Is Dollarama (TSE:DOL) a Strong Defensive Option in 2024?

2020 has been anything but normal. In fact, it’s been so far off the spectrum of normal that investing attitudes have changed permanently. Investors learning how to buy stocks in Canada are now focusing on “stay at home” plays as we continue with harsh shutdowns.

An example? Well, Canadian stocks in the technology sector have transitioned from high-growth plays to defensive options due to the changing landscape of businesses.

But, the fact remains that there will always be room for plain old defensive, recession proof stocks in your portfolio.

Today, I’m going to go over one of those stocks and discuss whether or not this once high-flying growth stock still has room to run, or if it’s growth has been exhausted.

That stock is Dollarama (TSE:DOL).

What does Dollarama (TSE:DOL) do?

As you could probably tell by the name, Dollarama is a retail store that sells low cost items, typically in the $1-4 price range.

It’s Canada’s largest dollar store chain by a landslide, totaling over 1310 stores and the company has a significant presence in every province in Canada.

However, there’s no questioning the fact the company has a strong reliance on the provinces of Ontario and Quebec, with over 900 of its stores in the two provinces.

Dollarama has a stranglehold on the Canadian discount retail market

If you take all of Dollarama’s major competition here in Canada and combine them, Dollarama still has over 2.5x the stores.

And, if we’re speaking on its next biggest competition in terms of store count, Dollarama is 5.7x bigger than Dollar Tree Canada, which has a total of 231 stores.

The company has built its brand and its business model to be able to sustain most any environment, highlighted by the fact that Dollarama stores are present and profitable in smaller, rural based towns.

The bulk of the company’s revenue is generated by selling general merchandise, whether it be toys, pens, pencils, cutlery or decorations.

However, 41% of the company’s revenue is generated by selling consumables like cleaning and food products. This creates a steady stream of recurring customers who opt for cheaper, no name product variants.

Why has Dollarama performed so well in 2020?

Market Cap: $16.79 billion

Forward P/E: 29.98

Yield: 0.33%

Dividend Growth Streak: 9 years

Payout Ratio (Earnings): 10.06%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 9.80%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

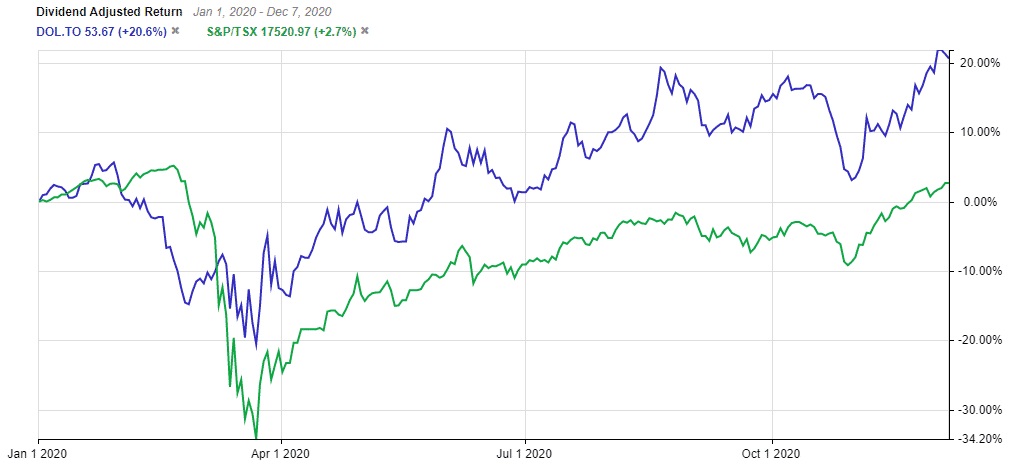

It’s likely not a surprise to you that Dollarama has outperformed the TSX Index in 2020.

With an Index that is comprised primarily of financial and oil and gas stocks, it wouldn’t take much for a consumer staple stock like Dollarama to outperform the broader market.

