National Bank Direct Brokerage Review for March 2025

National Bank Direct Brokerage (NBDB) is one of the leading online brokerage platforms for us Canadians when looking to buy stocks.

The platform offers a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). With NBDB, you will find a user-friendly interface, free commissions (yep, that’s right), and extensive research tools. National Bank Direct Brokerage is a popular choice among investors looking to self-manage their investments.

Let’s take a deep dive and review as much of NBDB as possible, covering its features, pricing, pros, cons, and more. We will also compare it to other leading online brokerage platforms.

Whether you are a seasoned investor or just starting, this review will provide insights into National Bank Direct Brokerage. Hopefully, this summary can help you determine if it is the right platform for your investment needs.

Overview of National Bank Direct Brokerage

National Bank Direct Brokerage is an online discount brokerage service offered by National Bank of Canada. National Bank has been providing brokerage services for over 30 years. NBDB was launched in 2000 and has since become a popular choice for self-directed investors in Canada.

Although I don’t use it myself, I had the opportunity to take a trial run of the platform, and it’s one of the best out there for those who are looking for free commissions as well as in-depth tools.

As a discount broker, NBDB offers competitive pricing for trading stocks, bonds, options, and exchange-traded funds (ETFs). The platform also provides access to research tools, market data, and educational resources to help investors make informed decisions.

NBDB has a user-friendly online platform that is easy to navigate, making it an excellent option for both novice and experienced investors. With the bank being focused in Quebec, it also has a multitude of options in French.

Trading platform

National Bank Direct Brokerage offers a user-friendly online trading platform that allows investors to trade equities, options, ETFs, and mutual funds. The user-friendly interface provides various features and tools for trading and investing. I can access my account through a web browser or a mobile app.

Although their mobile app isn’t as in-depth as others, it is still very functional and I found I never really had difficulty navigating to what I needed.

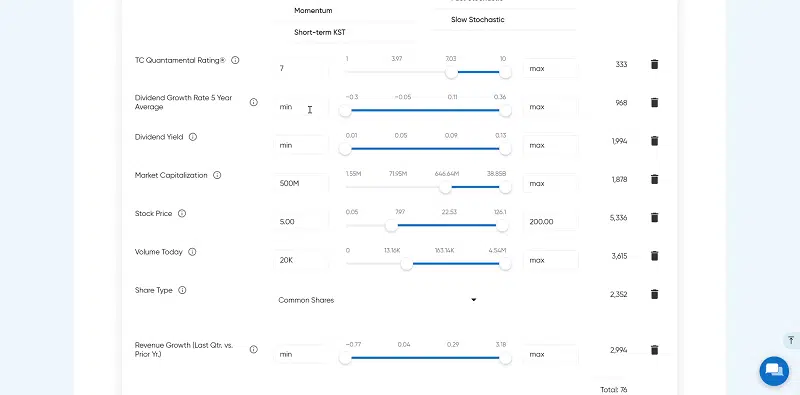

NBDB offered me access to a range of research and analysis tools. I can access real-time market data, financial news, stock screeners, and research reports. I have listed some of the features here below:

