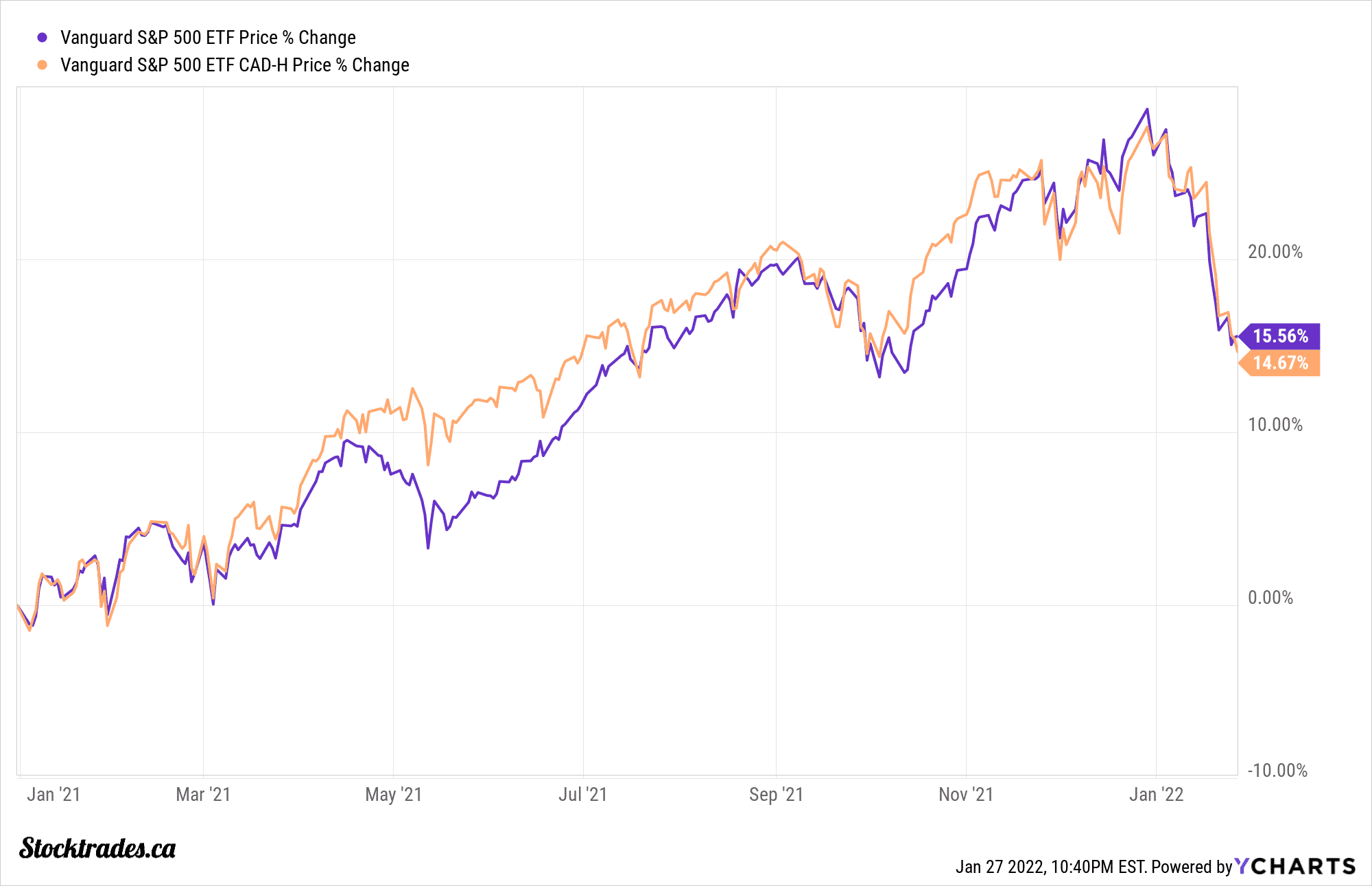

A prime example of this would be the strengthening of the Canadian dollar versus the US dollar in 2021. The rise of the CAD would have caused unhedged ETFs to underperform their hedged counterparts. We can see this in action in the chart below.

Around May of 2021, VSP, which is the Vanguard S&P 500 ETF that is hedged, outperformed VFV, which is the identical index fund, but unhedged. This is because the Canadian dollar rapidly increased by nearly 6% from March to May 2021.

So, how does a hedged ETF actually protect me from currency volatility?

The idea of currency hedging seems easy enough. But, what exactly are these fund managers doing behind the scenes to protect you from exchange rate fluctuations?

This is done through things we call derivatives, primarily options contracts and forward contracts. By definition, a derivative is a financial contract between two parties that depends on the movement of the underlying asset. In many situations, that asset can be a stock or even a commodity like oil. But in this situation, the underlying asset is currency.

