Is Kinross Gold (TSE:K) The Best Gold Play of 2024?

It’s hard not to think of the material sector when we think of Canadian stocks. However, most learning how to buy stocks in Canada avoid the sector due to its complex nature.

A decent chunk of the TSX is made up of these stocks. In fact, the most recent article I read suggested that material companies like gold, silver, and copper miners make up nearly 15% of the index.

This, and the TSX’s exposure to oil and gas, is one of the primary reasons it underperforms our American counterparts. Prior to the pandemic, gold was on a significant bear run and as a result gold companies were suffering.

Now that gold has finally broke out of its rut and has seen a significant run up in 2020, investors are looking to gold producers. Many think it’s too late, but the fact is there are still some very attractive gold plays out there. The one I’m going to talk about today is Kinross Gold (TSE:K).

What does Kingross Gold (TSE:K) do?

Kinross is a senior gold producer here in Canada.

The company produces around 2.4 million ounces of gold per year and has a market cap in the $9 billion range, making it one of the largest gold companies in the country.

The company has 8 mines in 4 different regions, including South America, Russia, North America, and Africa. In terms of production, approximately 56% of this production comes from the America’s, while 21% comes from Russia, and 23% from West Africa.

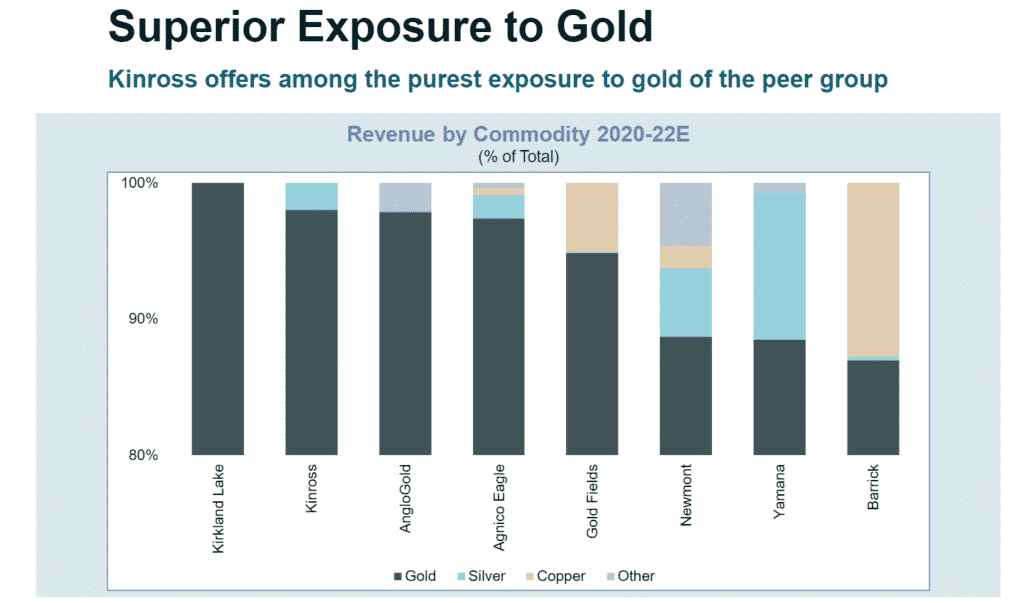

Besides Kirkland Lake (TSE:KL), Kinross Gold is the biggest pure play gold company in the country. If we take a look at the chart below, we can see that around 98% of the company’s production is gold, while a small fraction is dedicated to silver mining.

So overall, if you’re looking to take advantage of gold, and exclusively gold, Kinross is one of the best options in the country.

How is Kinross planning to grow moving forward?

The company does plan to ramp up production, going from 2.4 million ounces in 2020 to 2.9 million ounces in 2023. This is a considerable production uptick, and should bode well for the company and investors, especially if gold can maintain current prices.

However, investors are going to have to be patient as Kinross expects production to essentially come in flat in 2021. They expect 2.4 million ounces again, before jumping to 2.7 million in 2022 and finally 2.9 million in 2023.

Gold producers at their core have a fairly simply business model. More production and lower all in sustaining costs leads to more cash flows, and more profits.

