Doordash Leaves Payfare – Is it a Buy After a 75% Dip?

Key takeaways

- Payfare’s strategic review at the expense of a major client isn’t really a good thing

- The company relied way too much on a sole client, and is now paying the price

- The drop in market price likely accurately represents the revenue it will lose

- 3 stocks I like better than Payfare

Payfare’s partnerships with major players like Uber and Lyft have helped it carve out a niche in a relatively growing market, the gig economy. However, the loss of one of its major clients last week caused the stock to fall off a cliff, literally.

The recent news of Payfare initiating a strategic review process ahead of losing a major client in Doordash is yet another example of a poor Canadian IPO during the pandemic era.

Whenever a fall like this happens, I tend to get a lot of inquiries about the stock, primarily revolving around whether it’s a buy.

Is Payfare stock a hidden gem on a 75% decline or a risky bet?

Let’s take a deeper look.

The company just lost its largest client, DoorDash

Payfare has lost its biggest client, DoorDash. This is a massive blow to its business model and future prospects.

The loss of DoorDash exposes a glaring weakness in Payfare’s strategy. They put too many eggs in one basket. This overreliance on a single client created a dangerous concentration risk.

Now Payfare faces an uphill battle. They need to replace a huge chunk of their revenue quickly. It’s not going to be easy in the space, as it is ridiculously competitive.

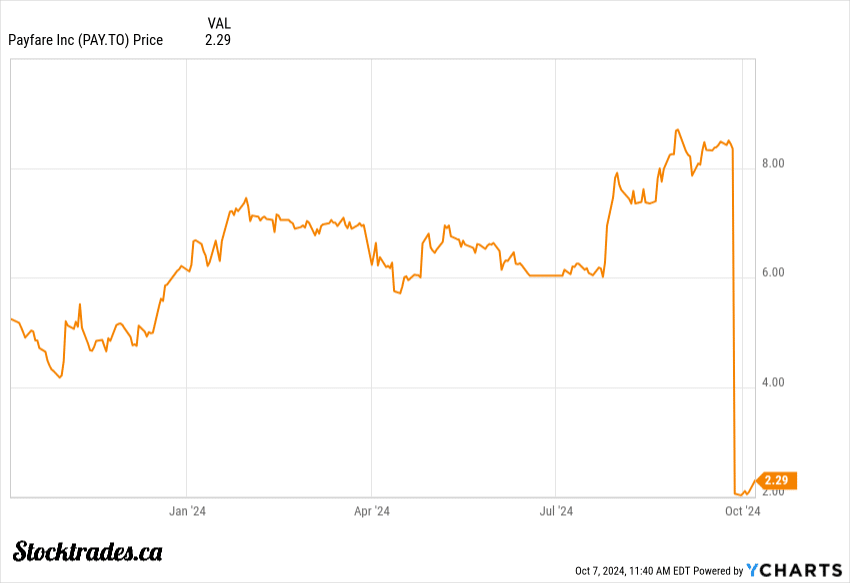

The market’s reaction has been brutal. Payfare’s stock price plummeted by over 75% on the news. This crash reflects serious doubts about the company’s ability to ever recover.

In my view, Payfare’s future looks shaky. They’ll need to do the following, none of which are “quick” solutions:

- Diversify their client base ASAP

- Innovate their product offerings

- Cut costs to stay afloat

While Payfare has $100 million in cash reserves, I’m skeptical about how long that runway will last. The loss of DoorDash is a game-changer, and Payfare’s path forward is unclear at best.

Payfare has withdrawn guidance as a result

The company’s decision to withdraw its 2024 financial guidance isn’t really all that surprising.

This move signals a lack of clarity about Payfare’s future earnings. In reality, how can you blame them? They just lost the majority of their business. They truly have no idea how the future is going to look.

As mentioned, the market’s reaction was swift and harsh. Payfare’s stock plummeted by 75% in a single day.

While Payfare claims to have other growth opportunities, I’m skeptical about their ability to offset such a significant loss quickly.

In my experience, companies that withdraw guidance often face prolonged periods of volatility. Payfare will need to work hard to rebuild investor confidence in the coming years.

There is no quick and easy solution for this.

The company is now looking to possibly sell

After losing DoorDash as its biggest customer, the company is exploring “strategic alternatives” – which in laypersons terms means putting up a “for sale” sign.

I’m not convinced selling is the best move. Here’s why:

- Weak bargaining position

- Limited buyer pool

- Uncertain future growth

Who wants to buy a business that just lost its largest client? And even if they do, they’ll take advantage of the company’s tough position and offer rock-bottom valuations.

Who might buy? Perhaps a larger fintech firm or a gig economy platform looking to bring financial services in-house. But I worry any offers would be lowball given Payfare’s current struggles.

For shareholders, a sale could provide a quick bump from the current rock-bottom price. But I doubt it would match previous highs. There’s a risk of selling at the bottom.

I think management should focus on replacing lost revenue and cutting costs before rushing into a fire sale. They still have the Lyft partnership and claim to be “well capitalized”.

A merger with a complementary business could be more promising than an outright sale, in my opinion.

Is this a buy the dip opportunity?

I don’t believe Payfare stock presents an attractive buying opportunity, despite its recent price drop. The risks are simply too high, and this price drop is simply an adjustment after losing a massive chunk of business.

Payfare’s future revenue streams are now highly uncertain. Without DoorDash, the company’s long-term viability is in question. They may struggle to attract new clients of similar size.

While the stock seems cheap, it’s a classic value trap. The low price reflects serious concerns about Payfare’s business model and growth prospects.

Investing in Payfare now would be pure speculation in my opinion. The risks far outweigh any potential rewards. I’d want to see some forward progression over the next year or so before I’d dive in.

Sure, maybe I miss the bottom. However, I am at least making an investment that is more fundamental based rather than speculation.