Neo Financial Review – How Does This Digital Bank Compare in Canada in 2025?

Neo Financial’s cool, tech-savvy banking style fits perfectly for someone always on the go like me.

Their seamless online experience, from mobile banking to customer service, means that my financial life fits comfortably in my pocket, always just a few taps away. A nice mesh with the digital world makes banking less of a chore, easier to manage, and more effective in saving and investing money.

So here we are. I feel like I had to share this Neo Financial review and my overall experience with you. We love reviewing all these different personal finance companies.

That way, Canadians have, at minimum, ample choices concerning our finance tools. Neo has many products, for those who like to bundle services with one bank. Let’s get started right now.

What is Neo Financial

Neo Financial focuses on providing digital banking solutions, which include a range of services accessible primarily through their mobile app or website.

Founded by Andrew Chau with Jeff Adamson, and Kris Read, the company’s mission is to create innovative, seamless financial services for its clients. The team behind Neo Financial is equipped with the proper industry knowledge and expertise.

This is evident when I use the product, as it’s tailor-made for Canadians seeking easier banking solutions.

The company’s firm footing in the Canadian market is paving the way for further expansion and success as it shapes the future of financial services in Canada.

What products does Neo Financial have?

Neo Financial has a wide variety of products, and the company is continually expanding. Whether you’re looking for a high interest savings account, credit card, cash account, investment products, or even a mortgage, Neo has you covered.

Lets go over their suite of products.

