How to Invest in Gold in Canada – 4 Ways to Get Gold Exposure

Many investors have often been told that gold is a perfect hedge to uncertain times both in the stock market and the economy.

There are some common misconceptions when it comes to investing in gold in Canada. We’ll first go over those and then go over some popular ways for you to buy gold in Canada today.

The inflation illusion – read this before you buy gold

Warren Buffett has been quoted calling inflation a “tapeworm”, as it consistently and savagely eats away at your hard-earned money. Many people head to the internet or maybe family or friends to figure out what they should do about it.

And often, the answer given is to purchase gold bullion. After all, gold is an excellent hedge to inflation, right? Wrong.

Probably one of the most common misconceptions when it comes to inflation is that the purchase of gold, whether it be gold coins, gold stocks, gold bars, or even another type of precious metal should protect you.

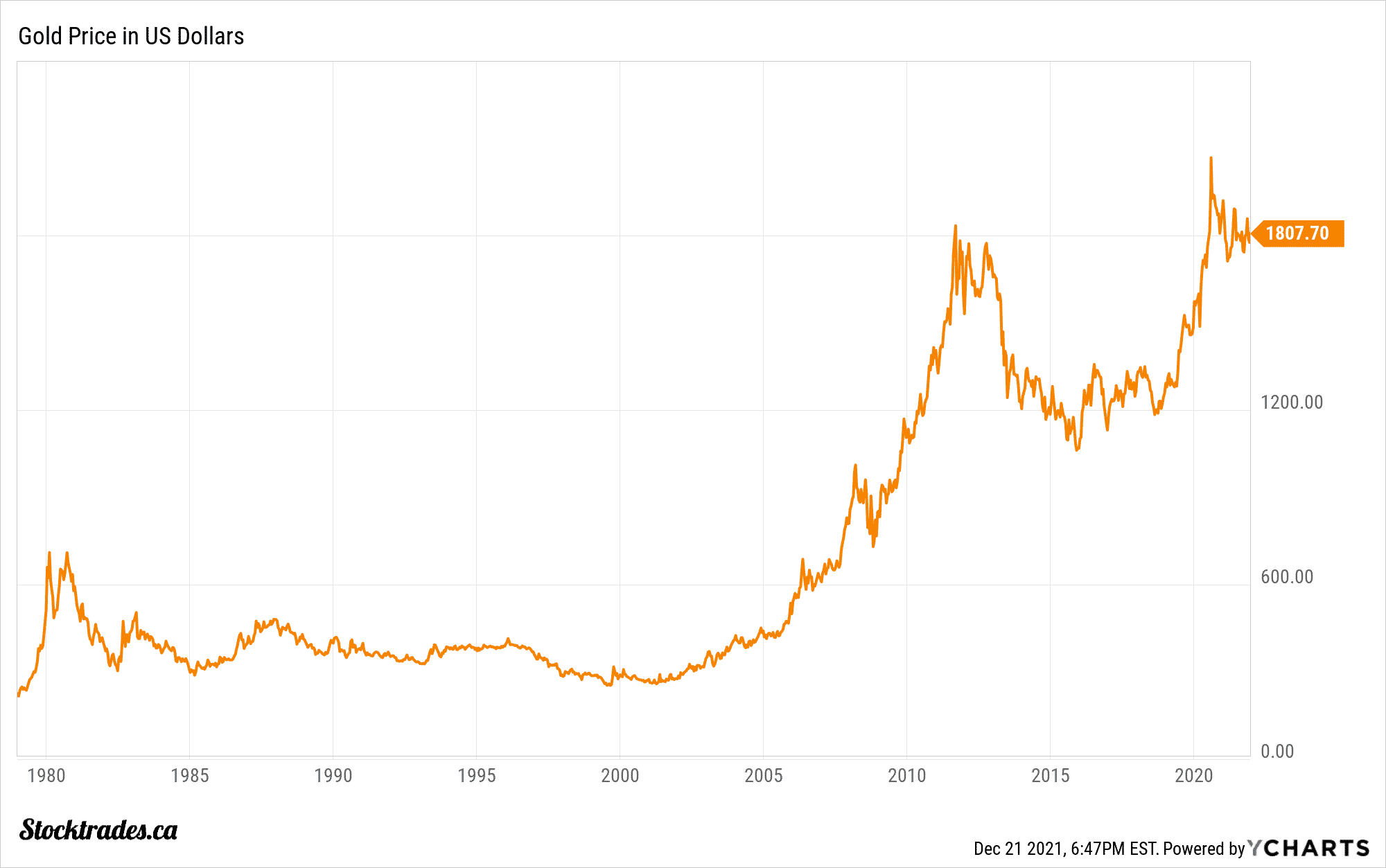

As we can see by the chart below, there is almost no correlation between the price of gold and steadily rising inflation. In fact, as we can see through many periods in the late 80’s and 90’s, as inflation peaked and troughed, gold stayed relatively flat, even decreasing.

