Is Tourmaline Oil (TSE:TOU) The Best Energy Play in Canada?

Unless you’ve been living under a rock, you’re probably well aware of the energy crisis the world might be faced with in the coming months.

Oil demand is outstripping supply due to the re-opening of economies and the overall bottleneck of supply chains. As a result, Canadian stocks, particularly those in the oil and gas sector are getting a long, hard look after a catastrophic 2020 in terms of returns.

Although oil and gas companies have proven time and time again they aren’t suitable for long term holds, it’s hard to not be drawn into these companies over the next couple years to reap the rewards that could come from increased prices.

In this article, I’m going to speak on a single player, one in the natural gas sector and one that I believe is one of the best in class producers in the country, Tourmaline Oil (TSE:TOU).

Why Tourmaline Oil (TSE:TOU) stock is more of a play on gas than oil

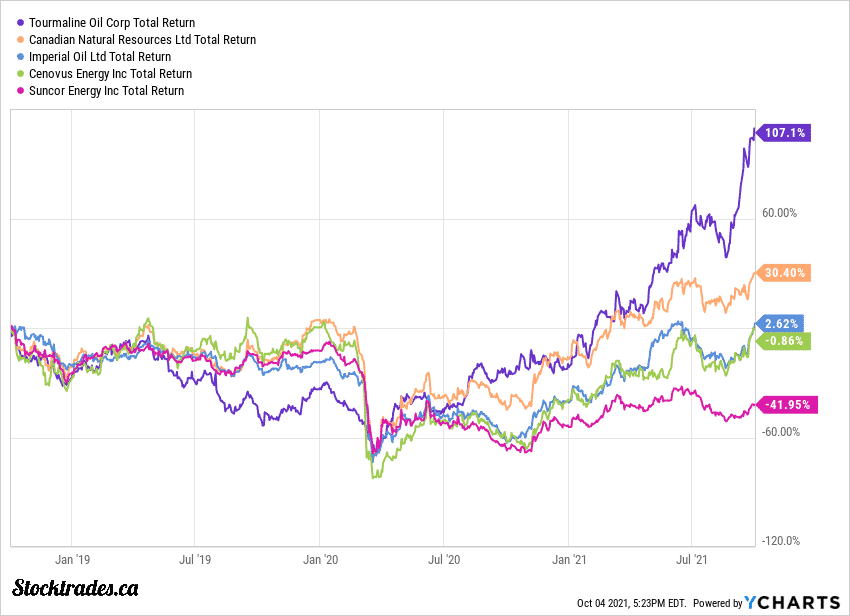

Don’t let the name confuse you, Tourmaline Oil is very much a natural gas play. In fact, over 80% of the company’s production profile last year was natural gas, and it is currently the largest natural gas producer in the country. In fact, oil only accounts for 3% of production, which is exactly why the company didn’t struggle as much as some producers during the height of the pandemic, as you can see in the chart below.

The company’s production forecasts in 2021 are 440,000 – 445,000 boepd and Tourmaline is one of the best cash flow generators in the industry.

The company has some of the lowest greenhouse gas emissions out of all major producers, including companies like Cenovus, Suncor, and Canadian Natural Resources. The company has proven its ability to operate profitably during multiple cycles of rising and falling natural gas prices.

