Moomoo Canada Review – How Does This Canadian Brokerage Compare?

Moomoo just landed in Canada, and loads of folks are excited to find out what this platform brings to the table.

Known for its advanced trading tools and access to global markets, moomoo caters to active traders looking for a comprehensive trading experience. With a slick mobile app and desktop interface, the platform brings to Canadians a level of functionality often reserved for professional trading desks.

Moomoo is also aiming to become the first choice of your self-directed RRSP/TFSA platform as they gear up to launch RRSP and TFSA in January 2024.

The buzz around moomoo’s offerings in Canada is grounded in the platform’s commitment to providing a one-stop trading solution.

Its entrance into the Canadian space indicates a promising development for those particularly interested in US stocks, with features tailored to enhance trading efficiency.

The anticipation has been building since the app became available for download, and I’m excited to get to review the platform for you today.

Moomoo’s current bonuses:

Register and deposit any amount to receive your 6% idle cash booster and a $2000 commission rebate card. If you deposit more than $2000, you could get $200 cash rewards. Additionally, if you transfer your portfolio to moomoo, you could receive up to $2300 in cash rewards or an Apple gift card. Cash rewards are issued after maintaining assets for just 90 days, which is lower than most other institutions.

What is Moomoo?

Moomoo was originally founded in Palo Alto (Silicon Valley), California, in 2018. Over the course of five years, moomoo gradually entered markets in Singapore, Australia, Japan, and Malaysia.

In 2023, moomoo finally launched in the Canadian market (currently available to residents of Ontario, British Columbia, Quebec & Alberta, with more regions to follow).

As of now, moomoo has amassed over 21 million users worldwide, securing its position as one of the top financial apps in the global market.

Presently, one in every four Singaporeans chooses moomoo as their investment platform. Moreover, moomoo is Australia’s first technology broker to employ intelligent-assisted technology for investment analysis.

Since its establishment, moomoo has partnered with leading financial markets and garnered numerous global industry awards.

Exploring Moomoo’s platform trading tools and research

Moomoo’s platform is a treasure trove for traders who demand cutting-edge charting and comprehensive market insights.

The one thing I’ve noticed with a lot of platforms these days is their mobile app is lacking when it comes to charting and technical tools. Otherwise, you have to pay for those functions on third-party platforms. You won’t find this issue with moomoo.

Advanced charting and analysis

Moomoo equips traders with advanced charting tools to help them time the best entry and exit points.

Users can leverage a plethora of technical indicators and custom charts to enhance their trading strategies.

The platform’s charting functionalities allow for a granular examination of stock performance, deploying a variety of time frames and analytical overlays to identify and take advantage of movements in stock prices.

Market data insights

With moomoo, traders get more than just surface-level price information; they can access real-time Level 2 market data, providing a professional level look into market volumes.

When I was with Questrade, they wanted $70 a month to access this level 2 functionality. With moomoo, you get it for free.

As an active trader, level 2 data can be instrumental in timing proper entry and exit points. What was once reserved for professionals is now available to most all retail traders thanks to moomoo.

Education and Tutorials

Education is a cornerstone of the moomoo ecosystem, with a rich library of tutorials and resources.

They understand that helping their clients through solid education is just as important as providing sophisticated trading platforms. Moomoo’s educational content ranges from beginner to advanced topics, featuring in-depth yet comprehensible materials on market strategies, analysis, and more.

These resources are designed to be interactive and engaging, meant to bolster the confidence of every trader on their platform. Whether one seeks to understand the basics of trading or delve into complex chart analysis, moomoo’s education section is an invaluable asset.

User-friendly interface

Moomoo’s platform boasts a user-friendly interface, making navigation and trading straightforward. Their software integrates charting tools within a sleek design that emphasizes a clutter-free environment.

I’ve used plenty of mobile applications for trading, including Questrade, Qtrade, and Wealthsimple Trade. This is the best I’ve come across yet, zero question.

You won’t have any problem identifying necessary data and execute trades efficiently. The mobile app mirrors this accessibility. Moomoo understands that in this day and age, the vast majority of investors are doing so on the go instead of on a desktop platform. They prioritized their mobile application because of this and knocked it out of the park.

Fees and commissions

Commissions are the main focus for everyone who is looking to open up a brokerage account. No matter how much functionality a platform has, if you’re paying a fortune, your returns will struggle.

