Is Goeasy (TSE:GSY) Still a Solid Dividend Growth Stock?

There is some stocks that have clearly set themselves apart on the Toronto Stock Exchange over the last while.

There’s high flying growth options like Shopify who have created fortunes in as little as 5 years, telehealth companies like Well Health and CloudMD who’ve made Canadians rich (on paper if they still hold) in a matter of months.

And then, there’s Goeasy Ltd (TSE:GSY). A Canadian dividend stock that has quietly posted some of the best returns on the TSX Index over the last two decades. More notably over the last 5 years of course as a niche market here in Canada is catching on in a big way, and that’s alternative lending.

So, is Goeasy still a solid dividend and capital growth option for Canadian investors moving forward? Should you be buying stocks today in the alternative lending sector in general? As always, lets first take a look at what Goeasy does.

Goeasy Ltd (TSE:GSY) stock analysis

Goeasy Ltd is a Canadian alternative lending company that specializes in offering a wide variety of product loans to Canadian consumers, ranging from furniture, electronics, computers, and appliances.

The company also offers the opportunity to lease things like household furnishings, and unsecured installment loans. The company operates in two primary segments, its easyhome, and easyfinancial segments. The bulk of its revenue comes from its easyfinancial department.

Goeasy’s operations are viewed as predatory by some Canadian investors, and as such an investment in the company isn’t for everyone. Some feel the company preys on high-risk lenders with poor spending habits.

However, regardless of how you view the company’s business operations, one thing is clear. What Goeasy is doing is working. This is highlighted by one of the fastest growing dividends in the country.

How good is Goeasy’s dividend?

A Canadian Dividend Aristocrat, Goeasy Ltd has raised dividends for 5 straight years, and over that 5 year period it’s raised them at an impressive pace.

The company has a 5 year annual dividend growth rate of just under 30%, meaning the company is essentially set to double its dividend every 3~ years if they were to continue current growth. Its most recent increase actually tops this growth rate by a wide margin as well, as the company increased the dividend by 37.8%.

Charts provided by StockRover. Check out Stockrover Here!

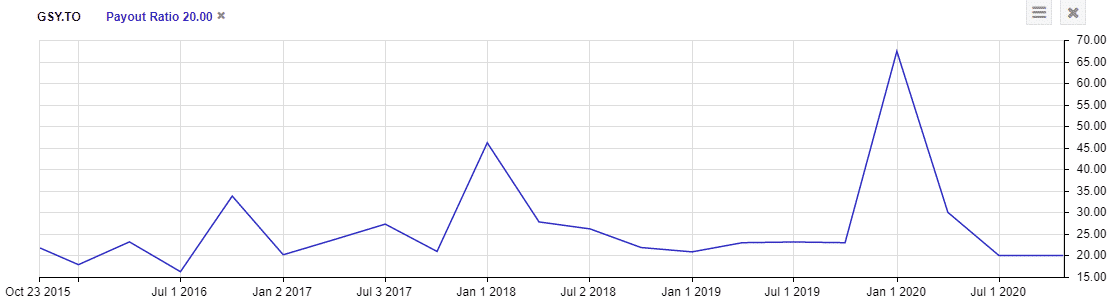

As Goeasy is a financial company, using the free and operating cash flow payout ratios are not as effective as looking through earnings to determine the overall safety and potential for the dividend to grow.

In Goeasy’s case, it has a ton of room. With a payout ratio of only 20% of earnings, I expect the company to continue to grow its dividend at a rapid clip, and I don’t foresee a cut for the company in any way.

The interesting thing to monitor will be if Goeasy Ltd meets restriction criteria set out by the Federal Government when it comes to dividend growth by major financial institutions and insurance companies during the pandemic.

If I were a betting man, I’d say no, and I would fully expect Goeasy to go ahead and raise the dividend yet again in 2021. The last time they raised was early 2020, prior to COVID-19, so all eyes will be on the company in Q1 2021.

The company currently pays an annual dividend of $1.80 a share, working out to be around a 2.50% yield at these prices. So, how has Goeasy been able to raise its dividend so fast, yet present such a low yield? Well, the answer is in Goeasy’s large level of growth in terms of stock price over the last while, which we’ll discuss next.

