How to Buy Stocks in Canada – Start Investing Wisely in March 2025

If you’re looking to get started when it comes to investing, particularly buying stocks, then you’ve come to the right article. Depending on your situation you’re likely to receive CPP payments or old age security in retirement, you still need that extra boost if you want to retire happy.

Investing and prudent personal finance are the best paths to building long-standing wealth. And although it’s intimidating to get started, the fact you’re here shows you’re almost ready to take the plunge.

So, we’ve prepared a huge guide that is going to get you set up in terms of buying stocks so that you can stop listening about people who’ve made money investing, and start doing it yourself.

How to buy stocks in Canada

- Open up a brokerage account (our brokerage of choice being Qtrade Direct Investing)

- Open a TFSA, RRSP, cash account or even a LIRA

- Set up a deposit method & recurring withdrawals with a discount brokerage

- Start small. Don’t feel like you need large amounts of money to get started

- While you’re waiting for the transfer, study what type of investor you want to be

- Buy your first stock through your online brokerage!

Getting from the top of this list to the bottom is when things become challenging. From the S&P, New York Stock Exchange, Toronto Stock Exchange, market order, limit order, and even a stop order, you’ll be familiar with all the terminology by the time this article ends and much more comfortable with investing.

However, with so much information, this article is quite large, so feel free to use the table of contents below.

First, let’s get started with the most basic, yet critical step. Opening up a brokerage.

Step 1: Open a brokerage account

In order to build an investment portfolio, you need to have a brokerage account. We’ll go over why there are particular situations where you don’t need one, but 99.9% of the time it’s going to be beneficial to make investments through a brokerage.

So, what brokerage should you choose?

For the longest time, I had suggested a discount brokerage here in Canada called Questrade.

I was a decade-long client with Questrade, and generally enjoyed the platform.

However, my tune changed and after reviewing a popular platform here in Canada Qtrade, I decided to move all of my investment accounts over to them.

To understand why I made the switch, have a read of my Qtrade review here. In my opinion, it’s the best brokerage in the country, bar none. And this is not only when it comes to Canadian stocks. It’s excellent for buying US stocks in Canada as well.

I believe the platform is more transparent, more intuitive, and most importantly more directed towards beginner investors. The brokerage is also a part of the Canadian Investor Protection Fund (CIPF).

And, there is even perks if you’re starting young, like their Young Investor Pricing.

The process of opening an account with Qtrade takes all of 10-15 minutes. Just have the following documents ready:

- Your social insurance number

- Government issued ID

- Details of your net worth

Step 2: Opening your investment accounts

Now that you’ve opened up your account(s) with Qtrade or any other Canadian brokerage, you have to decide what type of investment account you want to open to start investing in stocks.

Canadian investors who are brand new to investing and have never contributed any money, or haven’t had their money managed by an advisor, very likely have contribution room in their Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP).

These accounts, available at practically any brokerage, are what we like to call tax-sheltered.

This means that when you buy stocks, exchanged traded funds, mutual funds or any other type of investment, they won’t be subject to capital gains, which is a particular type of tax you have to pay on gains made from investing in the stock market.

