Is Right Now The Time To Buy Canada’s Major Banks?

I was recently provided with some research and commentary from Hamilton ETFs and their team of financial sector specialists that may shine some light on a potential bullish future for the Canadian banks.

Just a few weeks ago, I did a deep dive on the banks and the main headwinds facing them right now.

Although high rates could potentially continue to be a headwind in the near future, the data Hamilton presented to me in regards to Canadian banks and their historical drawdowns was quite eye-opening.

A little bit about Hamilton ETFs

Hamilton ETFs is currently the #2 provider of Canadian bank ETFs by AUM, accounting for over $1B of the firm’s ~$3B in AUM. At the end of this post, I review 3 of their ETFs that have been gaining popularity at a rapid pace.

In their recent article, Canadian Banks: History Points to a Stronger 2024 (after Two Tough Years), Hamilton ETFs reviewed historical data to see how often the Canadian bank index had negative two-year returns and measured the performance of the index in the following twelve months.

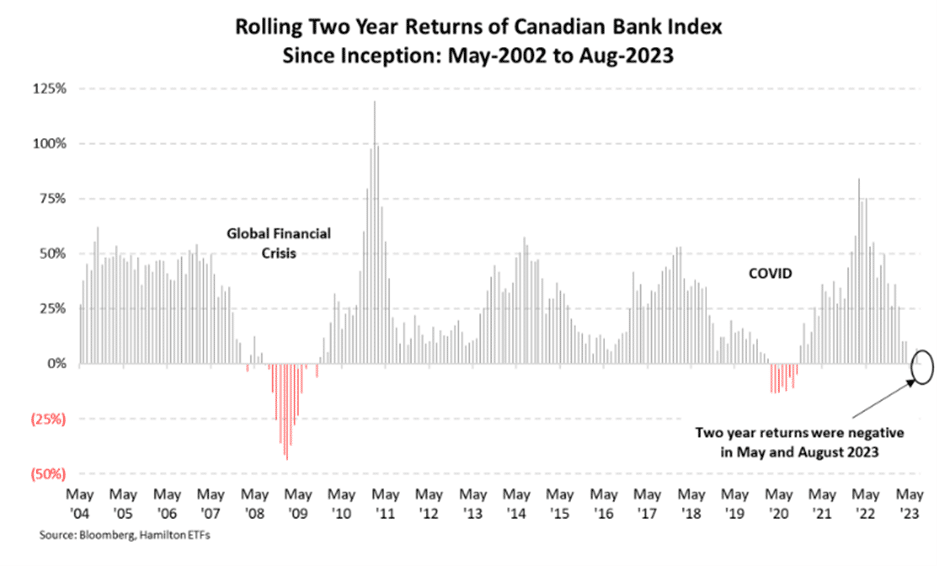

The chart below shows rolling two-year returns of the Canadian bank index since 2002:

This chart packs a lot of punch in terms of data. However, Hamilton provides some key takeaways. Lets have a look:

- Since inception, the Canadian bank index had a negative rolling two-year return at 22 times month ends (in red), out of 232 month-ends, excluding May and August 2023

- Of those 22 periods, the Canadian banks generated a positive return in the following year 21 times

- Negative two-year returns are clustered around the Global Financial Crisis (GFC) and COVID

- The sector managed to generate positive two-year returns through other challenging periods for banks stocks including European Sovereign Debt Crisis (2011), Brexit (2016), and recession concerns and yield curve inversion (2018)

- Most importantly, the most recent periods – May and August 2023 – stand out as unusual as their negative returns are modest, and not closely tied to a severe global macro event

What Does this Mean for the Banks Now?

Let me preface this by saying not all down periods – or recoveries – are created equal.

In the following chart, Hamilton compiled a table of the 22 month-end periods where the Canadian bank index had negative two-year returns and calculated the following 12-month return.

The one thing I noticed about this chart almost immediately is that the larger the drawdown, the larger the recovery over the next 12 months. This isn’t the case in 100% of situations on this chart, but it’s pretty close.

