How to Invest in Index Funds – Complete Guide To Indexing

Investors looking to learn how to buy stocks may be overwhelmed by the whole process.

As a result, they may look towards investing in index funds as an investment strategy. Although less attractive to those looking to earn higher returns, index investing is more passive.

In this article I’m going to explain what exactly index investing is, the pros and cons of index investing vs picking individual stocks or sector related ETFs, and in general I hope this article is an overall embodiment of index funds and their uses for Canadian investors.

Over the course of this index fund guide, we’ll go over the following (click to jump to that particular section):

- What is an index fund?

- How does an index fund work?

- What exactly is an index?

- Can you lose money in an index fund?

- Do index funds track an index perfectly?

- Are index funds better than stocks?

- What are the advantages of index funds?

- What are the disadvantages of index funds?

- What is an example of an index fund?

- Can index funds make you rich?

- How to invest in index funds?

- Do index funds pay dividends?

- How long does it take to sell an index fund?

What is an index fund?

A lot of investors are confused as to what an index fund actually is. They see things like mutual funds, or exchange traded funds, and wonder how an index fund fits into the mold.

I know this will confuse you at first, but an index fund can be both of these things.

That’s right, index funds can be both mutual funds or ETFs.

This is because an “index fund” is really no more than a mutual fund or ETF that tracks a broader stock market index.

If you, or your financial advisor have purchased an index fund, all you’ve done is purchased a mutual fund or an exchange traded fund that’s overall goal is to passively track a broader index like the S&P/TSX Composite Index, or the S&P 500.

Easy enough? Awesome.

How does an index fund work?

Now that we know that an index fund is simply a type of ETF or mutual fund, we now need to wrap our head around how an index fund tracks a stock market index.

The easiest way to describe how an index fund works, is the idea that if you want to track a particular stock market index in whole, you need to buy the whole market. That is, you need to own every single stock that trades on the Toronto Stock Exchange, or the S&P 500, for example.

And, that’s exactly what these index funds do, in most cases.

In some instances, fund managers can use something called sampling. Sampling is a strategy deployed by an index fund manager to replicate an index, without actually having to own all of the underlying securities of that index.

So, if we’re looking to build an index fund that tracks the TSX Index, we have the choice to buy all the stocks on the index, or we can take a sample of stocks that a manager feels would largely represent the overall returns of the index and instead purchase those.

As a result, as the markets move up and down on a day to day basis, so does the index fund, in close fashion. I say close fashion because there will never truly be an index fund that tracks the overall returns of a stock market index perfectly. And, I’ll explain why later in something we call tracking error.

What exactly is an index?

If you’re going to purchase index funds, you’d better be sure you know what exactly an index is before doing so. Much like purchasing an individual stock without knowing anything about the company, buying an index without knowing what it is can end up costing you.

It’s easy when we look at the New York Stock Exchange or the Toronto Stock Exchange. However, the names of all indexes are not this clear.

An index is essentially a measure of the performance of a set of stocks. For example, the Toronto Stock Exchange contains over 1,500 publicly traded companies and the New York Stock Exchange contains over 2,800 companies.

Index’s can be weighted a variety of ways. For example, the Dow Jones includes the top 30 companies in the united states. However, it’s important to note that the Dow Jones is actually a price weighted index. Meaning that the share price of the stock, not the market capitalization of the company, is what determines the weighting of the index.

This is a rarity, and one that has been kept with the Dow Jones to ensure continuity for some time.

There are plenty of stock market indexes around the world, including but not limited to:

- Toronto Stock Exchange

- New York Stock Exchange

- NASDAQ

- S&P 500

- Russell 2000 (small-cap index)

- The Dow Jones Industrial Average

- UK 100 Index

- Nikkei 225 (China)

Can you lose money in an index fund?

As with any other investment, it is definitely possible to lose money in an index fund.

In fact, with an index fund that tracks a large market index like the TSX or Dow Jones, you are at the mercy of the index itself. If the index your fund tracks falls 10%, your investment falls 10% as well.

Index funds get praised for their simplicity. But, be careful not to confuse simplicity with safety.

Do index funds track an index perfectly?