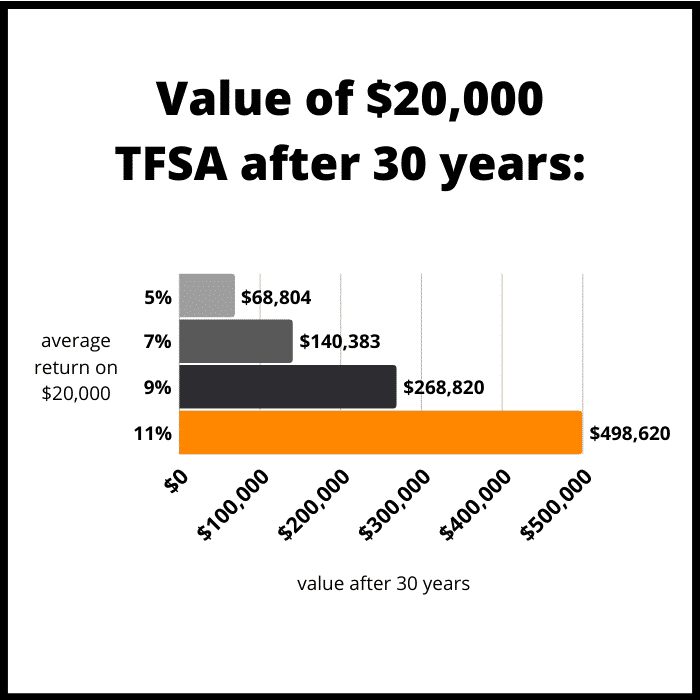

These tax-sheltered accounts will prove to be critical in your self-directed investing career, as tax-free investment gains can compound and create a “snowball down a hill” like effect on your money. Just have a look at the TFSA example below.

Keep in mind, not only are the gains from investing in stocks or other investments tax-free in these accounts, but also the dividends paid by the stocks you buy.

Step 2A: The benefits of non registered accounts

Before we get to whether or not you should open a TFSA or RRSP to begin buying shares of companies, we should explain the benefits of opening non-registered accounts, or as some like to call them, taxable accounts, margin accounts, or cash accounts.

With a non-registered account, while you will pay capital gains on earnings made from investing in stocks and other securities, you can also write off capital losses, which is something you cannot do in a registered account like a TFSA or RRSP.

So, select investors might invest in stocks that they deem to be higher risk outside of their registered accounts.

This is so if the situation arises where their investments end up losing in value, they can claim a loss on their taxes when they sell an investment. This applies to stocks trading on Canadian indexes like the TSX Composite Index as well as US indexes like the NASDAQ and NYSE.

For the purposes of this article though, we’re going to focus on long-term, buy and hold investing. Which, if you have room, is best done inside of a registered account.

Step 2B: Deciding on your account: RRSP or TFSA

Whether it be ETFs, mutual funds, stocks, or even bonds, the vast majority of investors buy investments in Canada through one of these two accounts and do not have to worry about tax implications until their wealth grows.

The question now that you want to open an account is, which account is right for you?

Many articles you will see will make two blanket type statements as to what type of account you can open:

- Open and contribute to a TFSA if you’re in a lower tax bracket to invest in stocks

- Open and contribute to an RRSP if you’re in a higher tax bracket to invest in stocks

And for the most part, this is true. RRSP contributions are tax-deductible, meaning that Canadians in higher tax brackets will get more income tax back when they file the contributions as deductions.

However, there are many situations, such as employer contribution matching or the RRSP First Time Home Buyers Plan, that make contributing to and buying shares of strong companies within an RRSP beneficial regardless of your current income.

Overall, it doesn’t hurt to open up both accounts. Just check to see if your online broker requires you to keep a minimum amount of capital inside of the account. If so, you might want to figure out what type of account works best for you in terms of your tax situation, and open that one.

Step 3: Funding your account

In order to start investing in stocks, you need some money inside of your account!

The good news? It’s very likely your online brokerage makes funding your account very easy.

After you open an account, you’ll likely be asked to provide some identity verification in the form of a government-issued ID.

After that, your online brokerage should ask you how you want to fund your account. I haven’t witnessed an online broker that doesn’t allow a variety of funding methods including but not limited to:

- Wire transfers

- Cheques

- Money orders

- Pre-authorized deposits

- Interac e-transfers

- Transfer from another brokerage

- Bill payment via your online banking

Overall, you’re going to find the easiest way to deposit money into your online brokerage account is going to be through a bill payment via your online banking.

Step 3A: Set up automatic deposits

The best way to invest in stocks is to do it on a consistent basis.

Now that you’ve set up your initial deposit into your brokerage, most online brokers allow you to set up recurring deposits so that you can continue to add to your positions in your self-directed account.

In order to set up automatic deposits, you can tell your brokerage to set up pre-authorized deposits, or you can be in full control yourself and head to your online banking and set it up like a recurring bill payment.

For me, setting up automatic deposits was as easy as:

- Heading to my payees in my online banking

- Selecting add new payee

- Typing in the name of your brokerage, in my case “Qtrade“

- Setting a specific amount of money and a recurring date in which the money is withdrawn.

