Interactive Brokers vs Questrade – An In-Depth Comparison

Interactive Brokers and Questrade are two popular online brokerage platforms in Canada. They offer many investment products and services, including stocks, options, ETFs, mutual funds, etc.

In addition, they also offer some of the lowest commission levels in the country, which makes them very popular options for investors.

Interactive Brokers is an American company, but far-reaching. People who are interested in additional functionality in terms of international trading might have a look at Interactive Brokers.

Questrade, on the other hand, is a Canadian company, so Canadians will have access to more registered accounts. Thus, Questrade would be helpful for a more well-rounded overall personal finance situation.

However, you should be aware of some critical differences between the two platforms and despite being Canadian, you may prefer Interactive Brokers.

I personally tested both of these platforms out extensively to help investors decide which one is right for them. Because make no mistake, these are very different platforms.

Lets dive into my thoughts below.

Want the TLDR? I’m choosing Questrade over Interactive Brokers

Although Interactive Brokers does have more attractive commissions, being a Canadian, I’m choosing Questrade for a few reasons.

For one, the ability to open Canadian specific accounts. Secondly, the platform is more directed towards long term investors. What I mean by this is the simplicity of it. I’m a relatively experienced investor, and even I found Interactive Broker’s platform a bit too cumbersome. It is certainly tailored to more advanced traders, and for the average Canadian long-term investor, I believe Questrade would suite you just fine.

However, there is no doubt Interactive Brokers offers rock bottom commissions and attractive foreign exchange rates. If this is attractive to you, feel free to check them out.

Interactive Brokers vs Questrade – A look at each platform

Interactive Brokers

Interactive Brokers is a US-based brokerage firm that has been operating since 1978 and is known for its advanced trading platform and comprehensive research tools.

Managing my accounts with Interactive Brokers was a seamless process. I was able to efficiently monitor account activity, access statements, deposits and withdrawals with every little effort.

The platform also offers tools for tax reporting and in-depth account analysis. Anything that makes my life easier I definitely appreciate, and Interactive Brokers does that.

International market access

One highlight of Interactive Brokers is their expansive market access. I found Interactive Brokers quite helpful in opening up exposure to international trading. Yes, international ETFs have made this a little less important, but it’s still a very nice addition nonetheless.

With access to over 135 markets across 33 countries, I could diversify my investment portfolio and explore various asset classes from many parts of the globe. This global reach means I was not confined to a single market or asset type. I believe this is an issue that plagues Canadians, as most have a home-country bias.

Interactive Brokers could be worth checking out for those who look to diversify widely outside of North America.

