Is RioCan (TSE:REI.UN) The Perfect Contrarian REIT Play?

In an environment of all-time high markets, it’s becoming increasingly more difficult to find value.

Many investors looking to buy Canadian stocks are heading to contrarian plays that are still trading well below pre-pandemic price points, hoping for a post-COVID rebound.

One of those options today is Canada’s biggest real estate investment trust, or REIT for short, RioCan (TSE:REI.UN). The company was significantly impacted by the pandemic, and many investors are now wondering whether or not the distribution is safe and if this company can be a long term turnaround play.

Lets have a look.

What exactly does Riocan (TSE:REI.UN) do?

RioCan is Canada’s largest real estate investment trust, with a total enterprise value of over $14 billion as of June 30th, 2021.

The company is heavily focused on the retail and commercial sectors, however it is quickly adapting and redeveloping some of these areas into high profile office and residential spaces.

91% of the company’s revenue comes from the 6 major markets here in Canada including Vancouver and Toronto. And while its occupancy rate of 96% has dipped from pre-pandemic numbers, it’s still a strong rate.

The company also has a diverse mix of tenants, including just shy of 17% towards grocers/pharmacies and liquor stores, 13.8% to discount retailers, and 9.1% to furniture and home stores.

For those learning how to buy stocks, a REIT can be bought just like any other stock and these companies can provide some widely diverse exposure to several areas of the real estate market through varied types of properties and the tenants that occupy them.

The troubles of RioCan during the pandemic caused its share price to crater

At a time where malls, offices and other commercial areas were shut down due to the pandemic, RioCan’s top and bottom lines were hit significantly as many of its tenants could not pay leases or signed up for rent deferral plans.

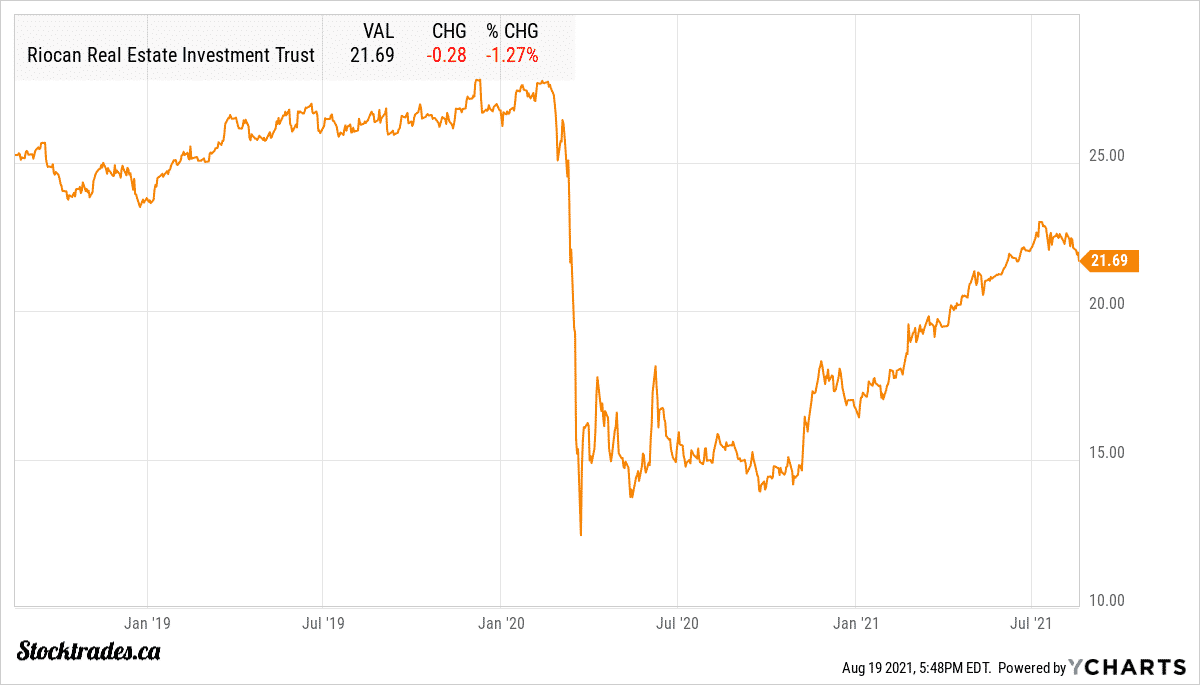

As you can tell by the graph, this resulted in a swift, and borderline catastrophic collapse of RioCan’s share price as it fell from the high $27 dollar range to as little as $11.90 in less than one month.