Investing in the stock market is best when it’s automated. If you’ve ever heard the term “pay yourself first” this is one of the best ways to go about it.

With automatic deposits, contributions to your online brokerage account are out of sight, out of mind, and continue to build your wealth.

Step 4: Learn some stock market terminology

It’s very likely if you’re done steps 1-3, you are in limbo while waiting for your money to hit your account.

However, use this time to get used to your brokerage. Figure out how you can buy or sell stocks or even exchange traded funds so that when the time comes, you’re ready.

Most brokerages streamline this process and buying can be done in the click of a few buttons. But before you invest your money, it’s important we go over some basic market terminology.

Let’s first start with some ratios that many investors use to make strong, long-term decisions. Remember, the vast majority of active traders lose money in the long-term, while buy and hold reigns supreme.

The price to earnings ratio

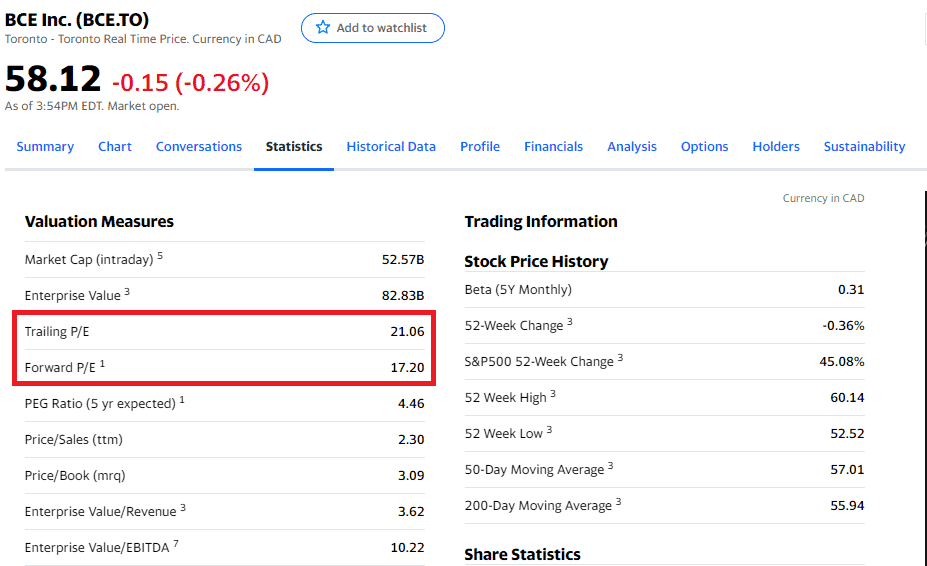

Probably the most common investment metric available to those looking to buy stocks, the price to earnings ratio (p e ratio) is a comparison of the company’s stock price to its actual earnings.

Courtesy of Yahoo Finance

The P E ratio is quite simple. It is the company’s stock price divided by its earnings per share.

So if a company has $5 in earnings per share and a $50 stock price, its price to earnings ratio would be 50/5 or 10. The price to earnings on its own doesn’t really tell you much about a stock.

A company with a price-to-earnings ratio of 15 could be overvalued, while a company with a price-to-earnings ratio of 30 could be severely discounted. The key is to look at the industry average, like the telecom sector. Or, compare competitors.

Market capitalization

Many beginners investing in stocks tend to get tunnel vision on stock price.

However, a company with a $5 stock can be worth significantly more than a company with a $100 stock. How? Well, something we call market capitalization.

The value of a publicly traded company is its stock price multiplied by its shares outstanding. A stock’s shares outstanding is the total shares on the market available for trading.

So as an example, you may think two major banks like Royal Bank (TSE:RY) and Bank of Montreal (TSE:BMO) are “worth” the same as stock prices are very similar.

However, RBC is significantly larger in size.

Royal Bank’s share price: $142

Bank of Montreal’s share price: $147

Royal Bank’s Market Cap: $142 X 1.42 billion shares = $202 billion

Bank of Montreal’s Market Cap: $147 X 648 million shares = $95.4 billion

So as you can see, despite having relatively the same price per share, Royal Bank is over twice the size as the Bank of Montreal.