Trading platforms

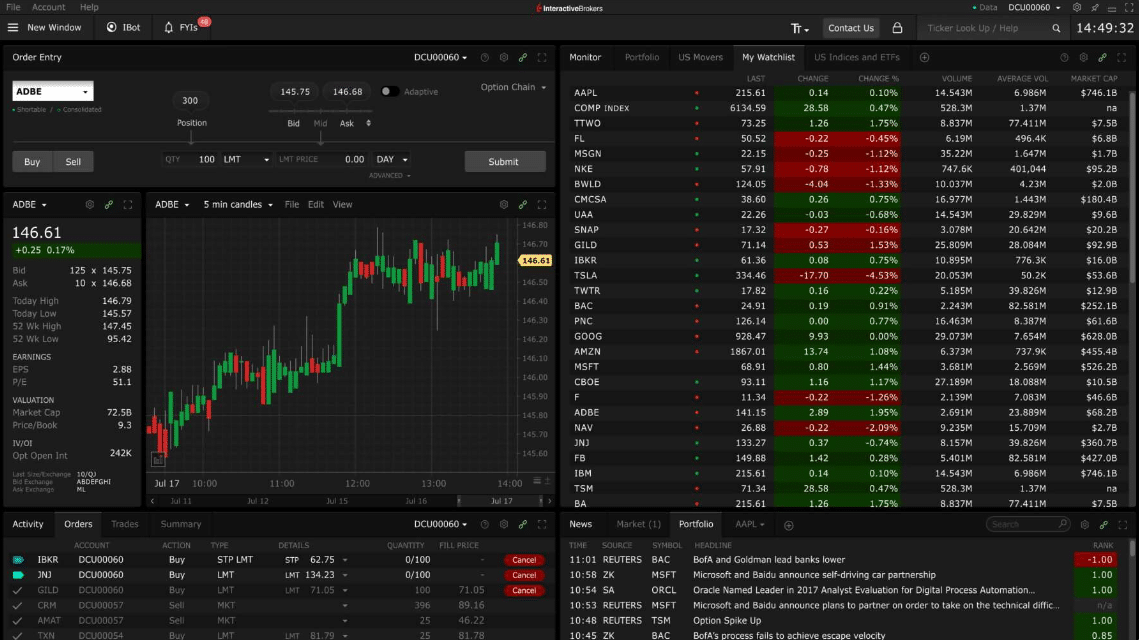

Interactive Brokers understands that traders have varied preferences and addresses this by offering multiple trading platforms. The Trader Workstation (TWS) is a comprehensive desktop platform allowing deep analysis, research, and sophisticated order execution.

Make no mistake, if you’re a trader who prefers advanced platforms, I cannot think of a better brokerage than Interactive Brokers. It is complex, but if you’re able to navigate the platform, it is a traders dream.

One of the key features of the TWS platform is its customizable interface. Users can create their layouts and save them for future use. The platform also provides advanced charting tools, including technical indicators and drawing tools. The TWS platform is available for desktop, web, and mobile devices.

I found the IBKR Mobile app for iOS and Android devices offers a relatively easy experience when it comes to trading on the go. The Client Portal provides easy access to account information and trading tools when I prefer a web-based platform, which in this day and age is becoming less and less.

A comprehensive suite of order types

The availability of a wide range of order types is a powerful tool for executing trades precisely. Interactive Brokers caters to complex trading strategies with order types such as market, limit, stop, trailing stop, bracket orders, and conditional orders.

You’d think this would be universal across brokerages. However, it’s not. For example, platforms like Wealthsimple Trade, although great, don’t have advanced orders like the trailing stop loss. Even a major brokerage like Royal Bank Direct Investing doesn’t have it.

Advanced margin tracking and short selling

Effective risk management is a paramount consideration in trading. Interactive Brokers excels in this regard with the Portfolio Margin tool.

This feature calculates margin requirements based on the overall risk of my portfolio. This is particularly advantageous for traders who deal with options and futures, enabling them to maintain a firm grip on risk management and protect their capital.

For me, as a long term investor, this isn’t really something I utilize. But, for someone who is looking to actively trade, it’s a huge feature.

The margin trading option is a valuable resource for users with eligible accounts. However, this is not without risk, and there are rules surrounding these types of investments. This would not be a strategy recommended for beginner investors.

Interactive Brokers’ support for short selling was an advantageous tool in my trading arsenal. It permits potential gains from declining asset prices, allowing exploration of strategies even in bearish market conditions. This capability benefits traders seeking to diversify their trading approaches in rising and falling markets.

Although I’m not an active trader, I do dabble in the odd short-sale to take advantage of declining prices.

This strategy can be quite risky, so it’s essential to have some investment experience and fully understand the risks involved.

Questrade

Questrade is a Canadian-based brokerage firm that was founded in 1999. Questrade is known for its low fees and user-friendly platform. The broker offers many registered account types as well.

I used Questrade for years. In fact, it was the first brokerage account I got involved with when I started investing more than 14 years ago. Although I’ve moved on to Qtrade, I still acknowledge the fact that this is an outstanding platform for Canadian investors.

With Questrade’s mobile apps, I could trade and manage my investments from virtually anywhere. These apps for iOS and Android devices made it easy for me to stay connected with my investments on the go.

Whether I’m commuting, travelling, or hanging out at home, these apps provide the flexibility I need to make investment decisions in real time, access my account information, view live quotes, and set up alerts for market movements.

Sure, the mobile app isn’t the best for looking at charts and making trading decisions. However, as a long term investor, I don’t really care much for it, and it’s not any better elsewhere.

