Telus Stock is Yielding 7%. Is it a Buy or a Yield Trap?

Key takeaways

- TELUS offers a high dividend yield but one that is barely covered by cash flows

- The company faces challenges in its wireless segment amid fierce competition and regulatory concerns

- Valuation multiples are cheap enough that it could be a solid option

As one of the Big Three wireless providers in Canada, Telus faces tough competition. The company has worked hard to grow its customer base and expand services; however, recent quarters have shown some challenges especially in the wireless segment.

Telus has a strong presence in both urban and rural areas in Canada. This wide reach and economic moat helps the company maintain its market share. It also offers a high dividend yield in the now falling rate environment.

However, yield is only one portion of total returns. Companies in poor financial health offer high yields all the time. High yield alone does not make a company a slam dunk. I won’t dig into this now because it is off topic, but there are plenty of reasons that a trash company can have a high yield.

For today let’s take a deeper look at whether or not Telus is solid.

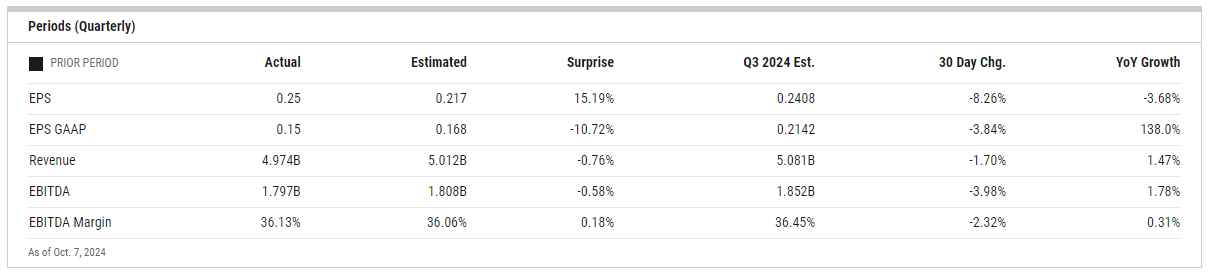

TELUS Q2 2024: Key highlights and insights

Telus’s Q2 2024 results showed a mixed bag of challenges and successes. There are some concerns around revenue and earnings, but customer growth was a bright spot for the company.

The company added 332,000 new customers, a record for Q2. This includes 101,000 mobile phone additions and 161,000 connected device additions. Their churn rate of 0.89% for postpaid mobile phones is a leading stat within the industry.

On the financial side, things are a bit murkier. Revenue only grew by 0.6% to $5.0 billion. This modest increase was driven by the Telus technology solutions segment, but offset by declines in their digital experience segment.

Some positive points:

• Net income up 13%

• Earnings per share up 7.1%

• Adjusted EBITDA increased 5.6%

I’ve always been a fan of the company’s focus on higher-margin segments for growth. Their TTech segment saw a 5.1% boost in Adjusted EBITDA and a strong margin expansion of 150 basis points.

The company’s outlook for 2024 is cautious. They’re expecting TTech operating revenues and Adjusted EBITDA to trend toward the lower end of their original targets. However, they’re maintaining their capital expenditure forecast of $2.6 billion.

In my view, Telus’s strong customer growth is promising, and the company is doing what they can to scale back and restructure to grow earnings.

Soft wireless performance is leading to challenges

Telus’s wireless segment is facing some rough waters. I’ve noticed a trend over the last few quarters that suggests the company is struggling to maintain growth in this area.

Telus saw a 3.4% drop in average revenue per user (ARPU) and barely squeezed out a 0.9% increase in wireless service revenue.

What’s behind this lacklustre performance? In my opinion, Telus is grappling with intense competition in the wireless market. The company’s significant exposure to this sector is proving to be a double-edged sword as market pressures mount.

I’m particularly concerned about Telus’s ability to attract and retain high-value customers. Competition is heating up as consumers are growing tired of expensive phone and internet bills, especially in 2024 as cost of living rises.