When you trade stocks, it’s very important you don’t chase after “cheaper” companies solely based on their share price, as this does not tell the whole story.

Price to book

The price to book ratio simply takes a stock’s price per share and divides it by its book value per share, which is often calculated using the balance sheet.

A low price to book, such as something under 1.00, can signify undervaluation. Again, use this metric against the company’s sector or competitors.

Dividend

As you continue to learn how to buy stocks in Canada, you will no doubt come across an investment strategy (which we’ll get to later by the way) called dividend investing.

In short, a dividend is essentially a “reward” issued to shareholders by a company due to it having earnings over and above what it needs to fund company operations.

On most websites, a stock will have a dividend yield, which is simply the annual dividend divided by the stock price. So, a $10 stock paying a $1 dividend yields:

1/10 X 100 = 10%

When you buy stocks in Canada, specifically Canadian companies that are headquartered here, they qualify for preferential tax treatment.

That is a story for another article (which you can find here). But all in all, a Canadian stock strategy that is focused around dividends is one many beginners deploy.

Price to sales

The price to sales ratio is another common stock valuation method in which you compare the stocks market capitalization as we highlighted above to its annual revenue.

A quick example, if a company has a market capitalization of $1 billion and has $500 million in annual revenue, the company will be trading at

$1,000,000,000/ $500,000,000 = 2 times sales, or a P/S of 2.

When looking to buy stocks or sell a share based on its price to sales ratio, it is critical you first compare it to industry averages or competitors. This is because much like the price to earnings ratio, it is most useful when compared to other stocks in the same industry.

Return on Equity (ROE)

The return on equity is probably the most advanced metric we’re going to speak about in this beginner guide on how to buy stocks in Canada. We believe it is one of the most important ratios when deciding to make an investment in a company.

Return on equity is the net income earned expressed as a percentage against shareholder investments.

In plain English: A measure of the management’s ability to use the money invested in the business by you and other shareholders. If you want to beat the markets, a ROE of at least 10% is essential.

Return on equity, like price to earnings, is best used to compare a stock to its competitors or its industry averages. For example, a company with a 15% ROE may be commonplace in the financial sector, but in another sector, a company with a 5% ROE would be industry-leading.

It’s also best to compare the company’s return on equity with its historical numbers to see if there is a trending increase in ROE or decrease. We almost always want to see increasing returns on equity, especially from younger companies. It becomes more difficult for established companies.

Step 5: Decide on your strategy for investing in stocks

I know we’re on step 5 and we haven’t even begun to buy and sell stocks yet, but it’s very important you get all your ducks in a row before you buy your first stocks online.

Much like a chess player goes into a match with a specific strategy, you must do so with your investments.

Fortunes have been lost by ill-informed investors, and this is your retirement and financial future at stake here. So, taking the time to learn how to properly buy stocks online in Canada is key.

Before we start to buy and sell stocks, we need to decide what type we’re going to buy.

A solid investment strategy will allow us to do this.

When it comes to stock trading, there are 4 key long term strategies we’re going to go over.

Step 5A: Dividend investing

For beginners first learning how to buy stocks in Canada, this is going to be the top strategies they gravitate to.

This is because dividend stocks, whether it be a Canadian company or US company, are typically (but not always) more reliable and less volatile than stocks that don’t pay a dividend.

So for those with a low risk tolerance or those still trying to figure out what their risk tolerance even is, buying reliable stocks that tend to fluctuate less can build up confidence.

The goal of dividend investing is to buy individual stocks or exchange traded funds that pay you income.

You then take this dividend income and re-invest it into the stock market, often in the exact same stocks that paid you the dividend.

In fact, you can often DRIP (automatically reinvest the dividends) at market price or even at a discount to market price depending on the company’s program.

And the best part, most of the time DRIPing your dividends is commission free.

Step 5B: Value investing

Quite possibly the most challenging strategy when it comes to buying stocks online is value investing.