However, you may notice something key in that chart

The chart clearly shows that during modest inflation, we don’t really see rising gold prices. However, during rapid inflation, as we see in the 1980’s, the Financial Crisis in 2008, and the Covid-19 pandemic, gold has proven to be a good hedge.

If you believe that inflation will soar in the coming years, buying gold makes perfect sense. But, buying gold in Canada also doesn’t need to simply be some doomsday preparation event. Many choose to hold a particular amount of gold in their investment portfolios simply for the exposure.

With all that said, if you’re still dead set on holding gold, let’s look at four unique ways in which you can buy it today.

How to invest in gold in Canada

Before we start with the methods of purchasing gold, it’s important you have a brokerage set up to make sure you can ultimately make the purchase when you are ready.

In our eyes, the best brokerage on the planet to buy and sell gold stocks, ETFs, and futures, is Qtrade.

Buying physical gold

If you really want something, you’ll just want to go out and buy it. Gold is no different. Practically all of the major financial institutions here in Canada such as Royal Bank, Bank of Montreal, and TD Bank will allow you to purchase gold. Or alternatively, you can purchase directly from the Royal Canadian Mint.

The benefits of buying physical gold? Unlike some of the methods below that are simply Canadian stocks or ETFs held in your brokerage account, physical gold is something you truly do own. It is real, you can hold the gold, it can sit in a safe in your home or even on your counter if you really wanted. Many people believe that if you can’t hold it, you don’t own it. And if we were truly to enter a situation of such high uncertainty, you would want to physically hold the asset you’ve purchased.

The downfalls of buying physical gold? There is the fact that you actually need the gold delivered. Typically when you buy from a bank, they’ll give you the option of shipping to your house or shipping to your home branch. Whichever you choose, you’ll then have to take the gold home and store it somewhere, likely alerting your insurance company of its value.

However, this is simply an inconvenience. The real issue with holding physical gold is liquidity. Out of all the methods to investing in gold on this list, the only one that lacks liquidity, which means the ability to sell the asset, is buying physical gold. It is much easier to log into your brokerage account and sell a stock or an ETF. In fact, it is often executed on the back end in seconds. If you’re looking to move a gold coin or gold bar, however, this gets much more difficult.

An interesting note, many Canadians don’t know that you can buy physical gold bars and bullion coins in a tax-advantaged way through an RRSP, TFSA, LIRA or any other registered account.

Doing so will likely give you the best prices for your bullion, as you will receive wholesale discounts. Silver Gold Bull, Canada’s largest gold retailer, launched a program for RRSP/TFSA investors interested in the highest purity gold bullion. The CRA only allows bullion coins and bars with a minimum purity of 99.5% pure, which means that collectible coins aren’t allowed.

Overall, if you’re looking to invest in gold in Canada, buying physical is not a bad idea. Your gold bar, coin, or whatever else you purchase will rise and fall with the value of gold. Just make sure you understand the risks in terms of storage and liquidity.

Investing in Gold ETFs

There are plenty of Gold ETFs and mutual funds on the market today that will either get you exposure to gold bullion or miners operating in the industry.

For example, something like the iShares Gold Bullion ETF (TSE:CGL and CGL.C) aims to replicate the performance of gold bullion for its investors. Instead of buying the gold bars and storing them in your home, for a modest fee of 0.55%, iShares will do it for you.

The two alternative tickers above represent the hedged (CGL) and non-hedged (CGL.C) versions of the ETF, meaning one will have you exposed to fluctuations in currency while the other will not.

On the flip side, you can invest in a Gold ETF that contains gold mining companies. The iShares Global Gold Index ETF is one of the most popular in the country and contains the likes of Newmont Corp (TSE:NEM), Barrick Gold (TSE:ABX), Agnico Eagle Mines (TSE:AEM), and Kinross Gold (TSE:K). Or, for a more aggressive route, you could look at the BMO Junior Gold Index ETF (TSE:ZJG), which targets smaller but more volatile gold companies.

There are a multitude of ETFs from each producer (BMO, Horizons, iShares, Vanguard) so it is important to choose one that works for you. Regardless of what you choose, these gold producer ETFs will expose you to the higher risk/higher reward of the gold mining sector.

Gold companies bring with them higher volatility than the price of gold itself. It is not uncommon to see gold rise or fall 1-2%, while producers rise or fall 4-5% on the same movement.

When you invest in an ETF that simply holds the gold in trust for you, you are exposing yourself to fluctuations in the price of gold and not much more. But when you purchase a gold miner ETF, you are exposing yourself to not only the fluctuations in gold, but also the operational performance of companies. Which, is something to consider.

Investing in gold futures contracts

We often see many investors speak on the futures market. Whether it be in stocks, oil, wheat, or gold. But the reality is, the vast majority of investors have no clue what the futures market is or what a futures contract is.