Lots of beginner investors looking at index funds think that if the index they aim to track earns 10%, their investments automatically will earn 10%.

However, because the index fund itself will have things like fees and general costs, they tend to lag, or return less, than the underlying index it tracks.

So as a general example, if an index returns 10% and you own an index fund that tracks that particular index, you may return 9.90%. The remaining 0.10% is called tracking error.

There is also the chance that if an index fund is using a sampling method of choosing stocks, tracking error could be higher if the sample isn’t as accurate as management thought to track the broader index.

Overall, you’ll never earn the exact amount the index returns, and although you’re trying to replicate the returns of a particular stock market index, in reality you will sometimes lag the returns of the index by the tracking error, plus any management fees you pay to the fund.

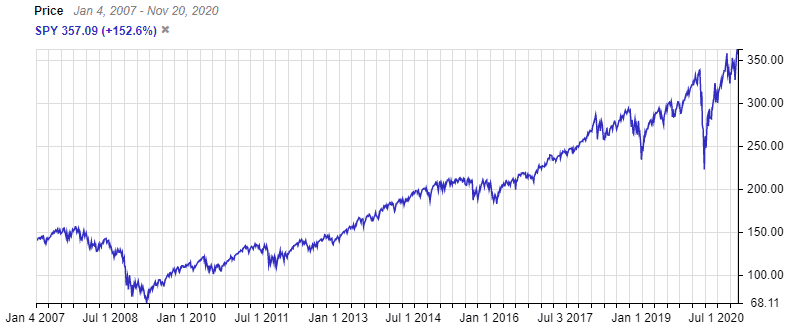

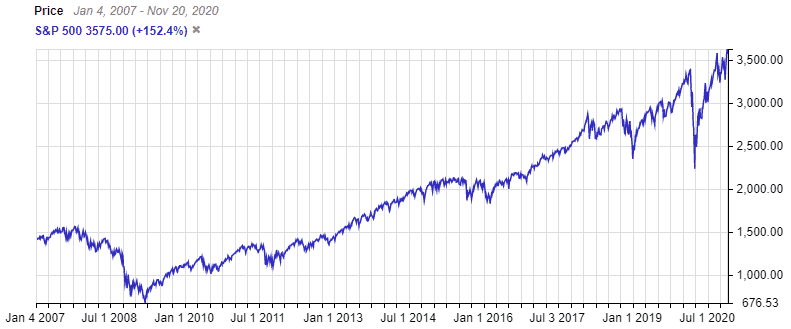

Here is the SPDR S&P 500 ETF Trust (SPY) from 2007 to 2020, that tracks the S&P 500. And below, the S&P 500 itself:

As you can see the above index and index fund are similar, but this doesn’t mean that an index fund tracks an index to perfection all of the time.

Are index funds better than stocks?

Ultimately, there is no solid answer to this, and anyone who is giving you one without first understanding your overall goals and investing skill level shouldn’t be doing so.

To an inexperienced investor, or someone that lacks time for research in depth, or maybe simply doesn’t want to put in the effort of purchasing individual stocks, index funds are an excellent option.

However, to someone who has adequate knowledge of digesting earnings reports and has a reasonable understanding of economics, they may be better off deploying an active investment strategy and instead purchasing individual stocks that they feel could outperform the broader markets.

What are the advantages of an index fund?

Index funds have much lower fees

In the investment world, the word “fund” doesn’t come without fees. After all, there are management teams and portfolio managers behind the fund you’re purchasing, and they need to make a living.

The good thing about index funds, because of their passive structure, they have significantly lower fees than an actively managed mutual fund. In fact, these lower fees can end up saving you hundreds of thousands of dollars, literally.

Broad market exposure in one click

The ability to own the whole market in a single click is a massive advantage to index funds. It allows investors who don’t want to pick individual stocks to simply buy a fund and let it generate long standing returns. In fact, there are some index funds that allow you to invest in the global economy in a single click.

Tax advantages

Both actively managed mutual funds and ETFs pass their capital gains and dividend tax on to the individual investor. With index funds, there is very little portfolio turnover, resulting in fewer taxable transactions within the fund.

What are the disadvantages of an index fund?

