Is Blackberry (TSE:BB) a Top Canadian Stock to Buy Now?

When we think of buying Canadian stocks, there’s a few popular names that come to mind.

Recently? Likely Shopify. The stock has a good chance to go down as the best performing Canadian stock in history.

But, one of the most iconic Canadian stocks has to be the once smartphone giant Blackberry (TSE:BB). Or, as we used to call it prior to 2013, Research in Motion.

This company is a far cry from what it used to be back in the early days of smart phones. However, recent activity with the company has caused it to resurface. So, the question a lot of Canadian investors are asking is this.

Should I be hopping on the second wave of Blackberry due to recent news? Well, lets have a look.

Is Blackberry (TSE:BB) one of the best Canadian stocks to buy right now?

Blackberry is a hardware turned software company that has experienced a significant turnaround over the last few years. The company was once one of the most prominent smartphone producers in the world, and as Android and Apple phones started to outperform Blackberries, the company struggled significantly.

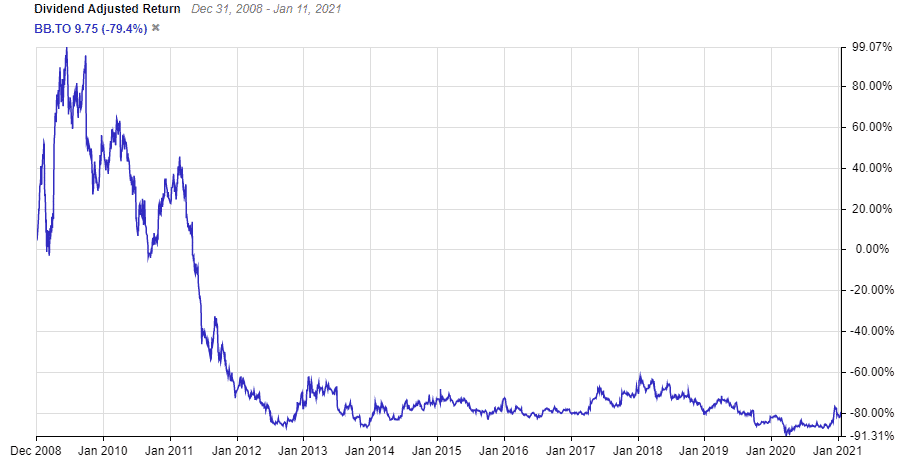

In fact, if we look at this company’s performance since late 2008, investors have watched a $10,000 investment shrink down to just over $23100 today.

So why is this company garnering the attention it has been recently? Why are investors interested in a stock that has put up abysmal performances for the better part of a decade?

The answer to that question is a particular deal the company struck recently with online giant Amazon.

Blackberry and Amazon’s deal to co-develop Blackberry IVY has caused its price to surge

Arguably one of Blackberry’s strongest features today is its QNX platform, which is a real-time operating system that is primarily used in vehicles and mobile phones.

Blackberry IVY however, is a combination and partnership of Amazon Web Services and Blackberry QNX.

As of right now, a broad scale of vehicle data is extremely hard to collect, as different vehicles are built with thousands of different parts, sensors, and often in different programming languages.

What the platform aims to accomplish is fairly simple. It wants to bring automakers more data and make it easier to analyze. With BlackBerry IVY, there won’t be any need to worry about programming languages, sensor formats or different variations of parts.

In turn, those automakers can use this information to better improve the driving experience for their customers.

There is no question BlackBerry stands to benefit from the deal, and it should be able to open up new doors for the company. However, I really think the stocks over 100% rise in price since the news released is simply unwarranted.

It’s most recent increase of 22% is even more puzzling, as this doesn’t seem to come on the back of any notable news event. There is no doubt a short squeeze played a large part in the stock’s surge.

There’s no evidence to show this deal will actually help Blackberry

BlackBerry often speaks about this deal potentially opening up new revenue streams for the company in the future.

But the issue is, there is really no concrete evidence, heck even a shred of evidence, that this deal will actually boost Blackberry’s revenue.

It’s safe to say that any partnership with Amazon is going to attract investors just based on the headline alone. But it’s fairly important we think of this from an investing standpoint.

Fundamentally, we know very little about what this deal will bring in terms of revenue from the company, and right now it’s simply a headline that’s placed the spotlight directly on Blackberry.

And as we’ve witnessed countless times in 2020 and even heading into 2021, when a stock gets the spotlight, it tends to run, unjustifiably so in most cases.

I’m cautiously optimistic this company can turn it around, but it is likely to keep rising

Blackberry has seen it’s sales shrink by an average of 17% annually over the last half decade. It’s also failed to post any sort of reliable earnings for even longer than that.

It’s going to take more than a early deal with Amazon to shift my thoughts about this perennial underperformer.

If the company had come out with a clear plan that showed me how this partnership was going to drive growth, I’d be more interested.

However, it’s share price has been driven up in the latter part of 2020 and early part of 2021 due to speculation.

I’d expect this to continue, as it seems like once a company gains some attention in the markets, it simply goes parabolic. Just understand that fundamentally, there isn’t much that’s driving this.

Analysts seem to share the same sentiment. They expect relatively flat earnings growth through 2022, and they expect revenue to fall by 14% in 2021 and 6.5% in 2022. They also expect relatively flat share price appreciation, with most analysts placing low single digit upside on todays price levels.

However, I don’t want people to get the impression I’m writing this company off for good. There’s a chance that more information could come out about the partnership with Amazon that could materially impact BlackBerry.

But for now, I’ll comfortably wait on the sidelines to see what comes of this. Another company that will take some patience to see how the future pans out for the company is Air Canada (TSE:AC).