The drop in ARPU suggests they might be struggling to upsell existing customers or bring in new ones willing to pay premium rates.

Looking ahead, I believe these challenges could persist for a while. The wireless market in Canada isn’t getting any less competitive, and Telus will need to find creative ways to stand out from the crowd.

To turn things around, I believe Telus needs to focus on:

- Improving customer retention strategies

- Developing more attractive service bundles

- Investing in network improvements to justify higher prices

Market position amidst competitive pressures

The company’s diverse business mix is a big plus. This is something that companies like BCE and Rogers lack. Telus is not as exposed to tricky markets like Quebec or low margin businesses like media. This definitely gives Telus a bit of a shield.

But it’s not all smooth sailing. Telus’s financial outlook is a bit mixed, and Telus Digital (formerly International) has quite frankly been a disaster.

On the better side of things, Telus’s cash flow looks better than some competitors. Their EBITDA growth expectations through 2025 are holding steady.

In my opinion, Telus is well-positioned to weather the competitive storm. Their diverse offerings and strategic approach should help them navigate these choppy waters.

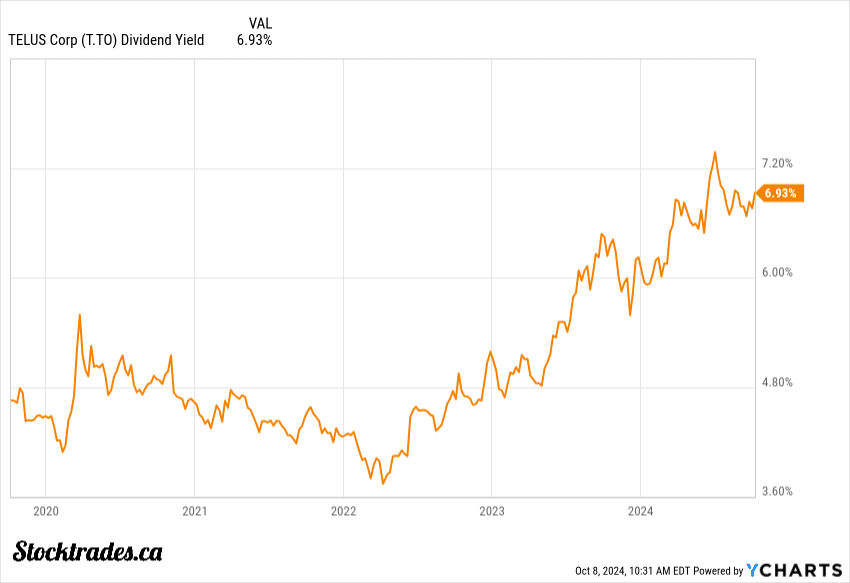

Impressive dividend yield

Looking to the dividend, Telus has a high dividend yield of about 7%. This can appear to be attractive for income-focused investors. Although I’m not one to laser focus on yield, when I see something yielding much higher than historical averages, I take a closer look at the situation.

Telus does have a solid track record of raising dividends for 19 straight years.

But I always look beyond the headline numbers. The payout ratio is a key metric I consider. Telus’s cash dividend payout ratio (TTM) is on the high side at around 100%. This raises some questions about sustainability.

The key focal point in this regard is going to be Telus’s free cash flow guidance for 2025. When they release it, we’ll have a better idea of how well the dividend will be covered.

Is Telus stock worth the investment?

I’m a fan of the company from a value perspective at the moment.

The company’s 7% dividend yield might be a selling point for income-focused investors. It offers solid cash flow potential.

Telus’s push into digital services and healthcare tech shows potential for future growth. Competition in the wireless space is fierce. They’ll need to grow these smaller segments of the business at a solid pace to make up for the wireless slowdown.

Telus’s long-term growth strategy seems sound, but execution is key. I’m cautiously optimistic about their ability to adapt in a pretty rapidly changing industry.

Overall, Telus could be a solid addition to a diversified portfolio, especially for those prioritizing dividends. But I’d keep a close eye on competitive pressures and their impact on Telus’s market share.