Shopify’s Stock is Soaring – Have You Missed the Boat?

Shopify has faced its share of ups and downs over the years. However, as a Canadian success story, Shopify’s journey from a small startup to a global powerhouse is nothing short of impressive.

The company’s stock has been a rollercoaster ride since its IPO.

Despite market challenges, Shopify has continued to expand its merchant base and improve its platform offerings. Shopify’s stock price has shown remarkable growth since its Q2 earnings release, rebounding from previous lows and signaling renewed investor confidence.

With its expanding suite of tools and services, Shopify is well-positioned to capitalize on the growing e-commerce market, potentially making it an attractive option for investors seeking exposure to the tech sector.

Lets dig into whether or not I think it’s a buy today.

Key takeaways

- Shopify’s stock has rebounded strongly since the Q2 earnings release, reflecting improved investor sentiment

- The company’s expanded offerings and growing merchant base support its long-term growth potential

- Shopify’s moat in the sector is expanding, which should provide a cushion in terms of earnings

Shopify stock soars on strong Q2 results and optimistic guidance

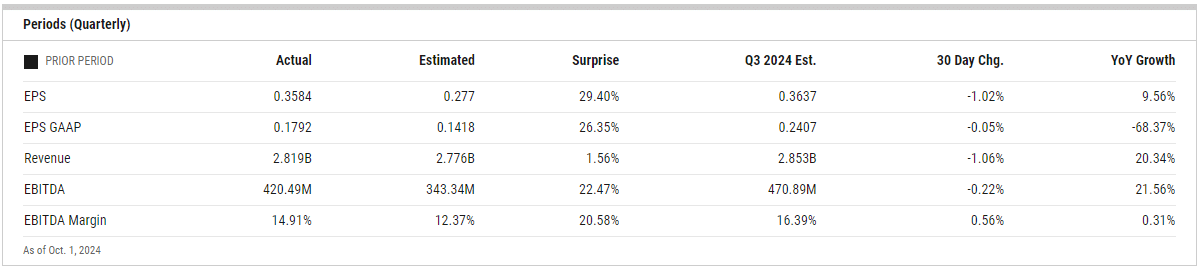

Shopify’s stock has taken off like a rocket after its strong Q2 2024 performance. The e-commerce giant beat revenue expectations, with a 21% year-over-year increase to $2.05 billion.

Subscription Solutions revenue grew by 27%. This shows Shopify is attracting more merchants and successfully raising prices on its plans.

The company’s Merchant Solutions segment was also a bright spot, with a 19% revenue bump. This growth stems from increased Gross Merchandise Volume (GMV) and wider adoption of Shopify Payments.

Tobi Lütke and his team have given investors plenty to cheer about with their optimistic guidance. They’re projecting low-to-mid-twenties percentage revenue growth for Q3 2024.

Sure, this is not as good as the peak of the pandemic. However, it’s still very impressive considering Shopify’s size.

What’s caught my eye is Shopify’s improving profitability. Their free cash flow margin more than doubled to 16% compared to last year. This shows they’re not just growing, but becoming more efficient too.

I think the e-commerce sector’s continued expansion is playing right into Shopify’s hands. As more businesses move online, Shopify’s comprehensive platform becomes increasingly attractive.

Revenue growth set to accelerate in the second half of 2024

I’m very bullish about Shopify’s prospects for the latter half of 2024. The company’s revenue growth is poised to pick up steam, driven by several key factors.

Seasonal trends typically boost e-commerce sales in Q3 and Q4. With the holiday shopping season approaching, Shopify merchants are likely to see increased traffic and sales.

Shopify Plus is becoming a major growth engine as well. This enterprise-level platform is attracting larger businesses, which could significantly boost revenue.

International expansion is another bright spot. Shopify is making inroads in new markets, opening up fresh revenue streams.

The company’s investments in AI tools are starting to pay off. These enhancements help merchants run their businesses more efficiently, potentially leading to higher adoption rates and increased revenue for Shopify.

Shopify’s fulfillment network is expanding. This could attract more merchants looking for end-to-end e-commerce solutions.

Revenue growth of 21% in Q2 2024 shows the company’s momentum. I expect this trend to continue and even accelerate in the coming months.

The growing partner ecosystem is another positive factor. New integrations, such as the recently announced PayPal partnership, make Shopify more attractive to a wider range of businesses.

Margin improvements driven by enhanced operating leverage

Shopify’s significant improvements in margins is something all investors should be taking note off. I’ve noticed a clear trend of enhanced operating leverage driving these gains.

The company has shown remarkable operating margin expansion, reaching 15% in recent quarters. This is well above analyst expectations and marks a huge turnaround from negative margins a year ago.

Several factors have contributed to this margin growth:

- Disciplined cost management

- Scaling of infrastructure

- Expansion of high-margin services

Shopify’s ability to handle more transactions without proportionally increasing costs is a key driver. The company has smartly invested in its technology stack, allowing for efficient scaling.

I’m particularly impressed by the growth in adjusted EBITDA. The shift towards higher-margin subscription services has played a crucial role. These recurring revenue streams provide stability and better profitability compared to transaction-based income.

Gross margin improvement has been another bright spot. Shopify’s strategic moves, including divesting its logistics business, have helped streamline operations and boost overall margins.

In my view, these margin improvements demonstrate Shopify’s maturing business model. The company is showing it can grow efficiently, which bodes well for long-term profitability and shareholder returns.

Is now the right time to buy Shopify stock?

I believe now is an excellent time to buy Shopify stock. The company has shown impressive growth and resilience in the face of market challenges.

Shopify’s revenue has been accelerating, with improving profit margins. This trend suggests the company is managing its expenses well while continuing to expand. The company is projected to achieve accelerated growth in both revenue and earnings, with a compound annual growth rate (CAGR) of 21.3% and 33.7%, respectively, through 2026.

The e-commerce market has enormous long-term potential. And Shopify’s wide moat and innovative products give it a strong competitive advantage.

While there are always risks in investing, I think Shopify’s potential rewards outweigh them. The company’s strong position in a growing market makes it an appealing long-term investment.