Is the Worst Behind Canadian Solar (NASDAQ:CSIQ) Stock?

Canadian Solar: Is the Worst Behind?

Canadian Solar Inc. (NASDAQ: CSIQ) stands as one of the world’s largest solar technology and renewable energy companies. It plays a crucial role as a leading manufacturer of solar photovoltaic modules, a provider of solar and battery energy storage solutions, and a developer of utility-scale solar power and battery energy projects. The company operates across a geographically diversified pipeline that spans various stages of development.

In this analysis, we will evaluate Canadian Solar’s current financial health, conduct a fair value assessment, and examine market sentiment using options data. Additionally, we will delve into the perspectives of Wall Street analysts to gauge their outlook on the stock.

By the conclusion of this review, our goal is to determine whether Canadian Solar represents a worthwhile addition to your investment portfolio and if the company has moved past its recent challenges.

Performance and Market Impact

The company’s stock price has faced significant pressure over the last several years. Canadian Solar has seen a sharp decline of over 43% year-to-date (YTD), largely due to rising interest rates and a cooling market for solar panels.

After peaking in January 2021, Canadian Solar was in downward trend, with the stock falling approximately 77% since then. Market sentiment toward electrification has weakened since July 2023, further weighing on the company’s performance.

Key Business Segments

Canadian Solar reports two primary business segments: (1) Recurrent Energy – This segment handles the development of solar power and battery energy storage projects, selling electricity, capacity, and ancillary services; (2) CSI Solar – This division focuses on the sale of solar system kits, battery storage solutions, and other related materials and services, driving approximately 97% of the company’s total revenues.

CSI Solar is also responsible for generating the company’s overall profitability, while the Recurrent Energy segment remains unprofitable at the EBIT level. Despite challenges such as significant drop in polysilicon spot prices, stabilization at lower levels for the last several weeks suggests that the worst may be behind the company.

Q2 2024 Earnings Review

Canadian Solar recently announced its Q1 2024 earnings on May 9, reporting earnings per share (EPS) of $0.19, beating analyst estimates by $0.20. Revenue for the quarter was $1.33 billion, slightly below the consensus estimate of $1.35 billion.

For Q2 2024, the company expects total revenue to fall between $1.5 billion and $1.7 billion, with a gross margin in the range of 16% to 18%. The company also anticipates full-year revenue between $7.3 billion and $8.3 billion.

Dr. Shawn Qu, Chairman and CEO, expressed confidence in the company’s future, stating that shipments, revenue, and gross margin met expectations. He highlighted growth in distributed generation markets and solar and battery project development, emphasizing Canadian Solar’s focus on expanding market share in strategic regions.