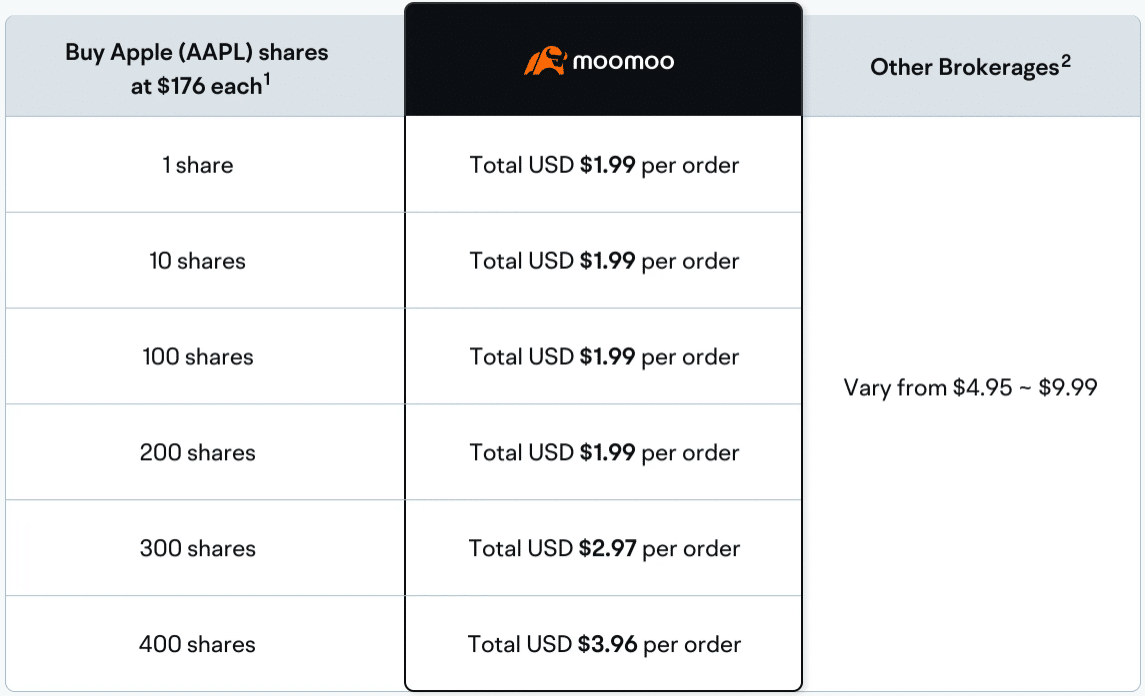

Commissions on stocks and ETFs

Moomoo stands out in the trading community for offering rock-bottom commissions for Canadians. You’ll pay only a cent per share, and considering the functionality the platform offers, the commissions are well worth it in my opinion.

For US stocks: You’ll pay $0.0099/share, with a minimum charge of $1.99 USD.

For Canadian stocks: You’ll pay $0.014/share, with a minimum charge of $1.49 CAD.

I’ve attached a chart below to show you how you’d have to be buying more than $35,000~ USD in Apple shares before you’d pay more than the minimum transaction per trade.

Commissions on options

Moomoo has an outstanding system set up for users to trade options as well. In fact, they’re cheaper than many of the major brokerages here.

- Transparent fee: $0.9/contract, min $1.5/order

- Real-time Option Chains: Get market quotes faster

- Real-time Option Calculator: Obtain theoretical option pricing for trading assistance

- Unusual Option Activity: Quickly monitor large market orders

- P/L Analysis & Implied Volatility Analysis: Get more advanced in-depth stock analysis