Neo MasterCard

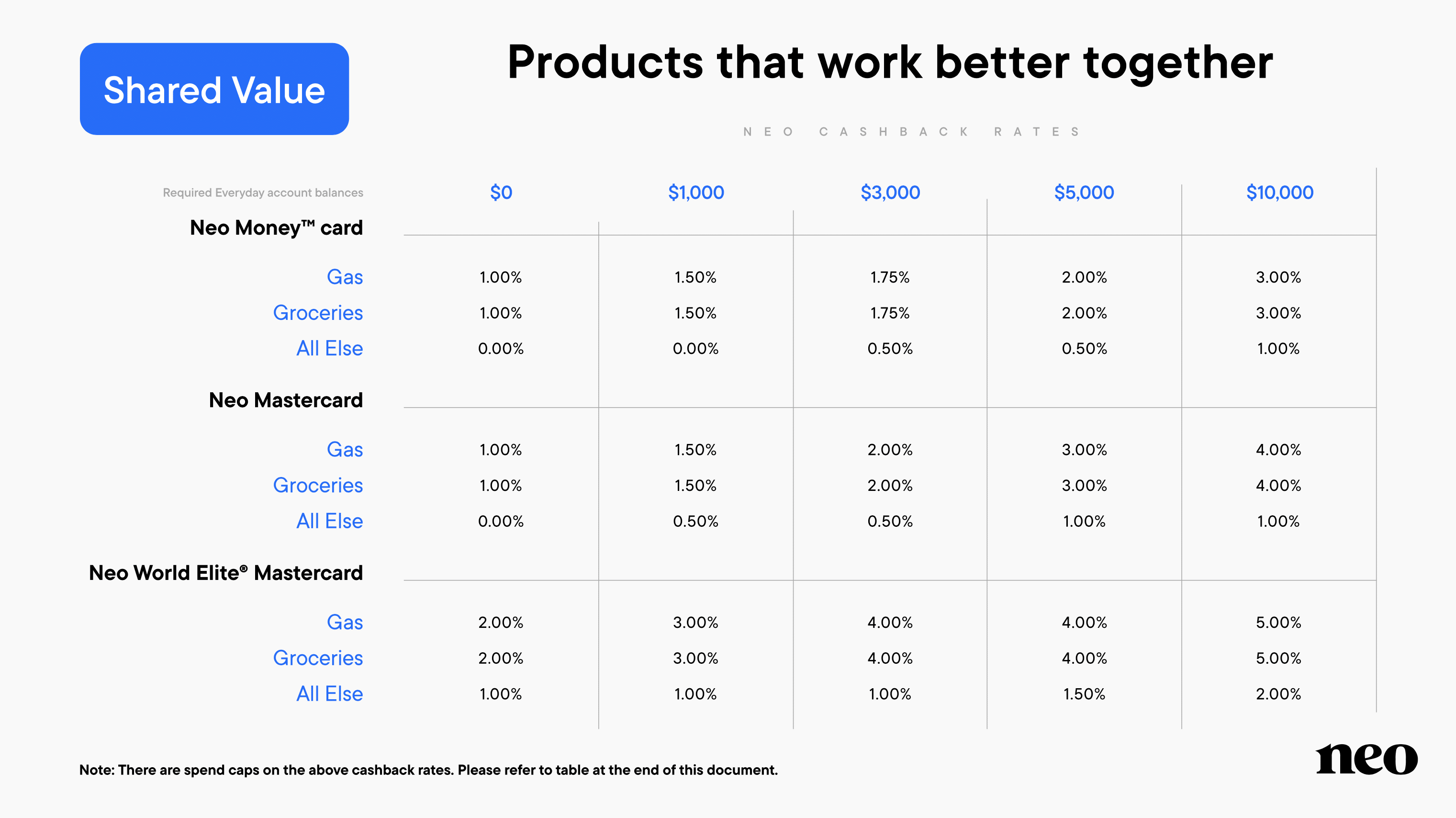

Neo Mastercard is best for our day-to-day spending. The application process is easy, the welcome offers are attractive, and the card has no annual fee, giving it a big advantage over some cash back cards offered by major institutions. It also offers some attractive incentives for everyday purchases, such as:

- Welcome bonuses of up to 15% cashback on first-time purchases at participating partners.

- Up to 4% off gas and groceries, and up to 1% off everything else.

- Average 5% cashback on food delivery, streaming and rideshare, restaurants, bars and cafes, and retail partners.

- No wait for a physical card to arrive. Add the virtual card to Apple Wallet or Google Pay, and start spending right after approval.

Secured NEO MASTERCARD

The Secured Neo Mastercard helps build a credit history and, in turn, a credit score. How does it do this? Well, it requires a deposit from the cardholder, typically up to the available credit limit. This deposit allows a person to get approved for a credit card, only spend what they have available, and build a solid credit score in the process.

Folks will find this card useful in ways like:

- Guaranteed approval.

- Start with as little as $50.

- Up to 4% off gas and groceries and up to 1% off everything else.

- Average 5% cashback on food delivery, streaming, rideshares, restaurants, bars and cafes, and retail partners.

- $5 monthly fee.

Hudson’s Bay Mastercard

The Hudson’s Bay Mastercard is a popular choice within the Neo credit portfolio. This unique card is a collaboration between Neo Financial and one of Canada’s favourite department stores, Hudson’s Bay.

Cardholders can enjoy exclusive benefits, such as earning reward points on purchases made at Hudson’s Bay and its affiliated stores.

Additionally, this Mastercard can be used anywhere Mastercard is accepted, allowing for more flexibility in spending and earning rewards.

There is no annual fee with the card, no inactivity fee, and on average you’re going to earn about 2% cash back at its partners.

Does Neo do a hard credit check for the Secured Credit Card?

If there is a hard credit check in the application, Neo will let you know beforehand. Applying for the Neo Secured Credit card won’t impact your credit score. There isn’t a credit check during that particular application, primarily because you are giving a deposit to get the card. You aren’t really borrowing anything on credit.

Overall, Neo Financial has a great offering of credit cards

Getting that average 5% back at a vast network of over 11,000 retail partners means that whether I’m buying groceries or treating myself to a new gadget, the shopping has become a treasure hunt where I’m almost always searching for the cashback rates that turn everyday purchases into a smart financial strategy.

Plus, the Premium plan subscriptions for the credit cards allow me to boost my cashback and unlock extra benefits included in the rewards program:

- Boosted cashback with an average of 6% cashback for dining and food delivery, 4% on streaming and rideshare services, and over 3% at retail partners (both online and in-store).

- Up to $240 per year per category with 3% cashback on everyday essentials such as gas and groceries, regardless of where you pay for them.

- Minimum total cashback each month of 0.5%.

- Enjoy enhanced purchase protection, extended warranty, and more.