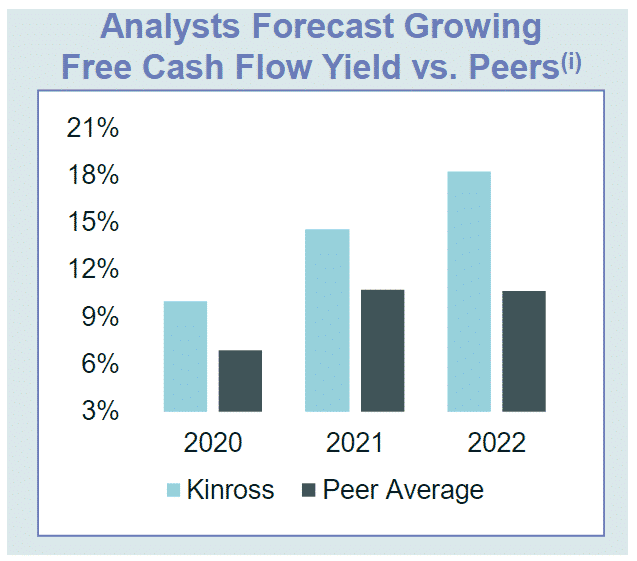

And as we can see by the graph below, Kinross is expected to grow its free cash flow yield significantly, nearly doubling it over the next few years. Compared to its peers, the company is fairly confident it can dominate.

The company is not exactly a low cost producer. In fact, when we look at all in sustaining costs it is right around the middle of the pack, lower than producers like Agnico Eagle Mines (TSE:AEM) and Newmont (TSE:NGT), but significantly higher than our other gold pure play here in Canada, Kirkland Lake.

All in sustaining costs for the company come in at around $978/oz. At gold levels above $1800/oz, this company is going to be printing cash, and we can expect cash flows to be considerably higher than previous periods.

And the good thing, is the company is continually looking to reduce costs, which will result in even more cash flow. It’s Russian operations reported all in sustaining costs of $550/oz, the lowest level they’ve been at in over 2 and a half years.

If Kinross can continue to increase production while lowering overall costs and if gold can maintain these levels, it’s going to be a prosperous time for them. And as such, they did something pretty important in 2020 in anticipation of this.

Kinross reinstates its dividend

Market Cap: $11.54 billion

Forward P/E: 9.69

Yield: 1.67%

Stocktrades Growth Score: Premium Members Only

Kinross is currently sitting on a strong cash position of over $900 million dollars, and it repaid a $750 million revolving credit facility. With such a strong cash position, it was a no brainer for the company to start giving some of that money back to shareholders.

The dividend isn’t much, $0.03 on a quarterly basis which works out to be around a 1.67% yield at todays prices, but I’d expect Kinross to post some pretty high dividend growth numbers over the next few years to go along with this.

With trailing 12 month earnings coming in at $0.85, the dividend is more than covered, and has plenty of room to grow.

Overall, this is a reliable pure-play gold company on the TSX

Kinross is extremely reliable when it comes to hitting guidance and projected earnings estimates.

In a more volatile industry, this is something I like to see. During the last gold bull run, many companies projected growth and dividend’s off high gold prices.

When the floor dropped out and gold fell, we witnessed dividend slashes and collapsing share prices. So the second time around, I’d want to see a reliable company that takes a more conservative approach.

In my opinion, Kinross is just that. The company is on track to meet or exceed guidance in terms of product, cost, and capital expenditures for the 9th consecutive year. Most of these 9 years have been through some pretty tough commodity prices for gold.

This isn’t a junior miner that’s going to blow you away with outstanding returns moving forward. If you’re looking for an extremely high risk, high reward stock, you may want to look at a company like Mind Medicine (MMED).

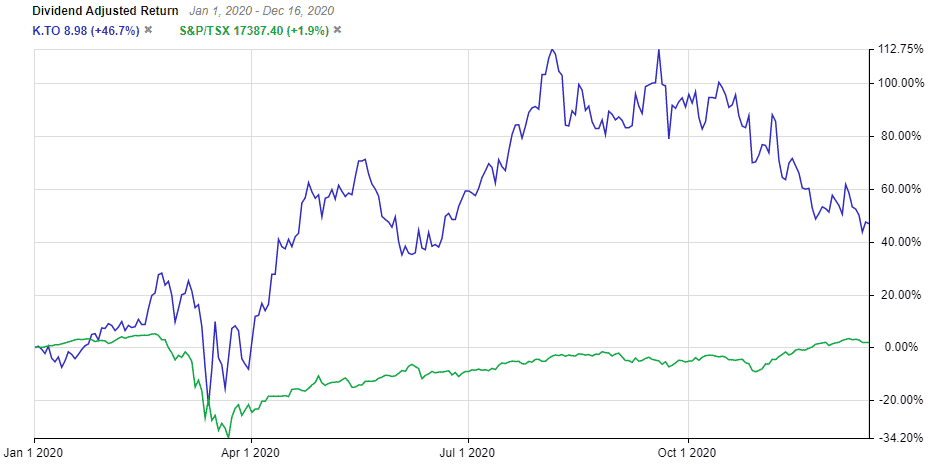

However, there is a possibility it could outperform. When we look at the top 5 Canadian gold producers in terms of share price appreciation in 2020, there is only one senior producer we find in that list, dominated by junior producers and exploration companies.

This chart provided by StockRover. Check out Stockrover Here!

And, that senior producer is Kinross, earning just shy of 50% on the year.