Has Meta Stock Become Too Expensive After Its Huge Runup?

Meta has come a long way since its early days as Facebook. It has faced its share of hurdles, from privacy concerns to regulatory scrutiny. Yet, it’s not only managed to stay alive, it’s thriving.

The firm’s massive user base across Facebook, Instagram, and WhatsApp remains its biggest strength. Meta’s ability to monetize this huge audience has kept it profitable even in tough times, and the user base gives the company a considerable edge moving forward.

But the tech landscape is constantly changing. Younger users are flocking to new platforms, which could threaten Meta’s dominance.

Let’s take a deeper look at the company.

Key takeaways

- Meta’s huge user base across its platforms remains a strength

- The company faces challenges with younger users and new competitors

- Meta’s future is closely tied to its ability to innovate and adapt outside of its traditional Facebook platform

Meta keeps crushing it in terms of earnings

Meta has been on a roll lately, consistently beating analyst expectations.

Here’s a quick breakdown of some key metrics:

- Revenue: $39.07 billion (22% increase)

- Net income: $13.47 billion (73% increase)

- Earnings per share: $5.16 (73% increase)

- Operating margin: 38% (up from 29%)

Meta’s advertising business continues to be the main driver of these strong results. Ad impressions were up 10%, and the average price per ad also increased by 10%. So, Meta’s ad platform is alive and well and still being utilized by marketers worldwide.

Costs and expenses only increased by 7%. We have to accept the Reality Labs division, which focuses on AR and VR tech, as a bit of a money pit for now. However, Meta is making significant investments to bolster its position in AR and VR, alongside the AI sector as well.

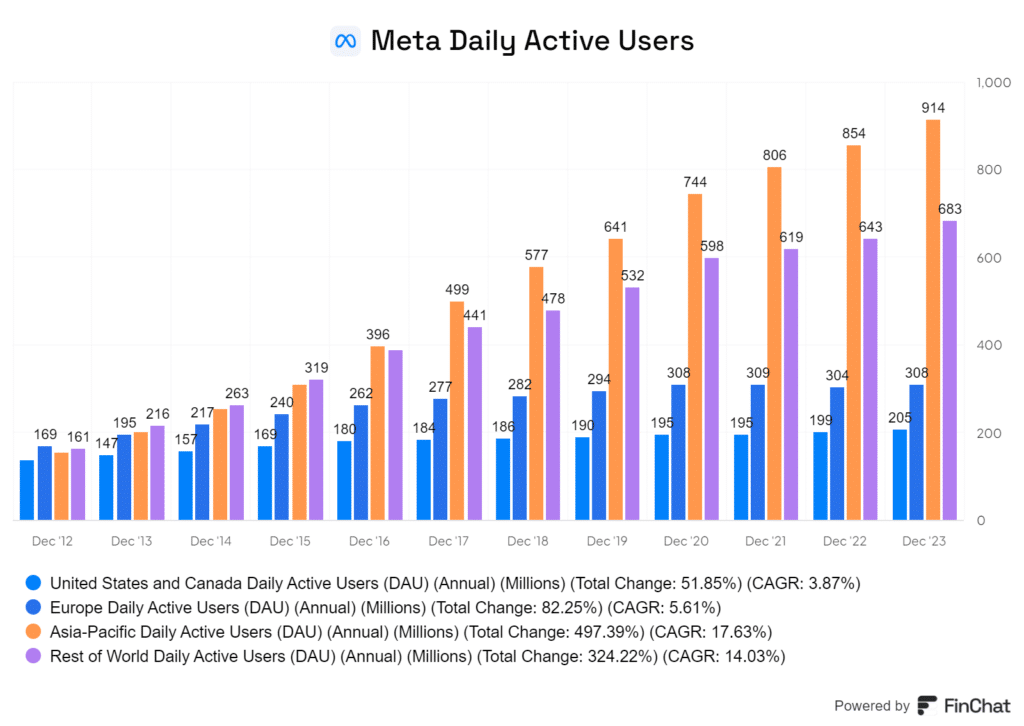

Daily active users across Meta’s family of apps reached 3.27 billion, a 7% year-over-year increase. Considering the population of the entire planet sits at around 8B, these numbers are shocking.

Lucrative mega user base

With 2.11 billion daily active users on Facebook alone, the platform’s reach is staggering. This scale is the backbone of Meta’s business and its ability to survive.

In addition to this, its Facebook platform arguably collects some of the most data out of any platform. This allows marketers to be able to laser target their audiences, reducing the cost of ads, and creating more advertising revenue due to return users.

The company’s family of apps – Facebook, Instagram, and WhatsApp – creates a powerful ecosystem. Users often hop between these platforms, increasing engagement and time spent. An audience of this magnitude is gold for advertisers.