Trading platform

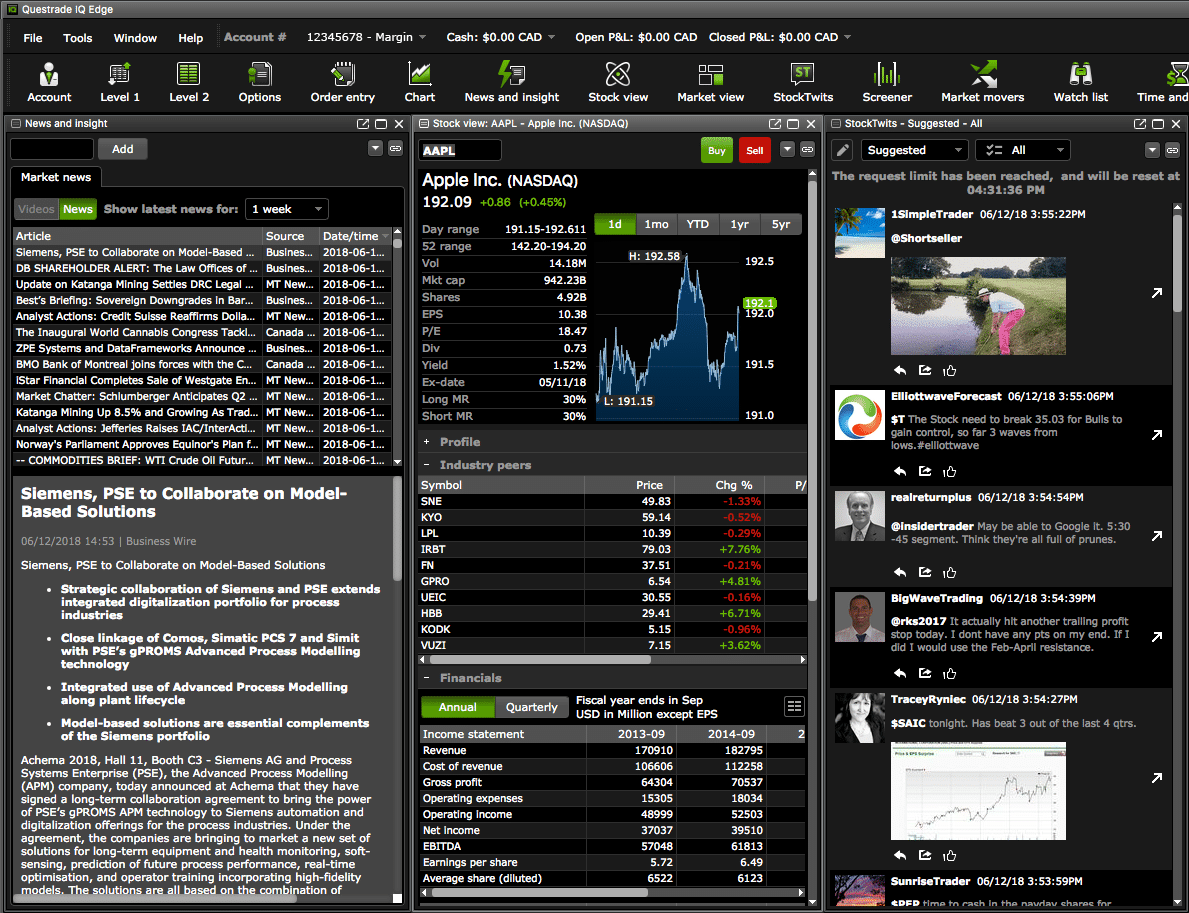

The Questrade Trading platform is straightforward and user-friendly. It’s perfect for me as an experienced investor, but is also very easy for beginners unlike Interactive Brokers.

I get real-time market data, customizable watchlists, and the ability to place various types of orders, such as market, limit, and stop orders. However, when I want to take my trading to the next level, Questrade IQ Edge, the downloadable desktop platform, is a game-changer (I attached an image below). It comes packed with tools, technical indicators, and features for options trading.

The platform is designed for both novice and experienced traders and offers a range of features to help users make informed trading decisions. The platform provides access to a variety of trading products, including stocks, options, ETFs, mutual funds, and bonds. Questrade also offers many educational resources to help investors expand their knowledge. I’ve looked at a few of them myself, they are top-notch in terms of quality.

