Pollard Bank Note (TSE:PBL) Is Soaring, but Is It Overdone?

There’s nothing I love more than a solid growth stock. One that not only has grown at an exceptional rate, but has a strong foothold in its market already. Today, I’m going to speak on one of those stocks, Pollard Banknote (TSE:PBL).

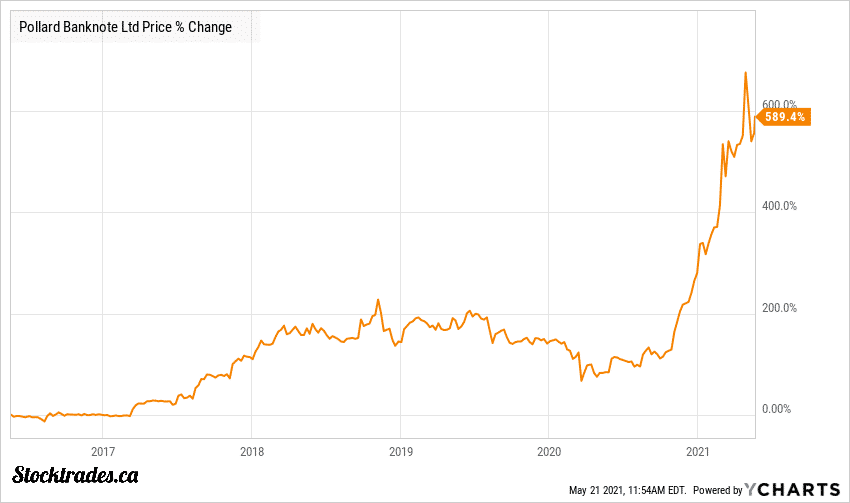

The stock has had an exceptional run in late 2020 and early 2021 and Canadian investors as well as those looking at Canadian stocks are now wondering if the company still has room to run, or if this high-growth stock is set for a big correction.

What does Pollard Banknote (TSE:PBH) do?

From the sound of the name, you’d think Pollard might be a financial company. However, it’s a gambling company. Pollard Banknote manufactures, develops, and sells scratch off tickets and other lottery based products.

In fact, the company is one of the largest producers of lottery tickets in the world. So, there’s a good chance if you head to a gas station and see the scratch off tickets underneath the checkout counter, it’s a Pollard product.

The company has a diverse set of products, as it not only supplies scratch off tickets but retail telephone selling, marketing, digital products, and instant ticket vending machines. It also includes a charitable gaming line that includes pull-tab tickets, bingo paper, pull-tab vending machines, and other ancillary products.

However, the bulk of the company’s revenue comes from the sale of its scratch off tickets.

How fast has Pollard been growing?

Pollard has achieved exceptional growth both organically and via acquisition. It has acquired some of the largest companies in the world in terms of charitable and lottery gaming products, and merged them seamlessly into the fold.

The company partnered up with NeoGames in a 50-50 joint venture called NeoPollard, and it is currently the most successful company in the industry…

Since 2014, the company has doubled its top line, going from $194.7M to over $414M to close out 2020. What’s even more impressive however is the bottom line has increased over that same period by almost 4X. Span that out to a decade long period? Pollard has increased net income nearly tenfold.

If we look to the chart above, we can see that Pollard’s growth in net income has accelerated significantly over the last two years.

The primary driver for its growth? The adoption of the iLottery space, which allows things like scratch off tickets to be purchased and played on the internet. The company partnered up with NeoGames in a 50-50 joint venture called NeoPollard, and it is currently the most successful company in the industry.

It’s possible the current trajectory for Pollard might continue. However, it’s important we take valuations into consideration.

Pollard is trading significantly higher than its historical averages

When you put up the performance Pollard has, you’re bound to get some attention. As a result, the company is currently trading at 35 times trailing earnings. That is a 20%, 32%, and 68% premium respectively to its 3, 5, and 10 year historical averages.

There’s zero question you’re paying a pretty penny for Pollard right now compared to what you would have paid other times in the last decade.

A purchase right now in Pollard must carry with it the confidence that management can continue to drive growth on both the organic and acquisition front, as well as continue to expand in the iLottery space.

Thus far, with exceptional returns on assets (10.36%), equity (28.22%), and invested capital (15.01%), this is a management team that has proven it can provide exceptional returns for shareholders. It also has a knack for topping analyst estimates, beating revenue and earnings expectations 75% of the time over the last 2 years.

The company has outstanding fundamentals, but at 35 times forward earnings, it will need to continue performing at an exceptional level to justify valuations.

I guess you could say the “buffer” and margin of safety in Pollard’s price have been reduced significantly. A once undervalued option that didn’t garner much attention, it was only a matter of time before they hit the spotlight, and the market values this company for what it is, an efficient high growth option.

If you’re looking for more in-depth convo and details relating to Pollard, consider joining Stocktrades Premium and hopping on our exclusive Discord server. We speak on the company quite frequently. Another Canadian stock that saw a run-up was Altagas (TSE:ALA).