Norberts Gambit – Step by Step Instructions for Major Brokerages

Although our Canadian markets are full of some very strong options in terms of buying stocks, we tend to want to invest in the US markets as well.

In order to do that, we need US Dollars. And, in order to convert CAD to USD, you should be performing Norbert’s Gambit.

In fact, if you aren’t, it’s very likely you’re costing yourself significant amounts of capital in currency conversion fees, depending on how much and how often you’re converting to the US Dollar.

But, there is two primary hurdles for many investors looking to convert CAD to USD using Norbert’s Gambit in order to save some money.

First, they don’t know what the heck Norbert’s Gambit is. And secondly, it’s a different process for every brokerage.

So, what I aim to accomplish in this article is to show you how to convert CAD to USD using Norbert’s Gambit at most major brokerages here in Canada.

And of note, if you’re currently at a brokerage that is not listed here, shoot me an e-mail and I will add a step by step process in!

But first lets get down to what Norbert’s Gambit actually is, so we can understand what we’re doing.

After that, we’ll go over Norbert’s Gambit with Questrade, TD Direct Investing, RBC Direct Investing, Interactive Brokers, CIBC Investors Edge and Qtrade.

What is Norbert’s Gambit?

A “gambit” is a calculated move, particularly one that has a degree of risk to it.

The best part? Norbert’s Gambit contains zero risks, especially if you follow this guide. All it does, is gets you US dollars for cheaper.

Norbert’s Gambit is a currency exchange strategy named after the advisor who first came up with it, Norbert Schlenker. In fact, he’s Canadian!

There are a few ways to perform Norbert’s Gambit, but the primary way is with a currency ETF called the Horizons US Dollar Currency ETF (TSE:DLR and TSE:DLR.U).

In a nutshell, performing Norberts Gambit is very easy:

- Purchase DLR.TO, which trades in Canadian Dollars

- Journal your shares over to DLR.U.TO, which trades in US Dollars

- Wait 3-4 days for the trades to settle, and sell your DLR.U.TO shares for US Dollars

You can also use dual-listed Canadian stocks, for example Fortis, which trades on both the TSX and the NYSE.

However, stocks are much more volatile than the Horizons US Dollar Currency ETF, and there is also the likelihood you will pay commissions when buying, and selling.

Why do I need to perform Norbert’s Gambit?

Performing Norbert’s Gambit, in most situations, will be the key to you not paying exorbitant currency exchange fees implemented by your brokerage in order to get US dollars or other forms of foreign currency.

For example, Questrade’s currency exchange fee when it comes to US dollars can be as high as 2%, meaning if you want to exchange $10,000 CAD for USD, it could end up costing you $200 plus the spread on the actual exchange.

It’s even becoming more beneficial to perform Norbert’s Gambit now because ETFs are often commission free.

So you can buy DLR.TO for free, and only pay a commission (and maybe small ECN fees which we’ll talk about later) when you sell your DLR.U.TO to get the US dollars.

But with all that said, lets get in to how to perform Norbert’s Gambit with specific brokerages, as each and every one of them will have a slightly different process.

One of the key differentiators is whether or not you need to talk to customer service in order to perform Norbert’s Gambit or not. Lets start with Questrade.

Norbert’s Gambit Questrade

With Norbert’s Gambit on Questrade, it actually requires contacting customer service. So, the process is a bit drawn out.

However, Questrade’s ability to hold both the US Dollar and Canadian Dollar in the same account is a huge plus. In fact, this is the only brokerage in this article where you don’t need multiple accounts to perform Norbert’s Gambit.

How to perform Norbert’s Gambit with Questrade:

- Log in to your account and head to your order menu

- Enter DLR.TO into your order menu, and figure out how many total shares you need by dividing the total CAD you want to convert (less commissions if applicable) by the current ask price

- Enter a limit buy order in at the ask price for the shares you need

- Once the order goes through, head to the live chat feature

- Go through the security verification and then tell the live chat agent you want to journal your DLR.TO shares to DLR.U.TO

- They will warn you that this transaction will likely take 3-4 days to finalize

- In 3-4 days, check your account until you see DLR.U.TO, and sell the shares

- You will now have US dollars in your account

Being a Questrade user myself, prior to the COVID-19 market crash and subsequent surge of new investors entering the markets, the process took all of 5 minutes.