In addition to the two most recent periods (May and August 2023), Hamilton highlights the only 3 other instances in the last 20+ years where the negative two-year return was less than 3%: August 2008, September 2008, and July 2009.

The average subsequent 12-month return for those three period ends was much lower than the average (of over 40%), but a still very healthy ~15%.

Relative to historical valuations, bank stocks are cheap

With the banks trading at just ~9.2 times their fiscal 2024 earnings, they are trading at very large discounts to their historical averages of ~10.5 times forward earnings.

This means at this point in time, the banks are trading more than ~15% off of their historical valuations, pricing in a lot of bad news: rising loan losses, large reserve builds, net interest margin headwinds, and tepid capital markets.

To read more about how the banks could set the stage for an improved f2024 and the catalysts necessary for bank stocks to rise, Hamilton provided their thoughts in their note, Canadian Banks: Three Ways the Banks Might “Clean Up” fQ4 (and Improve f2024).

Now that we’ve looked over that, we can go into a few ways you can take advantage of the discount in Canadian banks if you wish.

Each one of these ETFs provides a unique element, and I was surprised at the selection of Canadian bank ETFs that Hamilton had, and most importantly how cheap the fees were.

For low-fee exposure to the Big 6 – Hamilton Canadian Bank Equal-Weight Index ETF (TSE: HEB)

HEB is a fairly new ETF, starting in April of 2023. Make no mistake about it, however, its popularity is likely due to one thing: rock-bottom fees.

If we look to the most popular banking ETF in the country, BMO’s Equal Weight Bank ETF, you’ll notice a lot of similarities between these two funds. That’s because these funds contain the exact same holdings and track the exact same index. They both hold Canada’s Big 6 banks, equally weighted, and nothing else. The only difference here is fees.

With the lower cost HEB, management fees of 0.19% are getting to the point where you’re paying very little (around $1.90 per $1000 invested annually) to have a managed and automatically rebalanced portfolio of Canada’s 6 major banks.

For higher growth potential from the Big 6 – Hamilton Enhanced Canadian Bank ETF (TSE: HCAL)

If you’re confident banks have bottomed and are poised for strong long-term returns, HCAL is an ETF that not only invests in the Big 6 Banks, but does so with modest 1.25x leverage, meaning if the banks go up collectively by 1% on the day, your position will increase 1.25%. Additionally, the leverage increases monthly distributions.

Before investing, you need to figure out if leverage is right for you. Holding leveraged positions will ultimately result in you outperforming when stocks rise and underperforming when stocks fall. Think of it as amplified gains and losses.

The fees are a bit higher for HCAL. However, this can be expected as leverage is not free and will fluctuate with interest rates.

The best part about large fund providers is that Hamilton has access to materially lower borrowing rates than what would be available to an individual investor, so if you’re thinking of buying the banks on margin, HCAL would be a cheaper option.

Even though this fund currently yields over 8%, don’t confuse it with a covered call ETF. The fund uses no derivatives, simply 1.25x leverage to amplify returns in bull markets and give more income back to holders.

Maximize Yield from Canadian Financials with Covered Calls (TSE: HMAX)

The Hamilton Canadian Financials Yield Maximizer ETF (HMAX) aims to maximize the yield from a portfolio of Canadian financials stocks by selling at-the-money call options on roughly 50% of their holdings.

Compared HEB and HCAL which have current yields of 5.44% and 8.08%, respectively, HMAX boasts a yield of over 15%. It is important however, to first determine if a covered call strategy is suitable for your investment goals.

Covered call ETFs have been an increasingly popular strategy for income investors looking for higher yields in exchange for lower growth potential. Typically, covered call ETFs in Canada invest in a basket of stocks and then sell call options on a portion of their holdings in exchange for cash premiums.

As I’ve mentioned a lot in my commentary on covered call funds, the trade-off is that investors forego capital appreciation on the portion of the portfolio which is ‘covered’ (~50% for HMAX).