TD Bank’s Payout Ratios are Rising – Is the Dividend Safe?

Key takeaways

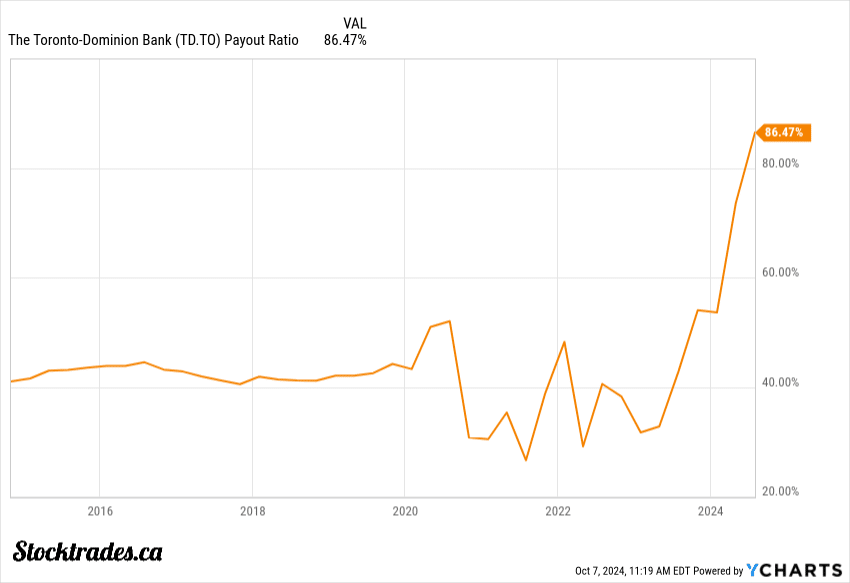

- TD Bank’s dividend payout ratios are creeping towards an uncomfortable level

- Regulatory fines and penalties may impact future dividend growth

- Investors should expect steady payouts but potentially lower growth rates

TD Bank’s dividend has long been a key attraction for investors, with a history of steady payouts and increases. In fact, at one point it was the best dividend growth stock out of all Big 6 banks.

Recent issues have brought challenges for TD Bank, including the company getting into some hot water with US regulators and a challenging economy in Canada.

These factors have put pressure on the bank’s ability to maintain its traditional dividend growth rate. The financial sector as a whole has faced headwinds, making it crucial for investors to reassess their expectations. However, TD Bank’s situation looks worse than others.

Is TD Bank stock still a good choice for dividend seekers? Let’s take a deeper look at the current state of TD’s dividend and what it means for investors.

Anti-money laundering fines have impacted payout ratios

TD Bank’s recent run-in with anti-money laundering (AML) regulations has put a dent in its financial health. The bank has been hit with hefty penalties that could reach up to US$4 billion.

These fines have pushed TD’s payout ratios to uncomfortable levels. I typically don’t like it when a bank is paying out more than 60% of earnings towards the dividend. 86%? That seems worrisome.

However, I don’t think there is any risk here over the short-term for a dividend cut.

The $3B+ set aside for penalties has eaten into profits. This directly impacts the cash available for dividends.

As a result, TD’s payout ratio is going to spike in the short term before normalizing as the company moves forward.

The bank is well-positioned to maintain its dividend payments, even in the face of potential fines or penalties. A one-time surge in the payout ratio shouldn’t really concern you here, considering the circumstances.

Although there is no fear of a dividend cut, I expect to see some pressure on dividend growth until the bank can absorb these costs.

Dividend growth could be in jeopardy

Once a dividend growth darling, I believe the bank’s AML regulatory environment could significantly impact future payouts.

Regulatory fines and penalties are a major concern. If TD faces steep fines, it may need to adjust its dividend policy.

Sure, payout ratios will eventually normalize and I don’t think the dividend is at any jeopardy of being cut. But if fines make the company leaner from a cash perspective moving forward, it may prioritize bolstering its capital reserves over increasing dividends by a large amount.

For this reason, I’d expect the bank’s dividend growth to come in at some of the lowest rates of the Big 6 banks over the next year or two.

The economic environment also plays a crucial role. A potential economic downturn to add to the AML fines could affect TD’s profits and ability to raise dividends.

Future dividend growth hinges on several factors:

- Severity of AML-related penalties

- Economic conditions

- Regulatory pressures

- Management’s capital allocation decisions

I expect TD to prioritize maintaining its current dividend. However, the pace of future increases may slow.

Overall, I’d expect a steady, but low (or no) growing dividend

TD Bank’s dividend outlook appears neutral in my view. I believe the bank will maintain its current dividend level, but significant growth seems unlikely in the near future.

The bank’s strong financial position supports dividend stability. But I don’t foresee major increases soon.

Why? The potential penalties TD Bank faces create uncertainty. It may take a more cautious approach due to this.

Long-term, TD Bank’s dividend prospects remain solid. But near-term growth is constrained by regulatory concerns.

The bank’s financial resilience provides a safety net for the dividend. But I expect management to act cautiously regarding increases until penalty risks are resolved.