- Up to 8 Order Types:Manage your risk during volatile markets

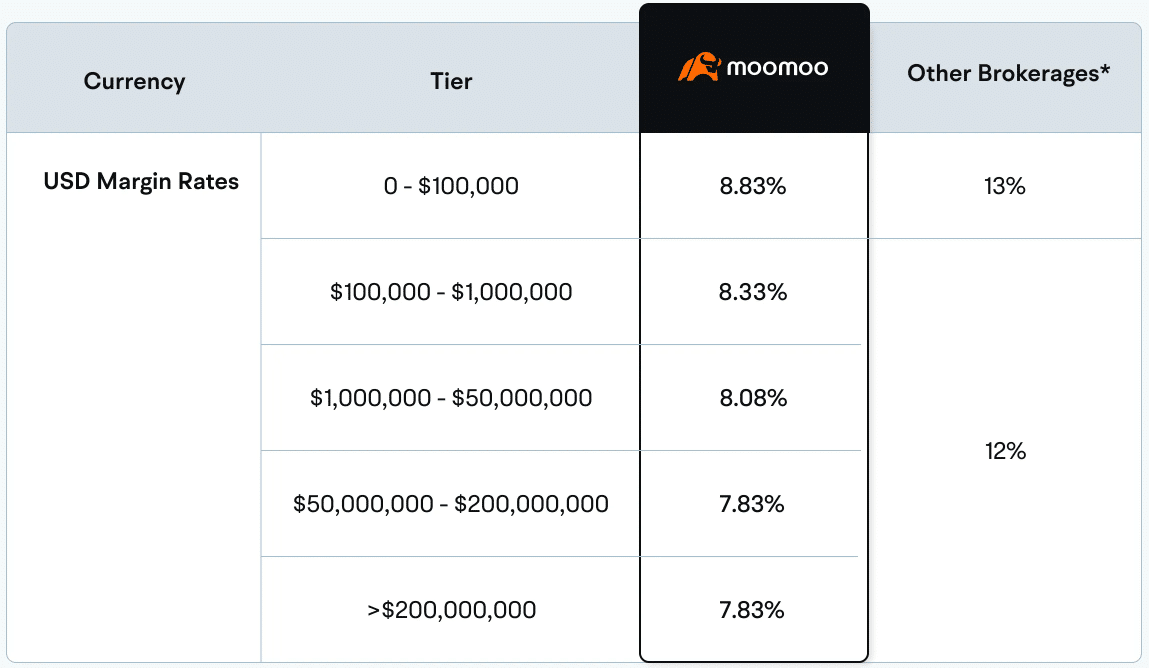

Margin rates and interest

For traders interested in trading with leverage, moomoo provides margin accounts. The margin rate, or the interest rate charged on the borrowed funds, is competitive, allowing traders to take advantage of margin at rates that are cheaper than most typical brokerages.

It is important for traders to fully understand how margin rates will affect their potential return on investments and consider these costs when planning their trading strategies. However, if you already understand this and are comfortable with the risks, then moomoo offers some of the best rates around.

Currency exchange

As Canadians, exchanging CAD to USD is always a constant pain. Moomoo certainly makes the process easy, and it does so with low fees.

You’ll see many brokerages offer conversion charges of 1% or more. For example, Wealthsimple Trade and Questrade charge 1.5%. This means to exchange $1000 CAD to USD, you’ll be charged $15, plus a likely spread on the currency exchange.

With moomoo, you’ll pay a flat 0.09% plus $2 USD.

This means to exchange $1000 CAD to USD, it will cost you just $2.90.

This instantly makes moomoo one of the best brokerages in Canada when it comes to buying US stocks.

