Is MTY Food Group (TSE:MTY) Still a High Flying Growth Stock?

As investors seeking individual Canadian stocks, our goal should be to outperform the TSX Index. We want to buy Canadian stocks that are set to grow at a faster pace than the Index.

If that isn’t the goal, we’re better off just purchasing an index fund and spending our time elsewhere.

It’s important we identify stocks that have strong potential to outperform the markets, and thus far MTY Food Group (TSE:MTY) has done just that.

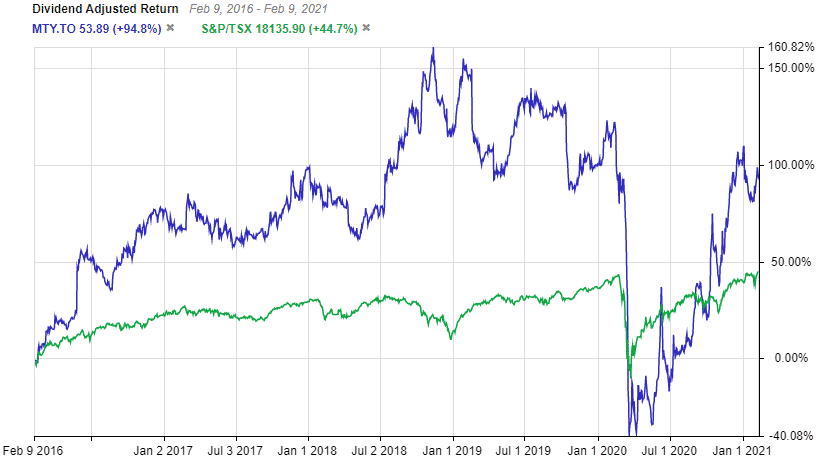

Over the last 5 years, MTY Food Group has nearly doubled, while the TSX Index has returned over 44.7%. So, what exactly does MTY Food Group do, why did it fall so hard during the COVID-19 pandemic, and is there a chance it could continue to outperform moving forward? Lets take a look.

What does MTY Food Group (TSE:MTY) do?

MTY Food Group is a franchising company with a plethora of brands in the quick service and casual dining industry around the world.

The company has over 80 brands listed on its website, including popular options like Mr Sub, Mucho Burrito, TacoTime, Timothy’s Coffe, Van Houtte, Papa Murphy’s, and South St Burger.

As of its most recent quarterly report at the time of writing, MTY had a total of 7123 locations, 54% of them being in the United States.

How fast is MTY Food Group growing?

Prior to the COVID-19 pandemic, MTY Food Group was actually growing at a fairly reasonable clip, especially when we look to company revenue.

From 2016 to 2019, the company had a compound annual growth rate of 30.27% on revenue and 9.28% on earnings. Although most investors would like to see the company’s bottom line growing in the double digit range, this is still a respectable growth rate for a small cap Canadian company.

However, 2020 hasn’t been as kind to the company, and I think most would come to expect this. The company has seen revenue shrink by 2.5% and adjusted EBITDA by 1.36%.

Considering the massive impact the pandemic has had on quick service restaurants, a glass half full attitude towards MTY Food Group would probably look at relatively flat earnings and revenue growth as a good thing.

One thing that has benefited the company is its reliance on the United States in terms of revenue. Although shutdowns are happening there as well, they’re not nearly as extensive as the shutdowns we’ve faced in Canada.

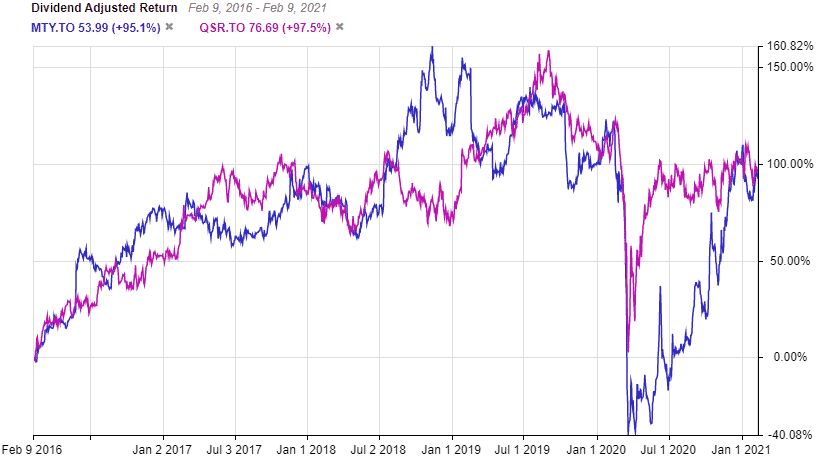

One of the primary reasons a company like MTY Food Group suffered more than a company like Restaurant Brands International (TSE:QSR) during the crash is the fact that a lot of MTY’s quick service restaurants are located in malls.

As social distancing and shutdown efforts increased, company’s like Restaurant Brands International were allowed to keep standalone stores open while retail malls were either outright shut down, or limited to 25% capacity.

However, like most of the economic fears due to COVID-19, the reaction to MTY was overblown, and as a result the stock roared back in 2020.

Market Cap: $1.3 billion

Forward P/E: 17.22

Stocktrades Growth Score: Premium Members Only

What is the forward outlook like for MTY Food Group?

The company has stated themselves that the outlook moving forward is simply impossible to predict given the lingering impacts of COVID-19.

As more news of vaccines surfaces, there is now seemingly an end in sight for the pandemic, but it’s still extremely hard to estimate the company’s forward growth.

From an analyst standpoint, they expect the company to post relatively flat revenue and earnings growth through 2021, and have placed a 1 year target price on the company that indicates almost no upside.

The company is still trading at a discount to its historical averages, but the gap is narrowing to the point where investors are almost paying pre pandemic prices for the company, despite the fact the pandemic is still having a large impact on the company’s operations.

MTY was arguably one of the strongest options in the quick service industry here in Canada, and I really like the fact they have strong US exposure with over 50% of revenue generated there. However, when I look at this company, I’m thinking 2022 or 2023 before it gets back to previous levels of revenue generation.

It’s easy to see this stock as a strong recovery play for many Canadian investors. However, you really have to understand the price you’re paying. If we see flat growth from MTY over the next few years, this is a stock that’s currently overvalued in my opinion, and I think the recent run up might be a bit overdone.

This pandemic is not going to be a “snap your finger and it’s over” situation. News of vaccine rollouts are one thing, but getting people back into malls and crowded environments will likely not happen until 2022. Which means another year of struggles for MTY.

Renewables have been making waves on the TSX recently. Check out what we have to say about Boralex (TSX:BLX).