Are There Too Many Headwinds for Magna International Stock?

Magna International, Canada’s largest auto parts maker, has faced its share of ups and downs in a post-pandemic environment.

The auto industry is changing rapidly, and Magna must adapt to stay competitive. Electric vehicles, autonomous driving, and shifting consumer preferences are reshaping the market. It’s been a difficult few years for Magna investors and I’m interested to see how the company positions itself for the future.

Is Magna stock a buy today? Let’s take a deeper look to find out.

Key takeaways

- Magna faces headwinds from industry shifts and recent controversies

- The company’s global presence and diverse product lineup offer potential upside

- Investors should watch Magna’s Q3 earnings report for signs of improvement, as cyclical stocks tend to change quickly

Magna International’s quarterly earnings certainly left something to be desired

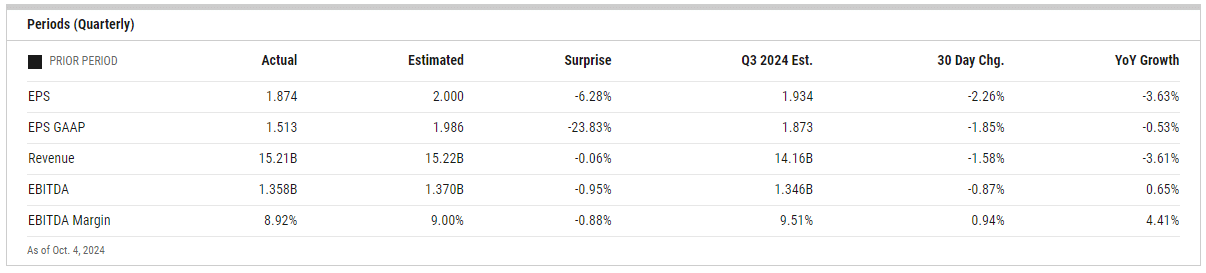

I’m concerned about the latest quarterly results from Magna. The company’s revenue decline and margin pressures are worrying signs. As you can tell below, the company missed earnings projections by a significant margin.

The automotive sector slowdown has hit Magna hard. Lower demand for key vehicle programs in North America has led to weaker-than-expected volumes. This is putting a squeeze on the company’s bottom line.

Supply chain challenges continue to plague the industry. While Magna is working to mitigate these issues, they’re still impacting production and costs.

I see a pattern emerging:

- Revenue growth is stagnating (Flat YoY)

- Profit margins are shrinking

- Free cash flow is under pressure

Magna International’s Q2 2024 results fell short of analyst expectations. The company reported adjusted EPS of $1.35, missing by $0.11 and revenue of $10.96 billion came in slightly below the $11.01 billion expected.

I’m a little worried about the company’s exposure to the electric vehicle market. The tempered outlook for EV penetration rates, especially in North America, could hurt Magna’s growth prospects. This is likely due to rising rates putting some pressure on people buying expensive EVs.

While management is taking steps to address these challenges, I’m not convinced they’ll be enough. The combination of industry headwinds and company-specific issues makes me a bit hesitant in terms of Magna’s outlook.

In my view, these weaknesses aren’t just short-term blips. They point to deeper structural challenges facing Magna and the broader industry.

Sexual assault allegations against the company’s founder don’t help its struggles

If you’re an investor, you should be concerned about the recent sexual assault allegations against Frank Stronach, Magna International’s founder. These charges could shake investor confidence, the company’s reputation, and impact the company’s stock.

Magna has launched a targeted review of its records in response to the allegations. This move shows they’re taking the situation seriously, but it might not be enough to calm investors’ nerves.

The company’s corporate governance practices will likely face intense scrutiny. Investors may question whether there were lapses in oversight or if the company culture enabled such behavior. Either situation can get ugly from a PR standpoint for Magna.

Legal implications could be significant as well. While Stronach is no longer actively involved in Magna’s operations, the company might face lawsuits or regulatory investigations.

These could result in financial penalties or reputational damage. Crisis management will be crucial. How Magna handles this situation could greatly affect its stock price in the short term. Transparent communication and decisive action are key.