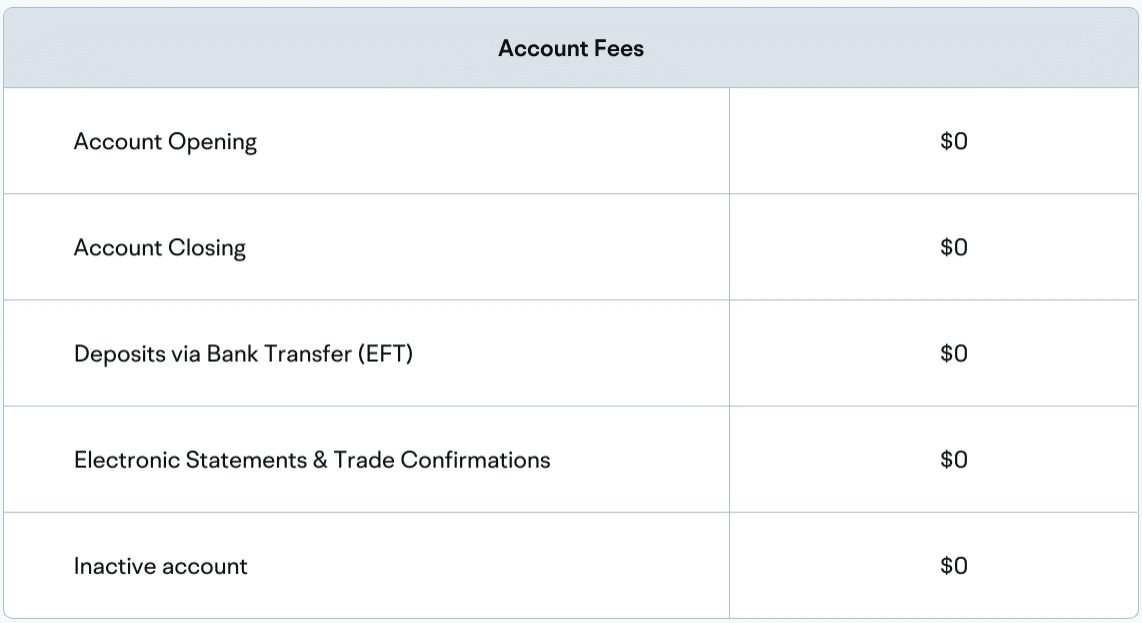

Other account fees

One of moomoo’s main objectives is to help people invest without barriers. For a long time, retail investors have been nickel and dimed by brokerages which ultimately eats into fees. Inactivity fees, USD account fees, high commissions, annual fees, account closing fees.

With moomoo, you won’t get any of this. As highlighted below, there is no gimmicky fees with moomoo.

Account options in Canada

When it comes to trading on the platform, Canadians have access to a variety of account options tailored to meet different investment needs, including US and even international stocks.

Types of accounts

Moomoo provides Canadians with the exciting opportunity to participate in global trading, particularly with US & CA stocks. The primary account offering for Canada is the personal non-registered margin account.

At present, individuals can also open a Tax-Free Savings Accounts (TFSA) or Registered Retirement Savings Plans (RRSP).

What can you trade on Moomoo?

Moomoo offers a broad range of investment products and markets, catering to active traders looking for a global trading platform.

Particularly notable is their access to diverse asset classes and a wide international market reach, including key financial markets in the US, Hong Kong, China, and more.

What investments can you buy?

Moomoo in Canada currently supports trading US stocks & ETFs and CA stocks & ETFS.

International reach

Moomoo’s platform excels in offering its users the ability to access multiple international markets.

Customers can generate market information not only from North American markets, such as the US and Canada, but also from key Asian markets, including Hong Kong, China, Singapore, Australia, and Malaysia.

This gives traders a valuable opportunity to tap into the growth potential of different economies and manage currency exposure with various currencies.

The platform’s expansive reach is particularly advantageous for those looking to invest in markets that are not as easily accessible on other trading platforms.

Safety and regulation

In the Canadian market, the app’s services are provided by Moomoo Financial Canada Inc.

Moomoo complies with the framework set forth by the Canadian Investment Regulatory Organization (CIRO). Additionally, as a demonstration of its commitment to investor protection, Moomoo Financial Canada Inc. is a proud member of the Canadian Investor Protection Fund (CIPF), which offers an extra layer of security to investors.

Outside of Canada, the company is regulated by many major security bodies, such as the U.S. Securities and Exchange Commission in the US.

Customer experience

I was pleasantly surprised at how well moomoo’s customer support system worked. Typically, brokerages can be a nuisance to deal with. I didn’t get that vibe at all from moomoo.

They offer a variety of contact methods, including email, phone support, and live chat, tailored to whatever contact method you prefer.

This is crucial for traders who might require immediate assistance with deposits, withdrawals, or wire transfers. The platform’s user interface is intuitively designed for ease of use, enhancing the overall usability and allowing traders to navigate the system effortlessly.

Ready to get started? Let’s open an account with moomoo

Opening an account with moomoo is simple. It was a four step process that had me in the app in just minutes.

Step 1

Head to Moomoo Canada and complete the registration form using your phone number or email address.

Step 2

You’ll need to compile some important information for this step, as moomoo needs it to complete your registration. Don’t worry, your information is secure.

Grab your residential address and social insurance number and enter it.

Step 3

Fill out the remaining personal information acquired and read the agreements and disclosures. After you’re happy with them, digitally sign the document and hit submit!

Step 4

You’ll now just need to wait for your account to be approved. This can be as fast as a single day, but there is a chance it can take up to three days.

Overall, moomoo is one of the best self-direct investing platforms in the country

If you’re looking to pay less to get more, moomoo is certainly worthy of your consideration. The only true knock I could find on the platform is the fact I cannot open up a registered account yet to take advantage of tax-sheltered savings. However, I have no doubt the company will start rolling those accounts out in the future, as they constantly seem to be innovating.

For now, Canadians can enjoy rock-bottom commissions for one of the most robust platforms in the country, along with exchange rates to start buying US stocks.