Is Canadian Natural Recourses (TSE:CNQ) Still a Viable Option?

The collapse of the oil and gas sector was unlike anything we’ve witnessed as individual investors, especially those purchasing Canadian stocks.

As the worldwide demand for crude oil evaporated in record time due to the COVID-19 pandemic, so did the price of crude itself and as a result both oil producers and Canadians buying the stocks were left scrambling.

One company that seemed to stand out from the rest, not only during the pandemic but also on a historical basis, is Canadian Natural Resources (TSE:CNQ).

Canadian Natural Resources (TSE:CNQ) has been and currently is Canada’s top oil producer

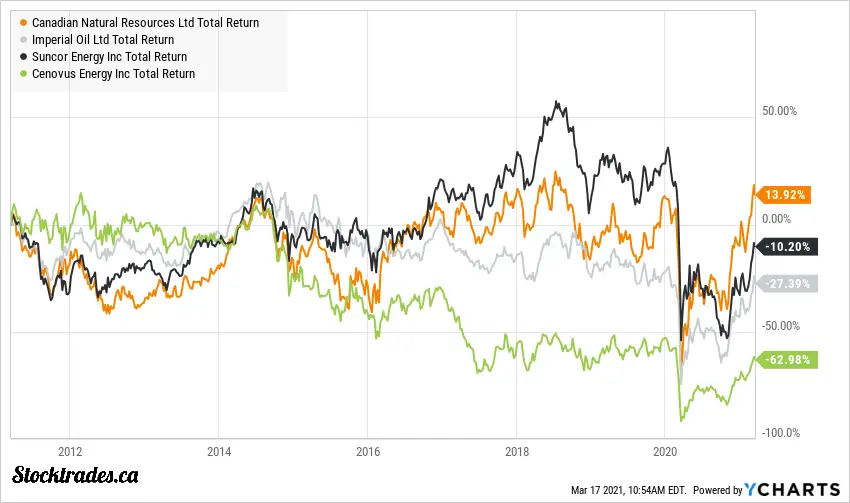

If we look to overall performance over the last decade, including dividends, Canadian Natural Resources is the only major oil producer here in Canada to keep its head above water.

That’s right, including dividends over a decade long time period, its been the only producer that hasn’t lost investors money.

Why?

Lets take a look and find out.

What does Canadian Natural Resources do?

Canadian Natural Resources is one of the largest oil and natural gas producers in western Canada, supplemented by operations in the North Sea and offshore Africa.

The company’s portfolio includes light and medium oil, heavy oil, bitumen, synthetic oil, natural gas liquids, and natural gas.

Production averaged 1.10 million barrels of oil equivalent per day in 2019, and the company estimates that it holds over 11.5 billion boe of proven and probable crude oil and natural gas reserves.

The company generated over $5.4 billion in net income in 2019 and had total operating cash flows just shy of $8.3 billion.

For the most part, the primary thesis behind an investment into Canada’s oil and gas stocks is for reliable dividend income.

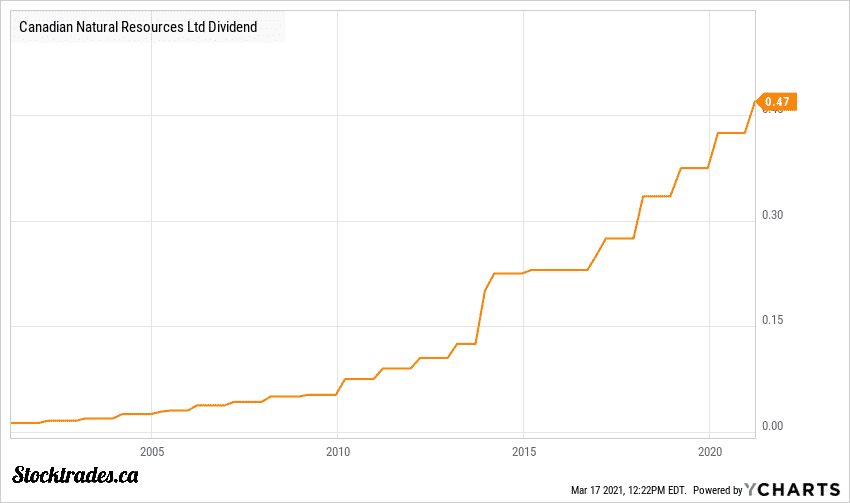

We can see long dividend growth streaks from not only Canada’s oil producers, but pipeline companies as well. So, one of the first things we’ll need to take a look at is the company’s dividend.

Is Canadian Natural Resources dividend safe?

