Royal Bank vs Scotiabank – Which Bank Stock is a Buy Now?

Royal Bank of Canada (RY) and The Bank of Nova Scotia (BNS) are two giants in Canada’s financial sector and some of the largest stocks in the country.

Royal Bank is the larger of the two and has shown impressive growth over the years, with its stock price recently reaching all-time highs.

Meanwhile, The Bank of Nova Scotia has faced some significant challenges Latin America and the Caribbean, and as a result its share price has struggled.

For investors looking at these two banking stocks one may question if the runup in Royal Bank stock makes the Bank of Nova Scotia a more attractive buy.

Both banks have proven their resilience in tough economic times, adapting to changing market conditions and regulatory environments. They’ve also maintained solid dividend track records, making them attractive options for income-focused investors.

But which one is the better choice for your portfolio? Let’s take a deeper look at these two powerhouses.

Key takeaways

- Royal Bank of Canada shows stronger recent performance and growth

- The Bank of Nova Scotia offers a higher dividend yield and potential value

- Both banks have solid fundamentals but face different market challenges

Valuations – Which bank is cheaper?

When we look to the values of these two banks, it is crystal clear Royal Bank is more expensive.

RBC’s trailing P/E ratio of 14.70 is higher than Scotiabank’s 12.58. This suggests that investors are willing to pay a premium for Royal’s earnings.

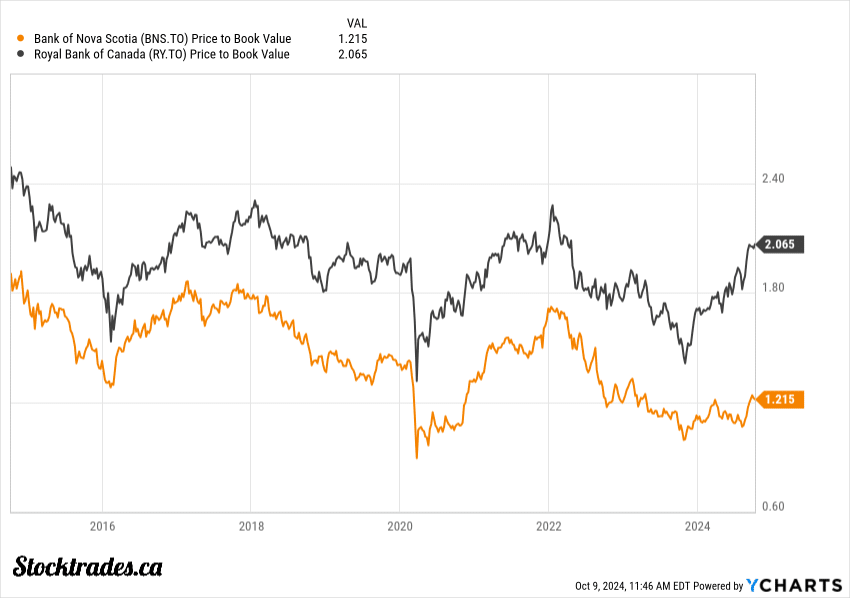

The price to book ratios, something I really only use in the banking industry these days, tell a similar story. RBC’s P/B of 2.04 is nearly double Scotiabank’s 1.09. I find this gap quite significant, indicating that the market values Royal’s loan book way more.

Both banks’ P/E ratios are lower than their 5-year averages, hinting at potential undervaluation. However, I’m cautious about this interpretation given current economic headwinds.

The Bank of Canada’s interest rate hikes have put pressure on bank valuations. Yes, they’re coming down, but they’re also coming down at the expense of the economy, which will continue to impact banks as well.

Overall, Royal Bank is much more expensive than Scotia. However, I tend to agree with the market about it being worth this valuation due to the fact it has higher quality assets and stronger earnings growth.

Royal’s Canadian exposure vs Scotia’s Latin American exposure

I believe Royal Bank of Canada’s strong focus on the Canadian market gives it an edge over Scotiabank’s international strategy. RBC’s deep roots in Canada’s stable economy position it well for steady growth.

The Canadian banking sector benefits from strong regulations and a robust housing market. This provides a solid foundation for RBC’s operations. Consumer spending in Canada has also remained resilient, supporting the bank’s retail business.

