Home Country Bias and the Impacts on Your Portfolio

This post is sponsored by BMO Exchange Traded Funds.

Home country bias is the tendency for investors to invest the majority of their investable assets (usually equities) in the domestic market.

In the past, Canadians had legitimate reasons to allocate the majority of their portfolios in in their home country

Foreign content was initially restricted in RRSPs and RRIFs until limits were introduced in the early 1970s. These limits were gradually lifted over decades, until finally eliminated in 2005. In the simplest terms possible, these rules restricted the amount of foreign investments you could have in the accounts.

Even when these limits were removed, international investing was made difficult due to the lack of investable options that made it easy for investors. Investing in individual stocks came with high transaction costs, making mutual funds the only viable option.

ETFs have made it easy to invest internationally

Today, the proliferation of the ETF universe has made it easy for investors to add international exposure in their portfolio.

Investors can use an ETF that invests in exposures as broad as the global equity market, an international region, a country or potentially as specific as a sector or industry within a country.

Furthermore, ETFs are extremely cost efficient, trade in our own time zone and can even come in a currency hedged format, reducing the risk of currency fluctuations.

However, even with the removal of barriers and the ease of foreign investing, Canadians still exhibit a strong home country bias.

You could be missing out on a “world” of opportunities

Home country bias exists today because of comfort as investors have a tendency to allocate based on familiarity or assets they understand. Even investing legend Peter Lynch was known for his principle “invest in what you know.”

While this may apply to picking individual stocks, it shouldn’t in the context of overall portfolio construction and asset allocation. This is particularly true when broad based ETFs can mitigate company specific risks.

How home country bias can impact you as a Canadian in particular

Canada is a very small portion of the global market

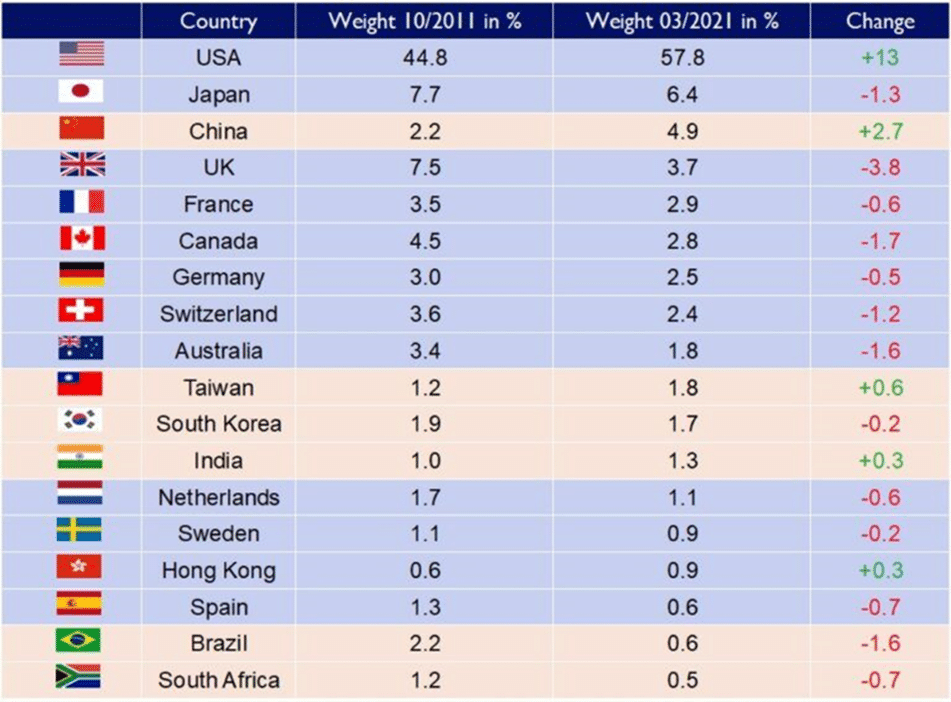

Canada’s equity market in relation to the global equity market is 2.8%, according to its weight in the MSCI ACWI Index (as of Dec 31 2023).

This index is one of the broadest measures of the global equity market which includes large and mid-capitalization stocks from 23 developed and 24 emerging markets. This index covers approximately 85% of the global investable equity opportunity set.

The inclusion of recently opened countries and the development of smaller countries in the last 10 years, has meant that Canada’s share of the global equity market will likely continue to be even less.

Source: Statisticstime.com, Nov 2, 2023.

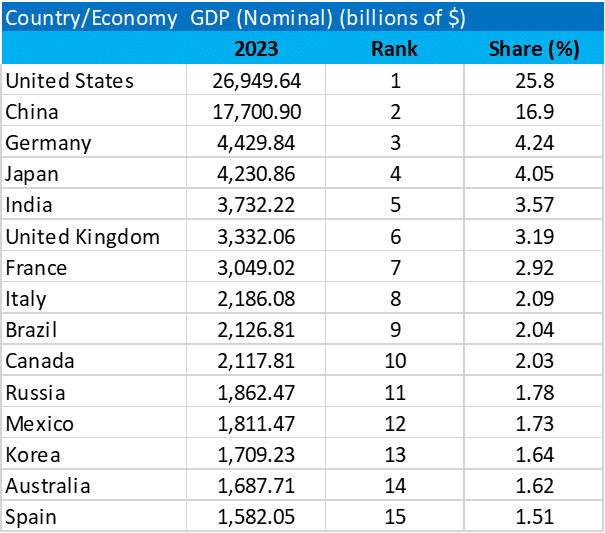

Canada’s GDP is very small on a global scale

In terms of its share of global GDP, Canada ranks amongst the top 10. However, Canada’s GDP as a percentage of global GDP is only 2.0%.

