Is Bce (TSE:BCE) a Canadian Dividend Dud Moving Forward?

There are particular Canadian dividend stocks that tend to have a strong investor following, regardless of performance.

Some of these are in the oil and gas sector, the financial sector, and what we’ll be going over in this piece, the telecom sector.

There’s a heated debate almost constantly when it comes to who is Canada’s best telecom company. If you’re new and just learning how to buy stocks in Canada, telecom companies is often the first sector investors look at due to its stability.

And more often than not, those who don’t care to do the research will issue a quick “you can’t go wrong with any of them.”

As you’ll see as we move forward in this piece, this can’t be farther from the truth.

So, is BCE (TSE:BCE), a Canadian Dividend All-Star, a solid telecom play moving forward despite a severe underperformance over the last half decade? Lets have a look.

What does BCE (TSE:BCE) do?

BCE is Canada’s largest telecom company with a market capitalization of $47.87 billion. Similar competition like Telus and Rogers have market caps of $29.94 and $28.08 billion respectively.

The company generates the bulk of its revenue from its Wireline broadband & TV as well as its Wireless products, coming in at 38% and 37% of revenue respectively.

However, the company does have smaller Wireline voice and Media divisions that generated the remainder of revenue at 15% and 10% respectively.

BCE currently provides services to approximately 22 million subscribers and has a network that can cater to 99% of the Canadian population.

There is no doubt that Canadian investors are attracted to the strength of BCE’s brand and its sheer size.

But in terms of the company’s dividend, is it safe, and can we expect further growth moving forward?

Lets take a look at BCE’s dividend

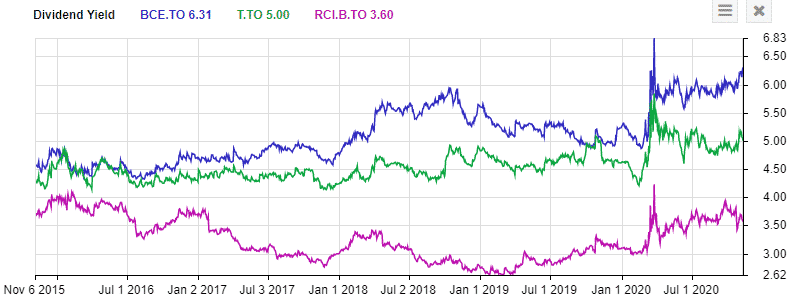

First off, if I were to rank BCE’s dividend compared to the other Big 3 telecoms here in Canada, I’d put them firmly behind Telus, but also firmly ahead of Rogers.

Market Cap: $47.86 billionForward P/E: 17.83Yield: 6.29%Dividend Growth Streak: 11 yearsPayout Ratio (Earnings): 107.42%Payout Ratio (Free Cash Flows): Premium Members OnlyPayout Ratio (Operating Cash Flows): Premium Members Only1 Yr Div Growth Rate: 5.00%5 Yr Div Growth Rate: Premium Members OnlyStocktrades Growth Score: Premium Members OnlyStocktrades Dividend Safety Score: Premium Members Only

The company is the highest yielding stock in the sector at 6.3% and it currently has a 11 year dividend growth streak, making it a Canadian Dividend Aristocrat.

When we compare this dividend growth rate to other telecom companies in the sector, BCE ranks fourth behind Telus who leads the way and the two Cogeco companies which sit at 16 and 15 years.

In terms of payout ratios, a company like BCE, along with many other telecom companies, is going to set off alarm bells to those who don’t look closer. Why is that?

Well, most telecom companies are currently paying out more, or close to their earnings per share in the form of dividends. For some companies this is a recipe for disaster, but for telecoms you need to dig a little bit deeper.

It’s critical we look at BCE’s dividend ratio when it comes to free cash flows. Why?

Earnings per share includes “non-cash” items like depreciation. Because telecom companies hold a lot of depreciating assets, this can hurt the company’s earnings per share.

Free cash flows however do not take non-cash expenses into account, so it is a more accurate measurement of the true cash a company has to spent. When we look at BCE’s dividend when compared to free cash flows, it’s only paying out 66.64%, signaling that this company’s dividend is more than safe.

However, dividend isn’t everything when it comes to telecoms here in Canada. We want strong and reliable share growth.

BCE has been one of the worst performing telecoms over the last half decade

When we look at how BCE has performed vs the other major telecoms over the last 5 years, it has clearly been a laggard.

Charts provided by StockRover. Check out Stockrover Here!

And, for those who jump and say “well, the dividend well help these returns!” No, this is on a dividend adjusted basis. Over the last half decade, BCE has lost shareholders 6.3%. The only major telecom company that has performed worse is Shaw Communications.

So why the lack of share growth? Why is this company struggling so much.

For one, BCE’s earnings have been shrinking at a 3.7% clip over the last half decade. To go along with this, the company has only increased revenue by 1.6% over that same time period.

If you understand how the telecom sector works, this isn’t a surprise at all. Expanding and developing infrastructure in the telecom sector is extremely capital intensive. As such, these companies need to borrow to expand.

Over the last 5 years, we’ve been in a high, and rising interest rate environment. This isn’t good for telecoms. So it’s no wonder that companies like Telus, Bell and Rogers Communications (TSE:RCI.B) among many others have experienced a lull in earnings growth.

But the environment is changing for BCE

COVID-19 has brought some of the lowest interest rates we’ve seen in quite some time, and the Bank of Canada says it has no plans to raise them any time soon. This should allow telecom’s to pay less interest on their current debts, and issue new debt at much lower interest.

As such, we can likely expect these companies to perform better moving forward, and we may see a resurgence from a company like BCE. Do I feel it is the best telecom moving forward in Canada?

No, I’d reserve that title for Telus (TSE:T), solely based off a well-rounded approach to selecting a telecom. I feel they have the best prospects in terms of capital growth, and the best dividend growth streak in the country in terms of telecoms.

However, there is no doubt if you’re looking for a high yielding, blue-chip dividend stock in the telecom sector, BCE is your best bet. The company has the best country wide presence and in my opinion the best reputation in the entire sector.

You won’t get outstanding growth moving forward from a company like BCE. But I do feel it will be able to outperform the general markets on a dividend adjusted basis, especially considering interest rates are expected to stay this low for at least the next 2-3 years as we recover from the pandemic.