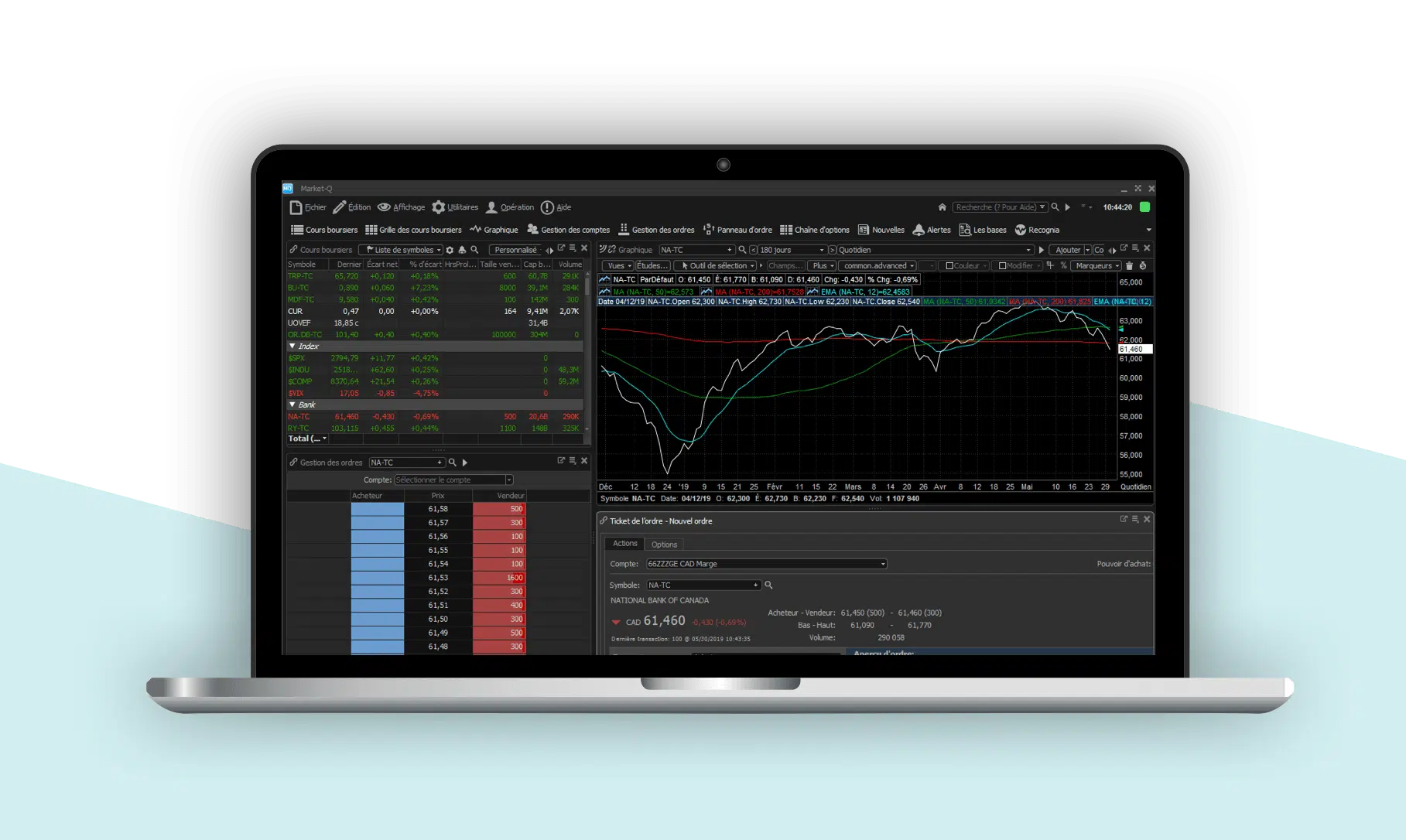

Market Q

The platform features Market-Q, a real-time market data tool that provides investors access to current market data and news. This tool enables investors to make informed decisions based on real-time market conditions.

Source: National Bank’s Website

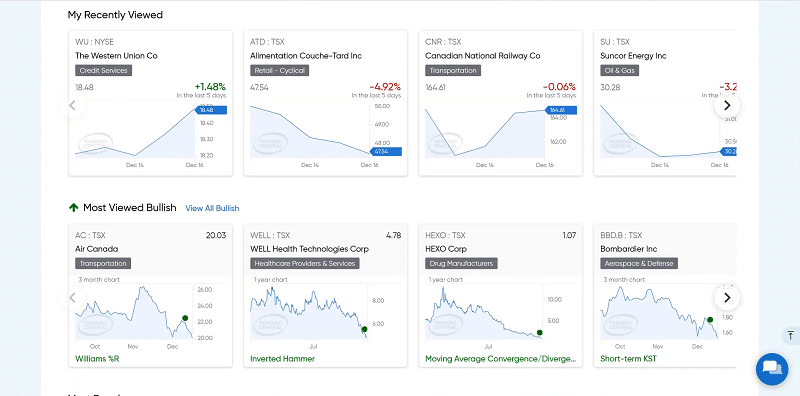

Technical Tools

National Bank Direct Brokerage’s trading platform also offers technical analysis tools to help investors identify trends and patterns in the market. The platform provides a range of charting options, including candlestick and line charts, as well as indicators such as moving averages and Bollinger Bands.

In addition to technical analysis, the platform also provides fundamental analysis tools. Investors can access company profiles, financial statements, and analyst ratings to help them make informed investment decisions.

The platform allows investors to create watchlists and alerts for specific stocks or ETFs. This feature lets investors stay on top of market changes and make timely investment decisions.

Overall, National Bank Direct Brokerage’s trading platform offers a range of tools and features. I can place various types of orders, including market, limit, and stop orders.

These orders allow me to specify the price I want to buy or sell a security. The platform is user-friendly and accessible. I would say it could be useful to both novice and experienced investors, which is something I wouldn’t really say about a platform like Interactive Brokers, for example.

Mobile app

National Bank Direct Brokerage offers a mobile app that allows me to manage my investments on the go. The app provides similar features and functionality as the web platform without being on the desktop.