Goeasy future outlook

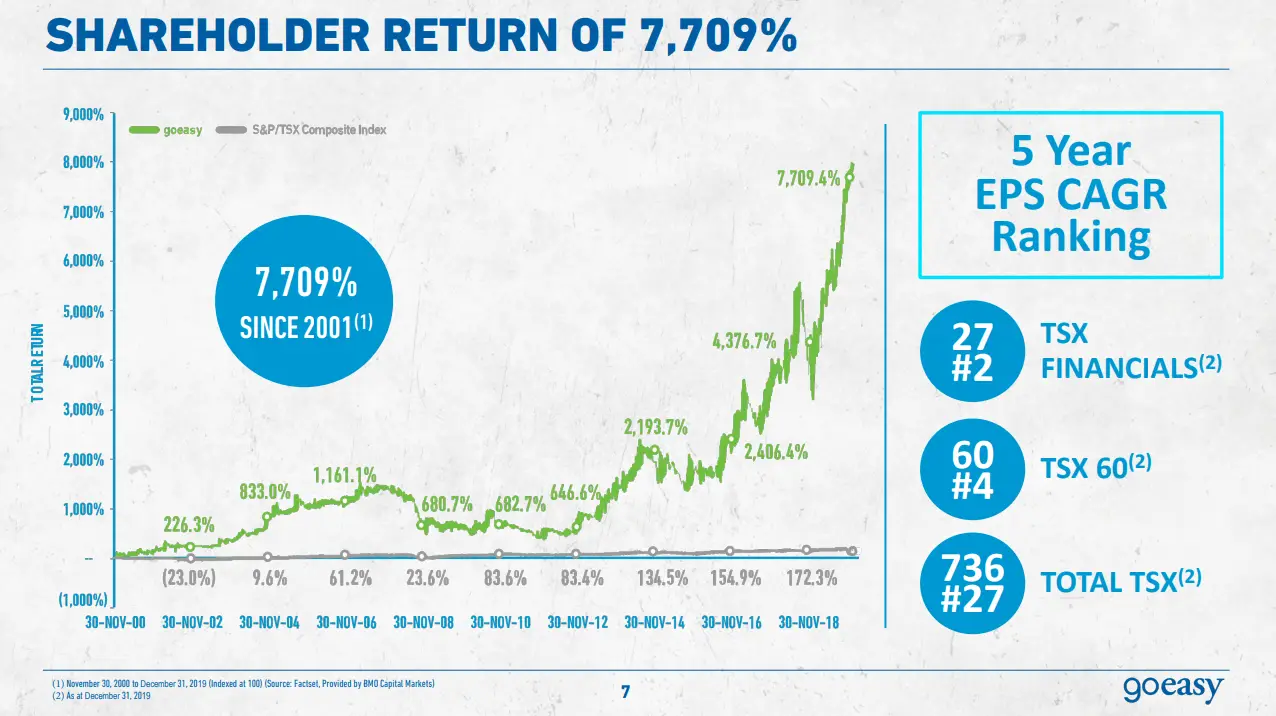

Since the year 2001, Goeasy Ltd has returned approximately 7,700% to shareholders. Over that same time period, the TSX has returned approximately 172%.

When considering this, it’s no wonder Goeasy provides strong dividend growth yet a low yield. The company’s stock price is increasing right in line with its dividend, driven by double digit top and bottom line growth.

Since 2001 again, Goeasy has a compound annual growth rate of 30.1% on net income. This is magnified even more when you look at the past 2 years, as they’ve increased net income by nearly 100%, going from $42 million in 2017 to $80.3 million in fiscal 2019.

So, how will the company look to continue this forward growth? By diversifying its product base, according to them.

And thus far, it seems to be working. The company expanded its loan products to offer higher dollar loan amounts, which is expected to be a multi-billion dollar industry, and they are also looking to expand in the private auto industry, what they state is a $26 billion market.

More and more major banks are rejecting consumers, and as such they’re heading to secondary lenders like Goeasy. As a result, investors often think that a Goeasy customer is automatically a high risk borrower.

Fortunately, that just isn’t the case. In fact, most Goeasy customers currently do not carry a mortgage, and thus less overall debt loads than a mortgage bearing consumer.

As tighter restrictions are placed on Canada’s major banks, I can’t help but think a considerable amount of them are going to get the money they need anyways, and Goeasy will more than likely be able to offer it.

Goeasy valuation

Market Cap: $1.05 billion

Forward P/E: 10.57

Yield: 2.56%

Dividend Growth Streak: 5 years

Payout Ratio (Earnings): 29.85%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 37.80%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

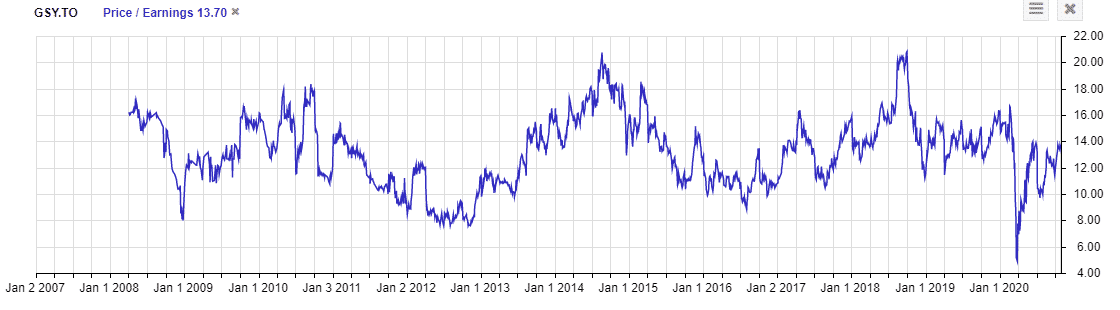

On a trailing price to earnings basis at 13.70, Goeasy hasn’t traded this cheap since late 2017.

However, when we look to forward estimates, the company is essentially right in line with what it typically does trade at.

Its currently trading at 10.1 times forward earnings and 1.5 times sales, both of which are higher than its 5 year historical averages of 9.1 and 1.2 respectively. However, Goeasy is by no means expensive, and I don’t think investors should be disappointed paying 10.1 times earnings for a company that has increased sales by 17% and earnings by 25.7% on an annual basis over the last 5 years.

Overall, Goeasy avoids a lot of headaches the major financial institutions have to go through to issue capital to Canadians seeking it. As a result, I’d expect the company to continue its torrent pace in terms of both dividend growth and share appreciation.

Keep in mind however, that Goeasy does not offer mortgages. If you’re looking for an alternative lender that deals in the mortgage space, check out another popular option like Equitable Bank (TSE:EQB).

They provide similar growth rates and have a promising future in the alternative lending industry as well.