Payout ratios when it came to funds from operations exceeded 100% and even though management stated the distribution was safe, it was slashed in 2020. And for those looking to invest in REITs, the distribution is absolutely key. So, it’s likely a strong factor for it lagging its pre-COVID price

But we are here more to look forward, not backward. Lets take a look at a bullish case for the REIT moving forward and a bearish case to see if RioCan might be worth looking at today.

The bearish case for RioCan moving forward

Many who are avoiding RioCan are doing so because of the company’s exposure to the commercial and retail space.

E-commerce has boomed in 2020, and whether investors like it or not, there will be less people returning to stores once the COVID-19 pandemic is behind us. Online shopping has created a convenience that simply cannot be matched. Avoid the stores, order in a few clicks and it shows up at your doorstep.

RioCan is adapting away from these types of properties being the company’s major focus. However, the company might have started the movement towards more residential properties a little too late. Nobody knew the pandemic was going to happen, but when it did, the company had just begun to branch out into the residential space and didn’t quite have the properties in operation to provide a cushion during the pandemic.

The company will need to provide growth moving forward, and many don’t believe it has the capability to do so with its current asset mix. In fact, the company was often ridiculed for making small raises to the distribution that weren’t even keeping up to the rate of inflation.

Because of the company’s distribution cut, it likely has a bit more wiggle room to raise it moving forward. However, I believe that the REITs dependence on the office, commercial, and retail sectors rather than residential and industrial, combined with the history of low distributions boosts will be key reasons a lot of investors head to other REITs.

The bullish case for RioCan stock

The positives when looking at RioCan are pretty obvious. This is a trust that is clearly in the midst of a turnaround.

On a year over year basis, rent deferrals and provisions are going down, rental prices per square foot are starting to head upwards again and the company’s retention ratios are above 91%.

Even through the midst of the pandemic, this is a company that has grown FFO on a yearly basis. If we look on a year over year basis, the company has boosted funds from operations by 25% compared to the 2nd quarter of 2020, when things started to unravel due to the pandemic.

The company is reducing its reliance on apparel, specialty retail, and furniture stores and instead boosting its portfolio when it comes to grocery anchored centers.

Due to the sheer size of RioCan, it has been able to launch some large and potentially lucrative residential projects in the GTA, some of which are already at 95% occupancy.

The company’s residential rent collections rates also remain very strong, north of 99% and there is no questioning the quality of RioCan’s properties.

The company’s debt ratios ballooned over the course of the pandemic, but we can also see them reducing on a quarterly basis midway through 2021. Debt to adjusted EBITDA sits at 9.87X and debt to assets 44.7%. These ratios are still high, but the positive thing to look at is that they are improving.

In terms of payout ratios, the company exited the quarter with the distribution making up 79.8% of funds from operations. Glass half empty investors may look at this and think that ratios should be even lower considering the distribution cut. But, RioCan does have a long way to go yet, and considering its FFO payout ratio was at 91% in the first quarter, this is a steep improvement.

Overall, there’s valid arguments on both sides

If I were to buy a REIT today, I’d stick to a pure-play residential option or an industrial one. However, I can see the case for a potential turnaround play in RioCan, and those who think this REIT can return to its former glory can get in at a pretty big discount relative to pre-pandemic prices.

But, you’re certainly going to need to be patient. This turnaround if it happens is likely to take many years, and there will be bumps in the event of further shutdowns.

Have you ever encountered a “Golden Cross”? Lets look into a potential Golden Cross for 2 Canadian stocks.