The app is available for both iOS and Android devices and can be downloaded for free from the App Store or Google Play.

The mobile app provides clients access to account information, real-time quotes, and market news. Clients can also place trades, view their transaction history, and monitor their portfolio performance. The app offers a user-friendly interface that is easy to navigate. In fact, I’d say it’s arguable the best mobile app out of the Big 6 Bank brokerage platforms.

The mobile app includes the ability to set up alerts for price movements, news events, and other market events, ensuring people are always up-to-date with the latest market information. The app also offers a Watchlist feature, allowing clients to track their favourite stocks and monitor their performance.

The mobile app is secure, with clients required to log in using their National Bank Direct Brokerage username and password. The app also offers Touch ID and Face ID authentication for added security.

What you can buy with National Bank Direct Brokerage

National Bank Direct Brokerage offers a wide range of investment products that cater to the needs of different types of investors. This is going to be relatively universal across most brokerages, but I’ve felt the need to include it for those who may not really know.

I have access to a wide range of investment options on NBDB. I can trade stocks, bonds, options, ETFs, mutual funds, etc. I can build a diversified investment portfolio, which I believe is critical to investing.

Entire industries and whole markets can be affected quickly. I find being widely diversified across different industries and various markets around the globe provides greater peace of mind.

Stocks

National Bank Direct Brokerage provides access to Canadian, U.S., and international stocks.

Investors can trade stocks on major stock exchanges such as the TSX, NASDAQ, NYSE, and more.

The brokerage offers real-time quotes, market data, and research tools to help investors make informed decisions.

Options

National Bank Direct Brokerage allows investors to trade options on Canadian and U.S. stocks and indices.

The brokerage offers a range of option strategies, such as covered calls, cash secured puts, and more.

Investors can also access educational resources and tools to help them learn about options trading. I believe this is critical, as investors can get burnt trading options, especially if they don’t educate themselves first.

ETFs

National Bank Direct Brokerage offers a broad selection of ETFs from various providers, including iShares, Vanguard, and BMO.

Investors trading ETFs on major stock exchanges can benefit from low management fees and diversification.

Mutual Funds

National Bank Direct Brokerage offers access to mutual funds from various providers, including Fidelity, Mackenzie, and Franklin Templeton.

Investors can choose from different types of mutual funds, such as equity, fixed-income, and balanced funds.

Bonds

National Bank Direct Brokerage provides access to Canadian and U.S. bonds, including government bonds, corporate bonds, and more.

Investors can trade bonds on major bond markets and benefit from fixed income and diversification.

Cash

National Bank Direct Brokerage offers a cash account that allows investors to hold CAD and USD. Investors can use the cash account to settle trades, earn interest, and more.

Exchange-Traded Debentures

National Bank Direct Brokerage offers access to exchange-traded debentures. These are debt securities that trade on stock exchanges. Investors can benefit from fixed income and diversification.

Linked Notes

National Bank Direct Brokerage offers access to linked notes. These structured products combine a bond with an equity or other underlying asset. Investors can benefit from fixed income and the potential for capital appreciation.

Accounts and fees

National Bank Direct Brokerage offers a range of account types. Setting up my account with National Bank Direct Brokerage was pretty simple.

I could choose from different account types: individual, joint, registered retirement savings plan (RRSP), tax-free savings account (TFSA), and more.

The platform allows me to manage these investment accounts, track my portfolio, and view transaction history. I can also set up automatic contributions or withdrawals for the registered accounts, such as my RRSP and TFSA.

Here’s a breakdown of the account types and any associated fees:

Registered accounts

National Bank Direct Brokerage offers Registered Education Savings Plan (RESPs), Tax-Free Savings Accounts (TFSA), Retirement Income Fund (RRIF), Registered Retirement Savings Plans (RRSP), and Spousal RRSPs as well.

Non-Registered accounts

National Bank Direct Brokerage offers non-registered accounts, allowing investors to hold securities outside registered accounts.

Margin accounts

Margin accounts allow investors to borrow money to buy securities. National Bank Direct Brokerage charges an annual interest rate that can vary depending on your balance, what type of account, or whether the account is in USD or CAD. Check out their website for the complete list of margin account interest rates.

Other account types

National Bank Direct Brokerage also offers Locked-in Retirement Accounts (LIRA – Provincial), Locked-in Registered Retirement Savings Plans (LRSP – Federal), and Life Income Fund (LIF) as well.

Account fees

National Bank Direct Brokerage charges an annual administration fee of $100 for accounts with less than $20,000 in combined eligible assets.

