Should You Buy Suncor (TSE:SU) or Canadian Natural (TSE:CNQ)

For those who are looking to gain exposure to oil and gas moving forward, there is often a hot debate on which producer to choose.

Those who want to take on a little more risk might opt for a junior producer. In a rising oil environment, we can expect junior producers to outperform. However, when things get rocky, they can be extremely volatile.

In this situation, many looking to buy Canadian stocks in the oil and gas sector look to major producers, as they tend to be more reliable and can withstand commodity swings.

The two most popular options in the country are Suncor (TSE:SU) and Canadian Natural Resources (TSE:CNQ). In this article we’re going to have a look at which option might be best for Canadian investors today based on three things:

- Income

- Growth

- Valuation

Suncor (TSE:SU) vs Canadian Natural (TSE:CNQ) business models

Suncor Energy is one of Canada’s largest integrated oil producers. In fact, it is currently in a back and forth battle with, you guessed it, Canadian Natural Resources for the title of Canada’s largest oil and gas company by market cap. Post 2020 crash however, Canadian Natural has widened the gap and is now $10B larger than Suncor.

In terms of production capacity, Canadian Natural produced an average of 1.16M barrels a day in 2020, while Suncor expects to produce around 740-780k barrels a day in 2021.

The key difference between the two is the fact that Canadian Natural Resources is strictly an oil producer, while Suncor has an integrated business model, meaning it has upstream, midstream, and downstream operations.

Lets have a look at the dividend

Investors generally look to oil and gas companies, especially major producers, for their dividends. I think it’s appropriate to analyze both Canadian Natural and Suncor on this front first. So, who has the best dividend?

The clear cut winner in this regard is Canadian Natural Resources, for a few reasons.

For one, the company managed to maintain the dividend throughout the 2020 oil crisis. Suncor on the other hand, due to poor timing in regards to share buybacks, was forced to cut the dividend only a month or so into the pandemic.

This effectively puts Suncor’s dividend growth streak to 0, while Canadian Natural’s streak sits at 20 years, putting it in a tie with TC Energy for the 13th longest dividend growth streak in Canada.

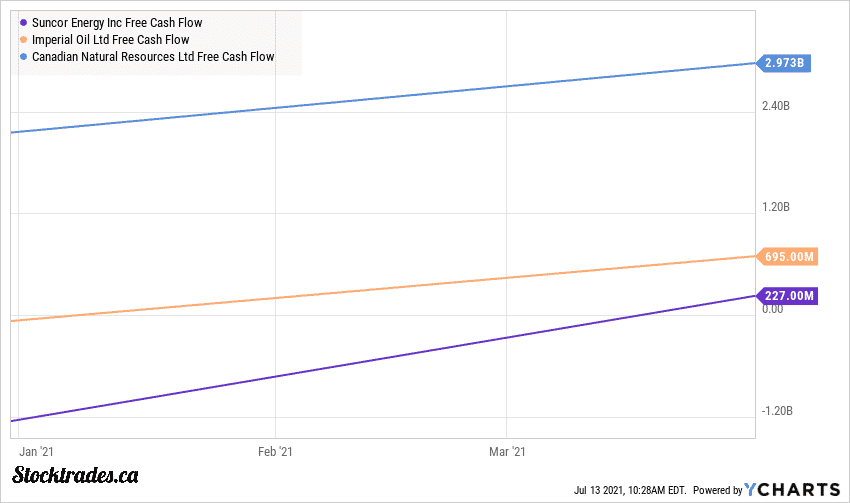

CNRL also tops Suncor in terms of yield at 4.22% vs 2.90% and has been a much more reliable option in terms of free cash flow generation. The company has the highest free cash flow yield out of any major producer and is expected to generate $7.9B USD in free cash flow in 2021, nearly $2.2B higher than its next competitor.

This allows for a more reliable dividend, and is one of the key catalysts to Canadian Natural continuing to raise its dividend from $1.70 to $1.88 a year in 2021, despite plummeting oil prices.

In terms of trailing payout ratios, you’ll likely think these dividends are at risk of being cut, but they aren’t. 2020 is a bad year to compare the dividend against earnings and cash flows. On a forward looking basis, both Canadian Natural and Suncor’s dividends are safe.

