Is Amazon Stock a Buy Despite the Sluggish Economy?

Amazon has come a long way since its humble beginnings as an online bookstore.

Today, it’s a global powerhouse in e-commerce, cloud computing, and artificial intelligence. The company’s growth story is nothing short of remarkable, and is a stock I’ve owned for quite some time.

From Amazon Web Services to its Prime subscription service, the company keeps finding new ways to grow.

Amazon’s growth has been impressive, but it also faces challenges. Regulatory scrutiny and tough competition in various segments are ongoing concerns. But the company’s track record of overcoming obstacles and its strong market position make it a compelling investment option.

Is the stock still a buy today? Let’s take a deeper look.

Key takeaways

- Amazon’s diverse business model supports its strong market position

- The company’s growth in cloud computing and AI shows promise

- Upcoming earnings could provide insight into Amazon’s financial health

Despite a consumer spending pullback, operations remain strong

The e-commerce giant reported net sales of $148.0 billion, marking an 11% increase year-over-year when adjusting for foreign exchange impacts.

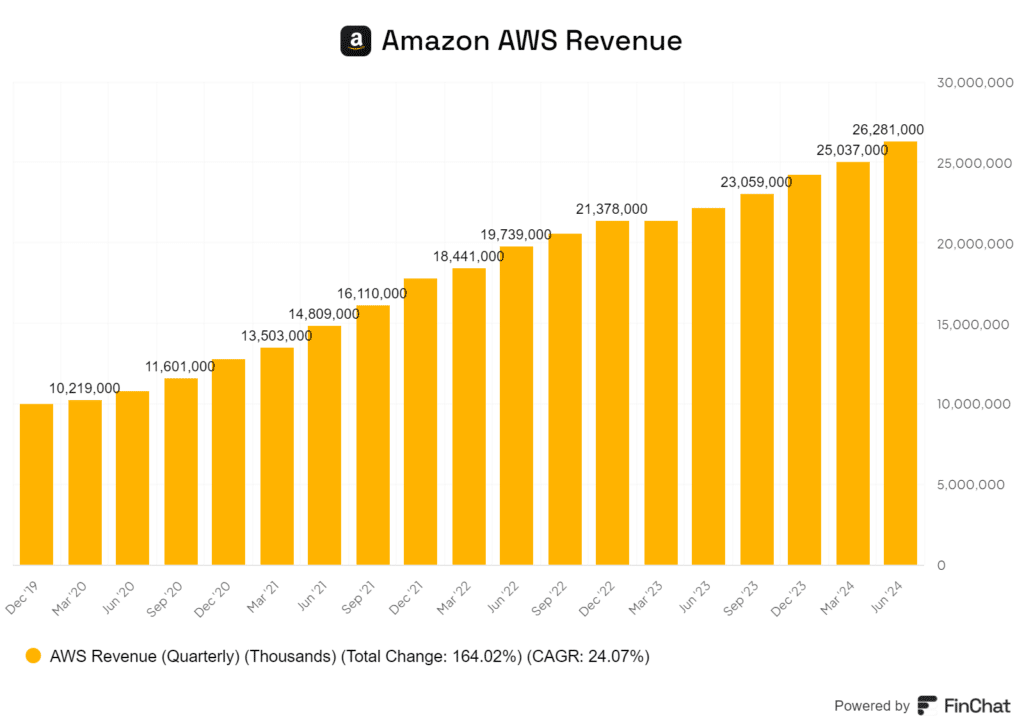

Amazon Web Services (AWS) continues to drive exceptional growth for the company. AWS sales jumped 19% to $26.3 billion, outpacing predictions and showing renewed momentum in cloud services.

This growth is crucial as AWS remains Amazon’s most profitable segment.

Operating income more than doubled to $14.7 billion, while net income hit $13.5 billion.

However, the core retail sector experienced slower momentum, with online store growth reaching only 5% from the previous year. Additionally, the advertising division, while expanding by 20% to hit $12.77 billion, still fell short of the projected $13 billion mark.

Looking ahead to Q3, the company projected cautious net sales guidance between $154.0 billion and $158.5 billion, representing 8-11% growth. Operating income is expected to range from $11.5 billion to $15.0 billion.

Considering the current economic environment, I’m pretty impressed with the results from Amazon over the last 3-4 quarters.

What’s driving Amazon forward

Amazon’s stock has been on a tear over the past several years, outpacing the S&P 500 by a wide margin. I believe this stellar performance is set to continue, driven by several key factors.

First and foremost is the impressive growth of Amazon Web Services (AWS). As mentioned, the platform is Amazon’s true growth driver at this point in time.