The approach with value investing is to trade stocks you believe are trading below their intrinsic value.

Intrinsic value is deemed the “fair value” of the stock, or what the stock should be trading at considering the value of underlying company.

Value investors view the stock market as inefficient, meaning that a stock could be worth much more, or much less than it is currently trading at today.

The end goal would be to buy individual stocks when you believe they are trading below their intrinsic value, and sell when you feel the price of a stock has gotten too ahead of its intrinsic value.

Value investing and dividend investing are often intertwined, as a lot of the time an investment in a value stock will be one that pays a dividend, as they tend to be mature companies.

However, if you’re looking to deploy this strategy, make sure to do your research including how fair values are calculated, and the discounted cash flow model.

Step 5C: Growth investing

Growth investing is an investment strategy that tends to draw the allure of many new investors looking to get started in the stock market.

This is primarily because it has the potential for large gains on a stock purchase.

This is because you’re making an investment in a company that may not be profitable today, but is growing at a rapid pace.

The stock markets often over value growth stocks. This is because investors are paying a premium now for the stock, hoping that it will be a discounted price to pay in the future because of its rapid growth.

However, if a growth stock doesn’t come to fruition and the company doesn’t meet expectations, it often causes prices to fall rapidly as investors become sellers and move to other options. We are seeing this extensively in 2021 and 2022.

Buying growth stocks takes a keen eye and accurate predictions when it comes to industry and individual company growth, and it’s often a trading strategy most beginners should avoid until they get their feet wet.

Step 5D: Index investing

I know this is a guide on stock trading and getting comfortable with buying stocks, but there is no doubt that index funds are making waves today, whether it be a mutual fund or an exchange-traded fund.

An index fund is essentially a basket of investments that aim to track a particular stock market index. So for example, you could purchase a mutual fund or ETF that tracks the TSX index. Inside of that index fund will contain either all or a sample size of all of the stocks trading on the Toronto Stock Exchange.

With these index funds, you then benefit from the rise (or fall) of the underlying stocks within it. Overall, index funds are an extremely low-cost way for beginners to get exposure to the markets.

And in fact, most investors would be wise to use a combination of both index funds and stocks to create a well-balanced portfolio.

Your trading platform may even offer commission-free trading of these funds, which make them even more low cost and feasible for many people looking to just start out.

Step 5E: Dollar-cost averaging

This isn’t necessarily an investment strategy that will determine what stocks you will buy, but it will determine how you will buy those stocks. Dollar-cost averaging is somewhat of an automated form of buying shares of companies you like.

When an investor dollar-cost averages, they are deciding to set aside an allocated amount toward a particular stock, regardless of the price. This can be every week, month, semi-annually or even yearly.

The key to dollar-cost averaging when buying stocks is to buy an exact dollar figure of the stock regardless of the price.

So, as an example, you’ve allocated $1000 every two months to stock ABC. The price currently sits at $50 a share. Your first purchase allows you to buy 20 shares. Over the course of the next two months, the stocks price has dropped to $40. You’ve done your research, and you still like the company, so you purchase another $1000 in shares.

You’ve now dollar cost averaged your way down in price, as you now own 20 shares from your initial purchase at $50 a share, and 25 shares at $40.

You now own 45 total shares for $2000, or an average price of $44.44 a share.

Dollar-cost averaging allows you to capitalize on short-term volatility and build out your portfolio over the long term. It’s important to keep up with the overall health of the company. If something has changed, especially for the worse, you may want to cease your dollar cost strategy and instead sell your position.

Step 6: Learn how to buy a stock on your brokerage

So finally, at step 6 of this guide on buying stocks, we’re ready to actually buy.

Many online brokerages have different interfaces and nuances to go about buying a stock, but the core method of doing so will be the same.