Why? Well, considering the state we are in right now, people are leaving expensive stores and heading to discount retailers like Dollarama.

When I say “expensive”, at least from the perspective of a Dollarama customer, even Wal Mart meets that criteria. This is why sales have thrived in the COVID-19 era.

Sure, this company doesn’t sell top quality products. But it sells products that get the job done in an economic environment where most people just don’t have money to burn.

The company will post third quarter earnings in a few days, but even if we look to its second quarter of 2020, we can see strong growth despite the world being in turmoil.

The company reported sales growth of 7.1%, gross margins increasing, net earnings increasing 2.1%, and 13 new stores opened. Now, these aren’t exactly lights out numbers. In fact, the company actually reported a decrease in EBITDA due to COVID-19 safety measures causing abnormal expenses.

But, we have to understand that this is one of few companies outside of the tech sector growing in 2020, and COVID-19 safety expenses are mostly due to one-time installations of plexiglass, floor stickers and the like.

So what are investors paying for a stock like this in this current environment? Unfortunately, that’s one of the only knocks I have against Dollarama right now, and it’s the fact that investors may be paying too much

Growth is slowing, and valuations are high

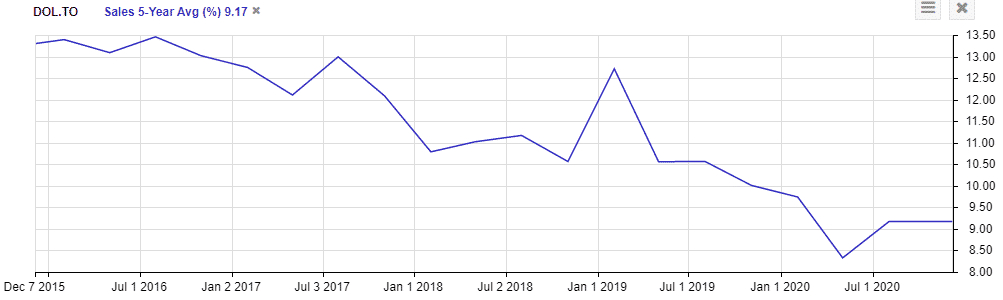

Charts provided by StockRover. Check out Stockrover Here!

As we can see by the chart above, Dollarama’s sales growth has been slowing for the better part of 5 years.

Now, lets forgive the whole fiscal 2020, and just applaud the company for its ability to generate any sales growth at all. But, the issue is that this company’s sales growth was shrinking pre-covid.

Similar to a company like Shopify, Dollarama was once a high-flying growth stock, but it has since slowed considerably in terms of top and bottom line growth. This is still a company that prior to 2020 was generating low double digit top and bottom line growth. Very respectable. And, I expect them to return to these growth rates after COVID-19 has subsided and the world returns to normal.

However, my issue with the company is that it is still trading at levels that justify higher growth than the company is likely to report.

Analysts expect 5.2% revenue growth in 2020 before rebounding to 14.2% in 2021. They also predict the company will grow earnings from $1.75 in 2020 to $1.82 in 2021. This is growth of around 4%.

Dollarama is currently trading at 4.3 times sales, and most importantly 27 times forward earnings. It’s a tough pill to swallow, paying 27 times earnings for a company that is only expected to grow its bottom line by 4%.

Overall, Dollarama is a strong company with an expensive price tag

It’s safe to say that sentiment towards discount retailers isn’t likely to change anytime soon.

We’re expected to face some pretty harsh environments moving forward, and I can’t see anyone selling out of a company like Dollarama.

This is likely why valuations are high, and will remain high for the foreseeable future. This is an expensive price tag to pay for a company who isn’t putting up the growth it once was.

However, this is still a strong company, and once COVID-19 subsides I’d expect it to return to low double digit top and bottom line growth, and provide a nice defensive option for Canadian investors heading into an uncertain economical landscape for the next half decade.