Forward growth estimate comparison

Next, we want to look at how both Suncor and Canadian Natural are expected to grow over the next few years.

In terms of both top line growth and free cash flow generation, Canadian Natural Resources is the clear cut winner again.

The company reported a loss of $0.276 per share in 2020, but is expected to make a sharp rebound in 2021 & 2022, with EPS estimates of $3.43 and $3.36 respectively. Expected revenue of $21.33B would mark a 60% increase off pandemic levels.

For Suncor, the company lost $2.83 a share in 2020, but is expected to rebound to a profit of $2.73 a share in 2021. Expected revenue of $36.87B represents a 47% increase from the year prior.

At $60 US WTI, Canadian Natural is expected to generate $11.5B in free cash flow, which works out to be $9.7 in FCF per share. Simply put, it’s one of the best free cash flow generators in the country.

Suncor or Canadian Natural stock at current valuations

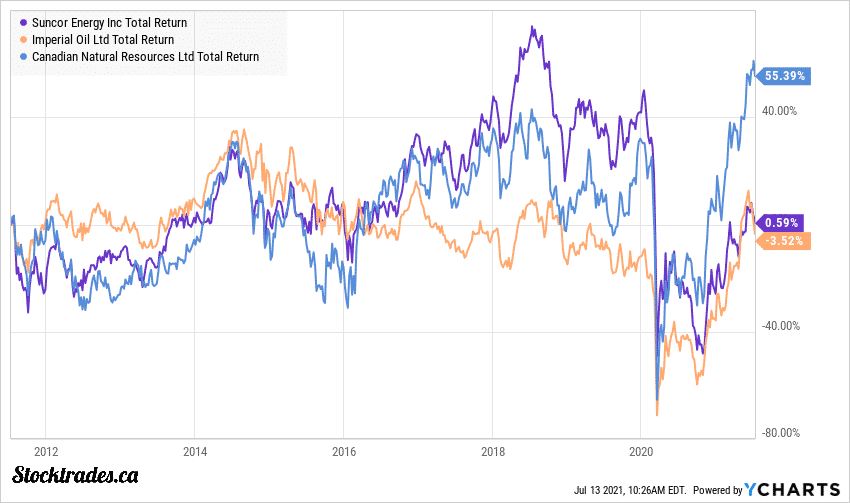

There’s no doubt that on a cash flow generation and dividend level, Canadian Natural is the better performer. However, in the end what you pay for a company is all that matters.

And in this case, Suncor seems to be the more attractive option at this point, in terms of both current valuations and when compared to historical averages.

Trading at 9.4 times forward earnings and 1.1 times forward sales, Suncor is trading well below its 3, 5, and 10 year median averages. However, it is important to note that most of these historical averages were prior to Suncor’s dividend cut.

Once a dividend is cut, the market will no doubt punish the company with a lower multiple in terms of both earnings and sales. Prior to the pandemic, it wasn’t out of the question to see Suncor trading in the high teens in terms of price to earnings.

For this reason, despite Canadian Natural Resources trading at 10.72X forward earnings and 1.99X forward sales, I view it as the better value.

It’s the more operationally efficient company, with breakeven prices in the $30~ WTI range, and is a cash flow beast.

Overall, if you’re going to buy an oil producer, stick to the best

It’s natural to want to bet on the underdog, or purchase what seems to be the cheaper stock. In this case, Suncor fits the bill for both reasons.

However, I lost a lot of faith in the company when it cut its dividend so quickly after the pandemic started. Yes, one of the key reasons was a massive share buyback right before the pandemic hit, and it’s partially just bad timing. However, a cut is a cut and these oil companies don’t provide much in terms of capital growth with them being so cyclical. So, a strong dividend is an absolute must.

You’ll pay a bit more for Canadian Natural on a forward looking basis. However, the market is rewarding the company with higher multiples due to the fact it is simply more consistent, more reliable, and overall the best oil producer in the country.

Out of the 3 major oil producers, CNRL is the only company that has managed to keep its head above water over the last decade. And, I’d be willing to bet it will be the best performer moving forward as well.

Have any interest in the potential psychedelics sector? Check out 3 top Canadian psychedelic stocks in 2021.