Is Jamieson Wellness (TSE:JWEL) Poised for Growth?

If the pandemic has taught us anything, it’s that we should be placing health at the top of our priority list.

As such, many investors are looking for Canadian stocks that can provide exposure to the healthy lifestyle movement. One of those stocks, and one that has been growing at a pretty rapid pace, is Jamieson Wellness (TSE:JWEL).

The stock has been on quite the tear over the last few years, and many Canadians who are looking to buy stocks poised for growth are wondering if it still has upside. Lets take a look in this article.

What does Jamieson Wellness (TSE:JWEL) do?

Jamieson Wellness manufactures, distributes, and markets multiple brands of natural health products. These products include vitamins, minerals, supplements, and more.

The company has two key segments, one being its Jamieson brands and the other being its Strategic Partners. The vast majority of its revenue comes from its Jamieson brand segment, which includes brands such as Jamieson, Progressive, Precision, and Iron Vegan.

How fast has Jamieson Wellness been growing?

In the grand scheme of things, Jamieson Wellness stock is not going to be a high flying growth option. But, it’s not necessarily a slow growing defensive stock either.

You’d be making a huge error not putting this one on a shortlist to watch moving forward. That’s because as of late, especially due to the COVID-19 pandemic, growth has been accelerating.

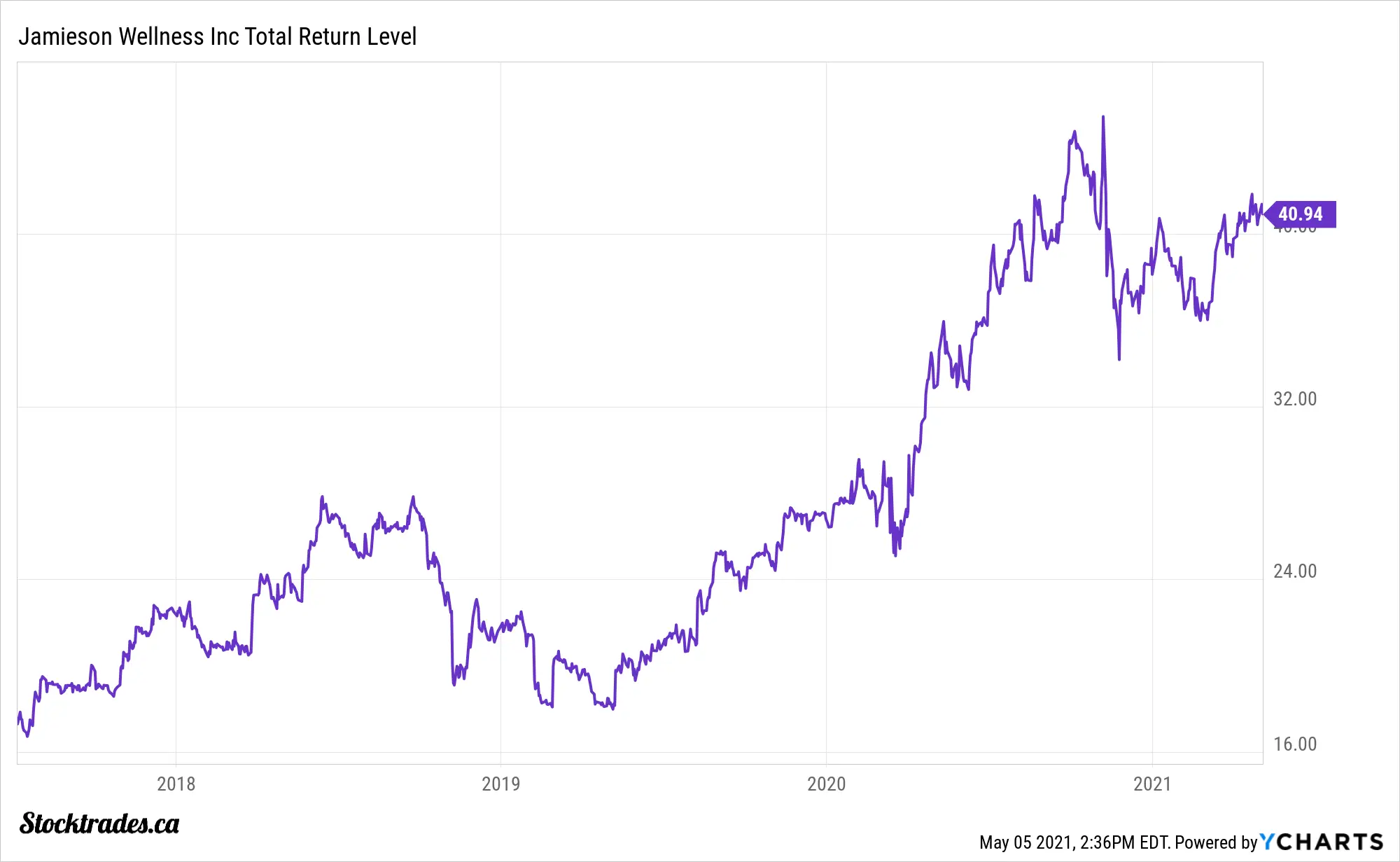

Jamieson Wellness (TSE:JWEL) 5 year total return

Over the last 3 years prior to the pandemic, Jamieson Wellness had experienced mid single digit revenue growth on average and had managed to become profitable in 2018. However in 2020 the company had a breakout year, posting revenue growth of 17% and earnings growth of 28%.

It’s difficult to say whether or not Jamieson Wellness will be able to keep up with this pace of growth. The thesis behind a purchase today would primarily be because of a permanent shift towards healthier living.

But, once the pandemic subsides, will humans simply go back to lifestyles they had prior? It’s difficult to say, which is why an investment in Jamieson in my opinion has some degree of speculation to it.

Jamieson needs high growth to continue to justify valuations

17% top line growth and 28% bottom line growth is nice, but we need to look at current valuations to see if Jamieson Wellness is worth the price you’ll pay today.

At the time of writing, the stock is trading at around 26 times forward earnings. In a normal environment this would be a price I’d be willing to pay for the type of growth it experienced in 2020. However, there are some important elements we have to make some educated guesses on to determine if its worth current valuations.

For one, how likely is it that consumer spending continues to surge in the health product area in 2022 and beyond? Sure, in the midst of a global pandemic it’s easy for those to focus on purchasing health products like Jamieson offers. However, once this is all said and done and the pandemic is behind us, will consumers go back to their old habits?

I’d say the shift to healthier living is here to stay for some Canadians, but not all. And as a result, we might see slower than expected growth for Jamieson moving into 2022 and beyond.

So right now, I think the stock is a little on the expensive side. Jamieson Wellness is a strong company, but one that will ultimately have to show me that it can keep producing 25% bottom line growth on an annual basis to justify paying its current price.

If we see slowing growth in 2021 and 2022 because of a return to normalcy, I have no doubt we’ll see Jamieson’s stock price correct as the market adjusts its valuations.

Overall, Jamieson Wellness stock is one to keep an eye on

The niche is extremely attractive, and one I think is going to grow at an accelerated pace due to a more conscience effort by Canadians to take care of themselves. That’s exactly why I’d be adding Jamieson Wellness to my watchlist today. If it can keep generating 2020 like growth and the shift appears to be more permanent, then I’d likely be a buyer.

For now, I’m cautiously optimistic. This is a stock that is trading well above historical valuations due to accelerated growth, and one that is bound to correct if investors aren’t happy with what they’re seeing over the next 3-4 quarters.