Rising Interest Rates? Have a Look at These Two Top Canadian Stocks

We’re entering an environment that is going to be increasingly difficult to invest in. Inflation was supposed to be transitory, but it’s becoming more clear that it’s here to stay. And as investors, we need to prepare our portfolios.

When consumer spending and inflation is high, the government steps in to take it down a notch. They do this to stop runaway inflation and rapidly increasing prices, and they do it by increasing interest rates. In the end, increased rates slows spending and borrowing as the government tries to moderate economic activity.

There is almost no question that rising interest rates are coming. So, what Canadian stocks should you be looking at today? Lets take a look at a few.

Royal Bank of Canada (TSX:RY)

The Royal Bank of Canada (TSE:RY) is one of the largest companies in the country. RBC is also the largest bank in the country, operating not only in Canada but in 37 other countries. The bank offers personal and commercial banking, wealth-management services, insurance, corporate banking, and capital market services.

Financial institutions like Royal Bank are set to benefit from a rising rate environment.

Why?

A financial institution utilizes current interest rates to price its products. Lines of credit, mortgages, and other types of loans are often based off of a core interest rate and then adjusted based on the clients overall risk and dollar amount.

As interest rates rise, Royal Bank will be able to charge more for these loans. There is the bear case that because of rising rates less will borrow, resulting in lower overall loan issuances. But historically, rising rates have proven to be a net positive for banks.

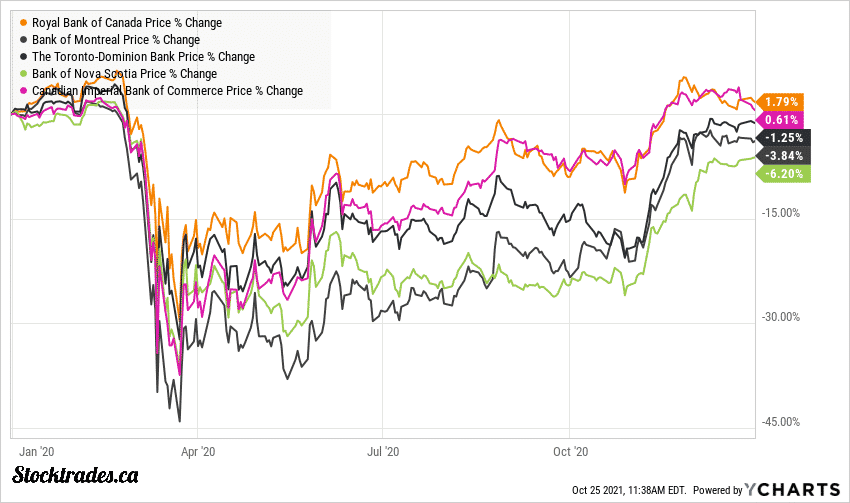

Interest rates aside, Royal Bank is a company that should hold a place in many portfolios regardless of the economic circumstances. The bank is a blue-chip giant, one that showed its resilience during the COVID-19 pandemic, being one of the best performing Big 6 banks in Canada.

Looking at a year to date chart or even a 1 year performance chart will show you that Royal Bank is the worst performing Canadian bank. However, it’s important to understand that this company’s international exposure and brand recognition caused it to perform exceptionally well over the course of the pandemic, and as a result it didn’t need a large rebound in price like the Bank of Nova Scotia (TSE:BNS) or CIBC (TSE:CM) did.

Financials have slowed down a bit after an extremely hot start to 2021, and Royal Bank is left trading at only 11.81 times forward earnings, which is below its 3, 5, and 10 year median averages. The company is also in an extremely strong situation in terms of dividend growth, and should be able to reward shareholders extensively once dividend restrictions are lifted by the OSFI.

All of Canada’s banks are extremely strong stocks to own. But, Royal Bank in terms of its blue-chip nature is one Canadians should look at.

Agnico Eagle Mines (TSE:AEM)

Not necessarily a company that will directly benefit from rising interest rates, Agnico Eagle Mines (TSE:AEM) is a company Canadians should be taking a look at because of the underlying situation that will cause rates to rise in the first place.

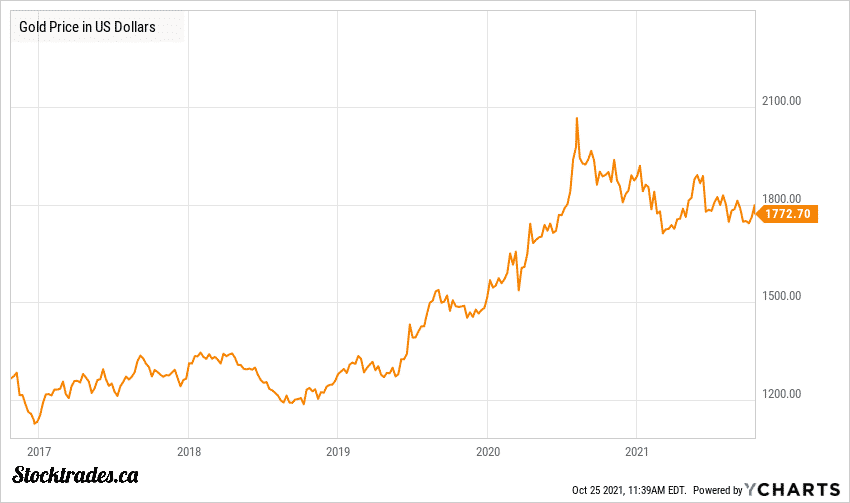

That situation being inflation of course. In particular, rapid inflation. Contrary to popular belief, the price of gold actually has no correlation to inflation, in normal situations. However if we expand this out to include a rapid inflation environment, gold has performed exceptionally well. And, if this is the case moving forward in 2021, some might want to have a material play in their portfolio.

Due to a recent merger with Kirkland Lake (TSE:KL), Agnico Eagle Mines is set to become one of the largest senior gold plays in the country, and is one you should be looking at today. The company operates mines in Canada, Finland, and Mexico, also owning 50% of the Canadian Malartic mine.

The company produced over 1.74 million ounces of gold in 2020, and with gold on the rise yet again after a lull in late 2020 and early 2021, at $1810 USD/OZ, Agnico is set to generate significant cash flow.

Is it the lowest cost producer? No. All in sustaining costs sit around the $1000 USD/OZ level. But the merger with Kirkland Lake, plus consistent history in a reduction of costs gives me confidence that Agnico will be able to continue this into the future.

The company has vaulted growth since the financial crisis, going from a single mine operation to adding more than 5 to its portfolio. And keep in mind, this is pre-merger. The company has had a double digit CAGR on its share price since the late 1990’s, and has also returned to strong dividend growth over the past half decade.

Agnico yields in the mid 2% range, has a 5 year dividend growth streak and has raised the dividend at a pace of 34% annually over that time period.

Overall, the merger with Kirkland Lake plus a rising price environment for gold should result in significant cash flow generation for Agnico moving forward, and it could be one of the best material plays in the country at the time of writing.

Another issue aside from rising interest rates affecting many companies – supply chain problems due to the lasting ripples of the pandemic. We looked at two top Canadian stocks to buy today on supply chain fears.