Is Hydro One (TSE:H) A Strong Utility Option In 2024?

One of the best places to find stable and reliable income among Canadian dividend stocks is the utility industry. Digging down even further, regulated utilities are excellent income stocks. They have considerable moats and the dividend is underpinned by long-term contracts and regulated cash flows.

One company that stands out as holding a considerable moat is Hydro One (TSX:H). The company is one of the largest electrical utilities in North America and operates in stable, rate-regulated environments.

Consistent and reliable growth

One of the overlooked aspects of being a rate-regulated utility, is that Hydro One benefits from predictable growth as it has expected rate base growth under multi-year capital plans. This means that when the company incorporates their capital plan within their submission for re-rating. In other words, they can predict their organic growth profile better than most.

Hydro One expects rate base growth of 5% and organic earnings per share to grow by 4-7% annually through 2022. Earnings which are 99% underpinned by regulated rates.

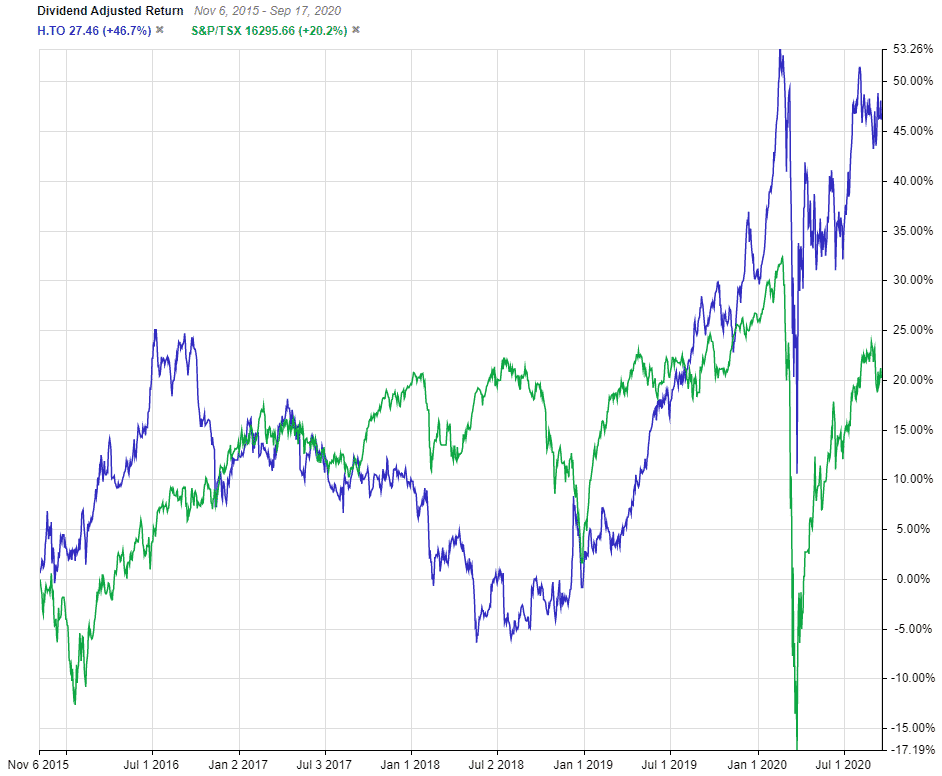

Since the company went public in 2015, Hydro one has returned approximately 70% to shareholders – this includes the dividend. In comparison, the S&P/TSX Index has returned around 50% over this same period.

5 year dividend adjusted return Hydro One (TSE:H.TO) vs TSX

Market Cap: $17.7 billionForward P/E: 19.43Yield: 3.42%Dividend Growth Streak: 5 yearsPayout Ratio (Earnings): 63.80%Payout Ratio (Free Cash Flows): Premium Members OnlyPayout Ratio (Operating Cash Flows): Premium Members Only1 Yr Div Growth Rate: 5.00%5 Yr Div Growth Rate: Premium Members OnlyStocktrades Growth Score: Premium Members OnlyStocktrades Dividend Safety Score: Premium Members Only

In our current environment of uncertainty, Hydro One has provided stability to portfolios. Over the past year, Hydro One’s stock price is up by around 13% which far outpaces the Index which has been flat.

When you couple Hydro one’s reliable organic growth with an appetite for making acquisitions, Hydro One is well position to deliver outperformance year over year.

Dividend Aristocrat

This growth will enable the company to support the company’s dividend. As the company only went public in 2015, it may not meet investor’s criteria for dividend growth. Many investors rely on the Canadian Dividend Aristocrat or All-Star lists as a starting point for their research.

Aristocrats and All Stars are companies which have dividend growth streaks of at least five consecutive years. This reliable history of dividend growth is attractive to income investors.

The good news is that Hydro One can now count itself as one among this prestigious group of dividend growth companies. Last year, the company raised the dividend by 5% to $0.2536 per share. The raise extended the company’s dividend growth streak to five years. Over this period, Hydro one has averaged 5% annual dividend growth.

Now that that company has achieved Aristocrat status, it will be added to the funds that track the Canadian Dividend Aristocrat Index such as the iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CAD).

Dividend Growth

Although a historical streak is a good thing, it is also important to look forward. Hydro One’s dividend accounts for only 63.8% of earnings and 28.13% of operational cash flows. Although the company’s payout ratio against free cash flow looks high at 130%, it is important to note that it operates in a high CAPEX industry.

It is consistently renewing and building new infrastructure that requires significant cash outlays. This is normal for utilities and the safety of that dividend is best compared against earnings. Also worth noting, Hydro One’s current payout ratio is below its targeted range of 70-80%.

What does this mean? It means it is well positioned to grow that dividend for years to come.

Hydro One isn’t a flash stock and there os nothing wrong with that. It can provide investors with consistent and reliable growth. This is true both in terms of capital appreciation and income. Likewise, it can stabilize a portfolio in times of uncertainly, much like it has over the course of this pandemic.