You can get the $100 fee waived in certain cases, such as:

- You are a young investor aged 30 or under

- You participate in a financial program for engineers, teachers, business, or healthcare professionals

There are a couple of other ways to avoid paying the $100 annual fee for your brokerage account, check NBDB website to see what is most applicable at this time.

Trading and commission fees

Stocks and Exchange-Traded Funds (ETFs): $0 commission, no minimum required.

Options: $0 commission + $1.25 per contract (minimum fee of $6.25).

Options (Value less than $2,000): $0 commission + $1.25 per contract (maximum fee of $19.95).

Exchange-traded debentures: $0 commission.

Investment funds: $0 commission.

National Bank Direct Brokerage was one of the first major brokerages here in Canada to go commission free. When you buys stocks or ETFs with National, you’ll pay nothing.

In terms of options contracts, it offers investors competitive contract fees to go along with zero commission.

A NOTE: The fees above apply to ONLINE TRANSACTIONS ONLY!

If you usually place trades with an agent, fees are charged. So check out NBDB’s website and get the whole picture of the associated costs of the transaction fees. These banks like to charge people who utilize services that require them to have staff on hand.

Customer service and support

National Bank Direct Brokerage provides customer support through various phone, email, and online chat channels. During my test of the platform, I sometimes contacted their support team for account-related inquiries or technical issues. The experience and quick responses were exceptional.

Whether you need assistance with your account, have questions about trading, or require technical support, the National Bank Direct Brokerage team is available to help.

Customers can contact the National Bank Direct Brokerage customer service team via phone, email or through the online chat feature available on the website.

NBDB also offers a comprehensive online help center, which includes a range of resources to help customers manage their accounts. The help center consists of a knowledge base, frequently asked questions, and various educational resources, including webinars, videos, and articles.

Whether you are a seasoned trader or new to investing, their team of customer service representatives can help you navigate the platform and answer any questions.

Security and protection

Security is a paramount concern for me. After all, this is the money I’m saving up to retire.

NBDB takes measures to secure peoples personal and financial information, including encryption and authentication protocols.

- National Bank Direct Brokerage is a Canadian Investor Protection Fund (CIPF) member.

- National Bank Direct Brokerage is regulated by the Investment Industry Regulatory Organization of Canada (IIROC). This regulatory body oversees all investment dealers and trading activity in Canada to ensure they comply with industry standards and regulations.

- Deposit based investments are covered by the CDIC

National Bank Direct Brokerage also employs various security measures to protect clients’ personal and financial information, including

- Two-factor authentication

- Encrypted communications

- Unusual activity alerts

Comparison with other brokers

Questrade

Questrade is well-known among online brokers, and offers commission-free trades on ETFs and low (not free) commissions on things like stocks.

NBDB may offer a broader range of research tools and market data, which may benefit more experienced investors. Questrade is a discount brokerage, focusing on cheaper pricing over in-depth tools. However, National Bank combines both the commission free aspect and a comprehensive suite of tools.

You can read a full review of Questrade here.

Winner: NBDB

Wealthsimple Trade

Wealthsimple Trade is a newer player in the online brokerage space, and it is known for its user-friendly platform and commission-free trades on Canadian and U.S. stocks.

Wealthsimple Trade lacks some advanced research tools and market data NBDB provides. However, the ease of use of the platform, large deposit bonuses, and the ability to make lightning quick deposits actually makes me prefer this platform over NBDB.

We have a full review on Wealthsimple Trade here.

Winner:Wealthsimple Trade

Qtrade

Qtrade is a well-established online brokerage that offers a wide range of investment options, including mutual funds, GICs, and bonds.

Qtrade’s platform may not be as user-friendly as NBDB’s, which could be a consideration for beginners. However, it is more feature rich than NBDB and I also like the fact you can purchase fixed income securities like GICs in a single click of a button.

Despite the platform having commissions, I do view it as slightly more robust.

We reviewed Qtrade here if you’re interested.

Winner:Qtrade

My overall opinion on National Bank Direct Brokerage

National Bank Direct Brokerage (NBDB) emerges as a solid choice for Canadian investors seeking an online brokerage platform.

With a user-friendly interface, competitive pricing, and access to a diverse array of investment options, NBDB caters to both novice and experienced investors. The platform’s educational resources, research tools, and mobile app contribute to its appeal.

NBDB’s commission free trades automatically make it an attractive option, especially for active traders. Its comprehensive account types, including registered and non-registered accounts, offer flexibility to investors with varying financial goals.

However, it’s important to note that NBDB might not be the ideal choice for advanced traders seeking sophisticated trading tools.

Do I use National Bank Direct Brokerage? No. I use a combination of Wealthsimple Trade and Qtrade. However, I no doubt see the value the platform provides. It’s just not over and above anything I use right now.