I can’t stress enough that prior to dabbling in gold futures, you need to understand what a futures contract is. Which, is another article and lesson altogether. But, to give you a quick rundown, if you were to buy a futures contract from somebody, you have entered an agreement to buy XX amount of gold at $XX price at a pre-determined future date.

So, you could purchase a contract that allows you to purchase 100 ounces of gold for $1700 USD per ounce on March 1st, 2025. If the price rises to say $2000 an ounce over that timeframe, you could pocket the difference in profits by selling your futures contract.

The one thing you don’t want to do, and this was an issue with many investors holding oil futures ETFs during the COVID-19 crisis, is allow the futures contract to mature. If it does, you would be responsible for purchasing and taking in $170,000 (100 ounces x $1700 an ounce) of gold.

Overall, this is probably the most advanced form of investing in Gold in Canada. Since most contracts are rarely held to maturity and delivered to retail investors, it is largely a speculative play on price movements. Again, make sure to research the futures market and see if it fits into your risk tolerance before trying it out.

Investing in gold stocks

The final method, and probably the one that most retail investors utilize is the purchase of gold stocks. When I say gold stocks, I primarily mean gold mining companies or gold streaming companies.

Most gold-mining stocks will trade on the Toronto Stock Exchange or the TSX Venture, and they give unique exposure to the gold market for investors and those learning how to buy stocks. That is, you are depending on the company to mine and produce gold, and be capable of selling said gold on the open market for a profit.

You are exposed to the capital expenditures of running a gold company and the ups and downs that go along with the industry. Next to futures investing which we talked about above, this is probably the highest risk option on this list when it comes to investing in Gold.

Even if you were to buy an ETF of gold producers, your risk is lowered. This is because you own many companies inside of one ETF, whereas investing in gold stocks often requires you to pick one or two producers to own. If those producers struggle, volatility could be high.

With a streaming company like Wheaton Precious Metals or Franco Nevada, their unique business structures allow them to collect royalties without being exposed to the price swings, exploration costs and operational hardships of the industry. When it comes to gold stocks, streamers can be thought of as a nice lower-risk alternative.

There are also a multitude of sub-industries that rely to some degree or another on gold production, including some of Canada’s top semiconductor stocks.

Should I be buying gold today?

There are many cases against purchasing gold. But, there are also a plethora of reasons to hold a little bit in your portfolio at all times. Investing in gold, whether you buy gold jewelry, gold coins, gold bars, a gold ETF, or even a gold-producing company, is a personal decision.

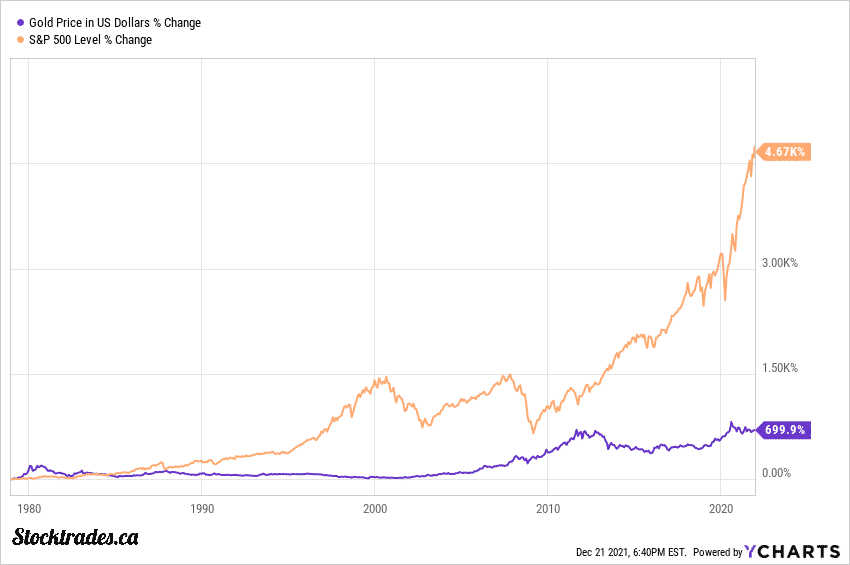

Over the years, especially when we look at returns versus the stock market, gold has struggled significantly. As you can see by the chart below, since the late 1970’s the S&P 500 has returned over 4600% while gold has returned 700%.

However, the past is never a guarantee of future results, and if people feel their portfolio needs to be hedged against rapid inflation and uncertain times, gold is the first place many head.

Price movement history in gold since the mid 1970s

Investing in gold in Canada is not hard to do, but make sure you’re buying for the right reasons

In this day and age, you can have physical gold shipped to your house from your bank in a matter of a week. Or, you can go online and gain instant exposure to a trust that holds gold bullion with a single click of a button.

This makes investing in gold in Canada extremely easy. However, it can also breed a trading-like mentality when it comes to trying to take advantage of gold prices.

In our opinion, if you are looking to purchase gold as a hedge to uncertainty or rapid inflation, it is best to deploy a long-term buy and hold strategy.