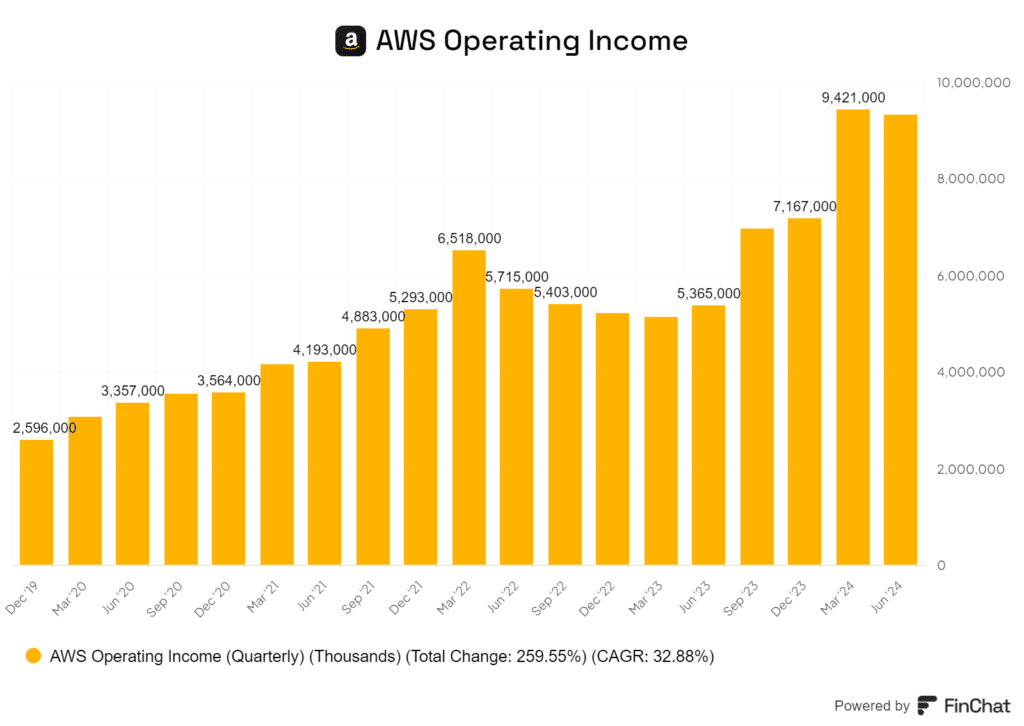

AWS is not just growing – it’s becoming more profitable too, with margins expanding significantly. Look at the chart below of the company’s operating income. It has nearly quadrupled from 2019 levels.

E-commerce also remains a solid foundation for Amazon’s growth. The North American segment’s 9% revenue increase shows there’s still room to expand in a market where it has a dominant market share.

I’m particularly excited about the international segment finally turning profitable, which could be a game-changer for overall earnings.

Amazon’s advertising business is another bright spot. It’s becoming a major player in digital advertising. It has so much consumer data, I have very little doubt the segment will produce strong results for advertisers, and thus outsized growth for Amazon.

Overall, the company’s moat in the retail business provides a rock solid foundation and stability for the company, and it utilizes that to expand its faster growing verticals. This is a recipe for success.

What to look for next quarter from Amazon

Amazon looks set to surpass earnings forecasts for Q3 2024. I believe several factors point to a potential upside surprise when the company reports results on October 24th.

Wall Street analysts have been trimming their estimates over the past few months. This lowered bar creates an opportunity for Amazon to exceed expectations.

The company’s core businesses are showing strength. AWS revenue grew 19% last quarter, while advertising revenue jumped 20%. These high-margin segments should continue driving profits higher.

Amazon’s focus on efficiency is paying off. Operating profit margins expanded significantly in Q2, reaching nearly 10%. I expect this trend to persist into Q3 as cost-cutting measures take hold.

Free cash flow has doubled since 2021, yet the stock price remains flat over that period. This disconnect suggests the market may be underestimating Amazon’s earnings power, likely due to the fears of a weakening economy.

The company’s guidance for Q3 operating profit growth of 18% year-over-year seems conservative given recent trends. I think there’s room for Amazon to beat its own forecast.

While macroeconomic risks remain, Amazon’s diverse revenue streams and dominant market positions provide insulation. The company continues to invest heavily in growth areas like AI, which should fuel future expansion.

Is Amazon a buy right now?

I believe Amazon stock is a buy at its current price. As I have mentioned, it is one of my larger holdings. The company’s proven track record and dominant market position make it an attractive investment.

Amazon’s e-commerce business still has significant growth potential, especially in international markets. The company’s ongoing expansion into new product categories and services should drive future revenue growth.

AWS is the real gem though. This high-margin business continues to be a major profit driver and has plenty of room for expansion as more companies shift to the cloud.

Amazon’s advertising segment is another bright spot. It’s growing rapidly and becoming a significant revenue source. I expect this trend to continue as more brands recognize the value of advertising on Amazon’s platform.

While economic uncertainties exist, I’m confident in Amazon’s ability to navigate the challenges. The company has shown resilience in past downturns.

For growth-oriented investors, I see Amazon as a compelling buy. The stock’s current price offers an attractive entry point.