I believe this scandal poses a risk to Magna’s reputation. Even if the allegations are unproven, the mere association could deter potential partners or customers.

In my opinion, potential investors may want to approach Magna stock with caution until more information comes to light about the investigation’s findings and the company’s response.

Why Magna stock looks cheap right now

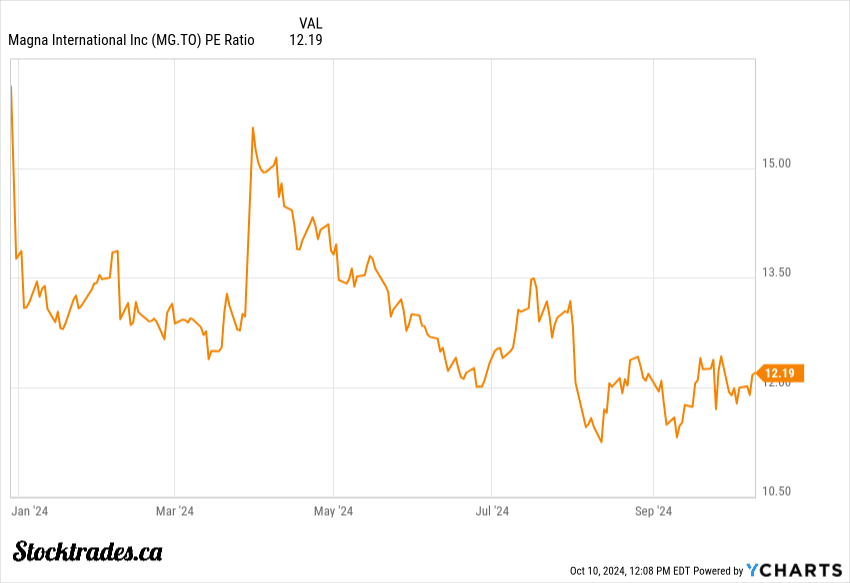

With a trailing P/E ratio of 11.99 and a forward P/E of just 6.47, Magna appears undervalued compared to many automotive industry peers. Its EV/EBITDA ratio of 5.74 also suggests the stock may be trading at a discount.

The company’s dividend yield of 4.61% is significantly higher than historical averages as well. The payout looks sustainable, with the dividend making up around 50% of earnings.

The company’s balance sheet appears to be in decent shape. A current ratio of 1.12 indicates Magna can meet its short-term obligations. While total debt stands at $7.46 billion, the debt-to-equity ratio of 0.62 shows that Magna has, at least historically, been able to grow its business not solely reliant on debt.

Operating cash flow of $3.37 billion over the past year is relatively weak, but we do have to understand this is a cyclical stock. Last quarter, operational cash flow jumped to $736 million, up from $189 million last year, suggesting the environment could be improving a bit.

Despite recent challenges, including supply chain issues and restructuring costs, the market may be overly pessimistic. Magna’s long-term growth potential could drive future value creation if the auto industry can finally get past its post-pandemic lull.

Key metrics to watch ahead of its next earnings report

As we approach Magna’s Q3 earnings report, I’m keeping a close eye on several key metrics.

Revenue projections for Q3 are hovering around $10.44 billion. This represents a slight dip from last year’s figures, which I believe reflects ongoing industry challenges.

Earnings per share estimates sit at $1.43, down from $1.46 in the same quarter last year. Since we are talking about declines year over year in these two key headline numbers, any surprise to the upside would be a positive sign, and its stock price would likely rise.

Margin trends will be crucial to watch. With ongoing cost pressures, watch for signs of how well Magna is managing its expenses.

Supply chain issues have been a thorn in the side of many automotive companies and ongoing theme, and labour costs are another area of concern.

Guidance for the full year will be telling. The current estimate for 2024 earnings is $5.43 per share. Any adjustment to this outlook could significantly impact investor sentiment.

I believe the macroeconomic headwinds facing Magna are substantial. However, the company’s ability to navigate these challenges will be a key indicator of whether or not its worthy of a long-term hold.