Market Cap: $47.66 billion

Forward P/E: 12.47

Yield: 4.68%

Dividend Growth Streak: 20 years

Payout Ratio (Earnings): -448.28%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 13.33%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

In my opinion, not only is Canadian Natural Resource’s dividend safe, it’s the best dividend in the oil and gas sector right now.

As we can see in the chart above, the company has a long storied history of reliable dividend growth. In fact, it just crossed the 20 year mark and has broke into the top 15 stocks in Canada in terms of dividend growth streaks.

Keep in mind, this also includes a recent dividend raise in the midst of a global pandemic. Not only was Canadian Natural able to keep the dividend steady while a company like Suncor cut, it came through with a better than expected raise of 10.6% in early March.

The company’s payout ratios don’t look pretty right now. In fact, somebody doing a quick skim of the company may simply pass up on it immediately. This is because the dividend currently makes up over 400% of earnings, and 110% of free cash flows.

But what we need to understand is that 2020 was likely a one off event for oil producers. I’m going to speak on what I believe oil producers will do to prepare for another pandemic later in this piece, but for now all you need to know is that comparing Canadian Natural’s dividend to its 2020 earnings isn’t the best way to go about it.

If we look to 2021 estimated earnings per share of $3.45, we can see that Canadian Natural’s $1.88 dividend is more than covered.

In fact, with a forward payout ratio of just over 50%, we can expect the company’s dividend to not only continue to be paid, but continue to grow.

So should you be buying Canadian Natural Resources stock right now?

As I highlighted at the top of the article, Canadian Natural is the only major oil producer here in Canada to keep its head above water over the last decade in terms of share price.

This is primarily due to the fact that, in my opinion, this is the most operationally efficient oil producer in North America. This partially has to do with the fact that Canadian Natural has a breakeven price of sub $30 WTI.

This allows the company to operate in harsh of economic climates when it comes to oil.

Commodities tend to do well in an inflationary environment. So, there is a chance we see oil producers and the industry in general rebound in a big way in 2021.

As a short term play based on an economic rebound and oil’s potential reaction to an inflationary environment, I can see a viable thesis.

Long term however, I’m still avoiding oil

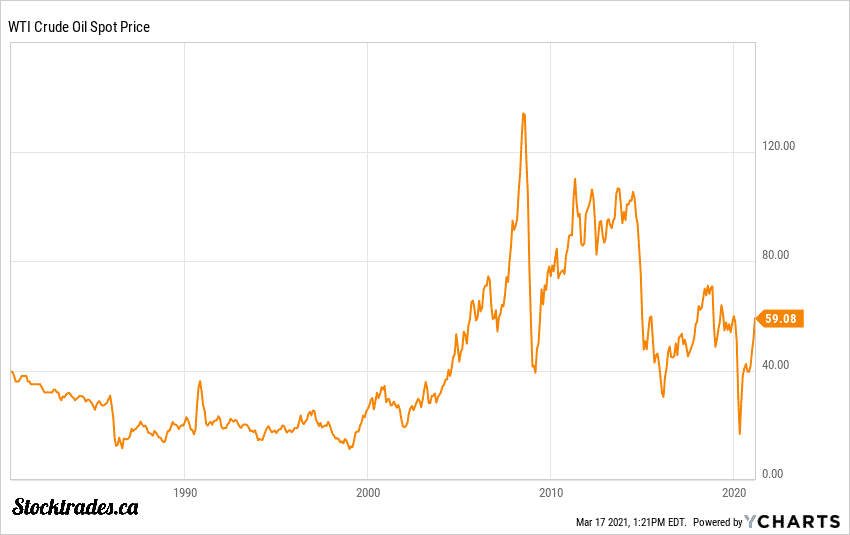

If we look to the historical price of oil, we can see numerous collapses over the last 15 years. In my opinion, this is one of the primary reasons why Canadian oil producers have underperformed.

The manipulative nature of the commodity, one that can see its price skyrocket or collapse based on simple production cuts or accelerations, is one of the main reasons I don’t want to park my money for the long term in the oil and gas sector.

I was willing to give producers a second chance after the markets were flooded in mid 2014, but the COVID-19 pandemic and subsequent flood of the markets again to go along with OPEC turmoil made me realize that this just isn’t a strong long term investment.

If you’re looking to time the short term ebbs and flows of the oil market, especially upon reopening of the economy, Canadian Natural is arguably the best play. But, if you’re looking for somewhere to park your cash for the next decade or longer, I’d avoid this cyclical play. We also looked at Alimentation Couche-Tard (TSE:ATD.B) as a potential re-opening play.