Is Laurentian Bank a Reliable Investment?

Canada’s banks are among the most reliable and consistent performers on the TSX Index. They are also among the best income stocks on the planet. All are not created equal however, and one Canadian stocks that has struggled significantly in recent years is Laurentian Bank of Canada (TSX:LB)

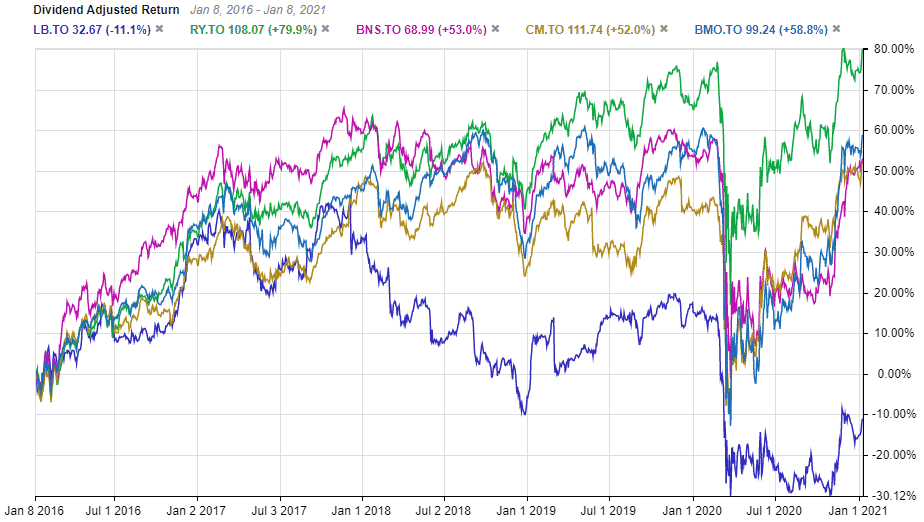

Over the past year, Laurentian Bank’s stock price has cratered. As of writing it has lost ~30% of its value and it is the worst performing of Canada’s bank stocks – by a longshot. The second-worst performing bank – Canadian Western Bank (TSX:CWB) has “only” lost ~10% of its value.

Unfortunately, it is not an isolated event. Laurentian Bank has been a perennial underperformer for years. It doesn’t matter if you go back 3, 5, 10, 20, or 25 years – Laurentian always brings up the rear in terms of performance. Fun (or not so fun) fact, Laurentian is the only bank to have negative share price returns over the past decade.

Market Cap: $1.41 billionForward P/E: 10.82Yield: 5.31%Dividend Growth Streak: 0 yearsPayout Ratio (Earnings): 54.80%Payout Ratio (Free Cash Flows):Premium Members OnlyPayout Ratio (Operating Cash Flows):Premium Members Only1 Yr Div Growth Rate: -39.40%5 Yr Div Growth Rate:Premium Members OnlyStocktrades Growth Score:Premium Members OnlyStocktrades Dividend Safety Score: Premium Members Only

This underperformance accelerated in late 2017, when it was caught up in a mortgage scandal. Although those issues appear to be behind them, it took a year to resolve and there are likely still lingering reputation issues.

To compound the issue, shareholders can no longer take solace in the company’s status as a reliable dividend growth company. Last May, Laurentian slashed the dividend by 40% effectively ending the company’s 12-year dividend growth streak. The bank also lost its status as a Canadian Dividend Aristocrat.

Why the cut? The bank said it would provide greater flexibility. According to their release:

“Although we believe that current earnings are not reflective of the future earnings power of the organization, we have reduced the dividend to $0.40 per share which improves operational flexibility until we reap the anticipated benefits of our strategic plan.” – CEO François Desjardins

It was a notable event as it marked the first dividend cut by a Canadian Bank in more than 25 years. The last Canadian Bank to cut the dividend was National Bank of Canada (TSX:NA) which did so back in 1992. Needless to say, it sent shockwaves across the industry.

The good news for everyone else, no other Canadian bank followed suit. While the Office of the Superintendent of Financial Institutions (OSFI) has prohibited banks from raising the dividend, it is unlikely another cut by one of Canada’s banks is on the way. They have all since rebounded from their post-pandemic lows and seem to be recovering nicely.

If not a strong performer, nor a reliable dividend payer, where does Laurentian Bank fit? Perhaps a value play? Unfortunately, that isn’t clear cut either. It has a P/E of 13.20 which is among the highest of all banks and on a forward basis it is trading at 10.64 times earnings, near the banking peer average.

Where the undervaluation does standout is on a price-to-book basis. It is trading at only 0.6 times book value, one of only two banks to be trading below book value. This is where investors can see the big disconnect in valuation between Laurentian Bank and its peers.

Investors must ask themselves, is the discount warranted? Given their struggles, one could argue the gap is justified.

It is still working through a big strategic shift to a branchless model, a shift that has taken longer and costed more than investors have been comfortable with.

Likewise, aside from beating in the last two quarters, it missed in the previous nine against analysts’ estimates.

Until Laurentian can prove itself by starting to deliver against expectations and improving its growth profile, it is likely to remain near the bottom of its peers in terms of performance.