The bull case for Tourmaline Oil in 2021 and 2022

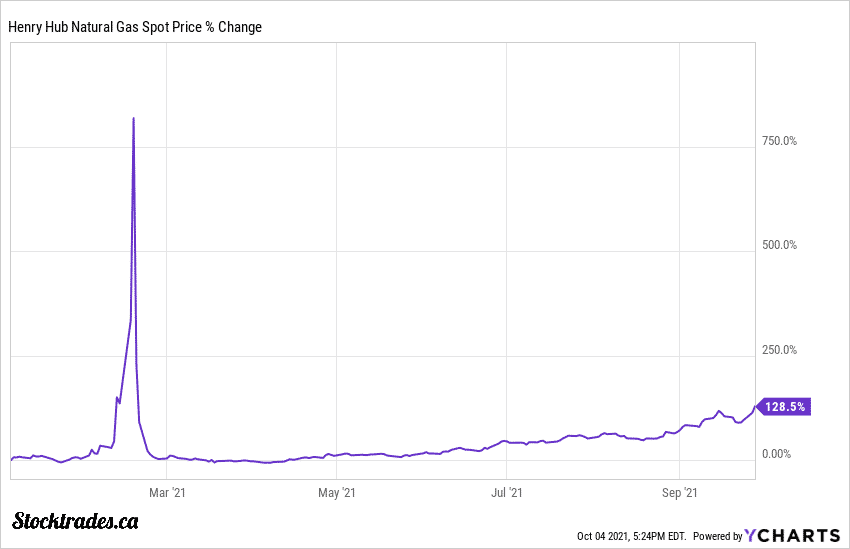

Much like oil, natural gas prices have been on the rise. In fact year to date prices have escalated as much as 121%. So much so that the company is guiding to free cash flows in excess of $3B in 2021.

This type of cash flow generation will likely result in some juicy dividend raises for shareholders and will allow the company to further fund expansion.

If we look to free cash flow estimates by the company over the next few years, it predicts it will be able to generate $1.58B in FCF in 2021, and $2.52B in 2022. Special dividends aside, considering the company only paid out $210M in dividends in Fiscal 2021, if we look towards next year the dividend will likely account for less than 10% of free cash flows.

Cash flows are expected to slow as we move to 2023 and beyond, but this is typical. It has been difficult to profit from the oil and gas sector on a long term basis.

This also makes buying stocks in this sector a bit rocky from time to time due to shifting commodity prices. Investors should always exercise caution when dealing with companies that can be directly affected by commodity prices.

However, there’s no questioning the fact that as winter approaches and supply becomes more and more of an issue, there could be money to be made in the short to mid term.

How Tourmaline plans to spend these excess cash flows and how shareholders can benefit

It’s not uncommon during rising commodity prices for energy companies to return the significant cash flows back to shareholders. Moving forward, Tourmaline plans to do exactly this.

This will likely lead to one of three things. The company will either permanently raise the dividend, or much like it just did in September, it will issue a special dividend. Of note, the single special dividend issued in September of 2021 by Tourmaline Oil was more than its normal payout on an annual basis.

Or finally, it can return shareholder value through share buybacks. In Tourmalines case, it has stated it prefers the second option, that being special dividends. This does make sense as the price of natural gas will not stay high forever. So, a special dividend based on excess capital can be wiser than increasing the dividend and being left with tight payout ratios during times of poor commodity prices.

The company has been very prudent with acquisitions, and it’s clearly paying off

Since 2019, Tourmaline has acquired over $2.3B in assets, and those assets now generate over 1/3 of the company’s total free cash flow that investors will no doubt benefit from over the next few years.

Over 4500 drilling locations, 1.2 million net acres, and over 1.4B boe in reserves have been added to the company, a significant addition to an already outstanding asset base.

Now, it is important to keep in mind that Tourmaline is going to be scaling back acquisitions in a big way. In fact, through the next few years the company envisions only small asset deals to take place.

Overall, Tourmaline is an excellent short term play for those looking to take advantage of a potential energy crisis.

The company has a disciplined approach in which it has targeted a leverage ratio of 1.0-1.5 times cash flow, with excess free cash flow used to raise dividends and buyback shares.

Furthermore, natural gas fundamentals continue to improve, and will likely see bullish sentiment into late 2022 at minimum.

The market dynamics for natural gas appear to be more stable than that of oil, as such Tourmaline is positioned to continue its strong performance relative to energy peers.

If you’re looking for an individual mid-term oil and gas play. Tourmaline Oil is one of the best in my opinion.

Keep in mind though, there will always be risk for increased volatility in commodities. For some it takes a correction or two for them to feel their over-exposure to highly volatile stocks. Here are two low-beta Canadian stocks for an upcoming correction.