Analyst Perspectives

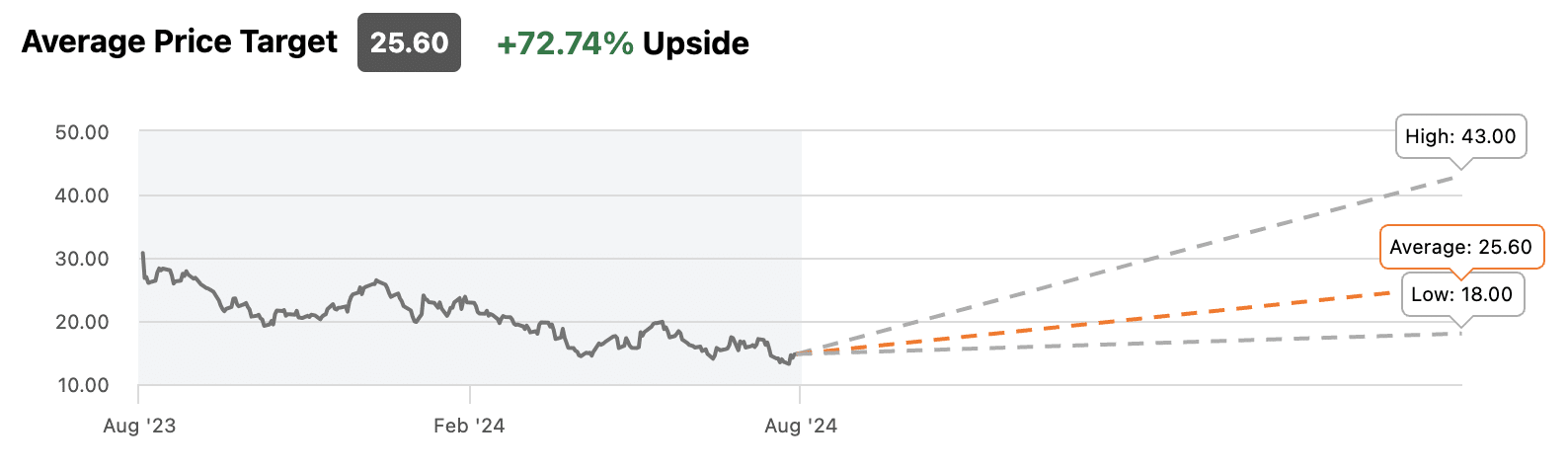

Wall Street analysts remain optimistic about Canadian Solar’s prospects. Price targets for the stock range from $18 to $43, with an average target of $25.60—suggesting a potential upside of around 72% from current levels.

Source: SeekingAlpha

Most recently, in May, Oppenheimer adjusted its price target for Canadian Solar, reducing it from $51 to $43, while maintaining its Outperform rating.

The analysts explained that as Canadian Solar’s battery business continues to grow, the company is wisely scaling back solar shipments to China due to the unfavorable pricing environment that does not support positive cash margins. In contrast, Canadian Solar is channeling additional volumes outside of China through its distributor network, which is helping to sustain margins.

Analysts are optimistic about the company’s growing project pipeline, particularly in the energy storage sector, which is expected to deliver higher-than-average margins. Additionally, they foresee Power Purchase Agreement (PPA) prices rising across various regions. Consequently, Oppenheimer has lowered its estimates in response to the reduced solar module shipment guidance, while still projecting 10% year-over-year growth in 2025.

Valuation and Market Sentiment

Canadian Solar appears to be trading at a discount, though not as significantly as estimated by Wall Street analysts. Based on a fair value analysis using various models such as Earnings Power Value, P/E Multiples, and Discounted Cash Flow (DCF) analysis, our estimated fair value of the stock is approximately $18 per share, suggesting a potential upside of 22% from its current price.

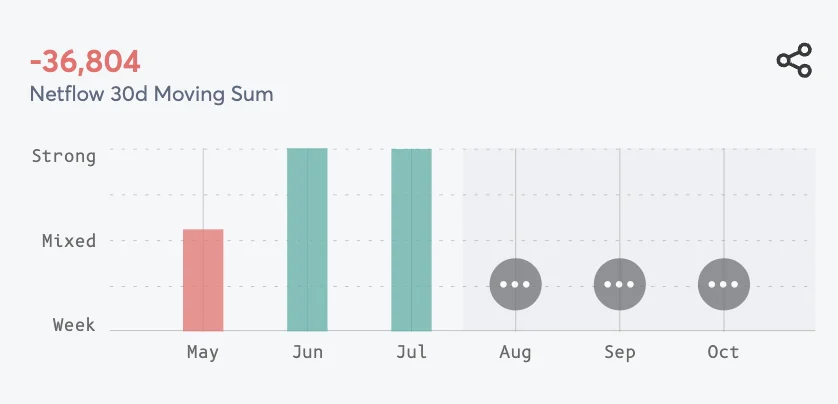

Beyond fundamental analysis, options data can offer critical insights into short-term market sentiment. Recent figures reveal a net negative flow in options contracts, with a 30-day cumulative total of -36,804.

Predictions for the months of August, September, and October reflect “Mixed” outlooks, highlighting continued uncertainty and potential price volatility. This indicates that there is no clear trend emerging, with the stock likely experiencing fluctuating prices over this period, without a strong tilt towards either bullish or bearish momentum.

Source: Visual Sectors

Risks and Considerations

A few key risks remain for investors. Approximately 80% of Canadian Solar’s manufacturing capacity is located in China, with an additional 15% in Southeast Asia. Starting in June 2024, CSIQ will face higher import duties due to ongoing U.S. and EU trade bans on Chinese-made polysilicon products. This could affect profitability, particularly as about 50% of the company’s revenues come from the Americas.

Political uncertainties may also impact the company’s future performance. For instance, the ongoing U.S. presidential election could lead to policy changes that affect clean energy investments. Former President Trump has pledged to dismantle the Inflation Reduction Act, which includes $370 billion for clean energy investments, potentially adding volatility to Canadian Solar’s stock in the months leading up to the election.

Conclusion

While Canadian Solar presents a compelling opportunity for potential upside based on analyst projections and our fair value estimate, several risks—including political uncertainties, trade restrictions, as well as mixed options sentiment—warrant caution.

Investors may want to wait for more clarity after the upcoming earnings report on August 22 before making any decisions to ensure that the worst is indeed behind the company and the stock is positioned for recovery.