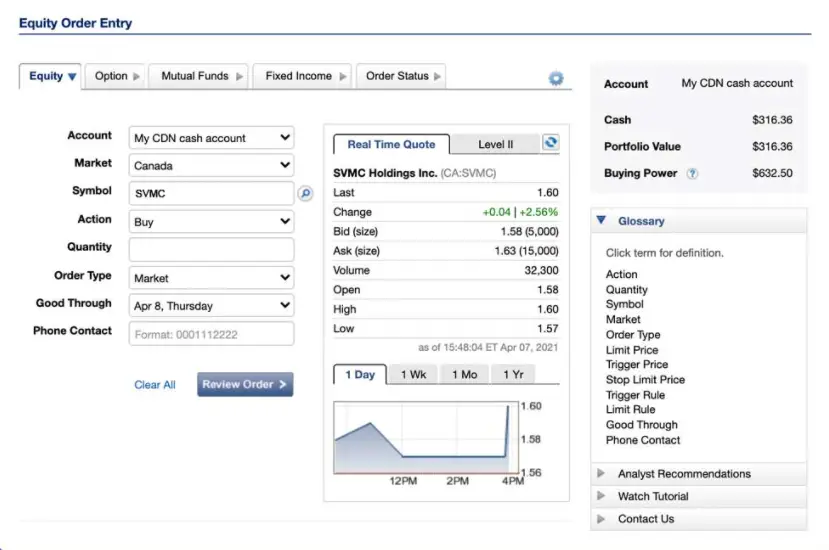

In my eyes, the best online brokerage in terms of simplifying the buying and selling process is Qtrade. Here is Qtrade’s order page below:

Discount brokerages tend to offer cheaper commissions, but it’s very important we don’t get focused on commissions only, and instead choose the best online brokerage that is going to help us succeed.

We need to now go over some terminology that is going to help you narrow down exactly how to place an order with your brokerage and actually buy your first stock.

Step6A: Bid and ask price

Think of the bid and ask price of a stock being the “billboard” of the stock exchange.

If someone wants to sell a stock for $5, the ask price of the stock will be posted as $5.

If someone is willing to buy a stock for $4.90, the bid price of the stock will be $4.90.

In reality, the stock markets have millions of these orders going on at once, but if we isolate a single event like this, we can see how the exchange works if you want to purchase shares in a particular company or sell a stock.

Because the ask is $5, and the bid is $4.90, the trader attempting to sell the stock will not have their order filled unless they bring their price down to $4.90, the highest an investor is willing to pay.

The difference between the bid and the ask is what we call the spread.

Market Orders

If you’re looking to start trading stocks and trade them fast, the market order is for you.

It is the most basic of all order types, as it simply tells your brokerage to buy or sell, regardless of the price you get.

Now, the brokerage will still get you the best possible price on your shares, however, liquidity comes into effect.

While this order likely won’t hurt you on a high-volume dividend stock like the Royal Bank of Canada, you may get punished severely for a stock that isn’t traded as heavily.

Brokers will list the total “volume” of a stock, which is how many shares are traded on a daily basis. If you place a market order for a stock like Royal Bank, often your order will be filled within a few seconds, and for the current trading price, give or take a few cents.

This is simply because of supply and demand. In a single day, over 1.5 million shares of Royal Bank could be traded. On the contrary, with a low-volume stock, someone looking to buy or sell shares of individual stocks may have set their price significantly lower or higher than the current trading price. Important to be mindful of that.

This is where the disregard for the actual pricing of individual stocks comes in. Your online brokerage will fill your order as fast as it can, and you may end up paying $25 for a $15 stock or selling your $15 stock for $5.

**Note: If you own mutual funds inside of your accounts and wish to sell, the price is often calculated at the end of the day, and you are issued your capital based on that calculated price. Mutual funds are a bit more complex and do not trade like stocks. So, if you’re considering buying a mutual fund, this is something to consider**

The Limit Order

Simply put, the limit order helps you control your price when buying or selling a stock.

With this order, you’re able to set conditions on your purchase or sale of an individual stock, and online brokers won’t execute the trade until your pricing conditions are met.

If you own a $20 stock and are looking to sell your investment, you may set a “limit” on the price of $19.50. This means that if you cannot sell your stocks for $19.50, you don’t want the order to be executed.

The same applies to buying a stock. If you’re looking for a stock that is currently trading at $20 and would be a buyer at no more than $21, you can set a limit order to not pay more than $21.