With a forward contract, the fund manager enters an agreement to exchange a set amount of currency at a specific value and a specific date in the future. This contract will fluctuate in value, often offsetting currency changes to the underlying currency.

With an options contract, it simply gives the holder of the option the right, but not the obligation, to exchange currency at a set price in the future.

We don’t want to fill up this article with the intricacies of currency hedging. In fact, the strategy is complex enough that most investors and those learning how to buy stocks would be better off simply understanding the basic premise of what it does, and that is to protect your investments from currency volatility.

The pros of currency-hedged ETFs

It goes without saying one of the largest benefits of a hedged ETF is the fact you are protected from any unforeseen fluctuations in currency. Which by the way, are virtually impossible to predict.

You get the true value of your investments and the underlying holdings, without having to worry about whether or not fluctuations in the dollar will erode your returns.

Overall a hedged fund exposes you to the quality of the underlying businesses within the fund, making investment decisions clearer.

The cons of currency-hedged ETFs

Currency hedging costs money. When the fund is buying or selling derivatives to protect the fund from currency movements, transaction costs will have an impact on the overall portfolio. As a result, you’ll typically see Canadian investors pay more when it comes to management fees with hedged ETFs.

Another downfall is the fact that currency doesn’t always work against you. For example, if we use the same situation above with the index fund gaining 10% and the currency swinging 10%, if the Canadian dollar had weakened, not strengthened against the US dollar, you could be sitting on returns of 20%.

So why should I be buying currency-hedged ETFs?

There is a multitude of reasons why you should be buying hedged ETFs to reduce your exposure to the fluctuations of foreign currencies. Let’s go over a few.

Your time horizon is short

It has been documented over the long-term that currency fluctuations tend to cancel themselves out. However, if your time horizon is short, limiting your foreign currency exposure is considered a necessity by many investors.

If you are nearing retirement, the last thing you want to happen is for currency fluctuations to impact your financial situation. The fee you pay when it comes to the management expense ratio of the fund is often worth the peace of mind that currency movements won’t impact your income in retirement.

But, it isn’t necessarily just retirement you need to worry about. If your time horizon is short overall, say you are saving for a house in 5 years, you may want to currency hedge as well.

You believe the CAD will rise vs the USD

When the Canadian dollar rises in value relative to the US dollar, a hedged ETF will outperform. So, if you believe at this moment the Canadian dollar will continue to rise, it would make sense for you to purchase a hedged ETF.

You are risk-averse

If you’re an investor that doesn’t have much of an appetite when it comes to risk, hedging makes complete sense. Although it will not reduce volatility when it comes to the underlying holdings in the ETF, it will at least reduce volatility when it comes to currency swings.

Why should I be buying an unhedged ETF?

There’s different strategies for different investors no doubt. And, some may prefer an unhedged ETF for a number of reasons.

Your time horizon is longer

As mentioned above, currency fluctuations over the long run tend to even out. So, as someone with a 10, 15, even 20 year time horizon, currency hedging may not make sense. Although you will go through the ebbs and flows of fluctuations over the short term, there is no sense in paying higher management fees to hedge yourself from risk when it is unlikely to matter anyways.

You believe the CAD will fall vs the USD

In an unhedged situation, if the value of the CAD relative to the USD were to fall, you would realize a currency gain. So, if you believe the Canadian dollar will fall in value, you are best to purchase an unhedged ETF.

Ultimately, should you be hedging or not?

The fact of the matter is, currency fluctuations are not always a bad thing. Unhedged ETFs do give you some diversification benefits when it comes to being exposed to the USD, or even other foreign currencies like the Euro, AUD, GBP, or Yen.

A large portion of your portfolio being exposed to a particular currency does pose some added risks. However, with broad-based global exposure to many economies and currencies, the need for hedging is certainly reduced.

I have never been much of a fan of hedged ETFs. Historically, unhedged ETFs have been known to outperform their hedged counterparts.

I do see value in currency hedging for those whose timelines are shorter. You don’t necessarily want a strengthening Canadian dollar to be taking a bite out of your portfolio when you need it most. And, for the ultra risk-averse, sometimes total returns is not the be-all end-all. We have to be comfortable sleeping at night with the portfolios we have.

I also would go against the strategy of flip-flopping when it comes to buying in and out of hedged/unhedged options. No matter how smart we think we are, currency fluctuations are impossible to predict, and you’re better off just buying one and sticking to that strategy.

Overall, as an individual stock investor I do not own any ETFs. But if I were to purchase one, I’d be going the unhedged route. My time horizon is long, and I’d prefer to save a little bit in terms of management fees.