Now, with longer queue lines in the live chat, it can sometimes take hours. So, just be prepared to sit on the live chat until you reach a representative, and hopefully they can fix customer service issues ASAP.

Norbert’s Gambit RBC Direct Investing

RBC Direct Investing clients rejoice. You by far have the easiest go at performing Norbert’s Gambit.

The small issue however, is that RBC Direct Investing does not currently have commission free ETFs. So, you’ll be charged $9.95 CAD to buy and sell. It’s important to take this into consideration when performing the strategy.

So, because RBC Direct Investing’s way of performing Norbert’s Gambit is instant, you can actually choose either the ETF, or a dual listed stock like Fortis (NYSE:FTS and TSE:FTS). Keep in mind however, the currency ETF would still be the preferred way, as its price fluctuates much less than a stock.

**Important note** – For Norbert’s Gambit on RBC Direct Investing to work, you need both a USD and CAD account.

Unlike Questrade, which has both currencies in an individual account, this is not the case with RBC Direct Investing and if you don’t have both CAD and USD accounts, it won’t work.

How to perform Norbert’s Gambit with RBC Direct Investing:

- Head to the “Place an Order” tab and select “Stocks and ETFs”

- Select the Canadian Dollar version of your account

- Enter the ticker symbol DLR into your Symbol section

- Under “Market” select “CDN” and hit show quote

- Once you have your quote, take the ask price and divide your total CAD you want exchanged (less commissions if applicable) by that price to figure out your shares needed

- Enter your shares and select a limit price at the ask of DLR and buy the shares

- Head back to the “Place an Order” tab and select “Stocks and ETFs”

- This time, select the US version of your account, and enter the ticker symbol DLR.U

- Sell the same number of shares that you just purchased of DLR

- Voila! You have instant access to your USD

Of note, you might get a warning that tells you you’re trying to sell a security that you do not own. You do own the security, it is just taking some time to settle in the back end.

In fact, it still takes the 3-4 days for RBC Direct Investing to settle the trades on the back end, so your account may look weird for a bit. For example, it might show you a negative share balance in your USD account.

But don’t fret, you have access to the USD. This is exactly why RBC Direct Investing is one of the best ways to perform Norbert’s Gambit, it’s instant.

Norbert’s Gambit Qtrade

Qtrade’s process of Norbert’s Gambit is much like Questrade’s in the fact that you have to wait 3-4 days for everything to settle. However there is a key difference, you can do it all yourself.

There is no need to contact customer service, which as of right now, is a huge pain for a lot of brokerages.

And of note, Qtrade is much the same as RBC Direct Investing, you need a CAD and USD account to execute this strategy.

How to perform Norbert’s Gambit with Qtrade:

- Head to the “Trade” tab and select equities, make sure you’re in your CAD account

- From there, enter DLR into the symbol feature, and grab the current ask price of DLR

- Take the amount of CAD you want to convert (less commissions if applicable) and divide it by the ask price

- Set a limit order at the ask price for DLR and buy the shares

- Once the order is filled, head to “My Accounts” select “Transfer Funds” and “Move Securities”

- Move DLR from your CAD account to your USD account

- Wait until the transfer is processed (can be a day or two)

- **Important step** When DLR hits your USD account, go to sell it. However, change the symbol from DLR to DLR.U to make sure it sells in USD

- From there, you should have US Dollars inside of your USD account!

Norbert’s Gambit TD Direct Investing

Much like RBC Direct Investing and Qtrade, you have to have a USD and CAD account to perform Norbert’s Gambit on TD Direct Investing.

If you don’t have one, set one up before you attempt to execute the strategy, or it won’t work.