In contrast, Scotiabank’s exposure to Latin American markets introduces more risk. These emerging economies face greater volatility and currency fluctuations. Political instability in some regions could also impact Scotia’s performance.

They’d tried to switch it up by buying a chunk of KeyBank, a US regional banker, but they have a long ways to go to convince me they’re back on the track for growth.

RBC’s Canadian-centric approach allows it to capitalize on the country’s economic recovery. As interest rates stabilize, I expect RBC to benefit from increased lending activity and improved margins.

Scotia’s international division may struggle with uneven post-pandemic recoveries across different countries. This could lead to higher loan loss provisions and slower profit growth.

I think RBC’s focus on Canada will result in more consistent earnings and dividend growth.

How do the dividends stack up?

When I look at Royal Bank and Scotiabank, I see two different dividend stories.

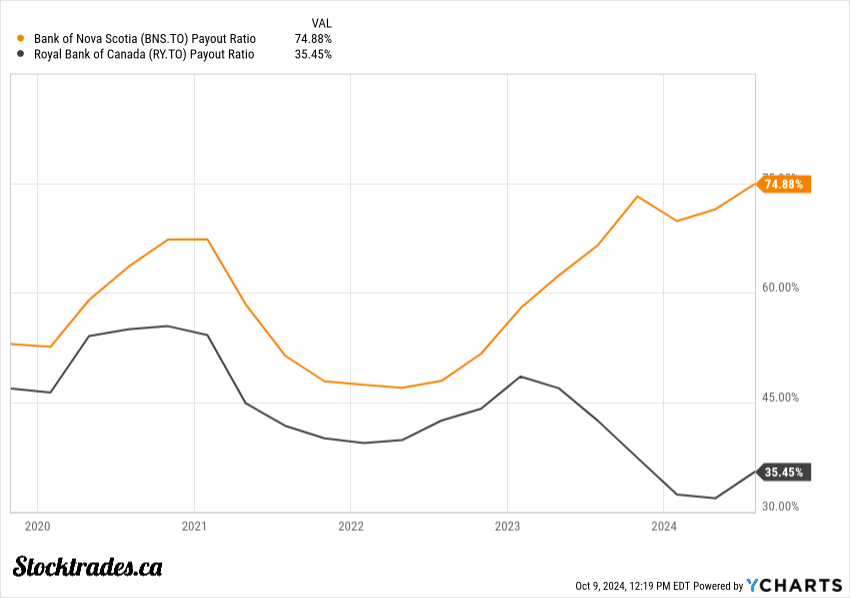

RBC boasts a 13-year streak of dividend growth. Its forward dividend yield of 3.42% might not turn heads, but the 6.69% five-year growth rate is one of the fastest growth rates of the Big 6. RBC’s payout ratio of 35% pretty much guarantees this growth won’t be slowing anytime soon.

In contrast, Scotiabank’s numbers paint a different picture. The 5.90% forward yield is eye-catching, but I’m a bit concerned about the sustainability. The 70%+ payout ratio is much higher than RBC’s, and is not a sustainable payout ratio for a financial institution.

The fact that Scotia hasn’t been able to grow the dividend in recent times either is concerning from a lot of angles.

Both banks face similar regulatory pressures, but I believe RBC’s lower payout ratio gives it more flexibility to navigate potential changes.

For income-focused investors, Scotiabank’s higher yield is tempting. But I lean towards RBC for its balance of yield, growth, and sustainability.

Am I buying Royal Bank or Scotiabank right now?

I believe Royal Bank of Canada edges out Bank of Nova Scotia as the top choice for investors in the current market, despite much higher valuations from Royal.

As for dividends, RBC offers a forward yield of 3.42% with a sustainable payout ratio of 35%. Sure, Scotia’s yield is higher, but the dividend likely doesn’t have much room to grow and the company could actually lose out on its Aristocrat status because of a lack of growth.

RBC’s position as Canada’s largest company gives it a competitive edge amidst a recovering Canadian economy from rate declines.

For growth-focused investors, RBC’s status as Canada’s second fastest-growing bank stock is noteworthy, especially given its large size.

While Scotiabank has its merits, I find RBC’s combination of growth, stability, and income more compelling in the current economic climate. I’d need to see some strong results for an extended period of time from Scotia before I’d buy the stock again.