Nvidia Stock: Priced To Perfection Means Added Risk

To say Nvidia has stunned investors would be an understatement. The company is up 2700% over the last half decade and 144% of 2024 alone.

This growth has been fueled by the AI boom and increased data center spending. But with such rapid gains, many are wondering if the stock has room to climb higher or if it’s overvalued.

If you’re thinking this, good. You’re not simply buying into the hype and FOMO of the stock.

In this post, I’ll share my thoughts on Nvidia’s potential, the risk it faces, and whether or not it’s a buy today. Keep in mind as well, Nvidia is purchasable on the Canadian markets under the ticker NVDA.NE.

Key Takeaways

- Nvidia’s stock has skyrocketed due to AI chip demand

- The company faces growth opportunities but also valuation concerns

- Export restrictions to China pose a potential risk to Nvidia’s outlook

Q2 Earnings – Good, but It Wasn’t Good Enough

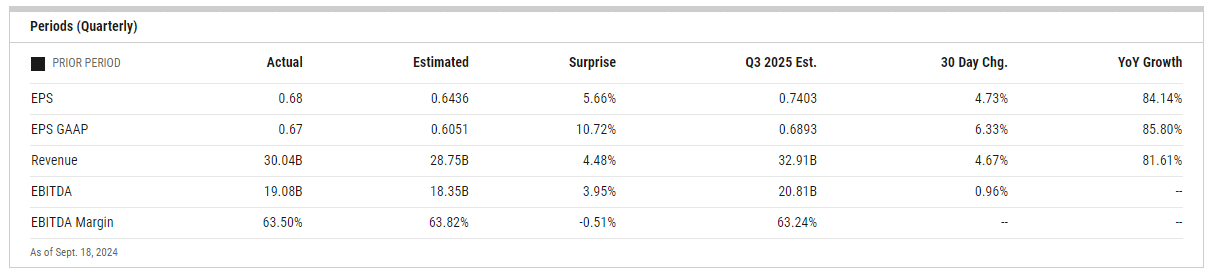

Nvidia’s Q2 earnings were impressive, but the market’s reaction kind of left me scratching my head. The company topped expectations for both revenue and earnings per share, yet the stock took a tumble.

Investors were clearly hoping for even more. In the market, we call this “priced to perfection” and it is a tricky situation to be in.

Nvidia reported a whopping $30B billion in revenue, topping estimates. Their earnings per share hit $0.68, well above predictions.

The star of the show? Data centres. They raked in $26.2 billion, a mind-boggling 171% increase from last year. This growth is fueled by the AI boom, and by the looks of it, this is just the beginning.

Despite these stellar numbers, Nvidia’s stock fell after hours. Why? It seems the market wanted even more spectacular guidance for Q3.

Nvidia’s runway for growth is extensive

I believe Nvidia’s potential for growth is simply massive. They’re not just leading the AI chip race – they’re dominating it. And this doesn’t even factor in their explosive demand for data centers.

Nvidia has positioned itself as the go-to company for AI hardware. Their GPUs are the gold standard for training and running AI models. This gives them a huge advantage as AI adoption skyrockets.

I expect Nvidia’s sales to keep soaring. Analysts project their revenue could grow 33% annually through 2026.

It is absurdly hard to grow at a 30%+ pace when you’re already one of the largest companies on the planet.

How will they do it?

• Expanding AI use will cause continued data center demand

• Rising demand for AI chips in self-driving cars and other products

• Growing adoption of AI in healthcare and finance

While competition will increase, I think Nvidia’s tech lead gives them a strong moat. With sky high margins, they also generate a boatload of cash flow and don’t pay out much of a dividend. That means more money for R&D.

There are risks, of course. AI hype could cool off. Customers might slow spending. But I’m bullish on Nvidia’s long-term prospects. Their growth runway looks long and wide.

The growth is there for Nvidia, but is the valuation too rich?

Nvidia’s growth story is truly impressive. The company’s revenue is growing at a triple digit YoY pace and it’s definitely got all the attention right now.

