Has National Bank’s Stock peaked, or is there more upside?

National Bank of Canada has been a standout performer in the Canadian banking sector for a long time now.

Its focus on Quebec and Ontario markets has helped it carve out a unique niche among the Big Six banks. Many have criticized it for having too much Canadian exposure. However, it has turned out to be a massive tailwind, while banks like Toronto Dominion and Bank of Montreal have struggled with US exposure.

The bank’s recent purchase of Canadian Western Bank is expected to boost its presence in Western Canada and diversify its geographic footprint. This move could open up new growth opportunities and help balance the bank’s heavy exposure to the Quebec market.

The current economic climate presents both challenges and opportunities for National Bank. With interest rates potentially falling, the bank’s mortgage and lending businesses could see increased activity.

At the same time, its wealth management and capital markets divisions are well-positioned to capitalize on market volatility and investor demand for financial advice.

Key Takeaways

- National Bank’s is one of the most efficient banks in the country

- The acquisition of Canadian Western Bank is set to expand National Bank’s reach across Canada

- Current economic conditions may benefit National Bank’s core business segments more than the other Big 6 due to Canadian exposure

National reported one of the better earnings reports out of all Big 6 banks

The bank’s net income jumped 24% to $1,033 million, outpacing its Big 6 peers.

Diluted earnings per share hit $2.89, up from $2.33 last year. This growth is remarkable considering how poor the Canadian economy was supposed to be.

What stands out to me is the bank’s diversified earnings mix:

- Personal and Commercial: 15% increase in net income

- Wealth Management: 19% rise in net income

- Financial Markets: 55% growth in net income

National Bank’s efficiency ratio improved across all segments. The overall ratio dropped to 51.3% from 53.8% last year, showing better cost management, and is one of the best ratios among the Big banks.

Loan growth was strong, with commercial lending up 14% year-over-year. Wealth management also increased revenue by 14%.

The Financial Markets segment’s 55% net income growth is outstanding. It reflects National Bank’s strength in capital markets and investment banking, and highlights the popularity of the equity markets at this point in time.

In my view, these results position National Bank as a top performer among Canadian banks. But that’s nothing new.

The company’s acquisition of Canadian Western Bank should fuel growth

I believe National Bank’s acquisition of Canadian Western Bank is a smart move that will drive significant growth. This deal opens up exciting new opportunities for expansion across Canada. Yes, I do believe it overpaid. However, sometimes you need to overpay for quality assets.

The merger creates a stronger competitor in the banking sector. It gives National Bank a much wider reach, especially in Western Canada where CWB has a strong presence.

I see major benefits in terms of diversification:

- Broader geographic footprint

- More diverse loan portfolio

- Expanded commercial banking services

- The ability to upsell current CWB clients on better product offerings

The combined entity will be able to offer customers a wider range of products and services nationwide. I think this will be especially valuable for small and medium businesses.

There are also likely to be cost synergies as the banks combine operations. However, National Bank plans to maintain CWB’s branch network and keep the headquarters in Edmonton.

I’m particularly optimistic about how this positions National Bank beyond Quebec. It transforms them into a truly national player with much stronger footing in Western Canada’s growing markets.

The company’s over-exposure to Canada is a tailwind because of falling rates

National Bank’s heavy focus on the Canadian market might seem risky to some, but I believe it’s actually a big plus right now. Why? Because interest rates in Canada are finally coming down, and faster than south of the border.

The Bank of Canada has cut rates three times in a row, bringing the key rate to 4.25%. This trend is great news for National Bank. As rates fall, more Canadians will likely borrow money for homes, cars, and businesses.

National Bank is perfectly placed to take advantage of this. They’ve got a strong presence in retail banking and mortgages in Canada. If the Bank of Canada outpaces the Federal Reserve in terms of cuts, National will continue to benefit.

But it’s not just about more loans. Lower rates also mean National Bank can earn better profits on the spread between what they pay depositors and what they charge borrowers. This could fatten their net interest margins nicely.

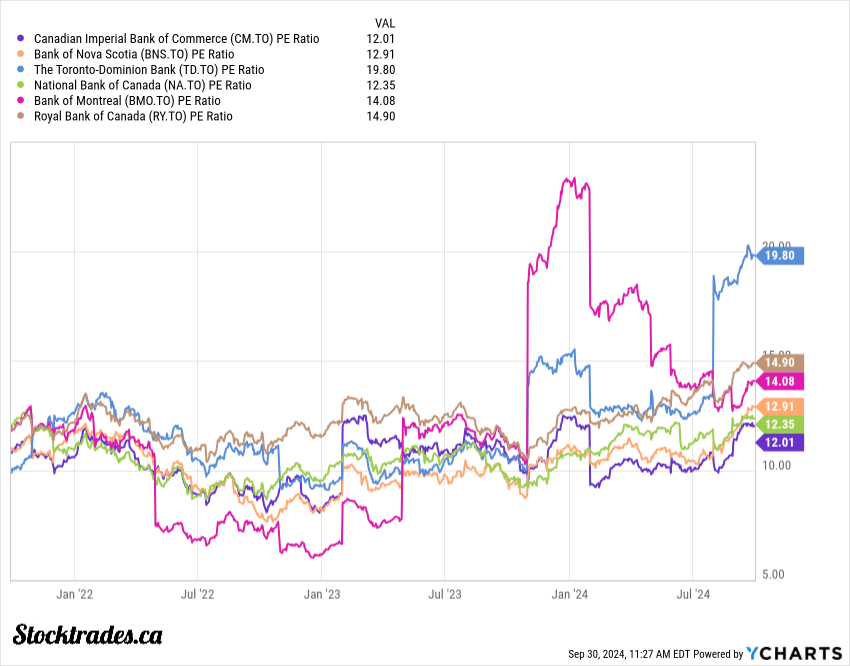

Valuations aren’t cheap, nor should they be for one of Canada’s best banks

National Bank’s stock is a bargain considering its performance.

Although its price to earnings is 12.35, one of the more attractive in the sector, investors have typically valued the bank at a discount to the other major institutions.

But I’d argue a premium is what the bank should trade at, not a discount.

National Bank’s return on equity sits at an impressive 15.18%, one of the best among major institutions.

Its quarterly revenue growth of 19.70% and earnings growth of 24.30% outpace many competitors. This operational advantage justifies a higher valuation.

While the bank’s price-to-book ratio of 1.84 might seem high, it is likely due to the fact the company has an exceptional loan portfolio.

Would I be buying National Bank today?

I believe National Bank stock presents a compelling investment opportunity right now.

The bank’s recent performance has been impressive. It has strong earnings growth and a solid position in the Canadian banking sector.

The company has made strategic moves, including potential acquisitions that could expand its market reach. I’m bullish on the CWB acquisition.

National Bank offers some attractive features:

• Safe dividend history

• Strong performance over the past decade

• Less exposure to mortgage renewals compared to peers

However, it’s crucial to acknowledge potential risks. The stock is trading near all-time highs, which raises questions about valuation risk.

Despite these concerns, I’m inclined to buy National Bank. The bank’s premium valuation seems warranted given its strong fundamentals and growth prospects.