Is Imperial Oil (TSE:IMO) A Contrarian Play With Rising Oil Prices?

Now that we’re likely going to see the COVID-19 pandemic in the rear view mirror by the end of 2021, investors looking to Canadian stocks are focusing in on oil and gas companies, particularly oil producers.

Why?

During the collapse of the oil market in 2020, there were many oil and gas producers like Imperial Oil (TSE:IMO) that were materially impacted by the pandemic.

As we’ll touch on later in the article, revenue and earnings collapsed and the overall fear of dividend cuts caused massive sell-offs and as a result extremely discounted share prices.

The market clearly overreacted, and oil stocks are picking up in price. However, many are still trading at significant discounts to pre-COVID highs. So, should you be buying Canadian stocks in the industry right now? Lets take a look.

What does Imperial Oil (TSE:IMO) do?

Because the pandemic was so unique to oil companies, I’ll speak mostly from a 2019 level when I refer to Imperial. I don’t think it would be fair to look at 2020 numbers considering the extreme, likely one-off circumstances of the pandemic.

Imperial Oil is one of Canada’s largest integrated oil companies. By integrated I mean the company has upstream, midstream, and downstream operations.

The company produced just shy of 400,000 barrels of oil per day in 2019 and had over 6.2 billion barrels of proven and probable crude oil and natural gas reserves.

The company is also the largest refiner of petroleum products in Canada, operating 3 refineries with a combined capacity of 421 mboe/d.

The company’s primary asset here in Canada is its Kearl Lake facility in Fort McMurray Alberta.

How healthy is Imperial Oil’s dividend?

I was surprised that Imperial Oil was able to maintain its dividend through the harsh environment in 2020, and it has garnered a lot more respect from me than it did in the past.

I viewed Imperial as one of the weaker performers of the 3 major producers. But as we witnessed during the height of COVID-19, Suncor Energy (TSE:SU) ended up being the one to cut the dividend, in an alarmingly quick fashion.

Market Cap: $20.47 billion

Forward P/E: 18.59

Yield: 3.16%

Dividend Growth Streak: 26 years

Payout Ratio (Earnings): 325.93%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 0.00%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

Imperial Oil has historically been one of the lowest yielders out of the 3 major producers. As we can see in the chart above, it didn’t break 2% until mid 2019 as the oil and gas sector faced further scrutiny and negative sentiment.

This is a company with a 26 year dividend growth streak, one of the best in the country. As we can see for most of this 10 year chart, the company was able to keep its yield steady up until the start of 2018.

In terms of payout ratios, it’s fairly difficult to evaluate the company right now. This is because on a trailing 12 month basis due to COVID-19, Imperial is paying out 325% of earnings and 119% of free cash flow towards its dividend.

In most all situations, this looks like a dividend that will be cut. However, if we look to 2021 analyst estimates, its payout ratio drops significantly.

Analysts estimate that Imperial Oil will earn $1.64 in 2021 due to the rising price of crude and the re-opening of the economy. If we look to payout ratios again, its dividend accounts for just over 50%, which would not likely be a dividend that’s getting cut.

Again, these are estimates and can be missed. But 2020 was likely a one-time event for these oil companies, and we can no doubt expect a big rebound in terms of revenue and earnings in 2021.

All in all, the company should continue to provide reliable dividends, albeit a smaller yield than the other two producers, to investors.

How will Imperial Oil grow, and is it better than Suncor or Canadian Natural?

When Canadians want exposure to the oil and gas sector, they often consider maybe a pipeline or two and a single producer. So, many are left with the decision of which one to choose.

And while I don’t think Imperial is the best option in the sector (more on that later) I still do believe that it is a strong option for Canadians.

The company saw a significant production uptick in the fourth quarter of 2020 compared to the same quarter in 2019, and Imperial has one of the best assets in the Alberta OilSands, its Kearl Lake facility.

Although it isn’t a super low cost producer like Canadian Natural Resources (TSE:CNQ), which can operate profitably at $30 WTI prices, in this environment Imperial will be generating strong cash flow. Another industry we like to watch alongside oil is related equipment companies such as Finning International (TSX:FTT).

Growing the dividend for 26 straight years, especially in a cyclical industry like the oil and gas sector, requires prudent management. You have to pay the dividend in situations like 2014 where the company posted annual EPS of $4.04, and also have to be able to pay the dividend in times like 2017 in which the company posted EPS of only $0.44.

So who is the best company in the sector?

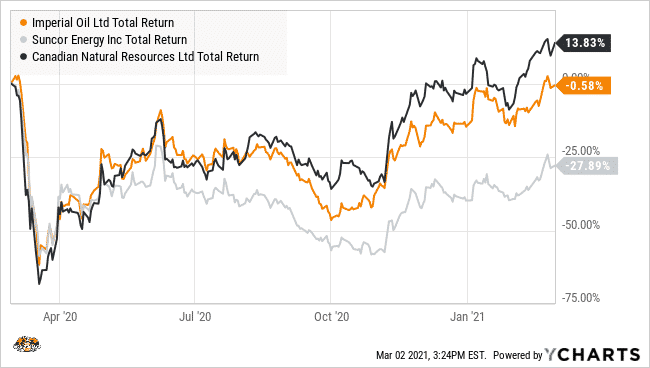

In my opinion, if you’re going to rank Canada’s big 3 producers, I’d probably put Canadian Natural Resources at the top followed by Imperial Oil and finally Suncor.

Imperial holds the longest dividend growth streak, but we see lower overall costs with Canadian Natural, which could make them appear to be a more efficient company overall. Prior to COVID-19, Canadian Natural was a cash flow machine, generating over $4.6 billion in free cash flow in 2019, despite low oil prices.

But, both of these companies are strong options in the oil and gas sector. One I’m not particularly a fan of, but one I know many investors are looking for exposure to in light of rising oil prices.