Like I said above, trading stocks that are moving at higher volumes more than likely won’t get you into trouble not using this order, but I suggest using a limit order any time you make a purchase of an individual stock. Why?

Using a limit order is a very good habit to get into, and reduces the chances of you slipping up and accidentally executing a market order on a highly volatile or low volume investment.

Most online brokers these days have interfaces that are very easy to use in terms of order types, and limit orders are usually near the top because of their popularity. Overall, the limit order is the number one order you should be using when buying stocks online. Protecting your investment from fluctuating prices should be your priority, and this does just that.

The Stop Limit Order

The stop-limit order is a very versatile order for buying stocks online. It can help limit your downside, and also eliminate the need for you to consistently watch your holdings.

With a stop limit, the investors issues a stop price, which is the price they’d like to sell their investment at. They also issue a limit price, which is the lowest they’d take for a sale of the stock.

This is much easier to explain in a simple example.

Say you purchased a stock for $10, and it has risen to $20. You want to see if the momentum will continue, but you also want to protect profits. So you issue a stop price of $18 and a limit price of $17. This means that once the stock hits $18, your brokerage will execute a limit order on the stock where it will execute your transaction as long as the selling price is higher than $17.

Step 6a: Order durations

Order durations are very important when it comes to trading stocks. This is because we often become busy, and don’t have time to monitor our accounts all day and change orders.

So, our trading platform allows us to set specific order durations to ensure our trade gets executed when we want and expires when we no longer see a use for it. This is one of the huge benefits of online trading.

On most online brokerages, you’ll see a “duration” tab when you go to purchase an investment. This tab will have a variety of options, most of them being pretty self-explanatory.

Good till canceled (GTC)

This means that a stock purchase or sale order will sit in the queue until conditions are met, and won’t expire until you’ve canceled it.

Good till date order (GTD)

Setting a GTD order means that your stock purchase or sale order will only go through up until the particular date you set. After that, the order will expire.

Good till extended market (GTEM)

This isn’t relevant for Canadian stocks, as we don’t have activity in our after-hours market, but your discount brokerage is likely to offer it anyways for international stocks.

This essentially means your order will be good until the extended (or after-hours) markets are closed.

Immediate or cancel (IOC)

An immediate or cancel order tells your brokerage to immediately attempt to fill an order at the current price, and if it can’t, cancel the order. The difference between this and a market order is the fact that an IOC order can potentially be partially filled.

So if you decide you want to sell 100 stocks at the exact price right now, an IOC order might get you that price on 40 shares, and you’ll be left with 60. Whereas with a market order, it would get whatever price it could to fill your whole order.

Fill or kill (FOK)

A fill or kill order is much like the IOC, except in the fact that you’re telling your brokerage to fill your whole order immediately, or fill none. It will not execute partial trades.

Step 7: How to buy stocks FAQ

This guide should be more than enough to get you started in terms of buying individual stocks and investing in general.

However, we do realize that investing comes with many other questions, so we’ve decided to add this FAQ for those who are looking to start investing, but still have questions about stock trading after reading this guide.

How to buy stocks in Canada without a broker?

This is a valid question, and initially this stumps beginner investors. This is primarily because they’re used to dealing with a bank that purchases mutual funds.

However, the process is pretty easy. All you need to do is open up a self directed brokerage account at a brokerage like Qtrade, which we believe offers the best platform in Canada.

Of note, you can also purchase through a direct stock purchase plan via the company itself. However, direct stock purchase plans are often confusing, and may require large amounts of capital before the company allows you to buy. The best option is by far a brokerage.

Is it a good time to buy stocks in Canada?

The best time to start investing was yesterday. Too many Canadians put investing on the back burner due to the markets being overvalued or too risky.

The longer you wait to start investing, the longer you’re giving up long-term, compounding returns.

Even as little as $5000 invested today earning 8% works out to $50,426 in 30 years.

How can I buy OTC stocks in Canada?

Buying OTC stocks here in Canada is as easy as getting set up with a brokerage like Qtrade.

