HXS vs VFV – Which S&P 500 ETF is Right For You? It Depends

When considering investments in Canadian exchange-traded funds (ETFs) that track the S&P 500, it is likely you find yourself choosing between VFV and HXS.

These two ETFs offer similar exposure to the U.S. stock market, but they have critical differences in structure that many don’t know about.

The main distinction between VFV and HXS lies in their tax efficiency and how they go about getting exposure to the S&P 500.

While VFV is a traditional ETF that holds the underlying stocks directly, HXS utilizes total return swap contracts to replicate the index performance.

This unique approach by HXS can offer potential tax advantages for Canadian investors, especially in non-registered accounts, because it does not pay a dividend.

Both ETFs aim to provide returns that closely mirror the S&P 500, but their methods of achieving this goal differ.

Lets dive into both funds now.

VFV vs HXS Comparison

HXS strategy

HXS employs a total return swap strategy to enhance tax efficiency. This unique approach allows you to defer taxes on distributions until you sell your shares.

Instead of holding the underlying stocks directly, HXS uses swap contracts with counterparties to replicate the index’s performance.

In the simplest explanation possible, Global X will go to a financial institution and say:

“I will pay you XX% every year, and you pay me the returns of the S&P 500, dividends included”

This way, because there are not distributions paid, the fund’s returns are treated as capital gains when you sell, potentially offering a tax advantage in non-registered accounts.

As a result, HXS’s fees are typically much higher than VFV. However, it is important we weigh the fees against post-tax returns, as they can end up making a huge difference.

VFV strategy

VFV takes a more traditional approach by directly holding the stocks in the S&P 500 index. As a “fund of funds,” it invests in the U.S.-domiciled Vanguard S&P 500 Index ETF (VOO) as its sole underlying holding.

You’ll receive regular dividend distributions from VFV, which are subject to immediate taxation in non-registered accounts.

Another thing to consider with VFV is the fact that because it is a Canadian domiciled fund that holds US underlying holdings, you will be subject to withholding tax even inside the RRSP.

Why is this? Well, the IRS and CRA have a tax treaty for RRSPs, making US dividends inside those accounts exempt from withholding tax.

However, in this situation, it is Global X that holds the US ETFs and receives the distributions, and they are not eligible to be exempt from withholding tax.

If you want to avoid withholding tax in an RRSP, you’ll have to own something like VOO. However, that brings on additional issues in terms of currency conversion, etc.

Fees – Not as clear cut as you think

HXS Fees

HXS employs a total return swap strategy, which impacts its fee structure significantly. The management expense ratio (MER) for HXS is 0.10%, slightly higher than VFV.

However, there’s an additional 0.30% swap fee embedded in HXS’s structure. This fee is part of the total return swap contract that allows HXS to provide tax-efficient returns.

Before you go casting aside HXS because of its fees, remember that its tax efficiency can potentially offset these costs, especially for investors in higher tax brackets.

The total return swap structure allows for returns to be treated as capital gains rather than dividends, which can be advantageous in non-registered accounts.

Whether or not these fees will be worth it for you in a taxable account is heavily dependent on your individual situation. However, in a tax-sheltered account, the higher fees don’t really provide that much benefit as you aren’t being taxed anyways.

VFV Fees

VFV offers a straightforward fee structure with a lower MER of 0.09%, making it appear more cost-effective at first glance.

Unlike HXS, VFV doesn’t have additional embedded fees. Its simplicity can be appealing to investors who prefer a more traditional ETF structure.

However, VFV’s dividends are subject to withholding taxes in non-registered accounts, and normal taxation in the year they are received. This can result in a tax drag for Canadian investors, potentially eroding some of the fee advantage over HXS.

When considering VFV’s fees, it’s important to factor in these potential tax implications, especially if you’re investing in a non-registered account.