No control over your holdings

When you purchase an index fund, you’re essentially purchasing everything within (or a sample of) the underlying index. As a result, you have no control over the holdings in your portfolio.

Prone to market fluctuations

With a portfolio of individual stocks, there is a chance for an investor to outperform the market. For example, in 2020 during the COVID-19 crash, those who held some tech companies outperformed in a large way. With an index fund, you’re at the mercy of the overall markets. If the TSX or S&P drops 35%, so does your investment. And as we saw in March 2020, this can happen.

Fees are fees

Although index funds provide significantly lower fees, they still are fees. Dependent on the index you’re attempting to track, the fees can be much higher. For example, a Vanguard index fund tracking the S&P 500 is going to have low fees, whereas a specialized index fund tracking a particular tech index may have higher fees.

What is an example of an index fund?

There are way too many index funds out there to ever narrow it down to a few options, but I’ll give you an examples here that is essentially purchased for broad exposure to an overall index.

Toronto Stock Exchange – XIC.TO is a good barometer for the returns of the TSX. The index fund has 223 holdings as is primarily weighted by market capitalization, with Royal Bank, Shopify, and Toronto Dominion Bank making up the top 3 holdings.

Can index funds make you rich?

The concept of an index fund is one that is passively managed, and aims to track the overall performance of the stock market index it has chosen.

So in reality no, you will never get rich from an index fund. Over the short term that is.

Before we learn how index funds can make you rich, lets understand why there’s almost zero chance of them making you rich over the short term.

A stock market index like the TSX or the S&P 500 gaining 20% in a calendar year would be the exception, not the rule.

So, lets go about as farfetched as we can get, and suggest that the TSX ends up gaining 20% annually over the next 5 years.

If you were to have invested $100,000 into an index fund that tracks the TSX, after 5 years you’d be sitting with $248,832.

Now, earning $148,832 is no slouch of a return. But we’re talking uncharted territory in terms of returns over 5 years, and you still aren’t “rich”.

More realistically, the index fund is going to earn you 8% annually, resulting in a 5 year value of $146,932.

However, index funds can make you rich over the long term. That $100,000 earning 8% over 30 years?

It would be worth just over $1 million dollars.

How to invest in index funds

Investing in index funds today has never been easier thanks to numerous discount brokerages. Not only are they offering index funds on their platforms for one click purchases, they’re also more than likely giving them to you commission free.

So, instead of paying $5 to purchase an individual stock, you can get set up with an index fund absolutely free, and only pay when you sell the fund.

At least, this is how it is with a brokerage like Questrade. And as we move forward, there are more and more investment brokerages offering commission free ETFs (remember, an index fund can be an ETF) trades.

To purchase an index fund, it’s as easy as logging in to your brokerage, typing in the ticker and selecting “buy”. In the case of an ETF index fund, they trade just like a normal stock would, and more often than not have sufficient liquidity to execute trades with ease.

If you haven’t signed up for a brokerage yet, click this link here to get $50 in free commissions to use with Questrade, just in case you’re looking to expand past index funds.

Do index funds pay dividends?

Absolutely. An index fund is simply a basket of securities like stocks. These stocks have the ability to pay dividends, and when this happens in the case of an index fund, the fund receives the dividend payment.

They then transfer that distribution on to the holders of the index fund.

A prime example of a dividend paying index fund here in Canada is the iShares S&P/TSX Canadian Dividend Aristocrats Index ETF.

This index fund aims to track all of the Canadian Dividend Aristocrats, and at the time of writing has a yield of 3.85%.

The index fund makes distribution payments on a monthly basis to owners of the index fund.

How long does it take to sell an index fund?

A lot of investors looking to make the move from mutual funds to index funds are concerned about the length of time it takes to sell an index fund, whether it be for an emergency or simply not wanting to own it anymore.

After all, a mutual fund may only calculate its net asset value at the end of the day. Meaning if you want to sell a mutual fund in the morning, your transaction likely won’t be put through until the end of the day.

With an index fund however, the transaction will be put through instantly, as long as there is sufficient volume to execute the transaction. This is because index funds, as I’ve mentioned before, trade much like a stock, in that transactions are processed throughout the trading day.