Preparing for a Stock Market Crash? Have a Look at This Defensive Stock

It’s been evident that the honeymoon is over for speculative stocks in 2021. As the markets touch new highs every week, to investors who are overweight speculative options it may seem like the market is outright crashing.

It may be hard lesson learned, but it’s clearer now more than ever that you need to be buying Canadian stocks that are defensive, stable options to be able to weather any sort of economic environment and market conditions.

In this article, I’m going to look at one of the relatively unknown Canadian stocks, one that has provided stability through the rocky market conditions we’re currently in, and pays an excellent dividend to boot.

That company is Andrew Peller (TSE:ADW.A)

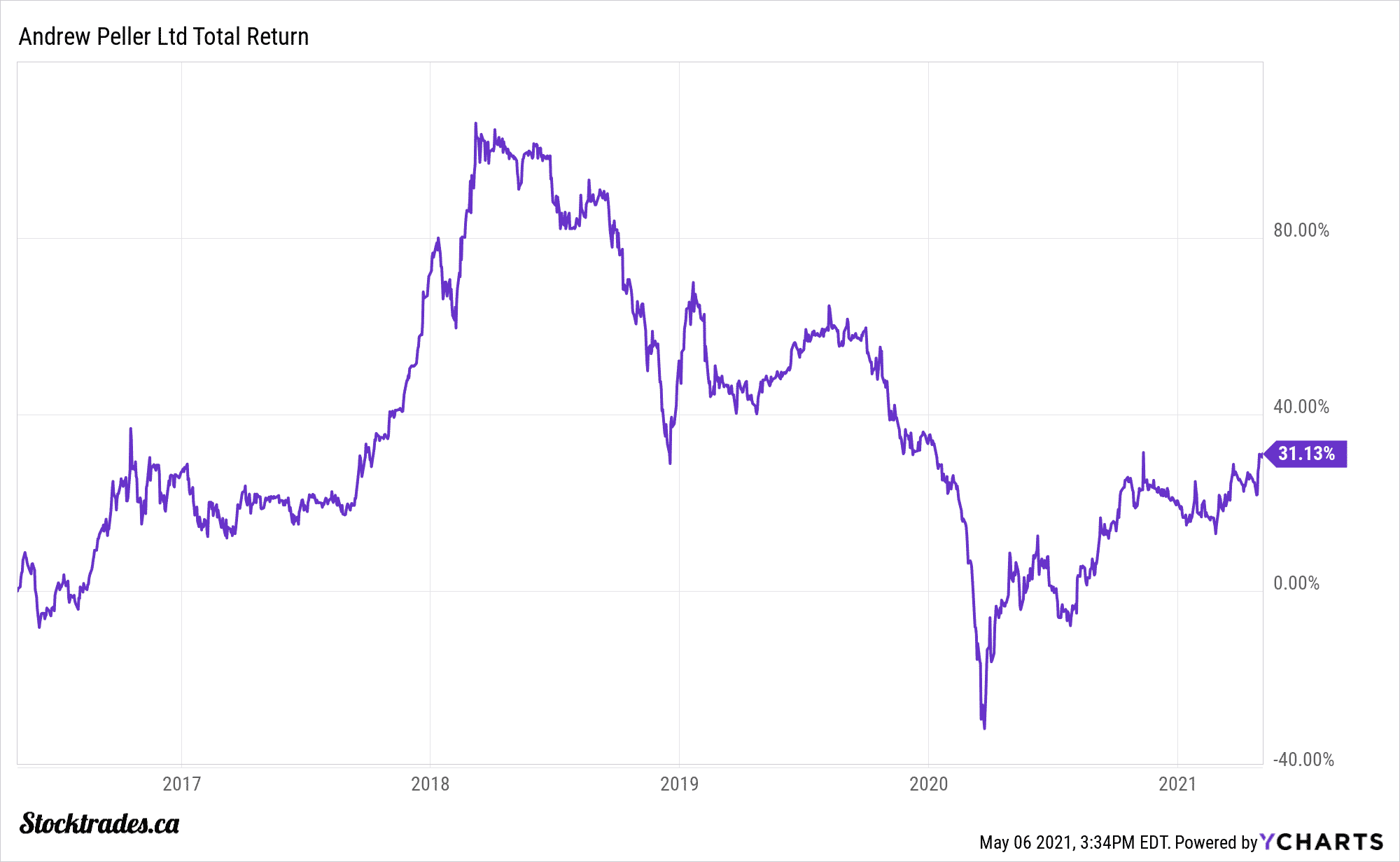

Andrew Peller (TSE:ADW.A) 5 year total return

What exactly does Andrew Peller (TSE:ADW.A) do?

Andrew Peller is a small cap Canadian company that produces and markets wines. Some of the company’s most popular brands include Peller Estates, Trius Winery, Thirty Bench, Wayne Gretzky, Sandhill, Red Rooster, Calona Vineyards and many more.

What makes Andrew Peller a defensive investment?

As we’ve witnessed throughout the COVID-19 pandemic and other economic slowdowns, revenue tends to increase for companies that produce “sin” products like alcohol and tobacco.

This was definitely the case with Andrew Peller. Although miniscule, the company reported growth on the top and bottom lines.

Some companies that were considered “defensive” in nature were severely impacted by the COVID-19 pandemic, the fact that Andrew Peller was able to increase earnings in the high single digits all while maintaining revenue is a testament to the true defensive nature of the stock.

The company holds some of the most popular brands across the country in terms of wine, and will no doubt be able to drive the top and bottom lines, regardless of economic conditions.

Andrew Peller is under-covered, and trading below historical valuations

There is a grand total of 2 analysts covering Andrew Peller. This has led to the company being undervalued on a historical basis and despite strong fundamentals, it is shrinking in price.

The two analysts who are covering the company have given it a $16.25 price target, which indicates almost 44% upside from todays levels, and on a valuation basis at 14.56 times earnings, Andrew Peller is trading at a steep discount to its 3, 5, and 10 year median averages.