The platform also provides advanced charting tools, including technical indicators and drawing tools. The Questrade IQ Edge platform is available for desktop and web devices, as well as mobile devices.

Questrade doesn’t just facilitate trades; it provides a range of resources to support me in my investing.

This includes real-time data feeds, technical analysis tools, and charting features with a wide array of technical indicators. It’s like accessing a treasure trove of market insights to guide my decisions.

The one thing I will say is a bit frustrating is their pricing for level 2 data. With Qtrade, I get it for free. With Questrade, unless you’re a heavy trader, it can cost you upwards of $70/month.

Margin trading

As someone who doesn’t trade much but does have some experience in it, I appreciate that Questrade offers margin trading. It’s like having access to a financial lever to amplify gains.

However, I’m also aware that it increases the potential for losses, so I exercise caution and stick to a well-defined strategy when using this feature, and I don’t use it often.

I would not say that this kind of investment is for beginners. People should fully understand the risks before engaging in margin trading.

It offers competitive margin rates and although it doesn’t necessarily have the margin tracking that Interactive Brokers does, it’s still a great feature.

Additional tools

The portfolio analysis tools provided by Questrade are like a navigation system for my investments. They enable me to assess the performance of my portfolio, analyze asset allocation, and set specific financial goals.

Questrade’s international trading capabilities open up a world of opportunities. It’s like having a global passport for my investments. I can trade on U.S. exchanges and access a broader range of investment options beyond Canada’s borders, allowing for further diversification.

Platform Comparison

As mentioned, both IB and Questrade offer customizable trading platforms with advanced charting tools. However, the TWS platform offered by IB is more geared towards active traders who require advanced features and tools.

Questrade IQ Edge platform is designed for both novice and experienced traders, along with long-term investors, and offers a more user-friendly interface.

If you’re just someone who is looking to build a buy and hold portfolio of stocks, you’ll likely find Interactive Brokers has way more than you need.

For this reason, I’m a little more biased towards Questrade’s platform. However, if I was an advanced trader, Interactive Brokers would be a dream.

Investment products and assets

Interactive Brokers products

The brokerage firm provides access to over 135 markets across 33 countries, including the NYSE, NASDAQ, and many other international equities markets.

This makes it one of the most comprehensive investment platforms available. Interactive Brokers also offers its clients access to more than 125 currency pairs, including USD and CAD, and it is one of the largest forex selections in the industry.

Interactive Brokers also offers its clients access to the following investment products:

- Stocks: Interactive Brokers provides access to stocks listed on exchanges worldwide. The brokerage firm offers competitive pricing for stock trades, with commissions as low as $0.005 per share.

- Bonds: Interactive Brokers offers access to various fixed-income securities, including government, municipal, and corporate.

- ETFs: Interactive Brokers provides access to a wide range of ETFs, including those that track major indices such as the S&P 500, Toronto Stock Exchange, and the Dow Jones Industrial Average.

- Mutual funds: Interactive Brokers offers access to thousands of funds from leading fund providers.

- Metals: Interactive Brokers provides access to gold, silver, platinum, and palladium.

- Commodities: Interactive Brokers offers access to various commodities, including oil, gas, and agricultural products.

Questrade Products

Questrade has very similar products on the trading end that Interactive Brokers does. However, where it lacks is the foreign exchange portion and the access to international markets.

But, make no mistake about it, this platform is going to have more than enough options for 99% of investors.

Questrade offers access to the following investment products:

- Stocks: Questrade provides access to stocks listed on exchanges worldwide, including IPOs. The brokerage firm offers competitive pricing for stock trades, with commissions as low as $0.01 per share.

- Bonds: Questrade offers fixed-income securities, including government, municipal, and corporate.

- ETFs: Questrade provides access to a wide range of ETFs, including those that track major indices such as the S&P 500 and the Dow Jones Industrial Average.

- Mutual funds: Questrade offers access to thousands of funds from leading providers.

- Metals: Questrade provides access to gold and silver. You’re able to buy and hold physical precious metals in most types of self-directed accounts – including registered accounts like an RRSP, TFSA, RIF, or RESP.

- Commodities: Questrade offers access to commodities, including oil, gas, and agricultural products.