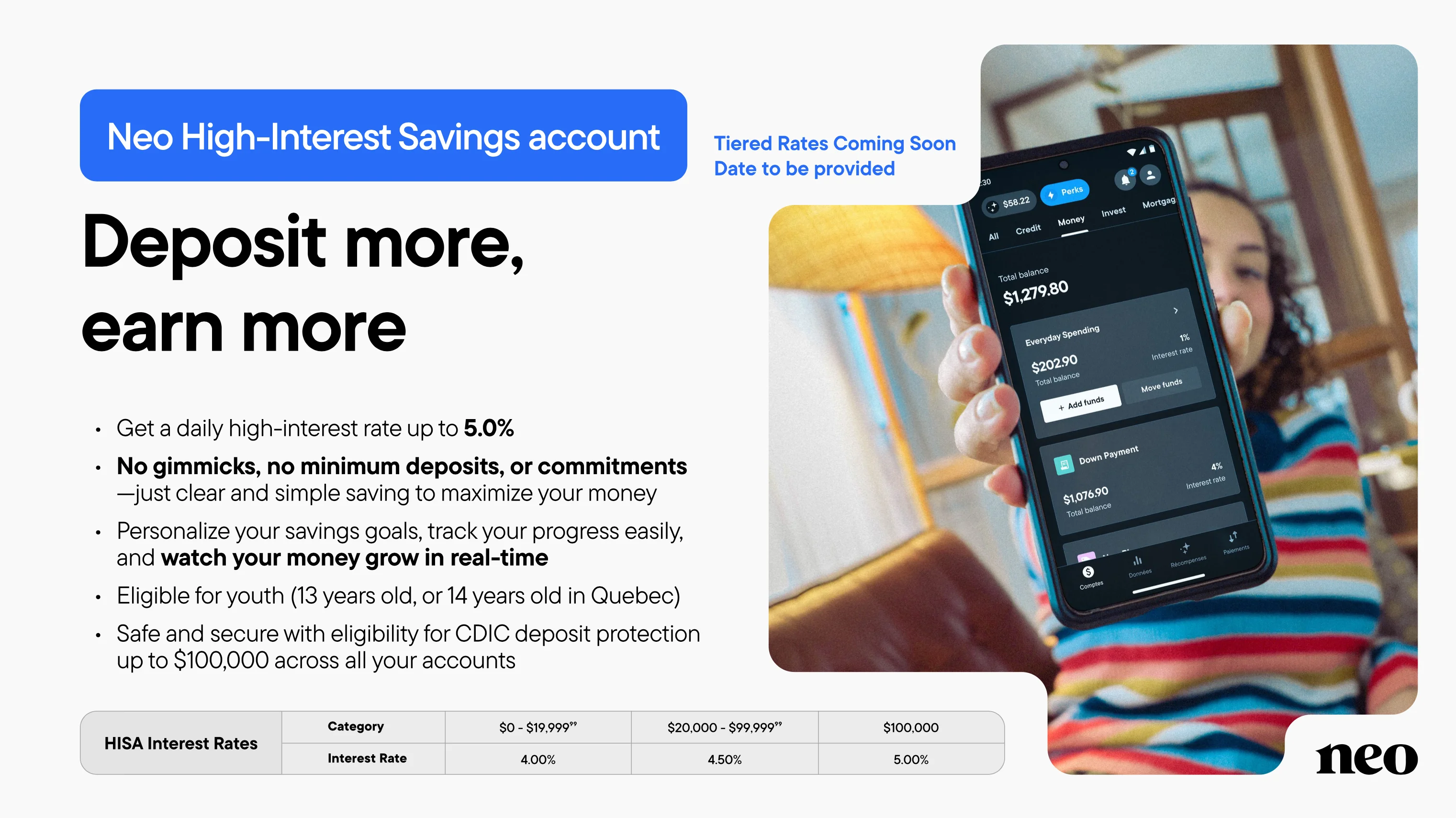

Neo High-Interest Savings Account

With Neo Financial, I’m enjoying savings growth via the high-interest rate, notably higher than what I’ve seen with traditional banks. This means my money isn’t just sitting idle; it’s working harder for me every day.

The high-interest savings account is a convenient and secure way to deposit and manage my funds. This account does not come with monthly fees or minimum deposit requirements and can be accessed through the Neo app.

I can easily access my funds when needed while the interest compounds and contributes significantly to my savings over time, helping to combat inflation.

For a very long time, we got next to nothing on our money in terms of savings. However, with interest rates the way they are today, we can’t ignore accounts like this.

The Neo HISA is very simple and offers the following:

- 3.75% interest (check the website for updated rates).