In fact, the last time the company has been this cheap on a price to earnings, price to sales, and price to book value was in 2014.

Under-covered stocks can be both a benefit and a downfall to investors. Although this generally makes them cheaper due to being out of the public spotlight, it also can make them deviate from their true value for quite some time. I believe this is the case with Andrew Peller. So, an investment would require quite a bit of patience.

Analysts are expecting steady growth for the company in 2021

As I had mentioned prior, the company only has two analysts initiating coverage. So, this tends to skew the overall consensus as a single analyst’s estimates have a much bigger weighting than if there were 10-15 analysts covering the company.

But, they are expecting strong growth for the wine producer in 2021, with revenue expected to come in around the $395 million range and earnings per share of $0.81. This would mark a 3.4% revenue growth and 26.56% earnings growth from 2020.

This also bodes well for the company’s excellent dividend, one that has been growing at an accelerated pace.

Andrew Peller’s dividend is an added bonus on top of stability

Andrew Peller has a 15 year dividend growth streak, making it one of the top 25 Canadian stocks in terms of consecutive annual dividend raises. Not bad for small cap stock.

It pays a modest yield of 2.08%, and the company has been able to grow its dividend by an average of 8.98% annually over the last half decade. Its most recent raise came in at only 4.87%, but with the dividend making up only 27% of earnings and 38% of free cash flows, it’s clear this was a prudent move by management because of the pandemic.

A low beta, strong dividend and reliable sales builds a strong thesis

Andrew Peller has a beta of 0.5, suggesting that when the TSX Index moves 1%, Andrew Peller moves 0.5%. This isn’t going to be a company that blows you away with outstanding capital appreciation, however I think it’s important to develop the mentality that we don’t need every stock in our portfolio to do so to justify a strong investment.

If you’re looking for a stock that’s undervalued relative to its historical numbers, pays an excellent dividend, and likely won’t face too much turmoil in the event of a market correction, Andrew Peller is one to add to your shortlist.