There are a few things to consider, however. For one, you’re not allowed to buy OTC stocks in a TFSA or RRSP unless it is cross-listed on an approved exchange. It’s very important to research whether or not the OTC stock you’re considering buying will be valid inside of a tax-sheltered account.

Secondly, OTC commissions per trade are much higher than normal. Whatever discount brokerage you’re with, make sure you understand costs, as there can be a wide range of commissions when comparing discount brokerages like Interactive Brokers and Questrade to a major bank like RBC Direct Investing.

What stocks to buy as a beginner?

The most reliable and least volatile stocks that you can buy as a beginner tend to be income-paying stocks in mature sectors like telecom, utilities, and financials.

These stocks typically don’t have big movements in price, so beginner investors are likely to make fewer mistakes owning them. We’re avid believers that the core of every investor’s portfolio should be built off safe, reliable dividend-producing stocks.

Is it worth buying 10 shares of a stock?

In short, absolutely. The amount of stocks you buy per trade has no bearing on the returns of an investment.

Purchasing one $1000 stock or a thousand $1 stocks makes zero difference. You have $1000 invested.

There is a common misconception that high-priced stocks struggle to go up as much as a low-priced stock.

The key thing to understand is total returns. a 10% return on investment is a 10% return, regardless of how many shares you own.

There are some instances where purchasing more shares benefits investors, like giving them the ability to purchase covered calls. But as a beginner, you don’t need to worry about this.

How can I buy US stocks in Canada?

The process is quite easy. Use a strategy like Norbert’s Gambit to convert your Canadian dollars to U.S. dollars, and purchase the U.S. stocks much like you would a Canadian stock.

The key thing to understand, however, is some accounts are better for holding USD stocks. For example, U.S. stocks in a TFSA will accrue a withholding tax on dividends, while dividends paid from U.S. companies inside of an RRSP will not.

It’s important to do some research prior to purchasing U.S. stocks in Canada.

How many shares of a stock should I buy?

Ultimately, you should buy however many shares that equals out to a well-balanced and diversified portfolio.

Optimally, a stock should make up no more than 7% of your current portfolio.

So if you have a balance of $10,000 and are looking to buy a $100 stock, 7 shares would align well with a 7% per stock allocation.

Should you buy stocks during a crash?

Purchasing stocks during a crash can seem daunting, and downright crazy.

However, this is primarily where money is made in the markets. The most important thing to do if you’re going to purchase stocks during a crash is to average into position.

This means spread out your purchases per trade over time. Average them out over several weeks or months. This allows you to reduce your overall risk. If you purchase all your stocks today and the it continues to crash, this isn’t optimal.

However, if you purchase some today, some next month, some the month after and so forth, you expose yourself to a longer period of price movements.

Can stocks go to zero?

Absolutely. It is possible for any stock to go to zero.

It is very, very unlikely solid blue-chip stocks will lose all of their value, but it is certainly possible with small/micro/nano cap stocks that are in the emerging growth phase to go bankrupt.

If this happens, you’d ultimately lose all the money you had invested.

Can you lose more than you invest?

In a tax-sheltered account like an RRSP or a TFSA, the government prevents you from purchasing stocks or other investments “on margin” or via borrowing.

However, in a non-registered account, your brokerage will allow you to borrow funds to invest. For example, with an account balance of $5000, they may allow you to invest $15,000. An account balance of $50,000 they may allow you to invest $150,000 etc.

So in this case yes, you could lose more than you invested. And this is exactly why beginners should avoid borrowing to invest at all costs.

Is there commission free share trading in Canada?

Yes, there is. Wealthsimple Trade is a very popular brokerage here in Canada that offers commission-free trading of Canadian shares.

However, it is important to note that Wealthsimple Trade does charge currency fees for exchanging Canadian to US Dollars, and fees cannot be reduced by performing a popular strategy like Norbert’s Gambit.

**Online brokerage services are offered through Qtrade Direct Investing, a division of Credential Qtrade Securities Inc. Qtrade and Qtrade Direct Investing are trade names and trademarks of Aviso Wealth Inc. and its subsidiaries.Please be advised that the information contained herein does not constitute investment advice and it should not be relied on as such.**