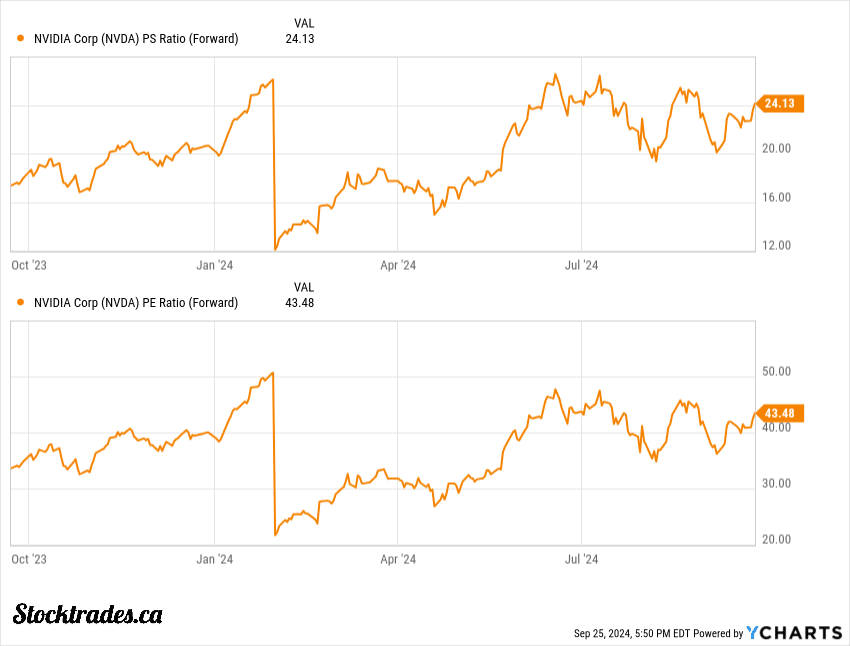

But here’s the difficulty: Nvidia’s stock price has soared even higher. Its price-to-earnings ratio sits at a lofty 57, while its price-to-sales ratio is a jaw-dropping 31.

Now, for a company that is growing this fast, forward price to earnings are likely a better indicator (listed in the chart above). And yes, it does get cheaper, but it’s still expensive.

Let’s put it this way: investors are paying a premium for Nvidia’s future growth. They’re betting the company will keep crushing it because of artificial intelligence.

This is why I believe Nvidia is priced for perfection. The stock’s valuation leaves little room for error. Any hiccup in growth or market share could send the shares tumbling.

The AI hype has pushed Nvidia’s market value to $3 trillion. That’s bigger than most countries’ economies!

In my view, Nvidia needs to keep executing flawlessly to justify its current price.

The risks of export restrictions in regards to China and Taiwan

Nvidia faces big problems with its China business. Last year, the US government told Nvidia to stop shipping some advanced AI chips to China.

With the United States and China in constant turmoil, there is no telling what export restrictions could be put in place in the future.

In addition, the company’s chip production is primarily fueled by Taiwan Semiconductor.

I think these restrictions create major uncertainties for Nvidia’s future. China is a huge market for AI chips. Losing access to it would be a big blow. Nvidia has warned in the past that the rules could cause permanent lost opportunities.

The export rules keep changing too.

Would I be a buyer at today’s levels?

Nvidia’s prospects are certainly attractive. The company’s incredible gains in the past year and its role in the AI revolution are hard to ignore. If it continues to execute, there is a good chance in continues to outperform the S&P 500.

Despite this, I wouldn’t be a buyer at current levels. My main concern is the lack of a sufficient margin of safety. At this price point, the risks, in my opinion, outweigh the potential rewards.

Here’s why I’m hesitant:

- High valuation

- Intense competition in the AI chip market

- Potential market saturation

- Geopolitical risks affecting supply chains

That being said, I don’t fault investors who want to own a piece of Nvidia. The company’s growth potential is undeniable, especially with the predicted “unprecedented” levels of AI investments.