- No minimum deposit.

- Withdraw money any time.

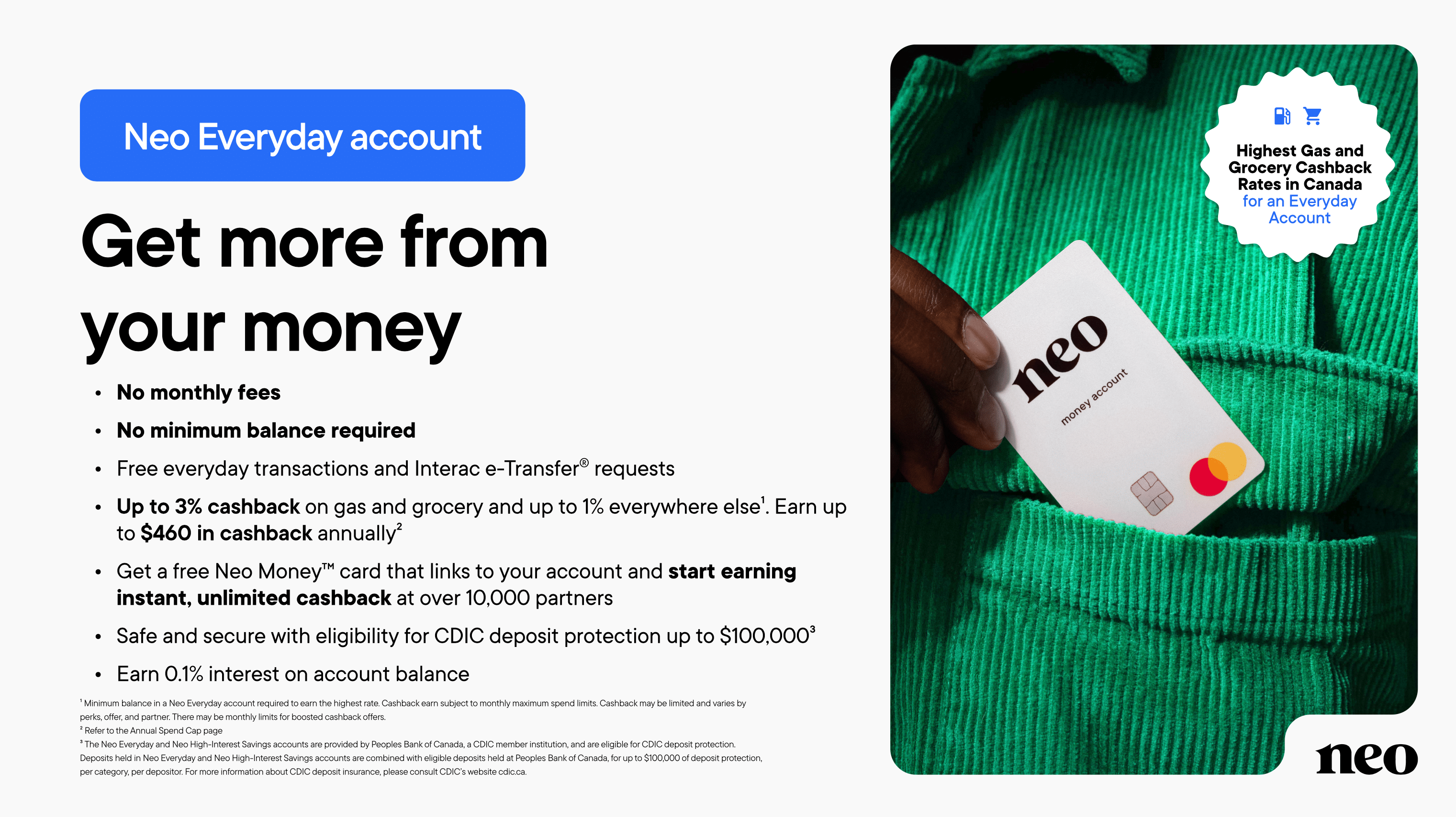

Neo EVERYDAY ACCOUNT

The Neo Money card is a prepaid Mastercard that pretty much acts like a debit card, with no preloading needed and no monthly fees. Because Neo is a digital only bank, this card can be handy for spending your cash at Neo. In addition, your deposits are covered by the CDIC, ensuring your money is safe.