Trading fees and commissions

Interactive Brokers fees

With the competitive fee structure offered by Interactive Brokers, I could optimize my returns. They have rock-bottom commissions, and this element of the platform makes it one of the most popular in North America.

The broker charges a commission fee based on the size of the trade, with a minimum fee of $1.

The commission fee for stocks and ETFs is tiered, based on the monthly volume of shares, from $0.003 to $0.008, with a minimum of $1 per trade.

So, if you bought 50 shares of Telus, you’d pay $1. If you bought 500 shares of Telus, you’d pay $5.

It also has some of the cheapest options contract commissions out there, offering anywhere from $0.15 to $0.65 per contract.

Questrade fees

Cost is a significant factor in my investment decisions, and Questrade doesn’t disappoint. However, it’s not as good as Interactive Brokers.

Questrade offers free ETF purchases, a fantastic way to build a diversified portfolio without incurring trading fees.

For stock trades, the commission fees are relatively low compared to many other Canadian brokerages, with a commission fee of $0.01 per share, coming with a minimum of $4.95 and a maximum of $9.95 per trade.

So, the difference here is the minimums. If you buy 50 shares of Telus with Interactive Brokers, you’re charged their $1 minimum. With Questrade, it jumps up to $4.95. However, once you get into high volume share purchases, they’re practically the same commissions.

For example, a 700 share purchase at Questrade and Interactive Brokers would cost you the exact same.

Account Types and Options

Interactive Brokers accounts

The issue for Canadians using this platform is restrictions in terms of accounts such as an RRSP and others. If you are thinking about using Interactive Brokers, you need to check out their restrictions for these types of accounts.

For example, Interactive Brokers does not support withdrawing funds from the RSP for the Home Buyers Plan. So, for many Canadians, it would not make sense to have the RSP intended for that use set up with Interactive Brokers.

For the most part, however, Interactive Brokers offers various account types, catering to a wide range of users. I could choose the account type that best aligns with my specific financial goals and tax considerations.

Whether I was looking for a standard account, joint account, saving for retirement, or managing a corporate entity, Interactive Brokers provided what I needed.

Their account types are extensive, and there are certainly use cases for Canadians. But there are restrictions that do not exist at Questrade, and that should be addressed before opening accounts.

Questrade accounts

Using Questrade is perfect for individual Canadian investors or for those who want to invest jointly with a partner or family member.

Questrade offers tax-advantaged accounts like Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs). The TFSA is a fantastic choice for tax-free long-term investments, while the RRSP allows me to save for retirement or even a down payment on a home while enjoying tax benefits.

Questrade’s Registered Education Savings Plans (RESPs) allow investors to save for their children as well.

Questrade also offers Locked-In Retirement Accounts (LIRA), Life Income Fund (LIF), Registered Retirement Income Fund (RRIF), and Registered Education Savings Plan (RESP).

There is also Questwealth Portfolios. This robo-advisor account invests in ETFs based on an investor’s risk tolerance and financial goals.

Overall, Questrade has a much larger account base suited for Canadians. It makes sense, as they’re a Canadian operated brokerage.

Customer service and support

Interactive Brokers support

Whether I had inquiries, concerns, or technical issues, I could contact Interactive Brokers via phone, email, or live chat. The support team is well-equipped, and it took next to no time to get results.

The company’s phone support is available in multiple languages, and clients can choose the language they prefer. The support team is knowledgeable, unlike a lot of support teams, and can help with any trading-related questions or issues.

Interactive Brokers also offers a chatbot service that can help clients with basic questions.

However, I found the chatbot is less effective than a human support agent, and clients may need to contact customer support directly for more complex issues.

Overall, I sampled the support with some “pretend” issues as I barely found any. I often had a remedy for most of the issues in less than 20 minutes.

Questrade support

Questrade’s customer support team is accessible through various channels – phone, email, or live chat – to get help with any questions or issues related to my account.

The online Help Center is a goldmine of information packed with FAQs and comprehensive guides to address common concerns. So much so that I barely needed to contact customer support.

However, when I did, I found the support to be much quicker than Interactive Brokers. In fact, I was almost instantly connected to a representative when requested.

The company’s phone support is available in English and French; clients can choose their preferred language.

