Is Wheaton Precious Metals (TSE:WPM) Canada’s Best Material Play?

The TSX Index and Canadian stocks in general are known primarily for two big sectors – financials and materials. The latter is one that is gaining lots of attention of late as the price of precious metals like gold and silver are once again trending upwards, and people are interested in buying Canadian stocks in the sector.

We’ve talked quite about various gold stocks, but having exposure to silver is another great way to gain exposure to precious metals.

While not a silver pureplay, one of the stocks that is well positioned to benefit from rising prices is Wheaten Precious Metals (TSX:WPM).

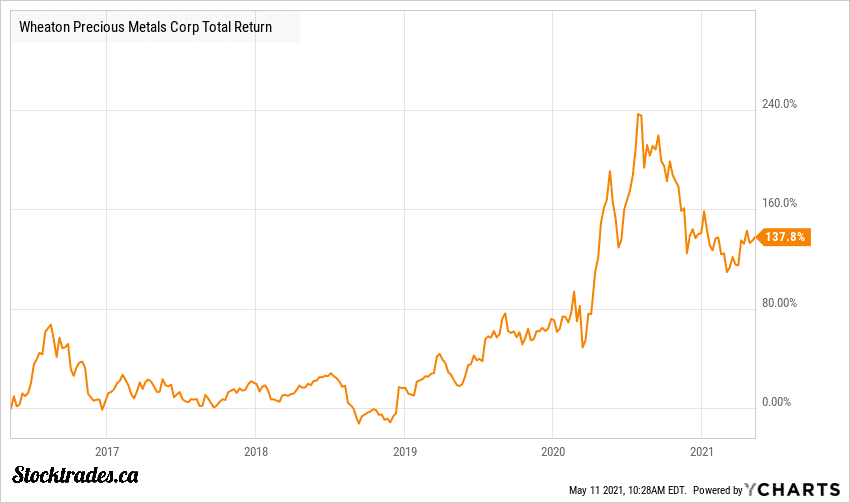

This dual-listed stock is flat in 2021 and is down by about 13% over the past year.

First, let’s talk about Wheaton Precious Metal’s (TSE:WPM) business model

As a streaming company, it has many benefits which includes lower costs, exploration upside and more predictable cash flows. In my opinion, the most significant advantage is the lower cost profile.

As a streamer, it is not saddled with the high costs of exploration and development, permitting, construction and ongoing mine maintenance. As such, WPM is less volatile than producers and exploration companies in the industry.

While it has lower upside in a bullish environment, it is likely to outperform in a bearish environment.

Wheaton has 24 mines in operation and another 8 under development and has many high quality partners. Over the years, the company has shifted from primarily a silver play to one that is more diversified into gold, much like another silver company in Pan American Silver (TSE:PAAS).

Wheaton Precious Metals expects to return to growth in 2021

Last year’s production fell below 2019 levels, largely as a result of pandemic restrictions that impacted operations at several of its mines.

In 2021, the company expects to return to growth and is forecasting 720-780Koz of gold equivalent ounces (GEO). At the mid-range, this represents a 3.6% increase over 2020 levels, and relatively inline with 2019 production of 750Koz of GEOs.

While flat production levels is nothing to get too excited about, Wheaton does expect to average 810,000 GEOs over the next five years. Also worth noting, guidance does not include any production from the properties currently under development.

Wheaton is also in a very strong capital position. It is levered to the price of commodities and cash flows will rise materially as the price of precious metals rises.

This should bode well for Wheaton’s dividend

Cash flows that will help support the company’s dividend. Currently, Wheaton yields approximately 1.23%. While this isn’t going to excite many income investors, it has room to move in a material way should gold and silver prices trend upwards.

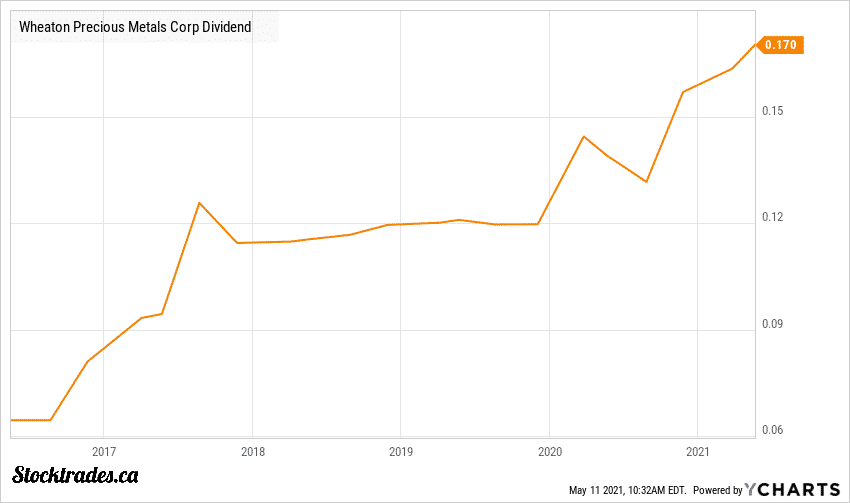

Unlike the majority of dividend growth stocks, Wheaton does not have a set quarterly dividend. It is why when you look at the company’s historical dividend chart it looks a little choppy.

Instead of declaring the same dividend quarter over quarter and subsequently raising it annually, Wheaton’s dividend policy is tied to cash flows. Specifically, the company aims to distribute 30% of the average of the previous four quarters’ operating cash flows.

In 2021, that will lead to a floor of $0.13 per share, which is a 30% increase relative to 2020.

The company’s dividend policy is one of the most sustainable in the industry and means the dividend will be paid so long as Wheaton generates positive operational cash flows.

Overall, Wheaton’s business model is attractive for those looking to capitalize on higher precious metal prices

The company’s low cost model leads to reliable cash flows, and if commodity prices reverse lower, Wheaton is likely to hold up better than most.

While the dividend yield may not attract income investors at the outset, it has plenty of room to grow in a rising price environment. Furthermore, investors will always know the status of the dividend since it is tied directly to OCF.

A clear and succinct dividend policy is welcomed in an industry prone to big dividend cuts in a bearish environment.