Is Tourmaline Oil (TSE:TOU) Canada’s Top Natural Gas Play?

It’s natural for Canadian investors to want to make contrarian plays. Invest in a sector while it’s in the dumps and hope to reap the rewards later on due to undervalued share prices.

Unfortunately for the oil and gas sector, it’s likely headwinds are going to stick around for a long, long time. In fact, we may not see pre-COVID prices on some of Canada’s top oil producers for half a decade or longer.

If you’re attempting to make a contrarian pick in the oil and gas sector, in my opinion stay far, far away from producers. Just because Warren Buffet is buying Suncor doesn’t mean you have to.

And by producers, I mean oil producers.

There is a particular producer out there that has been performing well over the course of this pandemic, and in fact it just hiked its dividend as I’m writing this. That is Tourmaline Oil (TSE:TOU). And despite the name, the Canadian dividend stock has little to do with bitumen.

What exactly does Tourmaline Oil (TSE:TOU) do?

Tourmaline Oil is the largest natural gas producer in the country. In fact, this is essentially a natural gas pureplay, considering that over 80% of the company’s revenue comes from natural gas.

The company is also the 5th largest Canadian midstream gas processing operator, and one of the lowest cost producers.

The most important part however, is that only 3% of the company’s production comes from oil. This is why it has survived and actually thrived during this pandemic.

In 2019 the company averaged 291,000 barrels per day, and the company estimates it has over 2.6 million barrels of natural gas and crude oil reserves.

Any company that is deemed to be a pure-play is not without risk. But, we’re going to go in depth on that after we look at Tourmaline’s dividend.

How does Tourmaline Oil’s dividend stack up?

If we look at Tourmaline’s dividend on a trailing twelve month basis, we’re going to see that its payout ratios are uncomfortably high.

This is primarily due to the fact that the price of natural gas has been tanking for a long time now. So the question is, how did Tourmaline manage to hike its dividend 17% in its most recent quarterly report?

It’s because the outlook for natural gas looks positive.

Charts provided by StockRover. Check out Stockrover Here!

We can see in the two year chart here that since July of 2020, natural gas has started to rebound off historical lows.

As a result Tourmaline has seen a significant increase in revenue. In fact, through the first 9 months of 2020 revenue is 50% higher than 2019 numbers.

So, although on a trailing 12 month basis Tourmaline is paying out 109% in terms of earnings and 106% in terms of free cash flows towards the dividend, the company expects to generate over $856 million in free cash flows in 2021, making this dividend well covered.

Market Cap: $4.67 billion

Forward P/E: 30.28

Yield: 2.56%

Dividend Growth Streak: 1 years

Payout Ratio (Earnings): 109.09%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 24.32%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

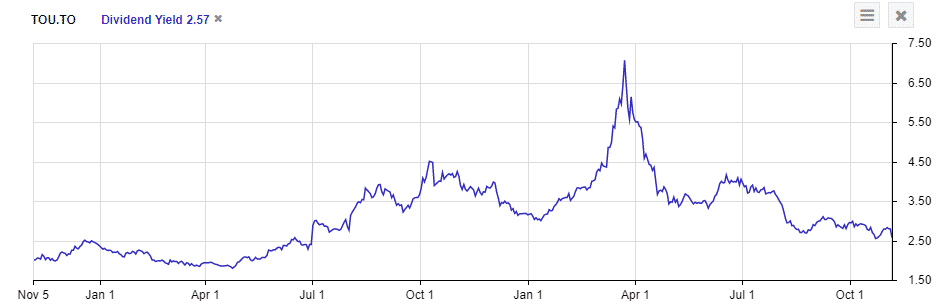

The company began paying a dividend 2 years ago, so it’s pretty tough to identify a historical dividend yield like I tend to do in these articles. Not as easily judged as companies that have a longer dividend history to review such as BCE (TSE:BCE), an example in telecoms. However, at the time of writing Tourmaline has a 2.57% dividend yield and should provide more than enough passive income to those who are looking to take a play on natural gas.

