HISA ETF Regulation – Why Money Market Funds Are an Alternative

One of the biggest trends in the market, thus far in 2023, has been the flurry of inflows ($AUM) into the money market and short-term fixed income.

We have seen a “great migration to cash” as investors are being paid handsomely to park cash on the sidelines in products like HISA and Money Market ETFs. In this article, we examine why these ETFs are gathering assets, the OSFI’s recent decision on HISA ETFs, and ETF options for your portfolio.

Money Market and Ultra Short-Term Fixed Income: after years of being a forgotten market segment, how and why are they the leading asset gatherer?

With the accelerated path of rising rates we have seen in the short end of the yield curve; (the overnight rate) the yield curve inverted. An inversion of the yield curve is caused when shorter-term rates rise faster than longer-term rates.

Generally, this is something that occurs but reverses quite quickly. Not this time. We are currently in a period of a prolonged yield curve inversion, which could be a leading indicator of economic weakness to come. This inversion is what these money market and ultra-short-term fixed-income investors are looking to cash in on. Lock in higher shorter-term rates and take advantage of the inverted yield curve.

For too long, investors were forced to move outside of investment-grade bonds and further out the yield curve to achieve their yield and return expectations. The market has shifted that paradigm on its head and allowed investors to truly get paid in cash to wait on the sidelines.

Risk: by targeting the short end of the curve, investors will be minimizing their interest rate sensitivity (Duration exposure). They will generally be buying bonds maturing in less than 1 year to maturity. Buying investment-grade bonds issued by high-quality issuers this close to maturity provides investors with downside protection as all these bonds will mature at par.

Reward: Achieve a higher yield to maturity than further out the curve. Allowing investors to earn higher yields for lower interest rate sensitivity risk. The current market isn’t paying investors to lend money for longer periods. The front end provides an extremely attractive proposition for investors.

Today’s market is uniquely positioned, and many market participants expect volatility to be on the horizon as higher interest rates make their way through the economy, potentially causing growth to slow down. Money market and short-term fixed income are well positioned for this environment as investors can weather the potential volatility in the market while still meeting income and return needs.

However, high-interest savings ETFs were the most popular option among investors for a long time. They paid higher interest rates than most money market funds, and investors poured into them in times of uncertainty. Assets under management ballooned, and some of these funds even had to suspend subscriptions for new units, driving prices above the net asset value of the fund.

This has all changed with a decision made by the OSFI on these HISA ETFs, and investors now must weigh the risk/reward of these HISA ETFs as they may not provide as attractive of a yield now. Let’s go over the ruling.

OSFI Makes a Decision on HISA ETFs

Early in 2023, OSFI announced it was conducting a review on the capital treatment of HISA ETFs because of liquidity practices varying significantly between deposit-taking institutions. In October 2023, OSFI made a ruling and set new liquidity guidelines for deposits from HISA ETFs.

The ruling is quite punitive and mandates that these deposits are carried with a 100% LCR runoff factor (implementation by January 31, 2024), which will result in a drop in yields on these popular HISA ETFs.

The OFSI decision highlights the lack of “stickiness” in these HISA ETFs assets. It considers them “wholesale funding” rather than having retail deposit-like characteristics. HISA yields are expected to drop by an estimated 0.50% to closer to 5%, more in line with the overnight rate.

With this change, short-term fixed-income and money market alternatives are delivering an attractive yield pick-up relative to the expected yields.

While the yields on money market ETFs/Short-Term Fixed Income ETFs will look attractive relative to HISA ETFs, it is important to note that short-term fixed-income ETFs hold securities and are subject to price changes based on interest rate changes, while the NAV of cash ETFs and money market is more stable.

ETF Options

If you’re looking for alternative options to HISA ETFs now that they will offer similar yields, BMO has a variety of money market and corporate bond ETFs that you can look through.

ETFs make it easy and efficient for investors to take advantage of this opportunity by offering a wide variety of ETFs that provide exposure to the short end of the curve.

Pure money market (safest, least volatile option), corporate (yield enhancement by investing in bonds issued by corporations), and options available outside of Canada to take advantage of similar market dynamics like the U.S.

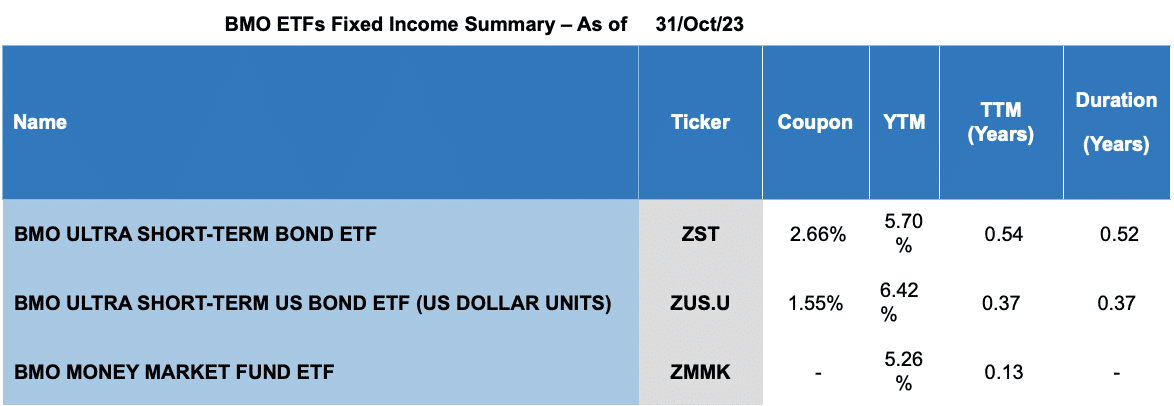

Investors who are interested in getting paid to wait can capture over a 5% weighted average yield to maturity (as of October 31, 2023) by using BMO Money Market Fund ETF (ZMMK), BMO Ultra Short-Term Bond ETF (ZST), and BMO Ultra Short-Term US Bond ETF – USD Units (ZUS.U)

Source: BMO Global Asset Management, October 31, 2023

The market value weighted average yield to maturity includes the coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing.

The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss.

Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party.

Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. ®/™Registered trademarks/trademark of Bank of Montreal, used under license.