Are You Paying Too Much For Royal Bank Stock Today?

Royal Bank of Canada (RBC) stands as a titan in the Canadian financial sector. As one of the largest banks in the country, its stock performance often reflects the health of the broader economy.

The bank’s recent financial results paint a picture of strength, despite what many would believe to be a very rough Canadian economy.

The bank has a history of consistent dividend payments and increases, providing a steady stream of income for shareholders. And I do believe it’s in the best position out of the major 6 banks to grow the dividend moving forward.

While the stock’s valuation may seem high compared to some peers, the bank’s track record and market position suggest it may be worth the premium.

Lets dig into why.

Key Takeaways

- RBC should be in the best position of the Big 6 in terms of dividend growth

- The bank’s strong Canadian operations are driving its success

- Current valuations aren’t attractive from a historical standpoint

Q3 Earnings – Royal continues to excel

The bank’s net income reached $4.5 billion, marking a 16% increase from the previous year. This is a relatively high growth rate for an institution of Royal Bank’s size, and is even more impressive considering the Canadian economy.

The bank’s return on equity improved to 15.5%, up 60 basis points from last year. This is one of the best return on equities out of the major institutions, and is even right up there with challenger bank Equitable Bank.

Royal bank hit the mark in practically every segment:

- Personal & Commercial Banking saw significant growth

- Capital Markets performed well

- Wealth Management posted solid results

The acquisition of HSBC Canada has already begun to pay dividends, contributing $239 million to the bank’s net income this quarter.

The bank’s PCL ratio decreased by 14 basis points quarter-over-quarter, indicating that PCLs are somewhat stabilizing.

The bank’s Canadian arm is driving most of its success

Royal Bank of Canada’s domestic operations are the powerhouse behind its performance. The bank’s Canadian division is outpacing its international units by a wide margin.

The bank’s Canadian Banking net interest income surged by 26% year-over-year, and it has seen 11% year-over-year growth in residential mortgage balances.

This growth outpaces many of its major Canadian competitors.

RBC’s lending volumes and deposit base have also shown strength, posting mid single digit growth while many of the other institutions are flat, or even declining to a degree.

I believe the acquisition of HSBC Canada will further cement RBC’s position as one of the best institutions in North America.

While RBC faces stiff competition from other major Canadian banks, it has a significant leg up on the competition at this point in time in my opinion.

Royal Bank’s dividend is the best of the bunch

Royal Bank of Canada stands out as a dividend champion in the banking sector. Its 3.3% yield isn’t the highest of the bunch, but that is primarily due to price appreciation.

What really sets RBC apart is its dividend stability. The bank has a long history of consistent payouts, even during economic downturns.

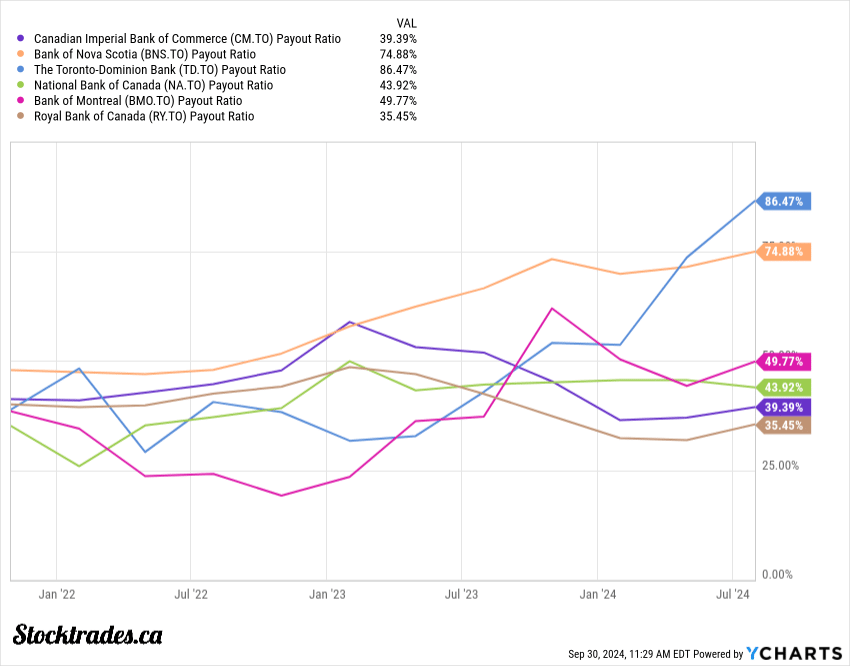

RBC’s dividend payout ratio sits at 35%, the lowest of all banks. I believe this payout ratio is going to be one of the main things fueling the best dividend growth rates out of any major bank moving forward.