Lets talk about tax efficiency

HXS tax efficiency

As mentioned, HXS employs a total return swap structure to enhance tax efficiency. This unique approach allows HXS to avoid distributing dividends directly to investors. Instead, the fund’s returns are entirely reflected in capital gains.

The swap structure effectively converts dividend income into capital gains. This conversion is beneficial because capital gains are taxed more favourably than dividend income in non-registered accounts for most investors.

You’ll only pay taxes when you sell your HXS units, potentially deferring tax liability for years.

HXS’s tax efficiency shines in taxable accounts. For investors in high tax brackets, this structure can result in significant tax savings over time. The absence of ongoing dividend distributions means you won’t face annual tax bills on dividend income.

Obviously, in tax-sheltered accounts, the benefits mostly go away, outside of the fact that there still wouldn’t be withholding taxes as there are no distributions.

VFV tax efficiency

VFV, while a popular choice, faces some tax inefficiencies compared to HXS. As a Canadian-domiciled fund with underlying U.S. holdings, VFV is subject to U.S. withholding taxes on dividends, even when held in an RRSP.

This withholding tax, typically 15% of dividends, reduces your overall return. In non-registered accounts, you can claim a foreign tax credit to offset this withholding tax. However, in registered accounts like RRSPs, this tax is unrecoverable.

VFV distributes dividends to unitholders, which are taxable in the year received when held in non-registered accounts.

This can lead to annual tax liabilities, even if you’re not selling your units.

Hidden risks with these funds

HXS risks

Many investors who buy HXS do not understand that additional risks that come with it.

HXS utilizes a total return swap contract strategy, which introduces additional counterparty risk. If the swap counterparty defaults, you could potentially lose a portion of your investment.

In layperson’s terms, if the bank that Global X has entered an agreement into cannot make the payments (in this case, the returns of the S&P 500) there is a chance Global X may not be able to pay out the full returns of the S&P 500 to its unitholders.

This risk is mitigated by regulatory requirements, but it’s still present.

The tax-efficient structure of HXS may be subject to regulatory changes. If the government alters tax laws, the fund’s advantages could diminish or disappear entirely.

Although both of these risks are highly unlikely to ever impact the fund, they still exist, and as such, need to be taken into consideration.

VFV risks

VFV is a relatively traditional ETF. So, there isn’t any added risks over and above any other S&P 500 ETF. Your investment value will fluctuate with the performance of the S&P 500 index.

However, as a CAD listed fund, currency risk is a factor for VFV. As it holds US stocks directly, changes in the CAD/USD exchange rate can impact your returns.

If you’re looking for a Vanguard fund that doesn’t have currency fluctuations due to its hedged nature, you could look to VSP.

VFV vs HXS performance

When comparing VFV and HXS, it’s important to understand their performance differences. Both ETFs track the S&P 500 index, but their structures affect returns differently.