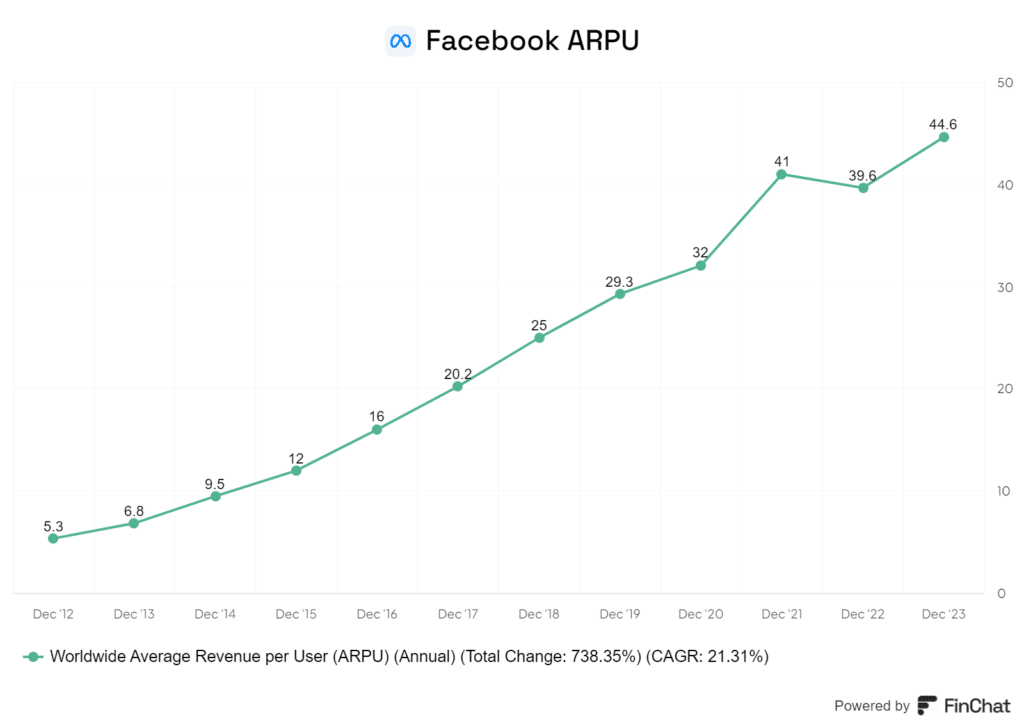

The company’s average revenue per user (ARPU) continues to grow, especially in North America and Europe. I believe this trend will likely continue as Meta refines its ad targeting capabilities with their utilization of AI.

The sheer size of Meta’s user base creates a strong competitive moat. It’s challenging for new social media platforms to break into the market, giving Meta a significant advantage.

Meta’s focus on AI and machine learning could lead to even better monetization of its user base in the future.

New generations using non-Meta apps is a significant headwind

Meta faces a tricky situation with younger users. While Facebook remains popular with older generations, it’s losing its edge with teens and young adults.

Many Gen Z people might view Facebook as a place for their parents and grandparents. They’re not interested in sharing their lives there. Instead, they’re flocking to TikTok and Snapchat as their social media staples.

Instagram and Facebook, at times, feel cluttered with ads, which can turn users away if the ads are too frequent or poorly targeted.

This shift in user behaviour is concerning for Meta’s long-term growth. Users from new generations are the future; without them, the platforms risk stagnation.

Here’s a quick look at where different age groups are spending their time:

| Age Group | Preferred Platforms |

|---|---|

| Teens | TikTok, Snapchat |

| 20-24 | Instagram, TikTok |

| 25-34 | |

| 35+ |

Meta will need to innovate to capture young users’ attention.

The company should focus on creating unique experiences that set its platforms apart. This might mean rethinking how social media works entirely rather than just tweaking existing formulas.

Meta’s challenge isn’t just about features, though. It’s about culture and perception. Changing how young people view its platforms will be a tough battle.

Is Meta expensive right now?

Meta’s price-to-earnings ratio of 30.32 seems steep at first glance, but compared to other FAANG stocks, Meta’s P/E isn’t outrageous.

Apple and Google have similar ratios, while Amazon’s is much higher. So, within that peer group, Meta isn’t necessarily overpriced.

Meta’s revenue growth of 22.10% year-over-year is impressive. It’s rare to see such strong growth in a company this size.

The company’s balance sheet is solid. With $58.08 billion in cash and short term investments, along with modest debt, Meta has ample financial flexibility.

Free cash flow is another bright spot. At $32.01 billion, Meta generates plenty of cash to fund growth initiatives and potentially return value to shareholders.

While Meta isn’t cheap, I believe its growth and strong moat justify the high multiple. For long-term investors, there may even be value here despite the recent stock price surge.

Would I buy Meta today?

I can imagine a scenario where someone that is interested in a VR or AI play long term might be interested in Meta as an addition to their portfolios.

I think Meta is putting up some strong numbers at the moment that could easily justify the premium it trades at, especially if it is able to continue to adapt its advertising algorithm moving forward.

However, there are risks to consider:

- Intense competition from other social platforms and innovators in VR and AI

- Potential regulatory challenges

- Shifting user preferences

Despite these concerns, I believe Meta’s strengths outweigh its risks. The company’s dominant position in the social media landscape makes it an attractive option.

When compared to other FAANG stocks, Meta’s valuation seems reasonable. Its price-to-earnings ratio is not as stretched as some of its tech peers.