Has PayPal Stock Hit its Limit or Will it Continue to Run?

Paypal faces all kinds of competition in the space, which has resulted in a monumental decline from pandemic highs.

But let’s face it, in terms of the OG payment processor, I recognize PayPal, and its pretty convenient.

But keep in mind that PayPal has been busy reaching as far and as deep as they can into different pools of revenue in an attempt to grow the business.

Payment processing, bill payments, international and local money transfers, POS, fraud prevention, risk management, discount code tools, cryptocurrency security, brick and mortar shopping returns locations, business payroll and payments, and more.

All those things listed above to say, you should definitely know that PayPal is much more than just the payment processor that most of us likely recognize. They have their hands in a ton of jars.

So, can PayPal continue to bring new prospects into the fold? How does the company stack up to competitors? And most importantly, despite a runup in price, is it still attractive as a buy today?

Key takeaways

- PayPal faces rising competition but maintains a strong position in digital payments

- The company’s expansion into new financial services could drive future growth

- Investors should weigh PayPal’s market position against its current valuation

Can the company survive with all of the competition these days?

PayPal faces lots of competition, but I believe it’s well-positioned to survive and thrive.

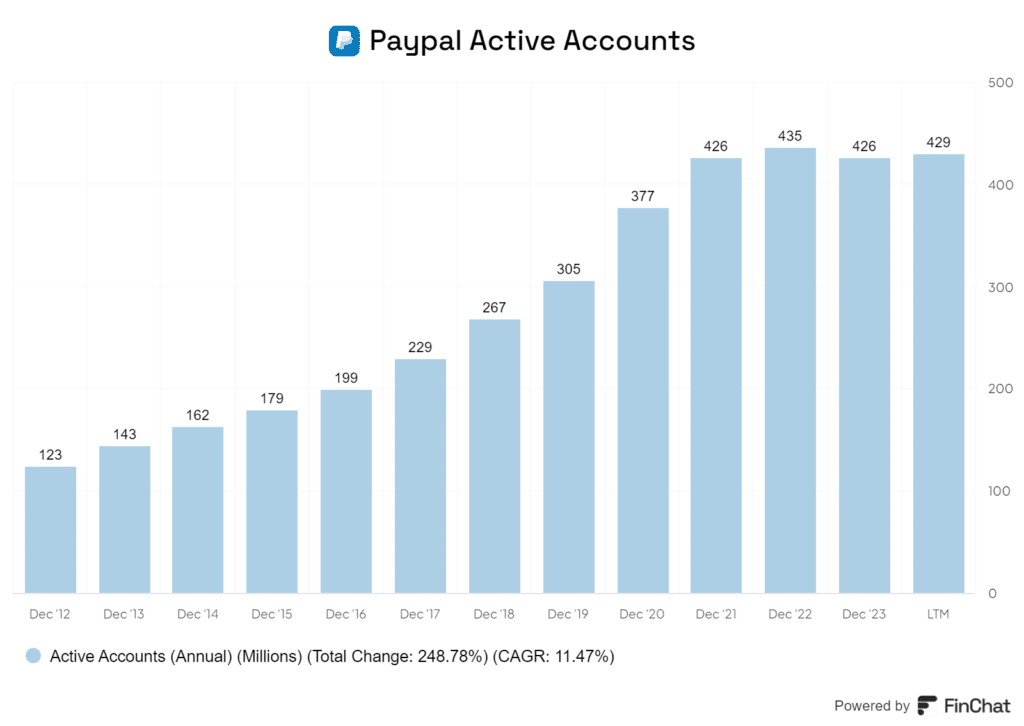

With 430 million active accounts, PayPal’s massive user base is huge.

The fintech landscape is crowded. Stripe and Square are formidable rivals. Traditional banks are upping their digital game too. But PayPal’s brand loyalty is strong. Any time PayPal is an option for myself I certainly make use of it.

So, how does the company stay on the check-out pages? How can the company keep cashflow moving to allow them to continue improving existing products and acquiring when opportune?

Despite a pretty good track record of smooth operations from their acquisitions, PayPal faces some tough competition. Isolating the original payment processor business for example, PayPal’s fees are among the higher fees in the industry.

The company is up against giants like Amazon and other well-known outfits like Stripe and Square. So, challenges remain in a few points of varying criticalness:

- Staying competitive

- DeFi potential to disrupt traditional payment systems

- Regulatory hurdles in different markets

- Keeping up with rapid changes in tech and fintech

Through all this, adaptability is going to be crucial for PayPal. Though, the company has shown to be well-executed in making profitable moves so far.

What is the company’s driver for growth in the future?

PayPal’s future growth potential is a curious prospect with the company getting involved in so many different models of money movement.

Braintree was obviously a major purchase for the company, which included Venmo. Venmo monetization could play a crucial role in increasing revenue by integrating crypto and expanding merchant fees.

International expansion is another exciting prospect. I could see potential in markets like India and Latin America, where digital payments are rapidly growing.

