Is Enghouse Ltd (TSE:ENGH) Canada’s Best Dividend Tech Stock?

There has been a massive shift in the investment landscape in 2020. In what was often viewed as a speculative growth style investment, investors are starting to see that tech is the future, and thus deserves a spot in every Canadian’s portfolio.

In fact, it’s likely if you had no exposure to tech during this COVID-19 pandemic, your portfolio significantly underperformed. What was once a sector primarily for those seeking high growth is now considered a must have.

Surprisingly enough, some of these tech companies are excellent Canadian dividend stocks. I’m going to speak on one today, and it is a Canadian tech stock that has been consistently and quietly raising dividends for quite a long time. That stock is Enghouse Ltd (TSE:ENGH).

What does Enghouse Ltd (TSE:ENGH) do?

Enghouse Ltd is a Canadian-based provider of software and services to a variety of markets. The company not only has operations in Canada and the United States, but large countries like India, Japan, Australia, and Sweden.

The company provides services to some of the most stable sectors in the country including utilities, telecom, finance, and most importantly, governments.

Enghouse has two primary segments, the Interactive Management Group, and the Asset Management Group. The company fuels growth primarily via acquisition, but we’ll speak on that later. First, lets have a look at how fast this high-flying tech company has been growing its dividend, and whether or not it’s got more room to run.

How safe is Enghouse’s dividend, and how much can it grow?

There are few companies in the Canadian tech sector that impress when it comes to dividend growth. Enghouse however, is one that does. The company has been growing dividends for 13 years, which is the longest streak in the tech sector.

Companies like OpenText and Tecsys are not far behind, but not only does Enghouse have a longer dividend growth streak than these two, it’s been growing its dividend at a significantly faster pace as well.

To go along with its 13 year dividend growth streak, Enghouse has been growing the dividend at an annual pace of 17.19% over the last 5 years. In fact, its most recent increase of 20% comes in above its 5 year averages, which is usually a good sign that dividend growth can be expected to continue.

Charts provided by StockRover. Check out Stockrover Here!

In terms of yield, this isn’t a company to write home about. Enghouse currently yields only 0.81%, and as we can see, this is lower than the company historically yields.

So, what exactly does that mean? When we have a company like Enghouse setting the pace to double its dividend every 5 years, why don’t we have an increasing yield? And even more importantly, why is the yield going down?

All you need to do is look to the company’s share price to figure this out. When I see a company that is growing the dividend at a near 20% annual pace and it’s yield is going down, I see a huge opportunity. This means that Enghouse’s share price is currently outpacing its rate of dividend growth.

And the best part about Enghouse? I believe the company still has a ton of room to run. Why? Well, the company isn’t paying out a significant amount when it comes to the dividend.

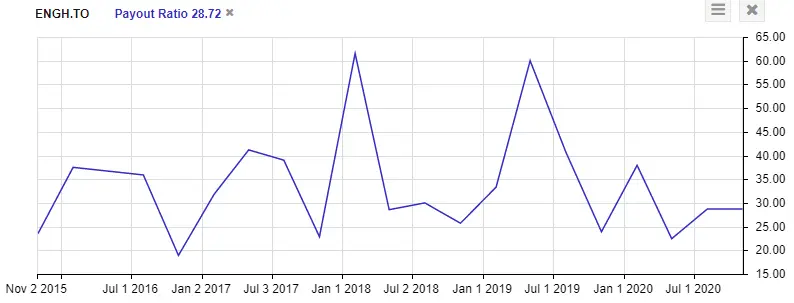

Enghouse is only paying out around 28.72% of earnings towards the dividend. This is the lowest the payout ratio has sat over the last half decade, despite strong growth. And, when we look to free cash flows, the dividend becomes even more attractive. Enghouse is currently paying out only 6.5% of FCF’s towards its dividend.

This isn’t a high yielding play like Pembina Pipeline (TSE:PPL). However, this is a company that is going to provide compounding dividend growth, along with a share price that has the potential to increase just as much as its dividend.

All in all, you won’t mind collecting only a 0.8% yield on Enghouse, because if it keeps up it’s current pace, it’s going to provide you with plenty of capital appreciation. Speaking of which, lets see how it’s going to continue doing so.

Enghouse Ltd forward outlook and valuation

In terms of revenue growth, analysts are particularly bullish on the tech company to post some big numbers both this year and next. Analysts figure Enghouse is going to be able to grow its top line by 34% in 2020, and then the gaining popularity of its platform is going to result in revenue surging over 50% in 2021.

Now, obviously these are estimates and should be taken with a grain of salt. But, it’s bullish news nonetheless. I tend to value a company’s ability to hit estimates when it’s been proven to do so in the past, and Enghouse has done just that.

The company has beat analyst estimates when it comes to earnings expectations 75% of the time over the last 3 years, often by large margins as well.

If the company can continue to grow its product and customer base, all while continuing to make strategic acquisitions, I have faith the company is going to provide long-standing returns to shareholders. However, is the price right? Remember, price is what you pay, value is what you get.

Market Cap: $3.65 billion

Forward P/E: 39.59

Yield: 0.77%

Dividend Growth Streak: 13 years

Payout Ratio (Earnings): 31.95%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 20.00%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

Historically over the last 5 years, there has been few instances where Enghouse has been this expensive. It’s currently trading at 40 times earnings, and this is after the company came down to earth after the tech surge in mid-2020.

Although, when we look to the price to earnings on a forward basis, Enghouse valuations actually aren’t that crazy. The company is currently trading at around 35 times forward earnings, which is a 10% premium to what it typically trades at.

Enghouse is expected to increase both top and bottom lines more than it has done in the past, and as such investors should be willing to pay more of a premium in terms of price. If Enghouse can truly grow its top line by 30%+ this year and 50%+ next, paying 35 times earnings is not that farfetched.

But, as with most of these tech companies, performance will be key. If Enghouse has a slip up and misses earnings in a significant fashion, it could cause a deep correction in the company’s stock price.

Overall, Enghouse is an excellent income and growth option

There are few companies on the TSX that provide both the dividend growth and capital growth that Enghouse has over the last decade. If you’re looking to buy stocks in the tech sector that have a strong blend of dividend and capital growth, Enghouse is it.

Whether or not it will continue remains to be seen, but we can make assumptions based on past performances to a degree in making decisions, within reason.

If you’re relying on what Enghouse has done in the past, you’re probably confident it will continue to be able to do so in the future.

It’s important not to get tunnel vision in terms of dividend yield with the company, and instead look at the whole picture.