In fact, California’s GDP alone is larger than that of Canada’s. While globalization is not dead, increasing tariffs and rising geo-political tensions have led to more fragmentation between economies.

Source: Statisticstime.com, Mar 31, 2023.

Canada’s benchmark index, the TSX, is cyclical in nature

The S&P/TSX Composite, which is the most widely recognized benchmark for the Canadian equity market, is heavily concentrated in three sectors: financials, energy and materials.

These sectors tend to be cyclical in nature, being more sensitive to the economic cycle. Exposure to sectors that are typically more defensive such as consumer staples, health care and utilities are not well represented in Canada.

Additionally, the three sectors that are well represented in Canada, are considered “Old World Economies,” which have played a key role in industrial expansion in the last century but may play less of a role compared to sectors such as “technology” which is considered a “New World Economy.”

Canada’s largest companies pale in comparison to other global equities

While Canada is home to some high-quality companies, particularly some of most sound banks in the world, it does not have any representation in mega-cap companies (>$200B in market cap).

About 50 of the companies in the S&P/TSX Composite are considered “big cap” (Between $10B and $200B), the majority of companies in Canada are considered mid cap ($2B to $10B).1

Larger companies tend to have revenue streams that are more global in nature, while smaller companies tend to be more exposed to the ebbs and flows of the domestic economy.

Going global

While the correlations3 between regional equity markets has increased, this has more to do with the flow of information. The emergence of the internet, led market moving headlines to cascade quickly around the globe, while social media has further increased the speed of information. As previously noted, globalization has retreated with trade and financial flows well below their peaks.

Rising tensions between nations will limit cooperation meaning economies will be more isolated. Investors can therefore benefit by reducing their home country bias and diversifying globally. Fortunately for investors, investing globally has never been easier.

Ways to diversify a portfolio

Build a globally diversified portfolio

Rather than building a portfolio through the selection of individual domestic stocks, investors can use ETFs that provide broad equity market exposure. Using these ETFs as building blocks to a portfolio allows investors to construct portfolios that are better diversified and allow for better coverage.

ETFs that provide exposure to international or emerging markets stocks can also be complemented for those investors that hold primarily stocks listed in Canada and the U.S. Examples include BMO MSCI EAFE Index ETF (ZEA) and BMO MSCI Emerging Markets Index ETF (ZEM)

Portfolio completion

For those investors that invest primarily in Canada, you likely have low representation in stocks in particular sectors. As a result, investors can use sector-based ETFs to fill in the gaps in their portfolios.

For example, ETFs that track the technology, health care and consumer staples sector can be used to increase the representation in those sectors likely to be underexposed in a typical Canadian portfolio.

Using asset allocation ETFs

A convenient way to diversify a portfolio is to use an asset allocation ETF, which combines various ETFs using asset allocation mixes that represent various risk profiles.

These ETFs are professionally constructed and regularly rebalanced and are low cost. It should be noted that these ETFs can be used as either a standalone investment, where additional capital can be added or as the base to a portfolio. Learn More Here

Some things you need to consider when investing internationally

Utilize limit orders

One of the benefits of investing in ETFs that provide international exposure is that they trade during our own time-zones. As ETFs represent the value of their underlying assets, bid-offer spreads tend to be tighter when the underlying market is open.

When the underlying market is closed, market makers will use a “fair value” model which will estimate its live price.

However, since its more difficult to assess a value with the absence of live prices in the underlying market, bid-offer spreads tend to widen in order to give the market maker a wider margin of error.

Investors are encouraged to preferably trade when the underlying market is open and/or use a limit-orders for best practice.2

Avoid unnecessary withholding taxes

When investing outside of Canada, whether through an ETF, through a mutual fund or directly, withholding taxes can be applied.

While there are no ways around withholding taxes in the local market, investors are encouraged to do their due diligence when looking for exposure via the U.S. For example investors that buy

Canadian listed ETFs that wrap a U.S. listed ETF that then invests in international markets are subject to withholding taxes in the U.S. as well. Canadian investors that buy U.S. listed ETFs that invest in local markets may also be subject to the additional layer of U.S. withholding taxes.

Canadian investors may want to look at ETFs that invests directly in the international stocks. As always its important to seek professional tax advice when I comes to these circumstances.

Understand currency risk

Investors can also consider whether or not they want the exposure to foreign currencies. Many ETFs offer a currency hedged version, which mitigates the risk between the foreign currencies and the Canadian dollar.

While home bias amongst Canadian investors still remains high, diversifying a portfolio has become increasingly important. Investment tools such as ETFs has made it easy and cost efficient for investors to add both broad based or targeted international exposure to their portfolios with a click of a key.

Learn more about BMO ETF’s line up of ETFs here.

1 Source: Bloomberg Dec 31 20242 Note: limit orders do have the risk of remaining unfilled if the market doesn’t hit the limit price.3 Correlation: A statistical measure of how two securities move in relation to one another. Positive correlation indicates similar movements, up or down together, while negative correlation indicates opposite movements (when one rises, the other falls).Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.®/™Registered trademarks/trademark of Bank of Montreal, used under licence.