Here are some perks to the Neo Money card:

- Up to 3% cashback on gas and grocery and up to 1% everywhere else.

- Earn up to $460 in cashback annually.

- Average 5% cashback for delivery, ride share, and streaming services at restaurants, bars, cafes, and retailers.

- Up to 15% cashback on first-time purchases at thousands of Neo partners.

- Deposits eligible for CDIC protection up to $100,000.

- Get notifications when money goes in and out of the account, and automate payments from your Neo Money account.

- Earn 0.1% interest on account balance.

Neo Mortgage

As a digital bank, Neo has the flexibility to offer better mortgage rates in most cases than traditional banks. In addition to this, its digital nature makes applying for a mortgage much easier than a traditional bank.

At the time of writing this, a 5 year closed mortgage at Neo Financial is 50 basis points lower than the average rate at a Big 5 Canadian bank. When we consider the average cost of a home here in Canada, this is hundreds of dollars saved every month, so it’s certainly worth considering.

You’ll likely have to have meetings with a mortgage advisor from Neo. However, they’ll either be through a video chat or through a phone call.

The savings in terms of lower rates and the ability to apply from a mortgage without having to even leave your home is definitely an added benefit.

Neo Invest

Neo Financial offers a wide variety of investment options to cater to the needs of Canadian investors with a digital investment platform that provides access to professionally managed investment portfolios. Of note, Onevest Management Inc. manages the portfolios.

Investors can choose from various investment options based on risk tolerance, financial goals, and investment horizons. Not all that surprising, the Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) are popular among the available account types.

Both investment vehicles have tax advantages and are designed to help Canadians save for retirement or other financial goals.

Neo Invest customizes the portfolio for each investor based on their unique requirements. This personalized approach makes investors feel confident that their investments are being actively managed by professionals who understand their needs.

Neo’s mobile app

The Neo app allows users to easily track their account balance, transactions, and accrued interest, putting them in control of their financial progress.

Available for both iOS and Android devices, the app enables customers to access their Neo account easily and securely.

You can add funds by:

- Transferring from another Neo account

- Link an external account

- Set up direct deposit

- Interac e-Transfer

Neo Financial app users can enjoy the convenience of both Apple Pay and Google Pay integration. This makes it effortless to manage spending, as transactions are seamlessly processed through the app without needing a physical card.

The app also provides valuable insights into customers’ spending habits, helping them keep track of their expenses and manage budgets effectively. Moreover, it enables users to monitor their credit scores, ensuring they stay updated on their financial health.

Neo Financial security, safety, and insurance

Neo Financial takes the safety and protection of its customers’ funds and information seriously. They have implemented various measures to ensure a high level of security for their accounts and transactions.

One of these measures is the insurance coverage provided by the Canada Deposit Insurance Corporation (CDIC). The CDIC protects deposits held in eligible Canadian banks and financial institutions. With this protection, customers of Neo Financial can rest assured that their deposits are safeguarded. You’ll be eligible for coverage up to $100,000 with the CDIC.

Another organization involved in regulating and protecting Neo Financial’s services is the Investment Industry Regulatory Organization of Canada (IIROC). IIROC oversees investment dealers and their trading activity, ensuring compliance with industry standards and maintaining investor confidence.

To further enhance the security of their platform, Neo Financial employs the following safety measures:

- State-of-the-art encryption technology to protect sensitive data during transmission and storage.

- Rigorous authentication processes to prevent unauthorized access to accounts.

- Ongoing monitoring and threat detection systems to identify and address potential risks.

These efforts combine to provide a secure environment for Neo Financial customers, giving them the peace of mind they need when managing their financial lives.

Overall, Neo Financial is an outstanding platform for those looking for a digital banking solution

There are a lot of choices these days when it comes to digital banks for Canadians. Equitable Bank, Tangerine, and Neo Financial lead the charge.

I like Neo Financial’s mix of products, and it has the best mobile app of the bunch. For Canadians looking for a digital bank, I’d rank it up there as one of the best. High-interest rates on its savings accounts, cheaper mortgages than traditional banks, and investing options for those who don’t want to do it on their own or for those who possibly want to ditch their high-fee mutual funds for more attractive products. Here is some additional information regarding some of the Neo products we are exploring today:

I hope you found this review useful, and I hope I’ve explained the features of Neo in an easy-to-digest way.