Of note, TD Direct Investing made some changes and it is now possible to do Norbert’s Gambit on the brokerage platform without contacting customer service.

As such, our steps have changed below. Thank you to the reader who e-mailed the new method in!

**Important: Make sure when you are doing the final steps and selling the shares in your USD account that you select DLR.U, not DLR. If you make the mistake of selling DLR shares, they will charge you currency conversion costs**

How to perform Norbert’s Gambit with TD Direct Investing:

- Log in and click the “Buy/Sell” button

- Put DLR into the symbol box, select the Horizons currency ETF and you’ll get the quote

- Take your total CAD (less commissions if applicable) and divide it by the ask price of DLR to get the total shares you want to buy

- Under action, select buy and under quantity, enter the shares calculated from step 3. Select limit order, and set the limit to the ask price you retrieved in step 2

- Enter your password to execute the trade, making sure this is your CAD account

- Wait 2-3 business days for the trade to be completed

- Go to your accounts tab, and select security transfers

- Enter DLR into the search bar, and transfer all shares into the USD account

- After the transfer is complete and you notice DLR in your USD account, head back to the “Buy/Sell” screen and under symbol select DLR.U

- Sell all of your shares of DLR.U

- Voila! You have your USD

Norbert’s Gambit CIBC Investors Edge

Much like any other brokerage on here except Questrade, you will need both a Canadian and USD account to utilize Norbert’s Gambit on CIBC Investors Edge.

But other than that, the process is much the same.

How to perform Norbert’s Gambit with CIBC Investors Edge:

- On the left hand side menu, select trading

- Under account, select your CAD account, select buy and place DLR in the symbol area. Gather the ask price from the quote

- Divide the total amount of CAD you want to covert (less commissions if applicable) by that ask price to get the total amount of shares you need

- Enter your password and go to the order summary screen, make sure your math is correct, and submit the order

- Once the order has been filled, call CIBC Investor’s Edge and get them to journal your shares of DLR.TO to your USD Account

- The trade and journaling should take 3-4 days

- Once you notice DLR.U inside of your USD account, sell DLR.U for USD.

- Voila! You have your USD

Norbert’s Gambit Interactive Brokers

If you’re with Interactive Brokers, you are in luck! Why?

Well, the discount brokerage offers such little fees to convert CAD to USD, there is almost no point to utilizing Norbert’s Gambit.

In fact, at the time of writing Interactive Brokers only charges you 0.20% to convert to USD, compared to something like 2% on Questrade. So, a measly $20 on $10,000 exchanged.

If we consider commission fees generated to buy and sell currency ETFs, it would take a significant amount of capital to be worth using Norbert’s Gambit and waiting the 3-4 days to complete it on Interactive Brokers.

ECN Fees with Norbert’s Gambit

Separate from the commission fees brokerages charge to execute not only Norbert’s Gambit transactions but any trade, there is also something they call ECN fees, or Electronic Communication Network fees.

To explain them in the easiest way possible, if you want your order filled immediately, you’ll be charged ECN fees.

So if you follow the steps above in all of the brokerage explanations, because you placed a limit order at the ask price, you will be charged an ECN fee, as a limit order at the ask price should fill instantly.

So why did I say to do it this way then?

Well, the fees are so miniscule that it is often not worth the hassle of setting orders below the ask price, as they may not get filled.

For example, Questrade charges a $0.0035/share ECN fees. So if you purchase 1000 shares of DLR (at the time of writing that would be a $12,670 purchase) to perform Norbert’s Gambit and you place a limit at the ask price to fill the order immediately, you’ll pay an extra $3.50 in ECN fees.

If you really want to be stingy on capital paid to perform Norbert’s Gambit, simply place a limit order below the ask price. Just keep in mind, it might not fill.

And also, when it comes to ECN fees, be aware that you will typically be charged ECN fees on share orders in excess of 100. So for example, a purchase of 500 shares will not be subject to ECN fees (as long as the conditions stated above are true), where a purchase of 560 shares, the 60 shares might be.

