Is Northland Power’s (TSE:NPI) Selloff Way Overdone?

One of the hottest sectors in the country when it comes to Canadian stocks is renewable energy.

At least this was the case six months ago. At the start of 2021, you would have been hard pressed to find a sector that was booming more than clean energy. However, valuations have since dipped significantly, and many of those clean energy stocks are now trading at double digit discounts to their peaks.

One of those stocks which we’re going to talk about today is Northland Power (TSE:NPI). The company isn’t exactly the flashiest of renewable energy stocks, but as a well-established company, it garners a lot of attention, especially with its juicy dividend.

So what exactly does Northland Power (TSE:NPI) do?

Unlike a company such as Algonquin Power and Utilities (TSE:AQN) which contains a mix of renewable and regulated utilities, Northland Power is more of a pure-play renewable energy company.

The company develops, builds, owns, and operates the infrastructure for sustainable power production. Primarily, Northland specializes in wind production as the segment accounts for the bulk of its revenue.

Its offshore wind generation is primarily located in Germany and the Netherlands, while onshore operations are located predominantly in Ontario Canada.

The company has 2.8 GW of net operation capacity and a large inventory of up to 5 GW of potential future capacity, including large projects in Hai Long Taiwan, and Poland.

Overall, this is an established company with roots dating back to 1987. But, with this large asset base and a reliable history, the company is struggling in 2021, so what gives?

Weak second quarter earnings have caused a slump in Northland Power’s stock price

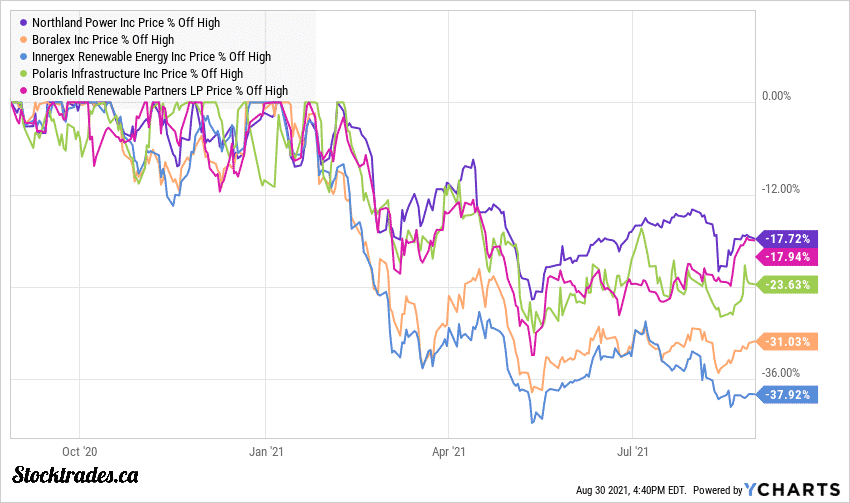

Due to the large-cap nature of Northland, it was one of the least impacted stocks during the renewable energy sell-off. In fact, if we look to the chart below, you can see that it is only 17.7% off highs over the last year, while other speculative companies like Innergex Renewables (TSE:INE) are down 37.9%.

But what you’ll also notice from the chart is that many major utilities such as Boralex (TSE:BLX) and Brookfield Renewables (TSE:BEP.UN) are recovering while Northland continues to stumble.

This is primarily the result of a weak second quarter from the company. In fact with a loss of $0.08 per share, the company posted its first loss in terms of EPS since 2016.

Revenue of $408M also missed the mark, as analysts were expecting a profit of $0.11 per share and revenue of $427.5M. As a result, the stock took a bit of a dive in early August before recovering. But, it’s still below its pre second quarter price.

So why did the company post such a poor quarter? It was primarily due to lower wind resources in the North Sea impacting operations. The company views this impact as temporary, and it shouldn’t be a drag on operations for long.

Wait, if Northland Power lost money, how can it pay its dividend?

Wind generation is prone to seasonality, and as such the company will have both higher and lower earnings periods. But, if we calculate the free cash flow of Northland Power, the company came out of the quarter with positive free cash flow, a good sign for the dividend. It is important to know which metrics to look for in analyzing a dividend, especially those just learning how to buy stocks.

Free cash flow is cash generated from operations minus capital expenditures. Net income (and EPS) can be manipulated by things like depreciation, amortization, and one off costs that are unlikely to impact business operations long term.

As such, even though Northland Power only has earnings per share of $0.34 through the first 6 months of the year and has paid out $0.60 in dividends, the dividend remains well covered, even though payout ratios are sky high.

Why? The company has generated $0.80 in adjusted free cash flow, which is the more reliable indicator of dividend safety in a capital intensive industry like utilities.

Second quarter weakness could provide an opportunity for investors

It’s becoming increasingly difficult to find value in the stock market today as we continue to break records and set new highs.

So while Northland Power isn’t exactly “cheap”, it is trading at reasonable levels and should be a company investors should watch.

It is trading at 7.5 times trailing cash flows, which is the cheapest it’s been since late 2017. On a price to earnings basis the company is trading at a double digit premium to historical valuations. However considering the pace at which Northland Power is growing at, 22 times earnings is a price I’d be willing to pay.

A warning to dividend growth investors however. This is a company that does not like to raise its dividend. In fact, it can be downright frustrating as an income seeking shareholder, especially one that needs growth.

Northland has paid a $1.20 per share dividend for 3 years now, and has only raised the dividend 3 times over the last decade.

If you’re looking to buy the stock today, it is likely to take advantage of its growing renewable portfolio and a shift away from fossil fuels, and not as a reliable growing dividend, no matter how well covered it is.

Interested in defensive Canadian stocks? Is Waste Connections (TSE:WCN) the perfect one?