The Buy Now, Pay Later (BNPL) space is heating up, and PayPal isn’t sitting idle. Through partnerships and acquisitions, they’re positioning themselves to compete with giants like Afterpay.

Crypto integration is a game-changer. By allowing users to buy, sell, and hold cryptocurrencies, PayPal is tapping into a massive market of DeFi-minded people. In the event DeFi garners more traction it will be companies that can adapt to this space that ultimately survive and thrive.

The PayPal Business app is evolving in terms of merchant services, offering more tools to small businesses.

Clearly the pandemic had a significant impact on the sector of online shopping. I think a lot of that demand spike is probably permanent. If a person did not know how to shop online pre-pandemic, I am betting that they do now. And now we have Honey, so we can find any coupon codes for the stuff that we have become accustomed to buying online.

Essentially, money will not stop needing to go from point A to point B. As time passes, the exchange and transfer of funds will likely become increasingly digital. More and more societies are becoming digital. So, if PayPal can continue to access new users of all kinds via opportune acquisitions and remain a competitive force across its verticals, then I am optimistic about the company’s future.

Are valuations still attractive despite the stock going on a tear recently?

PayPal’s stock has been on a roll lately, and valuations are not as attractive as they once were. Let’s break it down.

The company’s P/E ratio is currently sitting higher than many of PayPal’s fintech peers. So the stock is a bit pricey at the moment.

Compared to rivals like Block and Stripe, PayPal’s multiples are on the higher side.

The current market conditions are a bit of a mixed bag. On one hand, interest rates are falling, which ultimately creates a tailwind for a company like PayPal, among other high growth stocks.

On the other hand though, there’s been some rotation out of the fintech sector due to the competitive nature of the space. PayPal’s recent acquisitions, like Honey and Paidy, have beefed up its offerings. But they’ve also impacted the company’s financial health from a debt perspective, and I’m not sure if the market has fully priced-in these changes.

While the stock’s recent performance has been impressive, I’m cautious about jumping in at these levels. The valuation seems a bit rich to me, and I’d prefer to see a pullback before considering it a strong buy.

Would I be a buyer of PayPal at these levels?

I’m cautiously optimistic about PayPal’s prospects, but I’m not rushing to buy just yet.

The stock has fallen 80% from its all-time highs. This could present a compelling entry point for long-term investors.

PayPal’s large user base of 429 million active accounts is impressive.

The company’s transaction rates are still growing robustly, which bodes well for future revenue growth.

I’m particularly excited about Venmo’s potential and PayPal’s international expansion efforts. These could be significant catalysts for growth in the coming years.

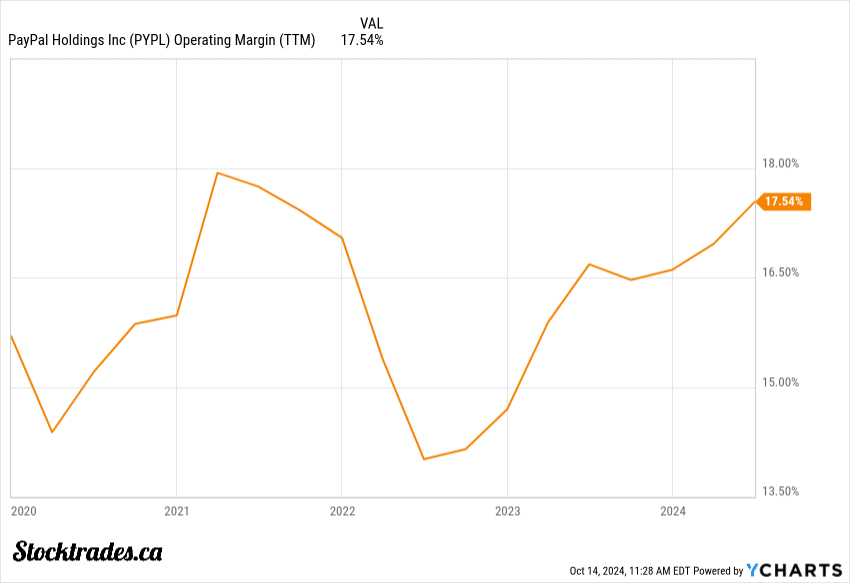

However, I’m concerned about increasing competition in the digital payments space. Tech giants and fintech startups are all vying for market share, which could pressure PayPal’s margins.

The macroeconomic environment also gives me pause. A potential economic slowdown could hamper consumer spending and transaction volumes.

PayPal’s take rate (the percentage it earns on each transaction) has been declining. I’d like to see this metric stabilize before considering a purchase.

On the positive side, the company’s margins are improving, and the stock looks historically cheap based on valuation metrics.

Investor sentiment seems mixed. While some see value at current levels, others are waiting for clearer signs of sustained growth.

In my view, the risk-reward balance is tilting towards favourable, but I’d prefer to see a few more quarters of consistent performance before buying in. I’m keeping PayPal on my watchlist and might consider initiating a small position if we see another pullback.