Research tools and market data

Interactive Brokers research tools

If you’re looking to gain access to research and tools that will save you time, help you identify better opportunities, and ultimately make you more money, it’s hard to argue with Interactive Broker’s suite of tools.

Market scanners, real-time news feeds, economic calendars, and fundamental data are at my fingertips. Moreover, accessing third-party research reports gave me a more comprehensive perspective on market trends, which is invaluable in developing trading or investment strategies.

Interactive Brokers offers a range of educational resources, including webinars, instructional videos, and informative articles. This commitment to education is beneficial for traders who are continuously seeking to get better. However, they have plenty for long-term investors as well.

One of the key features of Interactive Brokers’ research tools is its advanced screening capabilities. The platform provides users access to various screeners, including fundamental, technical, and options screeners. These tools allow traders to quickly and easily identify potential trading opportunities based on multiple criteria, such as earnings, revenue, and volatility.

For the most part, Interactive Broker’s offers as good of screening functionality as many paid platforms.

Interactive Brokers also offers a variety of alerts, which can be customized to meet the needs of individual traders.

Users can set alerts based on price, volume, and other criteria, and receive notifications via email, text message, or through the platform itself.

Questrade research tools

One of the things I like about Questrade is the wealth of research and educational resources it provides. It’s like having a team of experts right by my side.

I have access to market news updates, analyst reports, and stock screeners, which are incredibly valuable for identifying investment opportunities.

They also provide webinars, video tutorials, and articles on various investment topics. These resources help me understand the financial markets’ intricacies and enhance my investment strategies.

Questrade also offers a variety of screening tools, which can be used to identify potential trading opportunities based on a variety of criteria, such as price, earnings, and revenue. Users can also set up alerts to be notified when specific criteria are met.

If I were to pick which platform contains more features, I’d lean towards Interactive Brokers. But it is very close to just being a draw. If you’re a Canadian with the need to access Canadian specific accounts, you’ll likely sacrifice the very small functionality in terms of tools for account options.

Regulation and security

Interactive Brokers regulation

If I’m giving my money to a brokerage account, I want to make sure it is safe. After all, it’s my retirement at risk.

Interactive Brokers is a well-established and regulated brokerage.

Interactive Brokers is a publicly traded company regulated by the SEC in the United States and the Investment Industry Regulatory Organization of Canada (IIROC) in Canada.

Interactive Brokers Canada is a member of the Canadian Investor Protection Fund (CIPF), which provides insurance for client assets up to $1 million in case of insolvency of the broker.

Questrade regulation

The security measures at Questrade are incredibly reassuring. They use encryption to safeguard my data during transactions and while it’s stored.

The two-factor authentication (2FA) adds an extra layer of protection. It’s like having a bank vault for my investments, which no doubt adds confidence.

Questrade is also a member of the Canadian Investor Protection Fund (CIPF). In the unlikely event of Questrade’s insolvency, CIPF provides insurance coverage for eligible accounts, offering me peace of mind about the safety of my investments. It’s like having a safety net to ensure my retirement funds are safe.

Questrade is a privately owned company regulated by the IIROC in Canada.

Really, both of these companies have almost identical security, and your money is going to be secure at either one, as they’re heavily regulated and insured.

Should I get Interactive Brokers or Questrade?

After comparing Interactive Brokers and Questrade, it is clear that both online brokerage platforms have their advantages and disadvantages.

It is not so much Questrade vs Interactive Brokers and which is the best online broker. It is more about which features appeal to you. Each person’s situation can be different.

Questrade is an excellent choice for beginners and investors who want to start with a smaller minimum deposit. It is also going to be more suited to long-term investors.

On the other hand, Interactive Brokers has a bit more complex platform suited to traders and foreign currency investors.

Regarding fees, both Interactive Brokers and Questrade are discount brokers, meaning they offer lower fees than traditional brokers. Once you get up to medium share amounts, the differences in commissions are essentially negligible between these two.

The one main advantage to Questrade, and why I’d choose it personally, is the access to Canadian specific account types and overall the knowledge base being suited for Canadian investors.

The choice between Interactive Brokers and Questrade depends on the individual’s needs and preferences, but as a Canadian long term investor, I’m ultimately choosing Questrade.