While all major banks offer solid yields, RBC’s combination of yield, growth, and sustainability is hard to beat. For long-term investors, RBC’s dividend contributes significantly to total shareholder returns.

The steady income stream, coupled with potential share price appreciation, makes for an attractive investment.

Valuations are high, but likely worth it

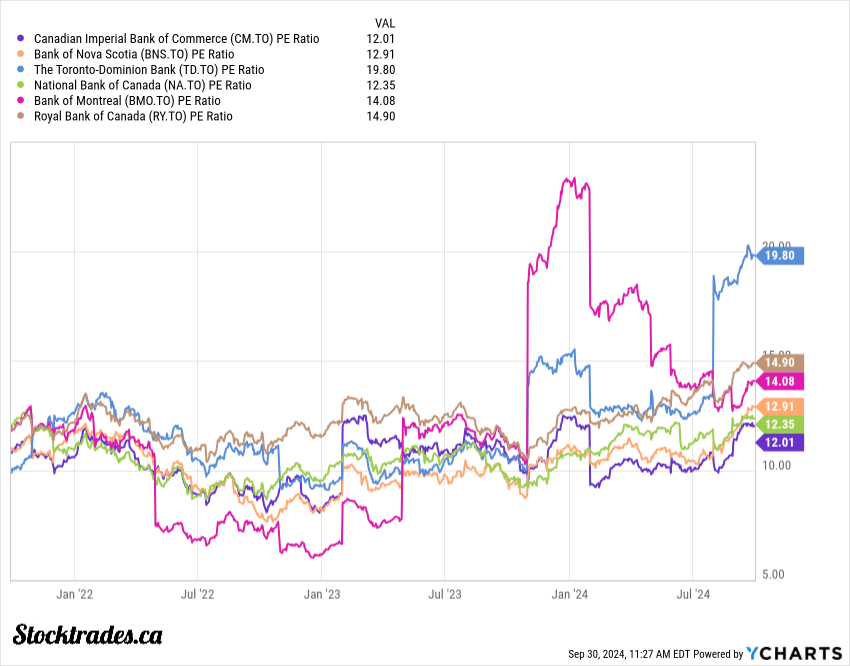

Royal Bank of Canada’s stock currently trades at a premium compared to many of its peers.

The P/E ratio sits at 14.9, which is the highest out of any institution when we don’t factor in TD Bank’s large ratio due to AML issues.

Similarly, the price-to-book ratio of 2.08 suggests investors are paying a premium for the bank’s assets. I don’t typically use price to book as a valuation ratio, but do still like it for banks.

At first glance, these valuations might seem steep. But I believe they’re justified when we look deeper.

Growth potential and overall stability shouldn’t be overlooked. When compared to its Canadian peers, Royal Bank often commands a higher valuation.

But I believe this is warranted given its:

- Consistent profitability

- Strong market position

- Comfortable payout ratios

Would I be buying the bank today?

Royal Bank of Canada presents an intriguing investment opportunity. Overall, I would have absolutely no issues buying today.

RBC’s dividend yield is attractive and is positioned to grow the dividend at the fastest pace of all the major banks, making it appealing for income-focused portfolios. The bank has a history of consistent dividend payments and increases.

On the plus side, RBC’s diverse revenue streams and strong capital position provide stability. It has exposure to over 40 different countries, but also boasts one of the largest Canadian lending portfolios.

One thing to keep in mind, however. The banking sector can be sensitive to market volatility and economic conditions. Canada is doing good from a lending perspective right now, but that can change on a dime.

Royal’s strong foundation and growth potential outweigh the risks, in my view. However, investors should be prepared for possible short-term volatility.