How much does Norbert’s Gambit save?

The answer to this question is it really depends on what brokerage you’re with, and how much capital you’re converting.

Why? Well, each brokerage has different currency conversion fees and commission rates.

For example, a discount brokerage like Questrade offers commission free buys, but you pay when you sell. They also charge a 2% conversion fee.

So lets just say for example you took $10,000 CAD and purchased a USD stock on Questrade. You’d be charged $200 for the instant conversion.

Whereas if you were to use Norbert’s Gambit, you’d be charged nothing to buy DLR, and $4.95 – 9.95 to sell DLR.U, depending on how many shares you have.

If we amplify this and say we want to exchange $200,000 CAD to USD, Questrade would charge you $4000 to do so!

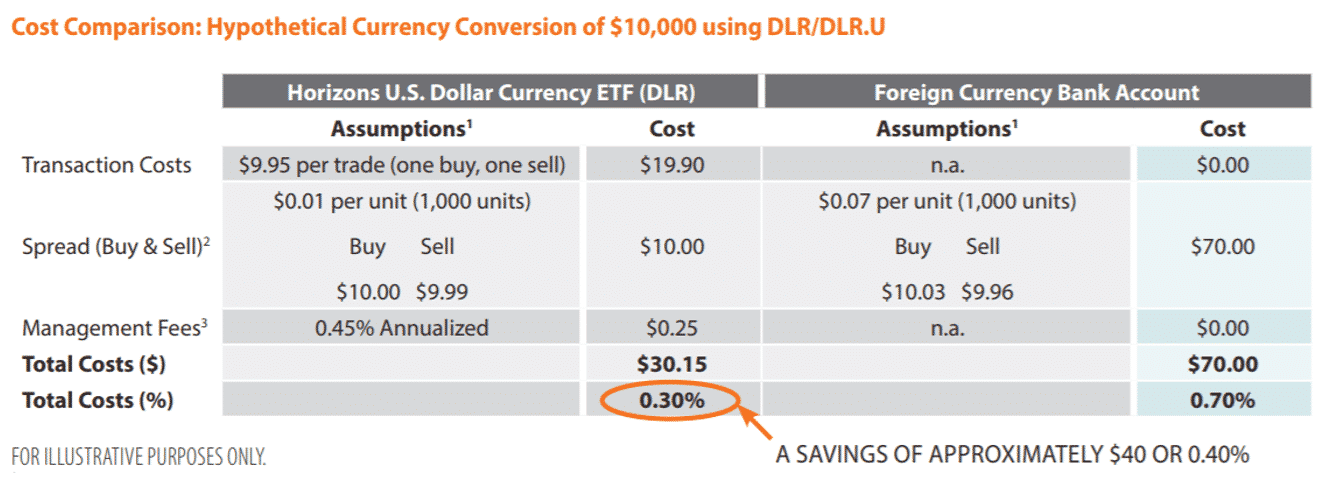

Of course there is always spreads on the ETF prices, but you still save a significant amount in terms of currency conversion fees. In fact, I’ll paste an example from Horizons US Dollar Currency ETF below.

This is why Norbert’s Gambit is, without doubt, worth executing even if it does take 3-4 days to complete (besides RBC Direct Investing of course, that’s instant.)

Is Norbert’s Gambit legal?

Absolutely it is. There’s nothing wrong with performing this currency conversion strategy to convert Canadian dollars for cheaper. In fact, most brokerages and customer service reps encourage it.

The process is seamless if you have to speak to a representation, as it is such a popular strategy most have done it time and time again.

Can you do Norbert’s Gambit on Wealthsimple?

Unfortunately, you cannot do Norbert’s Gambit on Wealthsimple. They do have USD accounts but do not support Norbert’s Gambit to get money from your CAD account to USD account.

And in this situation, Wealthsimple will charge you exchange fees much like any other brokerage to convert the currency.

At this current moment, the best way to use Wealthsimple Trade is to purchase Canadian stocks using Canadian dollars.