Is Aurora Cannabis (TSE:ACB) Finally a Buy in 2024?

If you were part of the cannabis boom back in late 2017 and 2018, it’s likely you witnessed the complete euphoria when it came to Canadian stocks in the cannabis sector.

And, it’s likely if you were new to buying stocks in Canada and showed up late to the party, you ended up losing a small fortune investing in these companies. Market valuations of single companies exceeded the total target market of the entire industry here in Canada, and valuations had become completely nonsensical.

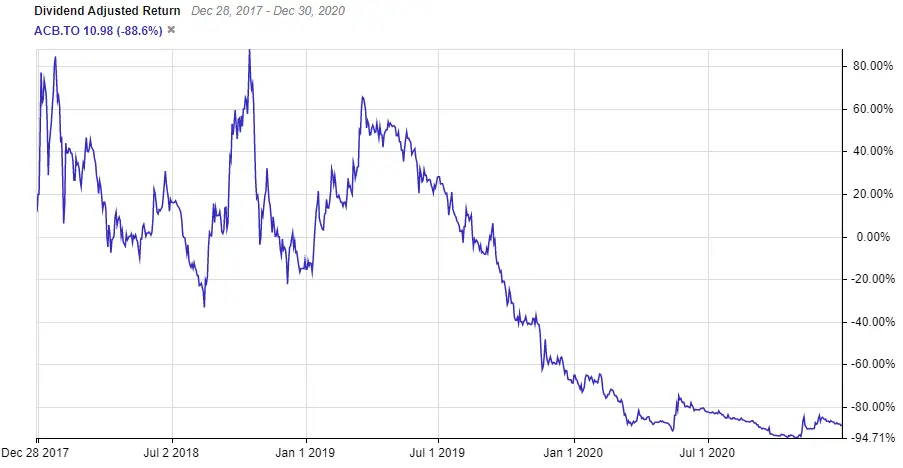

So much so, that a $10,000 investment in one of the more popular Canadian cannabis companies, Aurora Cannabis (TSE:ACB), in December of 2017 is now worth around $1100.

Market Cap: $1.73 billion

Forward P/E: 0.00

Stocktrades Growth Score: Premium Members Only

Charts provided by StockRover. Check out Stockrover Here!

If you were a buyer at that time, you now need the stock to increase almost tenfold to recover your initial capital. I think it’s pretty safe to say we can confirm that an investment in Aurora during the boom, is one that will never become a winning proposition.

However, that was then, and this is now. Investors are finally starting to revisit the industry to see if it has potential at these price levels, and many Canadians are wondering, especially with potential legalization south of the border, if a company like Aurora can make a comeback.

Lets have a look.

What does Aurora Cannabis (TSE:ACB) do?

Aurora Cannabis is a leading licensed producer of cannabis products and is focused on providing premium, innovative products to both medical patients and recreational users across the globe.

The company is the number one medical cannabis seller in Canada, and is one of the top CBD brands in the United States.

The company has operations in both Canada and Europe, including

- Aurora Sky, capable of 25,000 KGs of production per year

- Aurora River, capable of 28,000 KGs of production per year

- Whistler Pemberton, capable of 4,500 KGs of production per year

- Aurora Nordic 1, capable of 10,000 KGs of production per year pending GMP Certification

Aurora Cannabis has had a rocky 2020

Even though the industry has become more developed and mature, Aurora Cannabis is still a speculative play, much like it was in 2017.

The results of the US election sent Aurora shares soaring, due to the potential of US legalization, but once again they’ve quickly came back to earth, losing 33% of their value since late November of 2020.

The company also issued a share offering in November after its share price skyrocketed, nearly tripling in a week. Share offerings are well known to Aurora Cannabis shareholders, as the company is notorious for diluting its shareholders of value to raise more capital.

The end result of this share offering was more frustrated shareholders and an inevitable plummeting in price.

So I guess what I’m trying to drive home here, is if you’re interested in investing in Aurora Cannabis, be prepared for significant volatility, and reserve this stock for the speculative portion of your portfolio.

So now that we know the stock will fluctuate in price rapidly, we need to understand if it’s even worth a purchase in 2021. And in my eyes, the answer is a pretty clear no.

I’d be avoiding Aurora Cannabis moving forward

In my opinion, this is a cannabis company that has been plagued by mismanagement and high expectations never coming to fruition.

Those waiting for an investment in Aurora Cannabis to be fruitful may be waiting a long time. And in reality, that day may never come.

If we look to the first quarter of 2021, the company posted revenue of $82.06 million, which is essentially flat from the year prior.

Considering this is a company that is still trading at nearly 8 times sales, it’s an expensive price to pay for a company who simply isn’t growing its revenue, at all.

The company did finally achieve positive EBITDA in 2020, however this came at the expense of some pretty drastic cost-reduction strategies.

The company is cash strapped, which puts it at a severe disadvantage, especially considering for most of these cannabis companies to survive in today’s environment, they need to be diversifying and investing in new product development.

We can talk about potential all we want, and many have been speaking on it since the early days of the cannabis boom. However, there eventually comes a time where we have to ask ourselves, where is the progress? Where are the results?

It’s been a constant spinning of the tires from Aurora Cannabis for way too long in my eyes

The company has put a new management team in place, cut costs, and speaks of consistent profitability in the next fiscal year.

There is no question that the company needs this revamp. It’s quickly losing ground to competitors like Canopy Growth in the edible and vape space, and it’s even losing ground in the recreational cannabis market here in Canada. A successful change in strategy could provide investors purchasing now with some solid returns.

But it’s really hard for me to forget the constant share offerings, missed estimates, and back peddling on forward outlooks from the company.

And for that reason, this is a cannabis company that I would be avoiding right now. In fact, I’d likely be avoiding the whole sector.

In my opinion there are better places to put your money right now. Is Intertape Polymer (TSE:ITP) still worth looking at after it’s surge?