Lightspeed Stock: A Risky Bet for Tech Investors

Lightspeed has faced its share of challenges in recent years. The stock price has taken an absolute beating since pandemic highs in 2021, and many investors are wondering what is going to happen to the popular payment processor moving forward.

And, one of the main reasons I’m writing this article is they now know exactly what’s next: the company is looking to sell the business.

Lightspeed is now exploring a potential sale, which could shake things up for shareholders. This news has sparked renewed interest in the company.

Let’s dig into the details and see if Lightspeed stock might be worth a second look, especially on this news.

Key Takeaways

- Lightspeed’s stock price has fallen sharply from pandemic highs, despite strong performance

- The company is exploring a potential sale, which could benefit shareholders

- Current valuation looks cheap, but risks remain for this tech stock with heavy SMB exposure

Q1 2025 Earnings – The company is performing, but to no avail price wise

Lightspeed kicked off Fiscal 2025 on a high note. The company’s performance is impressive, with total revenue growing 27% year-over-year to $266.1 million.

Lightspeed also raised its Adjusted EBITDA outlook for fiscal 2025. This is a clear sign that they’re moving closer to profitability, which has been the main priority for the company after spending recklessly during the pandemic.

Despite this positive news, the stock price isn’t budging. It’s frustrating to see a company making strides yet not getting the recognition it deserves. As always, the markets can stay irrational longer than you can stay solvent.

The market’s hesitation might be due to Lightspeed’s focus on small and medium-sized businesses (SMBs). While this sector can be dynamic and growth-oriented, it’s also more vulnerable to economic downturns.

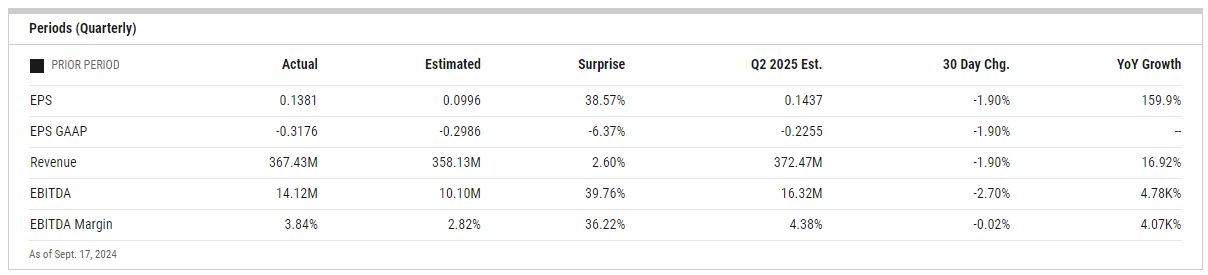

Here’s a quick breakdown of Lightspeed’s Q1 2025 highlights:

- Revenue: $266.1 million (27% YoY)

- Net loss: $35.0 million (much improved)

- Adjusted EBITDA: $10.2 million (exceeded $7 million outlook)

In my view, Lightspeed is doing all the right things. They’re growing, improving their financial position, and even raising guidance. Yet, the market seems to be turning a blind eye.

Valuation – The company is cheap, there is no doubt

I believe Lightspeed’s current valuation is pretty attractive. The company’s stock is trading at rock-bottom prices, which doesn’t make sense given its growth potential.

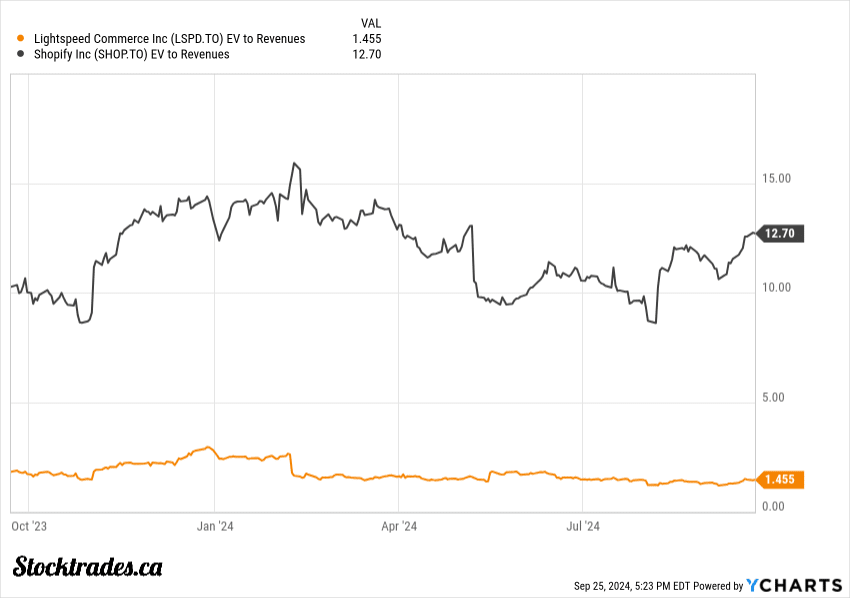

The company’s EV/Sales ratio comes in at 1.4X. This is incredibly low for a tech company with Lightspeed’s prospects. I’ve attached an image above that looks at Shopify’s ratio, which is nearly 10x this.

To put this in perspective, Nuvei, another payment processor, was recently taken private at 4.5x EV/Sales. That’s more than three times Lightspeed’s current valuation.

Lightspeed’s focus on becoming profitable should warrant a higher multiple. As they inch closer to breaking even, I expect investors to take notice and drive the stock price up. If it doesn’t get bought up, that is.

All this has led to Lightspeed seeking a sale

Lightspeed’s recent troubles, along with Nuvei’s lofty price tag, have pushed them to explore new options. The company is now working with a financial adviser to look at potential paths forward, including a sale.

This move doesn’t surprise me. With a market value of C$2.8 billion, Lightspeed’s still a big player in the payments software game. But I think they’re feeling the heat from competitors and from a lack of growth in small and medium sized businesses because of the economic downturn.

Here’s what I believe has led to this decision:

• Tough market conditions

• Increased competition

• Pressure to boost shareholder value

Lightspeed’s management likely sees a sale as a way to maximize value for investors. It’s a bold move, but one that could pay off if they find the right buyer.

The news has certainly caught investors’ attention. Lightspeed’s stock jumped 13% when word got out about the potential sale.

Potential short squeeze in the works?

I’m starting to wonder if we might see a bit of a short squeeze. About 3.5% of the company’s shares are currently sold short, which isn’t massive but still noteworthy.

The recent news about Lightspeed exploring a potential sale has me thinking:

If a deal goes through, those short sellers could be in for a nasty surprise. They’ve no idea how high the premium might be, and that uncertainty could spark some panic in terms of closing out short positions.

Now, I don’t want to get too excited. With only 3.5% of shares sold short, we’re not likely to see a massive squeeze. But even a small one could give the stock a nice little boost.

Would I be a buyer on this news?

Lightspeed stock looks like a good buy right now. The company seems undervalued at these levels. If a sale happens, we’d likely see a higher price than today’s.

Even if a sale doesn’t happen, I believe Lightspeed is an attractive add at current valuations. The company is trading at a steep discount to the industry on practically every single front.

Of course, there’s always risk involved. As I mentioned numerous times before, the company has a lot of exposure to small and medium sized businesses. During economic downturns, these businesses are the most susceptible to earnings fluctuations and thus churning in regards to their Lightspeed products.

In addition to this, the stock’s recent spike might not hold if a sale falls through. But I think the upside outweighs the downside here.

In my view, Lightspeed’s current price offers a good entry point for investors. Whether through a sale or continued growth, I see potential for outsized returns.