Is National Bank (TSX:NA) Canada’s Best Kept Secret?

When investors talk of Big Banks among Canadian stocks, they are usually referring to the Big Five. There is however, a sixth that too often gets left out of the conversation – the National Bank of Canada (TSX:NA). National Bank is Canada’s sixth largest bank and deserves to be in the conversation of Canada’s best bank.

Market Cap: $24.56 billionForward P/E: 11.46Yield: 3.89%Dividend Growth Streak: 11 yearsPayout Ratio (Earnings): 46.87%Payout Ratio (Free Cash Flows): Premium Members OnlyPayout Ratio (Operating Cash Flows): Premium Members Only1 Yr Div Growth Rate: 0.00%5 Yr Div Growth Rate: Premium Members OnlyStocktrades Growth Score: Premium Members OnlyStocktrades Dividend Safety Score: Premium Members Only

Globally diversified

Contrary to popular belief, the bank is globally diversified and much bigger than investors think. Although most income stems from Canada, it also operates in the U.S., Europe and other parts of the world. The bank operates in four segments:

- Personal and Commercial

- Wealth Management

- Financial Markets

- U.S. Specialty Finance and International

The latter accounts for approximately 15% of net income. With operations in almost every Province, it is also classified as one of the six systematically important banks in Canada.

Reliable income stock opportunity

National Bank has also established itself as a reliable income stock. Although it has been the lone Big Bank to cut dividends since the early 90s, it has since re-established itself as a reliable income stock.

National Bank has an 11-year dividend growth streak over which time it has averaged approximately 8% annual dividend growth. This dividend growth rate is among the highest of its banking peers.

Furthermore, it is one of the best positioned to continue raising the dividend. On a forward basis, the company’s payout ratio drops to 46.32% which is the lowest among the Big Six banks. In fact, no other Big Six bank is expected to have a payout ratio below 50% next year.

National Bank stands out

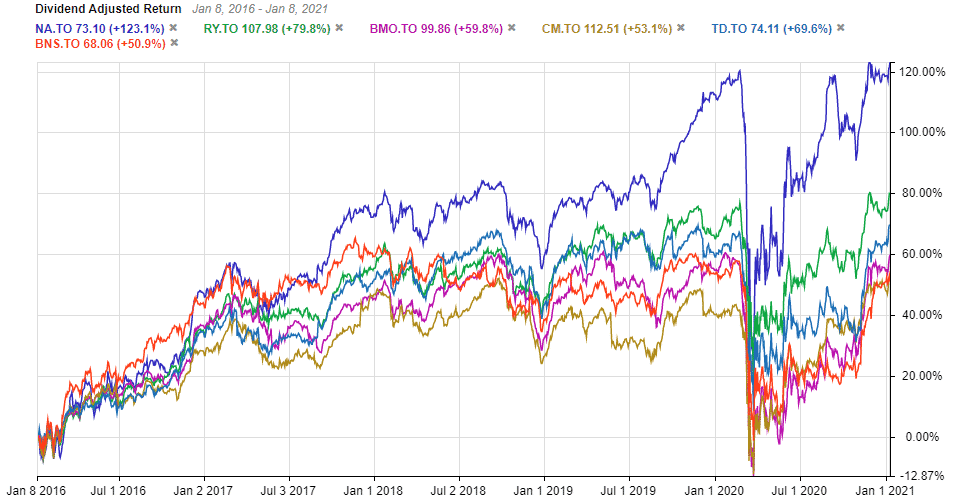

In terms of performance, National also stands out in relation to its peers. Over the past year, the bank’s stock price is flat which places it at the mid-range of its big six peers. Looking further out, National Bank’s outperformance is staggering.

Over the past five years, National Bank shareholders are sitting on total returns (including dividends) of ~30% which is more than double the ~13% posted by the Royal Bank of Canada (TSX:RY) its closest peer. There is a similar outperformance over the past five years: 120% for National Bank vs 73% for Royal Bank.

The gap narrows over the past decade, but it remains the top performing Big Six bank with total returns of more than 219%. One can’t argue this level of performance, it has simply been a best-in-class bank to own.

How are they positioned moving forward? Quite well.

National Bank is expected to post average annual earnings growth of 7.34% over the next couple years. This places it around the average expectations for the Big Six banks. Furthermore, the estimates are likely on the low side for two reasons.

- Analysts have been raising estimates over the past few months. Fiscal 2021 estimates have increased by 10.3% of the past 90 days.

- The company is one of the most reliable in terms of meeting estimates. Over the past 12 quarters it beat or met estimates 11 times, and only missed once to the downside.

Valuation

In terms of valuation, National Bank is only trading at 10.73 times forward earning which is among the cheapest of the big six. On the flip side, the company is trading at 1.79 times book value, which is among most expensive of the big six.

It is hard to argue against the National Bank of Canada being one of Canada’s best banks. Since it doesn’t enter the conversation as often as it should, I’d consider it Canada’s most under appreciated bank.

If you’re looking to buy stocks in Canada, investors should change the narrative from the Big Five to the Big Six. And all things considered, National Bank is well positioned to continue its strong performance moving forward. Another financial we have taken a look at is Manulife Financial (MFC.TO).