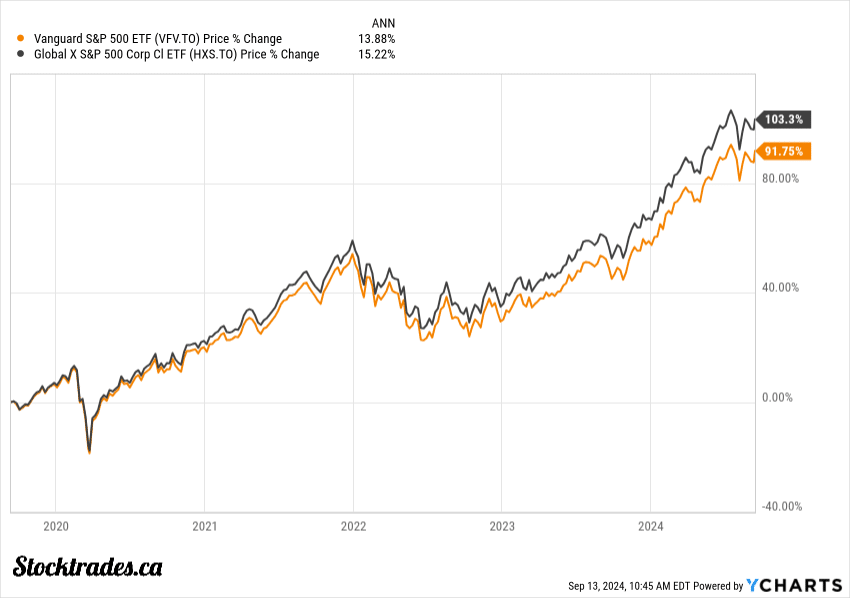

Lets take a look at the chart below, which shows the returns of VFV and HXS pre-distribution. We can see that over the last 5 years, HXS has outperformed VFV by about 12%.

This makes sense, as VFV pays out a distribution every year whereas HXS does not. So, HXS’s distributions will accumulate and be represented inside of its share price.

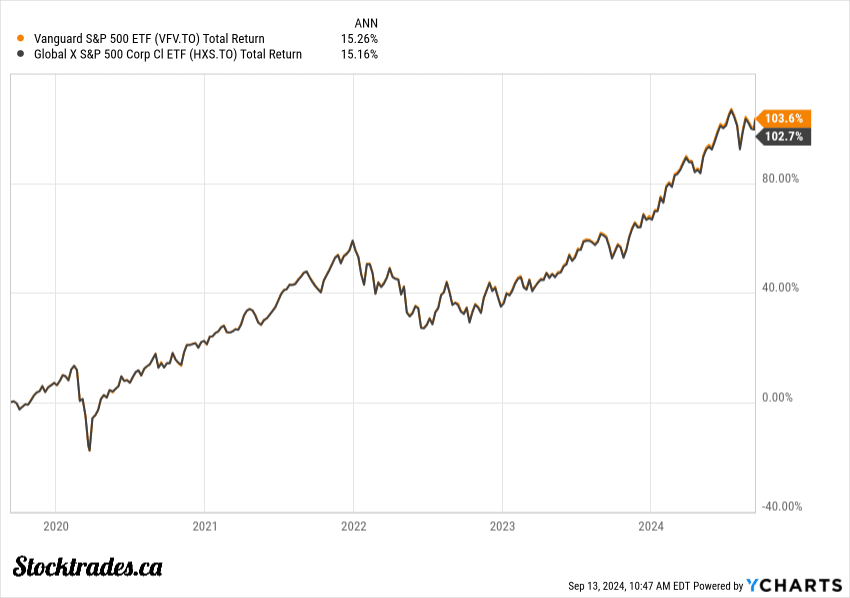

Now, lets look at a chart that highlights the total return of the funds.

As we can see, the performance narrows and we have a slight outperformance by VFV over HXS over the last half decade.

Now, before we automatically assume that VFV is the better fund because of the outperformance, we have to take into account that these returns would be pre-tax.

Over the years, you would have paid taxes on the distributions received from VFV, whereas with HXS, you would have only had to pay taxes when you decided to sell.

Because of this, depending on your situation, you may actually end up with more money in your pocket holding HXS than VFV, despite VFV returning a slightly higher amount.

Overall, it all depends on your individual situation and the account you hold these funds in.

Which ETF is better?

When comparing VFV and HXS, the key difference lies in their tax efficiency.

Both ETFs track the S&P 500 index, but HXS employs a unique structure that can be advantageous in taxable accounts, especially for higher earners.

HXS’s structure allows HXS to convert all returns into capital gains, potentially reducing your tax burden.

In contrast, VFV distributes dividends, which are taxable in the year you receive them.

Consider these factors:

- Tax efficiency: HXS has an edge in taxable accounts to some individuals

- Fees: VFV has a slightly lower MER (0.09% vs 0.10% for HXS)

If you’re investing in a taxable account and prioritize tax efficiency, HXS might be the better choice.

For tax-sheltered accounts, VFV’s slightly lower fees and simplicity could give it an edge.