What does Tourmaline’s future look like?

So, it’s fine to say that Tourmaline is an excellent play now. But, it would be wrong to assume it will continue to be indefinitely. The risk of a pure-play company on a single commodity is exceptionally high.

But, I imagine you’re well aware of this, considering what has happened to Canadian oil sands producers and in fact, oil companies around the world.

Tourmaline expects production to be around 400,000 BOEPD in 2021 and it wants to grow that production to 482,000 BOEPD by 2025. This would be a compound annual growth on production 3.8%, not world-championing by any stretch of the imagination, but still solid.

The company is also making strategic acquisitions, with Modern, expecting to add 12,500 BOEPD in 2021. Jupiter, expected to add 75,000 BOEPD in 2021, and Edson, expected to add 6000 BOEPD in 2021.

The company has high expectations, and is aiming to be the largest natural gas company in the country by a landslide in 2021, with Canadian Natural being second.

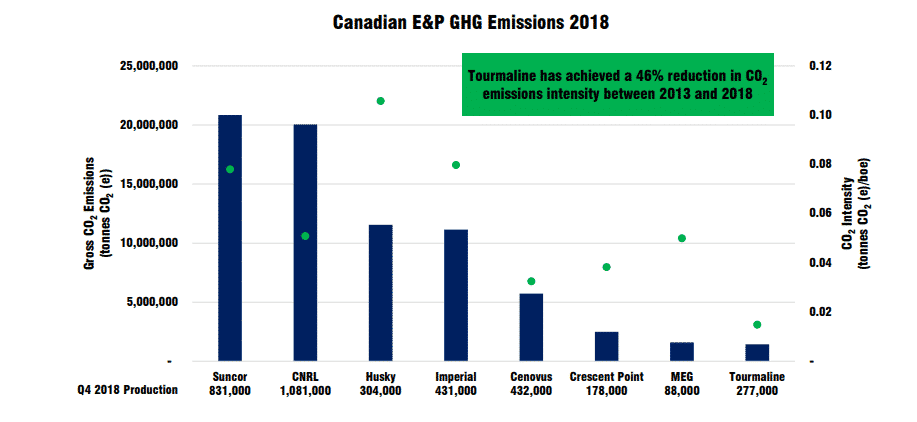

An interesting note as well, especially for green investors, Tourmaline Oil has the lowest greenhouse gas emissions intensity, which is measured in CO2 per barrel, among all Canadian Senior peers. Here is the image detailing the emissions below, directly from the quarterly report.

Valuation and cyclical danger

So, with Tourmaline outperforming at a significant rate in 2020, there is no doubt that valuations have reached highs the company hasn’t witnessed in some time.

The company is currently trading at 74.9 times trailing earnings. Seems high right? Well, when we flip that to a forward price to earnings basis, the company is trading at only 11 times earnings.

This is a 62% discount to its 5 year historical average, and this is primarily because again, natural gas has started to resurge. Analysts expect 21% revenue growth from the company in 2021 and have placed a price target on the company that signals 45% upside.

So, there is no questioning that Tourmaline is an excellent option right now for those looking to enter the oil and gas sector.

However, it’s an investment suited for investors who like to cycle in and out of outperforming sectors. Much like gold and crude oil, the price of natural gas will fluctuate over time, and there will be instances where Tourmaline is facing significantly lower prices than it expects in the future.

To investors who aren’t prudent enough to buy in and out of the stock, anticipating peaks, I would suggest avoiding the sector. For those just learning how to buy stocks in Canada, timing economic cycles can be extremely hard.

Another key factor will be management’s ability to raise the dividend at a conservative pace, and allow for dips in natural gas prices so it can keep the dividend steady for a long duration of time.

As we can see with many oil and gas producers, dividends were raised to the point where an exorbitant amount of cuts happened during the COVID-19 pandemic. This happened during the gold boom as well. During the gold boom in 2020, we’re seeing more prudent moves from management, raising dividends and spending capital based off $1200 gold, knowing that it could very well return to those levels.